Even if your New Year’s resolution is to start investing in 2024, why not get off on the right foot and start investing now?

If you’re a new investor, getting into the market has never been easier. With many brokerages offering commission-free trades and fractional shares, you can get started with as little as $1 in many instances.

But knowing what to buy can be tricky if you’re starting off. I think every portfolio must have a basic index fund. Even one of the greatest investors of all time, Berkshire Hathaway‘s Warren Buffett, has an index fund in his portfolio.

Owning the market has been a fantastic investment strategy for a long time

Investors who buy individual stocks often have the same goal: To beat the market. While I subscribe to this thinking, I know that not every investing period or pick will accomplish this goal. When that happens, you lose both time and money.

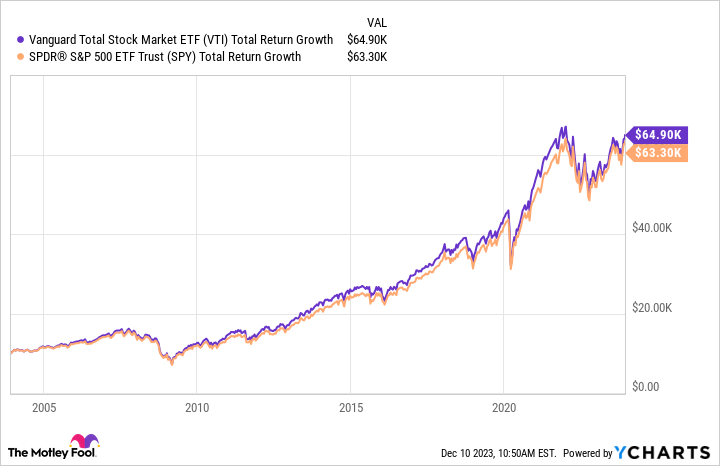

To offset this, I prefer to have some of my portfolio in an index fund like the Vanguard S&P 500 (VOO 0.50%), Vanguard Total Stock Market (VTI 0.82%), or the SPDR S&P 500 (SPY 0.52%). You may not beat the market by owning the index, but you’ll match it. Although a few individual stocks have crushed these fund returns, you’ve done pretty well if you’ve owned these indexes over the past 20 years.

VTI Total Return Level data by YCharts

A $10,000 investment in each of these indexes would have turned into more than $60,000 in 20 years — a high bar to clear.

Some people may think: “The market had a fantastic year in 2023; how could it possibly repeat in 2024?” As it turns out, just because the market has had a great year doesn’t mean it can’t have another.

Just because the market went up this year doesn’t mean it will go down next year

Using the total return data of the S&P 500 index (which includes dividends), there have been 36 years when the market has risen at least 20% (like it has so far in 2023). Of those 36 times, the market went higher 24 times the following year. So, if historical trends hold, you have a 66% chance of making money by investing in the market now.

Those are fantastic odds; you won’t find a casino, lottery ticket, or sports bet that will provide the same odds.

All the funds mentioned above are exchange-traded funds (ETFs), which trade like stocks even though they are a fund. This means they can be purchased in a brokerage account, IRA, or Roth IRA, or any other investment vehicles out there.

They are also low-cost funds, so you don’t have to pay the companies that run them much.

Investing in these funds guarantees market-average growth, which has been pretty good over the long term. It also lets your money grow while investigating which individual stocks you want to buy (if you’re interested in that).

Getting invested in the market as quickly as possible is smart, as the long-term trend has been up. With great and easy-to-use ETFs available to accomplish this goal, anyone aspiring to retire with a sizable nest egg should get started today.