Real eState

$400m worth of property Trump is banned from – realestate.com.au – realestate.com.au

Donald Trump is banned from $400m of real estate. Picture: Getty

Former US president Donald Trump will tell you he built the New York City skyline and in the process put his name on some of the city’s most iconic buildings.

However the ruling by a Manhattan judge means Trump could lose his grip on the property world he has been synonymous with since the 1970s.

Trump has been temporarily banned as CEO of his own company, putting around $US250m ($A392m) worth of property as a result of his civil fraud case.

According to the New York Post, In the early 1990s, the real estate market was in free fall and several of Trump’s business ventures — including the Trump Taj Mahal in Atlantic City and the Plaza Hotel in New York — had recently gone belly-up, which put the Queens native deeply in debt.

Trump Tower on Fifth Ave in Manhattan is one of the former President’s best known properties. Picture: Getty

MORE: James Packer’s $132m mansion for sale

Why NRL losers are winning more fans than Panthers

Scary interest rates warning issued

Licensing the Trump name became a way to boost his global profile, and bank account, without taking on the usual risks of a commercial real estate developer.

By attaching his name to a building project, Trump could collect a hefty payday while avoiding any liability.

The responsibility instead would fall to the project’s developer, who in turn received the benefit of being associated with a famous name.

Such licensing deals have resulted in an extensive portfolio of luxury hotels and golf courses around the world that bear Trump’s moniker — and pay him for the privilege to do so.

But by far the most of these deals were in the US, with 14 Trump-branded properties generating revenue from licensing or management deals, according to the Washington Post.

Sorry 45 but you can’t touch this. Picture: Getty

Licensing is a big moneymaker for the Trump Org, netting them some $59 million in revenue between 2015-2016 alone, the outlet wrote. Over the decades, the Trump name has been splashed on everything from wine and steaks to board games and golf courses. But his favourite prize has always been high-end real estate, particularly in Manhattan. Trump famously plastered his name on buildings all over Gotham, in many cases on buildings he didn’t actually own.

A Washington Post analysis of Trump’s properties conducted soon after he took office for his first term in the White House found that although his name adorned 17 properties in Manhattan at the time, he only actually owned five of them.

Donald Trump on the campaign trail. Picture: Getty

Following his ascent to the presidency, Trump’s name appearing on buildings in some cases became politically fraught.

In November 2016, days after defeating Hillary Clinton for the presidency, work crews removed the golden “TRUMP PLACE” lettering from a trio of luxury high-rises on the Upper West Side after a condo board vote.

The next year would see his name scrubbed from the Trump SoHo Hotel, which was rebranded as The Dominick.

By February 2019, Trump’s name had vanished from all six Trump Place condo buildings, according to the Washington Post.

But on Friday, Manhattan Supreme Court Justice Arthur Engoron may have delivered the 2024 GOP frontrunner’s real estate empire its worst news yet.

Trump has been barred from doing business in New York for three years and slapped with more than $355 million in fines following an 11-week trial over state Attorney General Leticia James’ fraud lawsuit against him, his two eldest sons, the Trump Org and others.

With the mogul’s future in New York uncertain, some of the iconic buildings around Manhattan that he either owns or has a financial stake in include:

Protesters outside Trump tower after the Republican’s 2016 General Election win. Picture: Getty

Trump Tower: 721 Fifth Ave

Standing tall at 721 Fifth Ave. in Midtown, Trump Tower is a 58-story skyscraper that has been a fixture in Manhattan since its completion in 1983.

MORE: Fashion power couple’s $100m real estate plunge

Aussie house prices ‘set to soar 15 per cent’

10,000 sqm for $41K: Sydney’s mind-blowing property buy

It serves as the central headquarters of the Trump Organization and boasts a mix of apartments, offices and stores. But perhaps the most famous feature of Trump Tower is former President Trump’s own penthouse, perched high above the city.

The Attorney General’s suit claims that the Trump Organization used deceptive practices to get the highest possible value for the tower. For instance, the organisation based value on the transaction for a building located nearby, which headlines supposedly detailed had set a world record.

That said, the former president and current candidate, along with his associates, claimed the tower’s value had risen by $170 million from the previous year.

