Business

Amazon posts higher 1Q sales on coronavirus-driven spending, sees $4B in 2Q costs – Yahoo Canada Finance

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Amazon (AMZN) reported first-quarter sales that topped consensus expectations and grew over last year, as consumers increasingly turned to the e-commerce company for deliveries of essentials amid widespread stay-in-place orders.” data-reactid=”16″>Amazon (AMZN) reported first-quarter sales that topped consensus expectations and grew over last year, as consumers increasingly turned to the e-commerce company for deliveries of essentials amid widespread stay-in-place orders.

However, earnings came up light as Amazon incurred costs to adapt to changing consumer demands and workforce needs as the coronavirus pandemic escalated. In addition, the company plans to spend at least $4 billion — virtually all of its forecasted operating profit — on coronavirus-related expenses, which sent its stock down around 5% in after-hours trading.

Here were the main metrics from the report, compared to Bloomberg-compiled consensus estimates:

-

1Q net sales: $75.5 billion vs. $73.74 billion expected and $59.7 billion Y/Y

-

1Q earnings per share: $5.01 vs. $6.27 expected and $7.09 Y/Y

The Seattle, Washington-based company has been one of the few corporations fortified by the global coronavirus pandemic. Amazon’s extensive array of everyday goods, groceries and expedited delivery options make it a popular choice among consumers confined to their homes.

Amazon’s net sales of $75.5 billion were up 26% over last year. However, net income of $2.5 billion, or $5.01 per share, fell 30% compared to the $3.6 billion, or $7.09 per share, reported in the first quarter of 2019.

That profitability pressure is likely to increase in the current quarter, with Amazon expecting to spend heavily to protect both workers and consumers from COVID-19 exposure.

“Under normal circumstances, in this coming Q2, we’d expect to make some $4 billion or more in operating profit,” CEO Jeff Bezos said in a statement. “But these aren’t normal circumstances. Instead, we expect to spend the entirety of that $4 billion, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe.”

Bezos said the company plans to invest in a range of services, including “personal protective equipment, enhanced cleaning of our facilities, less efficient process paths that better allow for effective social distancing, higher wages for hourly teams, and hundreds of millions to develop our own COVID-19 testing capabilities.”

Those costs could contribute to an operating loss of up to $1.5 billion in the second quarter, Amazon said in its guidance — making it the first among major companies this quarter to provide forward-looking estimates.

On the high end, Amazon said it could deliver operating income of as much as $1.5 billion, or still just half the $3.1 billion it delivered in the second quarter of last year. Amazon said it expects net sales will be between $75 billion and $81 billion for the second quarter, representing growth of as much as 28% over last year.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="During the quarter, Amazon hired 175,000 new workers to keep pace with orders, in a testament to the ballooning demand for products off the online marketplace.” data-reactid=”29″>During the quarter, Amazon hired 175,000 new workers to keep pace with orders, in a testament to the ballooning demand for products off the online marketplace.

But the company also had to alter its operations to meet consumer demand more narrowly focused on essential home goods and cleaning products, rather than the typical, broader product mix shift. The company also raised pay for many of its workers, generating additional expenses.

Shares of Amazon were up more than 30% for the year to date through Thursday’s close, making it one of the best-performing stocks in the S&P 500.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="This post is breaking. Check back for updates.” data-reactid=”32″>This post is breaking. Check back for updates.

—

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck” data-reactid=”45″>Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Read more from Emily:” data-reactid=”46″>Read more from Emily:

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.” data-reactid=”52″>Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Find live stock market quotes and the latest business and finance news” data-reactid=”53″>Find live stock market quotes and the latest business and finance news

Business

Gas prices surge in some parts of Canada. What’s causing pain at the pumps? – Global News

A sharp uptick in gas prices is fuelling road rage in some parts of Canada on Thursday.

Many motorists filling up at the pumps are facing higher prices — some up as much as 22 cents from yesterday in parts of Ontario, for instance.

