Warren Buffet’s Berkshire Hathaway (BRK.A; BRK.B) swung to a profit in the second quarter, boosted by its insurance business and investment gains.

Key Takeaways

- Berkshire Hathaway swung to a profit of $35.9 billion in the second quarter after losing $43.6 billion a year ago.

- The company’s stake in Apple ballooned to $177.6 billion by the end of the quarter.

- Berkshire added more than $16 billion to its nearly $150 billion cash stockpile last quarter.

Berkshire reported net income of $35.9 billion on total revenue of $92.5 billion. In the same period last year, the company reported a net loss of $43.6 billion on $76.2 billion in revenue. Second-quarter earnings were hamstrung last year by $66.9 billion in losses on investments and derivatives contracts while, this year, investments contributed $33.1 billion to earnings.

Berkshire reported a 14% increase in revenue from insurance premiums, helping lift total sales. The conglomerate’s railroad, utilities, and energy segment more than doubled revenue to $26.9 billion.

Buffett’s 5.8% stake in Apple (AAPL) continues to be the backbone of Berkshire’s equity portfolio. Apple has been a leader of this year’s market rally, surging 50% in the first half of the year. That’s added $26.6 billion to Buffett’s stake, which at the end of the quarter totaled $177.6 billion and made up 50% of Berkshire’s equity investments.

Buffett’s bet on Japanese commodity trading houses also paid off in the second quarter as all five firms beat net-income estimates for the quarter. Buffett raised his stake in the companies to an average of more than 8.5% in June.

Berkshire continued to grow its massive cash stockpile, adding $16.7 billion in cash and short-term securities in the quarter. Total cash now stands at $147.4 billion.

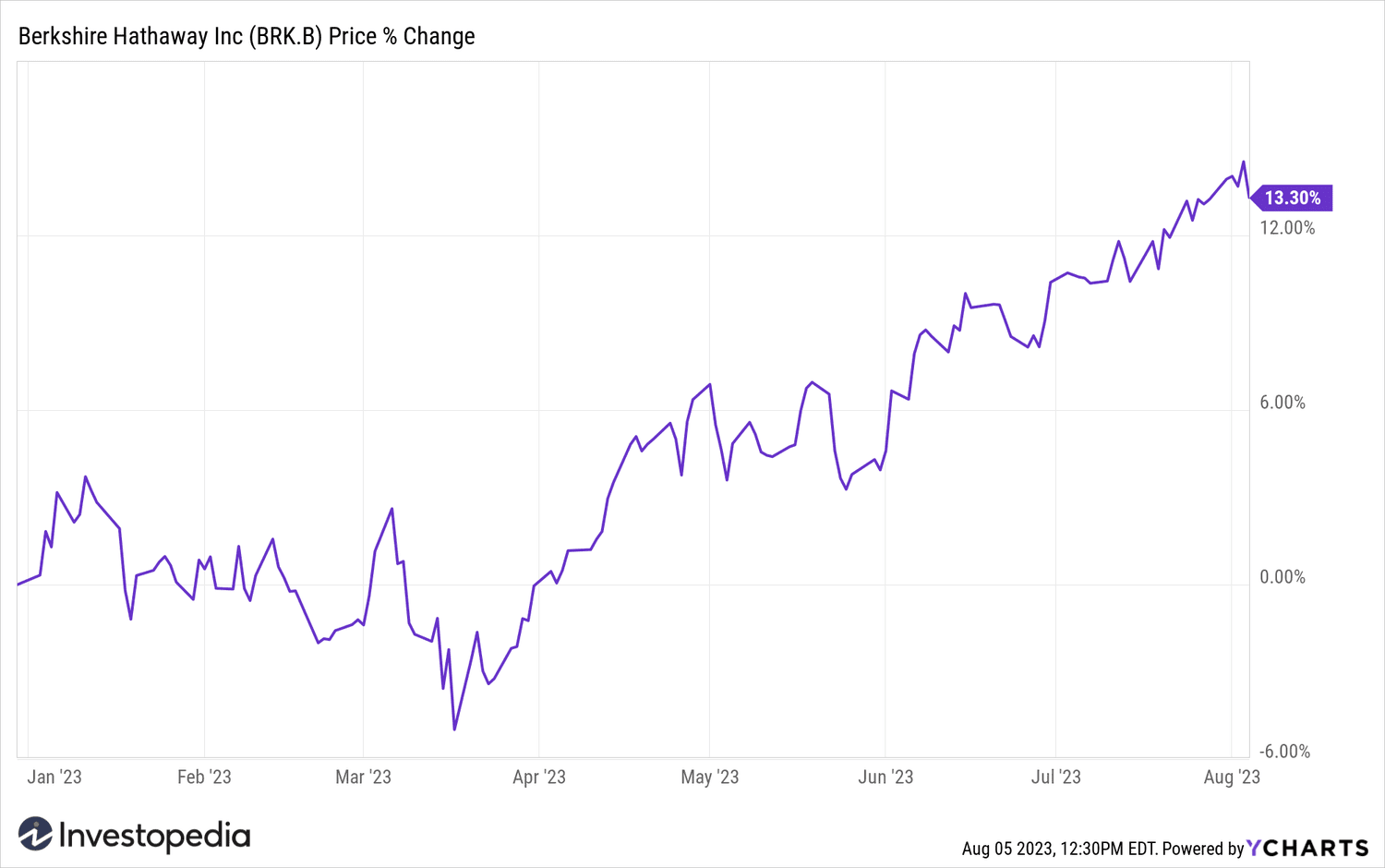

Class B shares of Buffett’s conglomerate were up 14% this year ahead of the report and closed on Friday at $349.99, near their record high of $362, reached in March 2022.