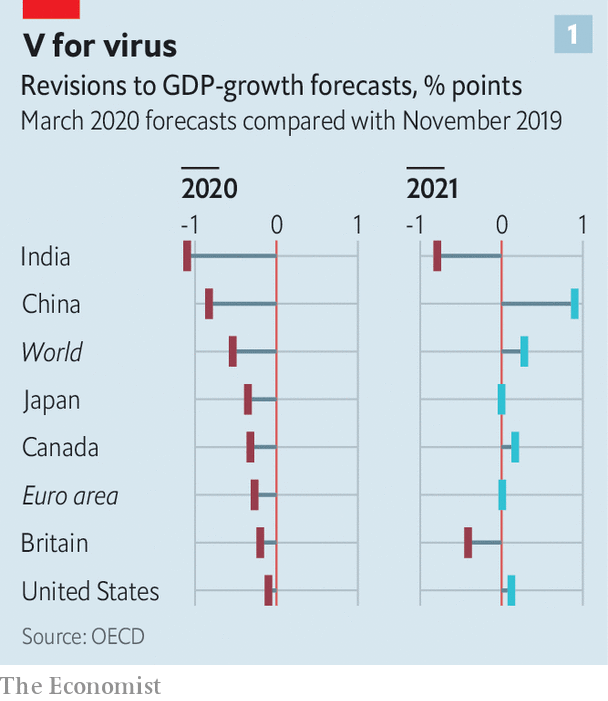

Forecasters are pencilling in sharp falls in output elsewhere (see chart 1). Goldman Sachs, a bank, reckons global GDP will shrink at an annualised rate of 2.5% in the first quarter. With luck the slump will end once the virus stops spreading. But even if that happens the speed and size of the economic bounce-back also depends on the extent to which those costly spillovers are avoided.

Economy

A recession is unlikely

IF THE FINAL week of February saw financial markets jolted awake to the dangers of a covid-19 pandemic, the first week of March has seen policymakers leaping into action. The realisation that global GDP will probably shrink for part of this year, and the looming risk of a financial panic and credit-crunch, has led central banks to slash interest rates at a pace last seen in the financial crisis of 2007-09.

On March 3rd the Federal Reserve lowered its policy rate by 0.5 percentage points, two weeks before its scheduled monetary-policy meeting. Central banks in Australia, Canada and Indonesia have also cut rates. The European Central Bank and the Bank of England are expected to follow. If the money-markets are right, more Fed cuts are in store. A composite measure of the global monetary-policy rate, compiled by Morgan Stanley, a bank, is expected to fall to 0.73% by June, from 1% at the start of the year and 2% at the start of 2019.

Yet there is an uneasy feeling that a flurry of rate cuts may not be the solution to this downturn. In part that reflects the fact that they are already so low. A golden rule of crisis-fighting is that in order to be credible you should always have more ammunition available. In 2008-10 the global composite policy rate fell by three percentage points. Today, outside America, rich-world interest rates are close to, at, or below zero. Even the Fed has limited scope to cut much further—one reason, perhaps, why share prices failed to revive in the hours after its latest move.

The tension also stems from the peculiarity of the shock that the economy faces—one that involves demand, supply and confidence effects. The duration of the disruption mainly depends on the severity of the outbreak and the public-health measures undertaken to contain it. Given those uncertainties, policymakers know that while interest-rate cuts are an option, they also need fiscal and financial measures to help business and individuals withstand a temporary but excruciating cash crunch.

One way the virus hurts the economy is by disrupting the supply of labour, goods and services. People fall ill. Schools close, forcing parents to stay at home. Quarantines might force workplaces to shut entirely. This is accompanied by sizeable demand effects. Some are unavoidable: sick people go out less and buy fewer goods. Public-health measures, too, restrict economic activity. Putting more money into consumers’ hands will do little to offset this drag, unlike your garden-variety downturn. Activity will resume only once the outbreak runs its course.

Then there are nasty spillovers. Both companies and households will face a cash crunch. Consider a sample of 2,000-odd listed American firms. Imagine that their revenues dried up for three months but that they had to continue to pay their fixed costs, because they expected a sharp recovery. A quarter would not have enough spare cash to tide them over, and would have to try to borrow or retrench. Some might go bust. Researchers at the Bank for International Settlements, a club of central banks, find that over 12% of firms in the rich world generate too little income to cover their interest payments.

Many workers do not have big safety buffers either. They risk losing their incomes and their jobs while still having to make mortgage repayments and buy essential goods. More than one in ten American adults would be unable to meet a $400 unexpected expense, equivalent to about two days’ work at average earnings, according to a survey by the Federal Reserve. Fearing a hit to their pockets, people could start to hoard cash rather than spend, further worsening firms’ positions.

Modelling the resulting hit to economic activity is no easy task. In China, which is a month ahead of the rest of the world in terms of the outbreak, a survey of purchasing managers shows that manufacturing output in February sank to its lowest levels since factory bosses were first surveyed in 2004. It seems likely that GDP will contract in the first quarter for the first time since the death of Mao Zedong in 1976.

That is why central bankers and finance ministries are turning to more targeted interventions (see chart 2). These fall into three broad categories: policies to ensure that credit flows smoothly through banks and money markets; measures to help companies bear fixed costs, such as rent and tax bills; and measures to protect workers by subsidising wage costs.