Data from GasBuddy’s live gas price tracker shows prices were 10.9 cents higher across Ontario for an average of $1.73 per litre by 4 p.m. Eastern Thursday, as compared to the previous day’s average.

Prices for gas rose by a similar degree in Toronto, but in southwest Ontario towns such as Sarnia, GasBuddy says the cost of gasoline has jumped 22.3 cents to $1.79 per litre as of 4 p.m. Other Ontario municipalities near the U.S. border such as Chatham and Windsor also saw double-digit jumps in the price of gas.

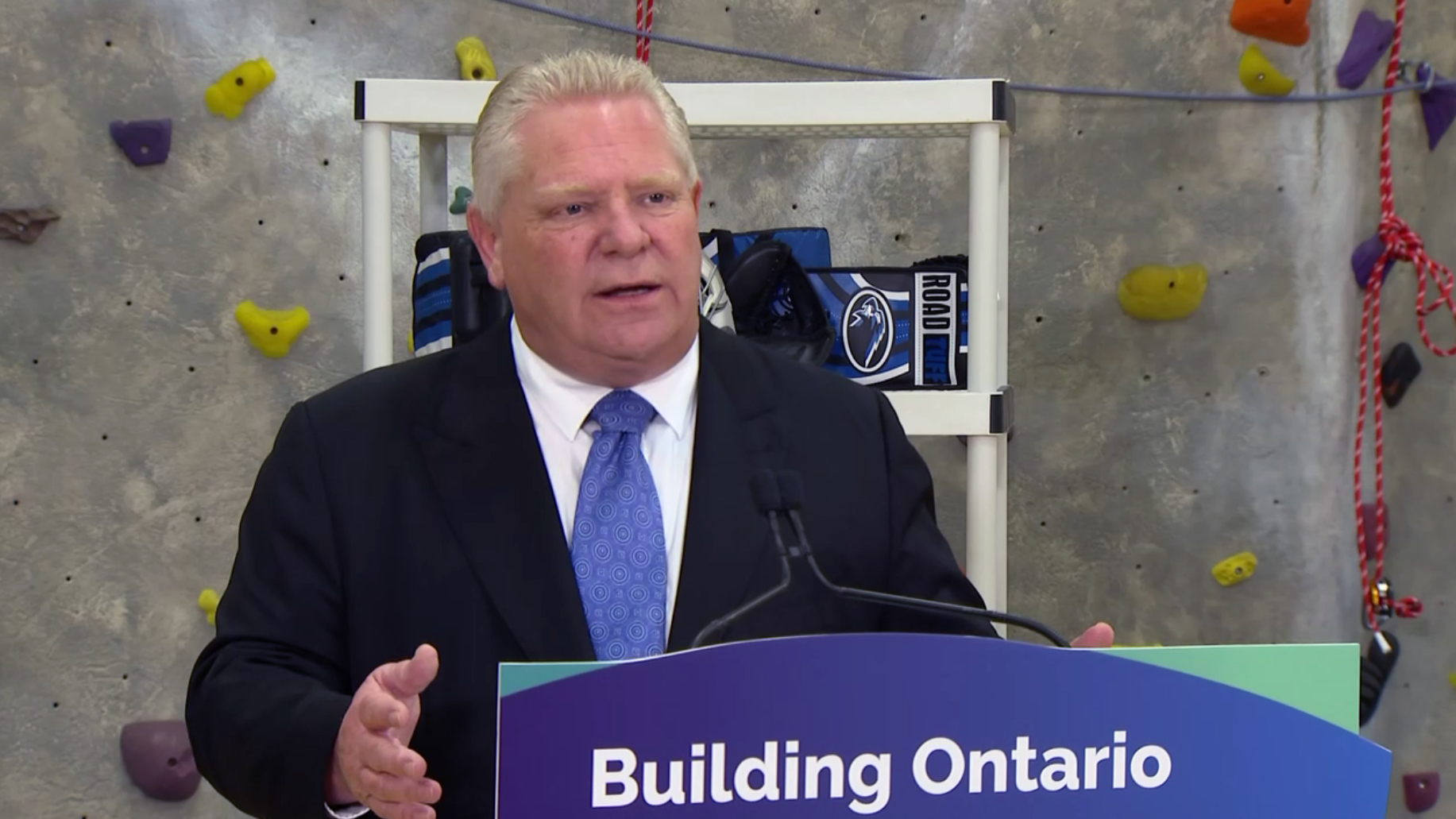

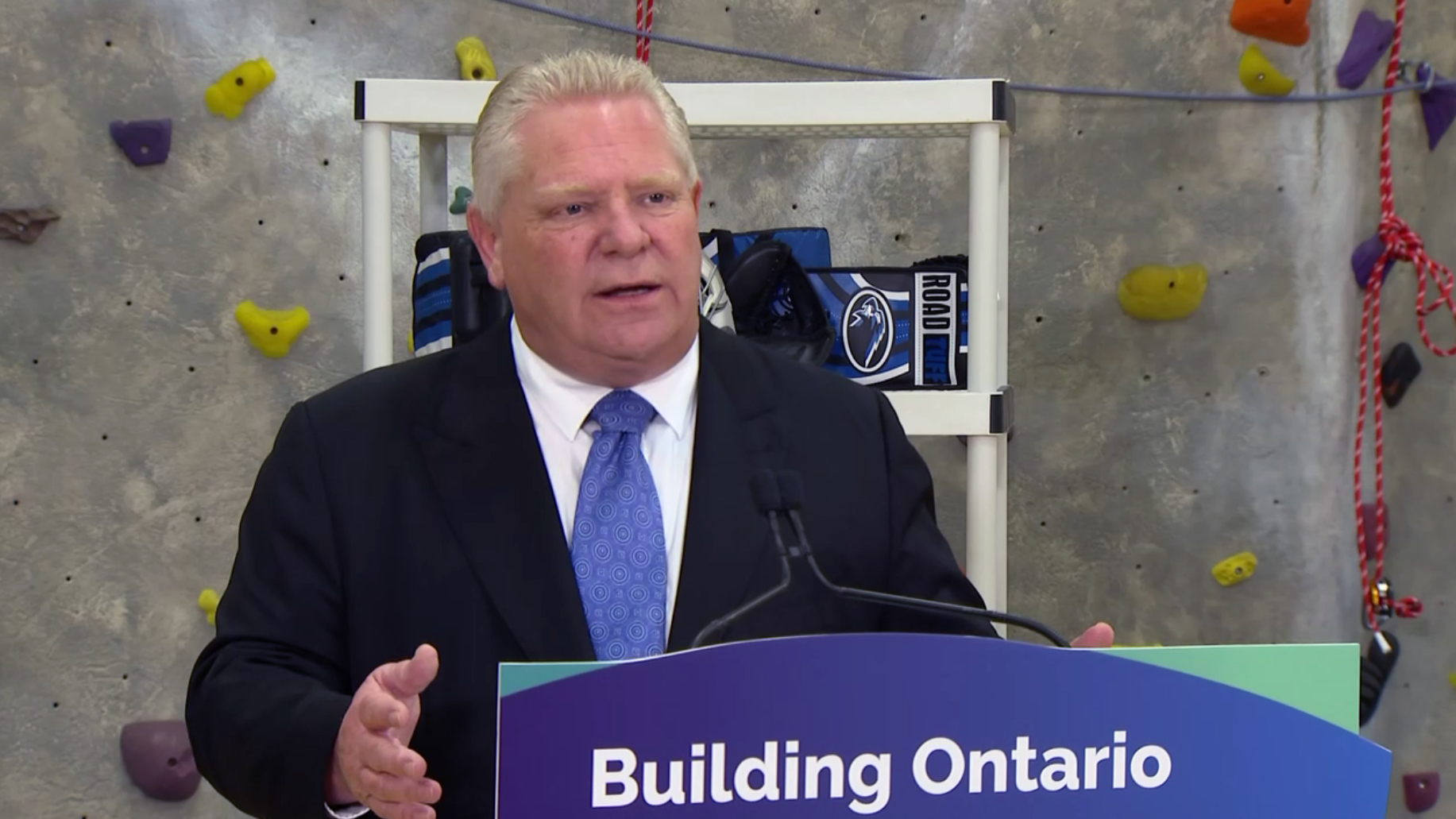

Ontario Premier Doug Ford shared his frustrations about the gas price hike on Thursday. Analysts had predicted prices would rise overnight due to a changeover to summer gasoline blends from winter fuel.

“You go out last night and you’re sitting there for 20 minutes in the line up to get gas, you know, and it’s unacceptable. Everywhere I was going, it was about a buck, 59. You wake up this morning and it’s $1.80. You know, it’s absolutely disgusting,” Ford said during an appearance in Oakville, Ont.

Quebec drivers were also seeing prices rise on Thursday, with a hike of 7.5 cents taking the province’s average cost past $1.80 a litre, according to the gas data. Montreal gas prices hit an average of $1.88 per litre as of 4 p.m., an 8.9-cent hike from Wednesday.

“Of course it will have an impact on our budget. So for normal people, regular people, families, it’s going to be tough,” Montreal Mayor Valérie Plante said Wednesday ahead of the price surge.

