I’m not saying that I am the next Jim Cramer, but I had a point when I wrote just a few weeks ago that former President Donald Trump’s social-media company was probably not going to be an awesome stock pick. Was this completely foreseeable and deeply obvious? Absolutely.

Trump Media & Technology Group, which owns the conservative Twitter clone Truth Social, went public via SPAC in late March. (For those not familiar, a SPAC, or special-purpose acquisition company, is a shell company that goes public with the intention of buying an actual company later. In the Trump case, the shell company Digital World Acquisition purchased TMTG.) When the merger was completed, the stock — which trades under the ticker DJT — popped to over $70 a share. TMTG’s market cap topped $9 billion, and the former president’s net worth, on paper, jumped to $7 billion.

And then, DJT popped again, but this time in the bad, bubble-bursting way. Its price fell, and then it fell again, and then it fell some more. The stock staged a bit of a rally at the end of last week, but it’s still well off of its March highs. As of the end of trading on Friday, TMTG was trading at $36.38 down 54% from its peak and 41% since I wrote about it three weeks ago. Correspondingly, the former president’s related wealth gains have come back down to earth. People on Truth Social feel pretty bad about it. Short sellers, if I had to guess, feel pretty good, even if Trump’s company is trying to prevent them from betting against it. Anyone investing in TMTG is in for a bumpy ride.

While Trump is a political figure, Trump Media’s stock price is not really a political story. Sure, there are some fervent followers who believe that buying the stock is akin to supporting the Republican presidential candidate. More broadly, though, TMTG’s fall from grace is more of a business story with a hint of cultural weight that let it achieve some meme-stock-like status.

The thing about TMTG is that it is not a good business. Its total revenue was $4.1 million in 2023, which is a little more than what a single McDonald’s franchise makes in a year, and it lost $58 million the same year. When the stock was near its highs, it was trading at something like 2,000 times the company’s annual revenue. That is a lot. Nvidia, the high-flying vanguard of the artificial-intelligence revolution and one of the hottest stocks this year, is trading at about 35 times its revenue.

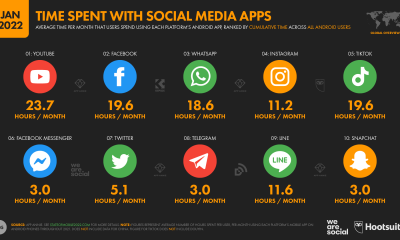

Besides required financial information, Trump’s media outfit won’t disclose central data points that would give a better picture of how well it is — or, likely, isn’t — doing. As my colleague Peter Kafka has pointed out, TMTG refuses to tell investors how many people are signing up for Truth Social, whether they’re sticking with the platform, or what’s happening in ad sales. In regulatory filings, the company says it “believes that adhering to traditional key performance indicators, such as signups, average revenue per user, ad impressions and pricing, or active user accounts including monthly and daily active users, could potentially divert its focus from strategic evaluation with respect to the progress and growth of its business.” In other words, it doesn’t think publicly disclosing how things are going will be good for its business prospects, which, I mean, tracks to the extent that the truth is probably bad. (To be clear, other publicly traded social-media companies, such as Reddit and Meta, do not keep a lot of this kind of information under wraps.)

For all the gloominess now, Trump’s media company says it has bigger and brighter days ahead. On Tuesday, TMTG announced that it planned to launch a streaming-TV platform where creators who can’t find an audience for “unjust” reasons “won’t be cancelled.” The same day, its stock price fell by 14%, though the next day it bounced.

TMTG isn’t going under tomorrow. Its CEO, Devin Nunes — yes, that Devin Nunes, the former US representative from California — has said it has millions of dollars in the bank thanks to the boost from going public. He’s also trying to push back against short sellers in an attempt to keep those betting against the company at bay.

All in all, for shareholders, this is not a fun roller-coaster ride. The stock is on a steady downward trajectory, and things aren’t looking good. The company has filed plans to issue more shares, which would raise even more cash for operations but dilute the value for current shareholders. Trump himself, who owns more than half of the company’s shares, is subject to a lockup period that prevents him from selling those shares for six months. This is pretty standard practice for SPACs to prevent pump-and-dumps. The board could speed that up and let him and other insiders sell earlier, which would give the former president a quick cash injection but almost certainly depress the stock’s price more. Why hold on to the stock when even its namesake is giving it up? So DJT will likely circle the drain even faster once major shareholders are allowed to sell, and it’s not really clear how the company plans to turn that around. Trump, for his part, has some bigger fish to fry, like competing in an election and hanging out in court.

That TMTG’s stock price has fallen isn’t surprising. It’s not a successful business, and it’s not clear how many people are ever going to want to hang out on Truth Social, let alone how many businesses would want to advertise there. The speed of the stock’s plunge, however, is a bit of a shock. It wasn’t a given that the gravity of reality would be such a strong, immediate force. But for now, the Trump Media & Technology Group illusion seems to be coming undone.

Emily Stewart is a senior correspondent at Business Insider, writing about business and the economy.

About Discourse Stories

Through our Discourse journalism, Business Insider seeks to explore and illuminate the day’s most fascinating issues and ideas. Our writers provide thought-provoking perspectives, informed by analysis, reporting, and expertise.

Read more Discourse stories here.