Start with credit flows. Central banks and financial regulators have tried to ensure that markets do not seize up, but instead continue to provide funds to those who need them. On March 2nd the Bank of Japan conducted ¥500bn ($4.6bn) of repo operations to ensure enough liquidity in the system. The People’s Bank of China has offered 800bn yuan ($115bn, or 0.8% of GDP) in credit to banks so long as they use it to make loans to companies badly hit by the virus. Banks have been asked to go easy on firms whose loans are coming due.

Governments are also helping firms with their costs, the second kind of intervention. Singapore plans corporate-tax breaks, and rental and tax rebates for commercial property. Korea will give cash to small firms struggling to pay wages. Italy will offer tax credits to firms that experience a 25% drop in turnover. In China the government has told state landlords to cut rents and given private-sector landlords subsidies to follow suit.

The final set of measures is meant to protect workers by preventing lay-offs and keeping incomes stable. China’s government has enacted a temporary cut to social-security contributions. Japan will subsidise wages of people who are forced to take time off to care for children or for sick relatives. Singapore has announced cash grants for employers of affected workers.

Today these policies are being sporadically announced, and their implementation is uncertain. As the virus spreads, expect more interest-rate cuts—but also the systematic deployment of a more complex cocktail of economic remedies. ■

This article appeared in the Finance and economics section of the print edition under the headline “Sneezy money”

Economy

Liberals announce expansion to mortgage eligibility, draft rights for renters, buyers

OTTAWA – Finance Minister Chrystia Freeland says the government is making some changes to mortgage rules to help more Canadians to purchase their first home.

She says the changes will come into force in December and better reflect the housing market.

The price cap for insured mortgages will be boosted for the first time since 2012, moving to $1.5 million from $1 million, to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

On Aug. 1 eligibility for the 30-year amortization was changed to include first-time buyers purchasing a newly-built home.

Justice Minister Arif Virani is also releasing drafts for a bill of rights for renters as well as one for homebuyers, both of which the government promised five months ago.

Virani says the government intends to work with provinces to prevent practices like renovictions, where landowners evict tenants and make minimal renovations and then seek higher rents.

The government touts today’s announced measures as the “boldest mortgage reforms in decades,” and it comes after a year of criticism over high housing costs.

The Liberals have been slumping in the polls for months, including among younger adults who say not being able to afford a house is one of their key concerns.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says manufacturing sales up 1.4% in July at $71B

OTTAWA – Statistics Canada says manufacturing sales rose 1.4 per cent to $71 billion in July, helped by higher sales in the petroleum and coal and chemical product subsectors.

The increase followed a 1.7 per cent decrease in June.

The agency says sales in the petroleum and coal product subsector gained 6.7 per cent to total $8.6 billion in July as most refineries sold more, helped by higher prices and demand.

Chemical product sales rose 5.3 per cent to $5.6 billion in July, boosted by increased sales of pharmaceutical and medicine products.

Sales of wood products fell 4.8 per cent for the month to $2.9 billion, the lowest level since May 2023.

In constant dollar terms, overall manufacturing sales rose 0.9 per cent in July.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

Economy

S&P/TSX gains almost 100 points, U.S. markets also higher ahead of rate decision

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets climbed to their best week of the year.

“It’s been almost a complete opposite or retracement of what we saw last week,” said Philip Petursson, chief investment strategist at IG Wealth Management.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

While last week saw a “healthy” pullback on weaker economic data, this week investors appeared to be buying the dip and hoping the central bank “comes to the rescue,” said Petursson.

Next week, the U.S. Federal Reserve is widely expected to cut its key interest rate for the first time in several years after it significantly hiked it to fight inflation.

But the magnitude of that first cut has been the subject of debate, and the market appears split on whether the cut will be a quarter of a percentage point or a larger half-point reduction.

Petursson thinks it’s clear the smaller cut is coming. Economic data recently hasn’t been great, but it hasn’t been that bad either, he said — and inflation may have come down significantly, but it’s not defeated just yet.

“I think they’re going to be very steady,” he said, with one small cut at each of their three decisions scheduled for the rest of 2024, and more into 2025.

“I don’t think there’s a sense of urgency on the part of the Fed that they have to do something immediately.

A larger cut could also send the wrong message to the markets, added Petursson: that the Fed made a mistake in waiting this long to cut, or that it’s seeing concerning signs in the economy.

It would also be “counter to what they’ve signaled,” he said.

More important than the cut — other than the new tone it sets — will be what Fed chair Jerome Powell has to say, according to Petursson.

“That’s going to be more important than the size of the cut itself,” he said.

In Canada, where the central bank has already cut three times, Petursson expects two more before the year is through.

“Here, the labour situation is worse than what we see in the United States,” he said.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

— With files from The Associated Press

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

Sports12 hours ago

Penguins re-sign Crosby to two-year extension that runs through 2026-27 season

-

News15 hours ago

Voters head to the polls for byelections in Montreal and Winnipeg

-

Politics15 hours ago

Next phase of federal foreign interference inquiry to begin today in Ottawa

-

News15 hours ago

Feds wary of back-to-work legislation despite employer demands: labour experts

-

Economy13 hours ago

Liberals announce expansion to mortgage eligibility, draft rights for renters, buyers

-

News15 hours ago

Ontario considers further expanding pharmacists’ scope to include more minor ailments

-

Sports23 hours ago

Slovenia’s Tadej Pogacar wins Grand Prix Cycliste de Montreal

-

Economy13 hours ago

Statistics Canada says manufacturing sales up 1.4% in July at $71B