Economy

2021 Election Issues: Economy – Todayville.com

Federal Conservative Pierre Poilievre has released video from a recent Question of Privilege in the House of Commons where he explains how the Federal Liberal government has been dodging parliament to significantly raise taxes.

Instead of going further into debt or raising taxes to pay for a massive increase in government spending, the Trudeau government worked out a deal with the Central Bank. Every week the Central Bank prints billions of dollars that go directly to government coffers. Without a single vote and without consulting Parliament, the federal government is effectively raking in the largest tax increase in Canadian history.

By printing money at this unprecedented rate, the federal government is responsible for driving up Canada’s inflation rate resulting in price hikes for virtually all goods and services. Poilievre calls it an “inflation tax”.

In this short video, Poilievre describes how the inflation tax hurts low and middle income Canadians, while increasing the value of assets owned by the richest Canadians.

Economy

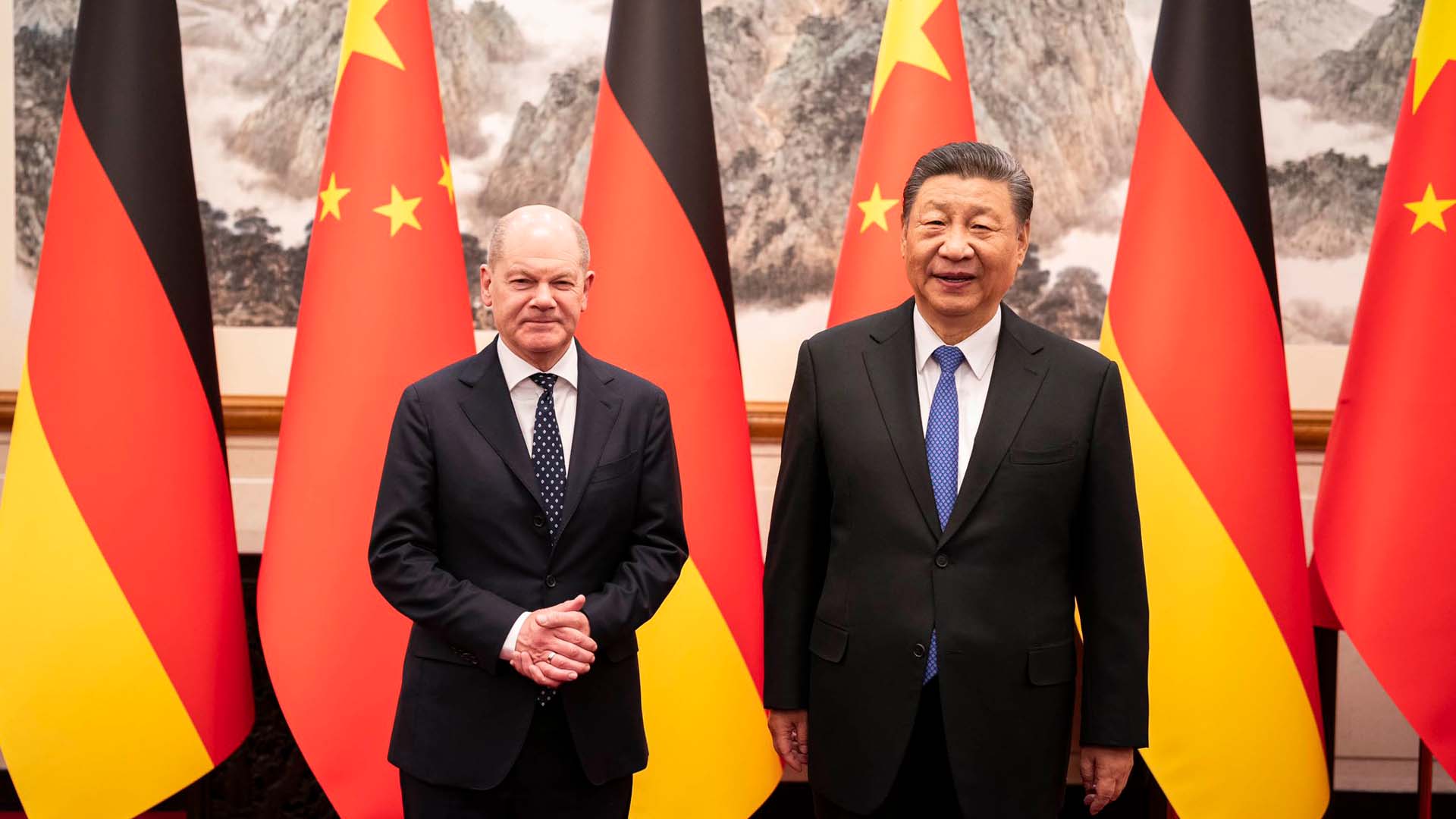

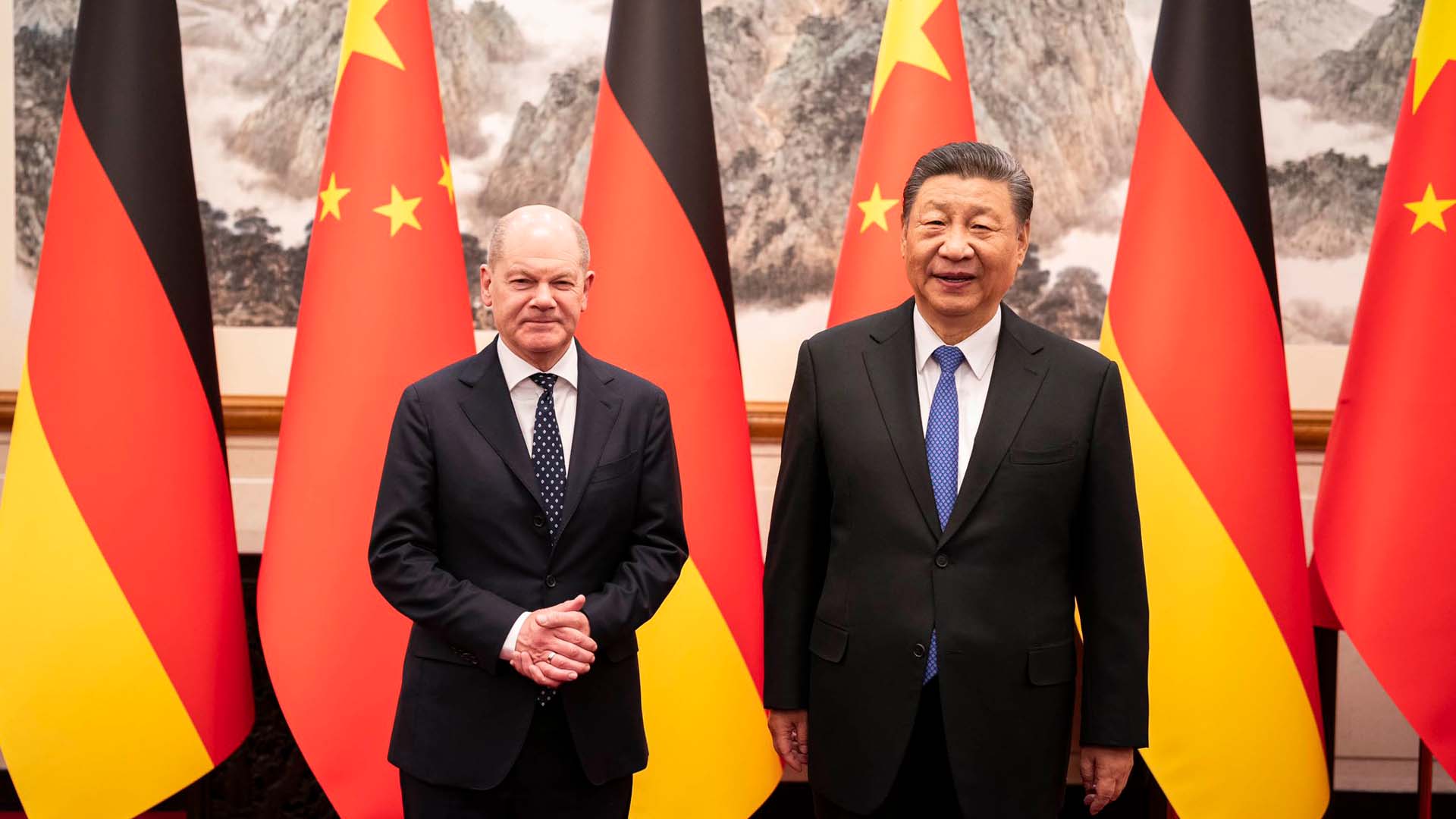

Why is Germany maintaining economic ties with China? – Al Jazeera English

German Chancellor Olaf Scholz has been on a three-day visit to China in a bid to shore economic ties.