Gas prices in British Columbia were meanwhile inching towards the $2 per litre mark, rising 1.4 cents to an average of $1.95 as of 4 p.m. Eastern.

Prices were also a few cents higher in Newfoundland and Labrador and New Brunswick on Thursday, but were largely steady in the other Atlantic provinces and in the Prairies.

Dan McTeague, president of Canadians for Affordable Energy, told Global News that Western Canada and some U.S. markets made the switch from winter to summer gasoline about a month ago. Those regions are tied to the Chicago comprehensive prices while most of Ontario’s prices are tied to what happens in the New York Harbour, which switched to the summer blend on April 16, he said.

Winter gas is cheaper than summer blends because it contains higher butane levels — an inexpensive but volatile element which lowers the cost of fuel, Patrick de Haan, head of petroleum analysis at GasBuddy, told The Canadian Press.

The cost of producing summer gas is higher because butane levels are reduced to meet Canadian environmental regulations and lower emissions.

Where do gas prices go from here?

On a national basis, the price of gas was on average $1.74 per litre as of 4 p.m. Eastern. That’s up 6.5 cents from Wednesday and 18.7 cents higher than the average in March, according to GasBuddy.

De Haan said Thursday that pump prices are expected to come down in July.

McTeague told Global News that where gas prices go from here depends in part on volatility in the Middle East, where attacks on any given day can send shocks into the global price of oil.

He said it’s unlikely for Ontario to hit $2/litre this summer, but those prices may be in the cards for Quebec. In much of Western Canada, “what you see is what you get,” with prices expected to hold around current levels, he said.

But for those who missed out on fuelling up before the overnight spike, McTeague also predicted gas prices would drop back another five cents in Ontario and Quebec on Friday.

Statistics Canada cited higher gas prices as fuelling a slight uptick in inflation last month, which accelerated to 2.9 per cent annually from 2.8 per cent in February. Prices were rising at a faster rate in Western Canada in March, StatCan noted.

Higher global crude oil prices are traced to geopolitical conflicts stymying production, the agency said earlier this week.

De Haan told Global News earlier this month that geopolitical strife like Russia’s war on Ukraine, more expensive summer gas, increased demand for summer travel and maintenance at refineries would keep prices elevated.

“It’s becoming more obvious that with every yearly increase, it’s becoming less and less likely that we would see a sub-dollar-a-litre-price,” De Haan told Global News.

Canada’s price on carbon also rose earlier this month, rising $15 to $80 a tonne in provinces that have adopted the federal regime. The hike was expected to add about three cents to the cost of gasoline for Canadians.