The judge denied this argument and ruled that the building was overvalued between $114 to $207 million.

Real estate tycoon Donald Trump poised in Trump Tower atrium. (Photo by Ted Thai/The LIFE Picture Collection/Getty Images)

MORE:

Israel Folau pockets $400,000 profit as Wallabies defeat sinks in

John Singleton’s old ‘Great Gatsby’ home for sale for $85m

Also vulnerable is that triplex penthouse. The suit alleges the longtime home was worth less than claimed. James and Engoron allege that Trump and his associates exaggerated the size of the unit — bringing it from roughly 11,000 square feet to 30,000. In Trump Organization financial statements, the home’s value jumped by 400 per cent, from $80 million in 2011 to $327 million in 2015.

Trump’s defence defended this by arguing that “the calculation of square footage is a subjective process that could lead to differing results or opinion based on the method employed to conduct calculation.”

Outside Manhattan Supreme Court on Monday, Trump himself took the opportunity to lash out at James and Engoron, calling the latter “unfair, unhinged, and vicious in his pursuit of me.”

Trump Park Avenue: 502 Park Ave

At 502 Fifth Ave., Trump Park Avenue was transformed into a residential building from a hotel in 2004 after Trump’s purchase in the early 2000s.

Trump bought the property for $115 million. Costas Kondylis & Partners, architects for many of Trump’s condo developments and numerous others throughout Manhattan, created 120 luxury homes, ranging in size from one to seven bedrooms. Reportedly, the renovator’s total cost was $100 million.

Donald Trump Jr. and his sister Ivanka Trump pose for a photo on the penthouse terrace of the Trump Park Avenue building in New York 11/04/06.

The building houses 12 rent-stabilised rental units, which the suit alleges were valued by the organisation as if they had rented for market prices. The Trump Organization offered a value for them of nearly $50 million, while the suit says the value cited by a third-party appraiser was much less — $750,000.

4-6 E. 57th St

Many may recognise this address as the former Niketown location.

In 2019, Trump and his companies that rent the buildings valued the property’s interest at $445 million, according to the New York Times. The lawsuit alleges that sum was inflated by mismatching income and expense periods. That inflation is at least $37 million. The lawsuit claims this is the result of the organisation of using higher forward-looking income figures combined with lower backward-facing expense figures.

40 Wall St

In the Financial District, this 71-story commercial skyscraper, completed in 1930, was designated as a city landmark in 1998.

Trump building – 40 Wall Street New York City.

MORE: Airbnb guest ‘from hell’ squatting at home for 500 days

Hugh Jackman’s luxury Sydney mansion for sale

The Trump Organisation’s 2015 appraisal of the property it leased was $735.4 million — though the lender-ordered appraisal was $540 million, according to the suit. The valuation included a $1.4 million lease with the upscale food market Dean & DeLuca for the building’s ground level, even though it hadn’t been signed. (Ultimately, and separately, that market location never came to fruition.)

Meanwhile, financial statements also understated building expenses. The Times noted that the Trump Organization reported management fees and expenses of $100,000 each year for 2012, 2013 and 2014 — though fees were closer to $1 million annually.

1290 Ave. of the Americas

Trump owns a 30 per cent share in this Midtown building, per the suit, located on a prime stretch of the avenue next to Radio City Music Hall and Rockefeller Center, but the rules of the partnership limit Trump’s own ability to sell his stake.

Still, in valuing that stake, the organisation is accused of calculating 30 per cent of the tower’s value minus its debt. Trump is also accused of using a “cap rate,” a valuation measure in real estate to compare investments, to inflate the building’s worth.

Trump National Golf Club Hudson Valley, Hopewell Junction

In the lawsuit, details regarding this upstate golf course, near Poughkeepsie, have to do with inflating the cost of memberships to boost property value. In 2011 and 2012, there was a listed initiation fee of $10,000. In 2011, the organisation pegged a value at 93 per cent of 161 unsold memberships at a $15,000 minimum. The next year, the organisation valued 78 per cent of 254 unsold memberships between $15,000 and $30,000.

