The Alberta government will create a new provincial corporation tasked with attracting foreign investment if a bill introduced Tuesday becomes law.

The Invest Alberta Corporation would have a budget of $18 million over the next three years to fulfil a mandate of pulling foreign dollars into Alberta as part of an effort to recover from the COVID-19 pandemic and economic downturn.

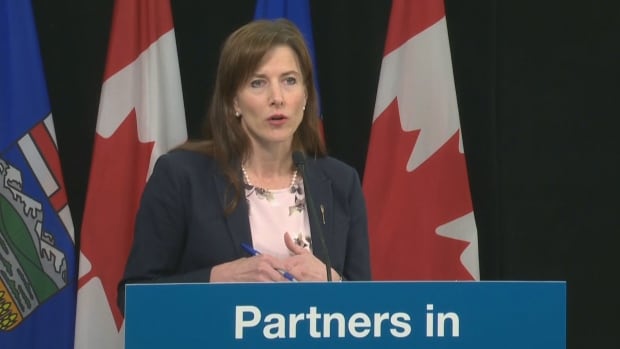

Bill 33, the Alberta Investment Attraction Act, would allow for the creation of the corporation, which would be governed by a board that would have up to seven members. The bill was introduced in the legislature on Tuesday by Tanya Fir, the minister of economic development, trade and tourism.

“There will be fierce competition as economies begin to re-open to attract this investment,” Fir said. “We know many other jurisdictions across the world, across Canada, already have these arms-length agencies in place that focus on investment attraction.”

Fir said other jurisdictions — such as British Columbia, Saskatchewan, Ontario and Quebec — already have organizations set up to do similar work, and that Alberta needs its own to compete.

“We need to be able to aggressively, proactively, eyeball-to-eyeball be communicating that message to investors around the world,” she said.

One such Invest Alberta office would be set up in Houston, Texas, where Dave Rodney will be Alberta’s agent general. Rodney, a former UCP MLA, stepped down from his Calgary-Lougheed riding in 2017 to allow Jason Kenney, now premier, to run for the seat. Fir announced Rodney’s appointment Tuesday.

Rodney will be paid a bi-weekly salary of $9,635. Though his three-year assignment will start immediately, he won’t relocate to Houston until the Canada-U.S. border reopens. In the role, he’s expected to work on creating closer business relationships and to pursue new investment opportunities to benefit Alberta’s energy sector.

Alberta already has existing international offices, and Fir said that, with the exception of the Ottawa and Washington, D.C., offices which are focused on advocacy, will begin reporting to Invest Alberta.

“That will allow for a more strategic and co-ordinated approach as we focus on investment attraction,” she said.

Fir also said the new corporation won’t duplicate efforts of existing agencies that promote specific industries, such as Alberta Innovates or the Canadian Energy Centre. She said her ministry will look for ways the different groups can collaborate.

If the legislation passes, cabinet will appoint up to seven board members, one of whom will be a member of executive council. The board will in turn select a CEO.

Source:- CBC.ca

Source link