Germany is China’s biggest European trade partner.

But, Berlin also sees Beijing as a competitor and a rival.

And – in its first-ever “strategy on China” launched last year – pledged to reduce German dependence on the Chinese market.

But, during his visit last week to China, the German Chancellor signalled his intentions to maintain business ties.

That may have angered some of Olaf Scholz’s closest allies.

The European Union has launched several investigations into exports of Chinese green technology to protect European industry from competition.

Are Nigeria’s reforms working?

We speak to the president of the United Nations General Assembly on sustainability.

Economy

BMO chief says US economy improving, calls California ‘a strategically important market’

|

|

TORONTO (Reuters) – The U.S. economy was showing signs of stronger than expected growth, with California being a strategically important market, said the head of Bank of Montreal, which has rapidly expanded in its southern neighbour.

CEO Darryl White, addressing shareholders at the bank’s annual meeting, said the bank was well positioned to cater to clients between American and Canadian economies in a shifting global landscape.

BMO, Canada’s third largest bank by market capitalization, makes about a third of its income from the United States after its $16.3 billion Bank of the West acquisition last year, the biggest ever deal in Canadian banking history.

He said that trade and investment between Canada and the U.S. is key to economic competitiveness noting that it is one of the largest bilateral trade relationships in the world.

“The relationship is significant. Put into context, just counting the Great Lakes region… (it) would be the world’s third largest economy, nearly equal to that of Japan and Germany combined, and the region employs about a third of the U.S.-Canadian combined workforce,” he said.

“Then add in California, an economy almost twice the size of Canada’s, and you can see the global impact this North-South partnership has.”

Canadian banks are increasingly looking to expand south of the border or in other parts of the world as opportunities at home are limited in a saturated market.

White cautioned about a higher-for-longer interest rate environment as borrowing costs remain high and demand weakens. But when rates begin to ease, the market could see a “new normal, an environment with fundamentally different characteristics than that of the past two decades,” he said.

(Reporting by Nivedita Balu in Toronto; Editing by Aurora Ellis)

Economy

AUD to USD Forecast: Australian Economy in Focus Amid RBA Rate Path Speculation

|

|

According to the CME FedWatch Tool, the probability of a 25-basis point Fed June rate cut fell from 56.1% (April 9) to 18.8% (April 16). The chances of the Fed leaving interest rates at 5.50% in September increased from 8.5% to 31.5% over the same period.

Short-Term Forecast

Near-term AUD/USD trends will likely hinge on Australian employment data, stimulus chatter from Beijing, and Fed speakers. Weaker Australian labor market data could tilt monetary policy divergence toward the US dollar. However, a stimulus package from Beijing would boost buyer appetite for the Aussie dollar.

AUD/USD Price Action

Daily Chart

The AUD/USD sat well below the 50-day and 200-day EMAs, confirming the bearish price trends.

An Aussie dollar breakout from the April 16 high of $0.64446 would support a move to the $0.64582 resistance level. A break above the $0.64582 resistance level would bring the $0.65 handle and the 50-day EMA into play.

Considerations should include stimulus discussions from Beijing, updates from the Middle East, and statements from the Fed.

Conversely, an AUD/USD drop below the $0.64 handle could give the bears a run at the $0.62713 support level.

Given a 14-period Daily RSI reading of 35.73, the AUD/USD could fall to the $0.63500 level before entering oversold territory.

-

Sports8 hours ago

Sports8 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState16 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech16 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Science19 hours ago

Science19 hours agoSpace exploration: A luxury or a necessity? – Phys.org

-

Investment22 hours ago

Investment22 hours agoGoldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg

-

Sports22 hours ago

Sports22 hours agoMcDavid hits century mark for assists in 9-2 laugher over San Jose – Edmonton Journal

-

Science21 hours ago

SFU researchers say ant pheromones could help prevent tick bites – Global News

-

Health18 hours ago

Health18 hours agoUpgrading the food at VGH for patient and planetary health