This past Monday, some Canadians living in provinces with the federal carbon price received the first quarterly rebate tied to the program.

– with files from Global News’ Jacquelyn LeBel, Gabby Rodrigues, Nathaniel Dove, Aaron D’Andrea, Kalina Laframboise and The Canadian Press

More on Money

© 2024 Global News, a division of Corus Entertainment Inc.

Business

BC short-term rental rules take effect May 1 – CityNews Vancouver

Premier David Eby says that as B.C. inches closer to new short-term rental rules taking effect, 17 communities have decided to opt into the restrictions.

The update comes as the regulations surrounding how many and what kinds of short-term rentals are allowed in B.C. come into effect on May 1.

The BC NDP tabled the legislation in October of last year which, once in effect, aims to return short-term rentals to the long-term rental market.

As of May 1, the province is requiring short-term rental platforms, like Airbnb and VRBO, to share data and to remove listings without business licenses and registration numbers “quickly.”

It is also limiting short-term rentals to a property owner’s principal residence — plus one additional unit or suite on that property — for municipalities with more than 10,000 people. Municipalities with fewer than 10,000 people, or those designated as resort municipalities, will be able to opt into the legislation.

Those communities that have opted in, like the resort municipality of Tofino, will see the new laws come into effect on Nov. 1. Some other communities that have agreed to the new rules are Kent, Gabriola Island, Bowen Island, Osoyoos, and Pemberton.

The province says through regulations, the fines for hosts breaking municipal by-law rules will increase to $3,000 from $1,000, per infraction, per day.

“Short-term rentals themselves are not the problem,” Eby said in the update Thursday. “What has been the problem is inadequate oversight over this sector. And a group of people who have … said I’d like to actually buy up a whole bunch of homes that would otherwise be rented by people, or what other otherwise be purchased by families looking for a place to live, and I’d like to operate a private hotel chain through Airbnb or VRBO.”

“To give you a sense of the scale of the problem we face in British Columbia with this kind of activity [from] this small group of individuals, we have 19,000 entire homes in our province that are available year-round on short-term rental platforms,” he continued.

“And I can tell you that there are 19,000 families and individuals that are looking for a place to live, to buy, to rent right now, that are in competition with people that are looking to operate homes as hotels.”

Data from McGill University released in 2023 showed that the top 10 per cent of hosts in B.C. earn nearly half of all revenue created.

Eby added that, starting Thursday, a portal will be available for people to report operators for going against the new rules, and also giving hosts a platform to check their requirements of operation.

“These rules balance the need for long-term homes, including people and tourism and hospitality industry where the need to accommodate guests. As the premier mentioned, people are seeing long-term homes open up for rent, and more short-term rentals are being listed for sale or becoming long-term homes for families and individuals,” Housing Minister Ravi Kahlon said.

The province reiterated Thursday that short-term rentals are still “welcomed” in B.C., as long as they operate within provincial and local rules.

“We encourage people to continue to explore beautiful British Columbia and stay in legal short-term rental accommodations. We want guests, hosts, local governments, and platforms to know what to expect May 1,” Kahlon added.

Short-term rentals create big economic impacts: Airbnb

In a statement Thursday, Airbnb claimed a newly released economic analysis shows it generated more than $2.5 billion “in economic impact across BC in 2023,” and supported more than 25,000 jobs in the province.

“The analysis shows that for every $100 spent on an Airbnb stay, guests spent an additional $229 on other goods and services such as local businesses, restaurants, attractions, shops, and more,” the short-term rental agency said.

Airbnb believes the new “strict” short-term rental laws are “putting at risk billions in tourism spending and economic benefits.”

“BC’s new short-term rental law is going to significantly impact the province’s tourism sector, just as peak tourism season arrives – taking extra income away from residents, limiting accommodation options for guests, and potentially putting at risk billions in tourism spending and economic impact,” said Nathan Rotman, Airbnb Canada policy lead in the statement.

“At a time when BC is facing record deficits and economic growth is slowing, these new rules hurt resident hosts, tourists, communities and the economy as a whole.”