Seven Springs, Westchester County

A Trump Organization subsidiary bought a 212-acre spread in the northern suburbs in 1995 that ran across three towns. More than 10 years later, son Eric Trump had planned to construct residences on 24 luxury lots on the grounds. In 2014, a hired appraiser pegged the value of the lots at some $30 million. That same year, per the suit, the company had a $23 million valuation for each lot in just one of those three towns, Bedford. Financial statements reported the values if those 24 luxe homes had been constructed, whereas in reality there was a legal challenge from the Nature Conservancy seeking restrictions on what could rise there.

Trump owns several golf clubs including in Westchester and Hudson Valley. Picture: Getty

Trump National Golf Club Westchester, Briarcliff Manor

As for this golf course, the suit charges that the organisation inflated its value by including hopeful income it would earn from new members. A valuation in 2011 reportedly relied on an assumption that 67 new members would each pay $200,000 in entry fees. In reality, many didn’t pay a cent.

MORE: Disney boss cuts home sale price by $235m

Is this Sydney’s most epic home extension?

Hermit faces eviction from 50yo cave home

Part of this article originally appeared in the New York Post and are republished here with permission.

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

Sask. real estate company that lost investors' millions reaches settlement – CTV News Saskatoon

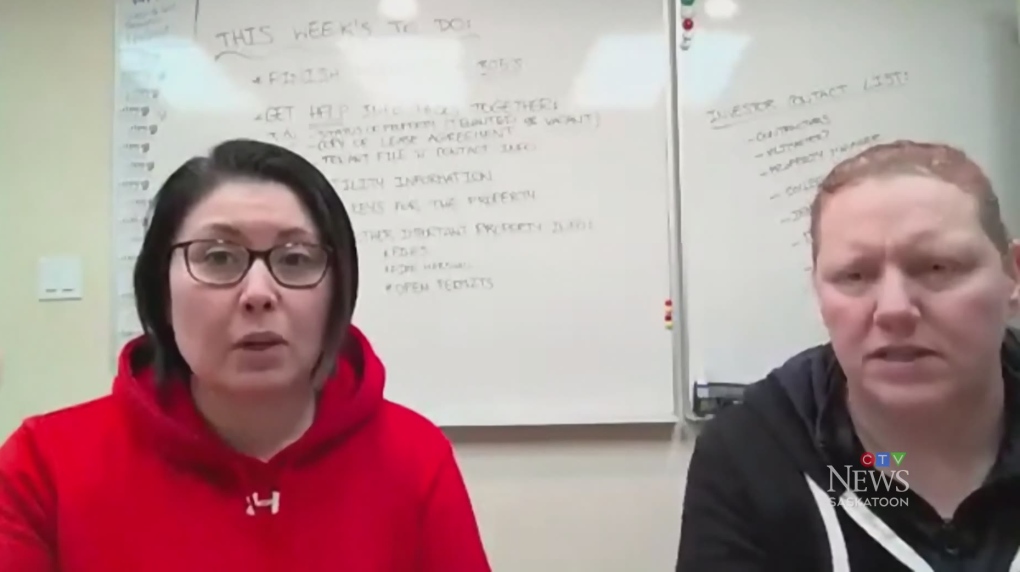

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

Real eState

Hidden Billions in Tokyo Real Estate Lure Activist Hedge Funds

|

|

The long-concealed market value of Tokyo’s largest skyscrapers is being unveiled by activist investors.

In Japan, there’s a huge gap — 22 trillion yen ($143 billion) by one estimate — between how companies value their real estate assets on their books, versus what those same properties would fetch if sold in the current market. That comes from two factors: First, many of the island nation’s firms have held onto properties for decades, each year writing down the cost of fixed assets due to annual depreciation, a common accounting practice. But at the same time, property prices have soared.

-

Media20 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Real eState24 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Tech38 mins ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Sports23 hours ago

Sports23 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Science24 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment21 hours ago

Investment21 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

Media23 hours ago

Meta's news ban changed how people share political info — for the worse, studies show – CBC.ca

-

Politics23 hours ago

Politics23 hours agoQuebec employers group urges governments to base immigration on labour needs, not politics – CityNews Montreal