Airbnb is also contributing to tax revenue in the province, the agency claimed, explaining, “British Columbian Hosts on the platform generated approximately $93 million in taxes in 2023, bringing much-needed tax revenue for a province that’s projected to face a record high $7.9 billion deficit.”

You can watch CityNews 24/7 live or listen live to CityNews 1130 to keep up to date with this story. You can also subscribe to breaking news alerts sent directly to your inbox.

Business

'It's disgusting:' Doug Ford lashes out at oil companies over double-digit gas price hike – CityNews Toronto

Premier Doug Ford lashed out at the gas companies for the double-digit overnight increase in the price of gas across the GTA, calling it unacceptable and disgusting.

Speaking at an unrelated announcement in Oakville, Ont., on Thursday, Ford took a moment to vent on behalf of “16 million people” across the province.

“You go out last night and you’re sitting there for 20 minutes in the lineup to get gas. It’s unacceptable,” said Ford. “Everywhere I was going it was a $1.59. You wake up this morning and it’s $1.80. It’s absolutely disgusting.”

Prices at the pumps surged 14 cents overnight to 178.9 cents/litre at most GTA stations. Analysts attribute the increase to the annual changeover from winter gas to summer gas.

“That is why prices are going up so significantly all at once is essentially we’re seeing discounts on winter gasoline to get rid of it but now that we’ve made the jump, summer gasoline inventories are much lower and thus a much higher price,” Patrick De Haan, the head of petroleum analysis at Gas Buddy tells CityNews.

That explanation, Ford said, was simply a way for the gas companies to gouge people.

“It’s absolutely disgusting what the oil companies are doing,” said an agitated Ford as he questioned whether the gas companies are waiting for the tanks to drain at gas stations before filling them up with the new summer formulation. “Or are you using the old gas and charging the higher cost.”

“I have my opinion that it’s not physically possible to drain every single gas station to put the fresh stuff in. So either you’re putting the fresh stuff in last month or you’re gouging the people right now.”

Ford went on to say that after consulting with some friends in the United States, he found that gas prices were trending around $3.80 per gallon. “Folks, let’s do the math – it’s a $1.80 (a litre) that’s $7.20 (a US gallon).”

Mike Eppel, 680 News Radio Toronto Senior Business Editor, says it also comes down to a refining capacity issue in this country.

“So there’s lots of oil, that’s not the issue – oil supplies are high. It’s the refining capacity. We haven’t had a refinery built in eastern Canada since whenever – you can’t get a pipeline built. And anytime there is any disruption in the system, up goes the price for gas.”

Ford did not limit his anger on rising gas prices to just the oil companies, closing his rant by taking a shot at the federal government’s carbon tax, which took effect on April 1 and pushed gas prices up three cents a litre.

“This goes back to the federal government sticking their hands in the people’s pockets, they don’t care that we have some of the highest prices in North America on the carbon tax, they jack it up 17.5 per cent,” explained Ford. “And then of course the oil companies thought they’d hop on board, no one’s going to notice, because if I remember … just a few months ago I remember filling up for $1.30 to $1.34. Did the barrel of oil go up 30 per cent? The answer is no. So where is the 30 per cent.”

While the price of gas is expected to fall by four cents/litre on Friday, prices will continue to fluctuate with no real relief in sight until June or July.

-

Tech22 hours ago

Tech22 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Health18 hours ago

Health18 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

News18 hours ago

Canada's 2024 budget announces 'halal mortgages'. Here's what to know – National Post

-

Science5 hours ago

Science5 hours agoJeremy Hansen – The Canadian Encyclopedia

-

News17 hours ago

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

-

Tech20 hours ago

Tech20 hours agoNew EV features for Google Maps have arrived. Here’s how to use them. – The Washington Post

-

Science18 hours ago

Science18 hours agoGiant, 82-foot lizard fish discovered on UK beach could be largest marine reptile ever found – Livescience.com

-

Tech23 hours ago

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life