Investment

Bullishness Remains Missing, Which Is A Good Thing

|

|

Despite media headlines, podcasts, and broadcasts suggesting “doom and gloom” lurks around the corner, investor bullishness has increased markedly since the October lows. This isn’t the first time we have discussed investor sentiment, which is often wrong at the extremes.

“One of the hardest things to do is go “against” the prevailing bias regarding investing. Such is known as contrarian investing. One of the most famous contrarian investors is Howard Marks, who once stated:

‘Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while.

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.‘” – Sentiment Is So Bearish It’s Bullish

That bolded sentence is the most relevant to today’s discussion.

Extreme sentiment readings, either bullish or bearish, typically denote the point where investors make the most mistakes. Such is because the emotions of “fear” or “greed” are driving investment decisions. From a contrarian investing view, we should be “buyers” when everyone is selling or “sellers” when everyone is buying.

However, that is a difficult thing to do because, as individuals, our own emotions are driving us to “follow the herd.” As Howard Marks notes, it is “challenging and lonely” to be a contrarian. However, it is often the correct thing to do.

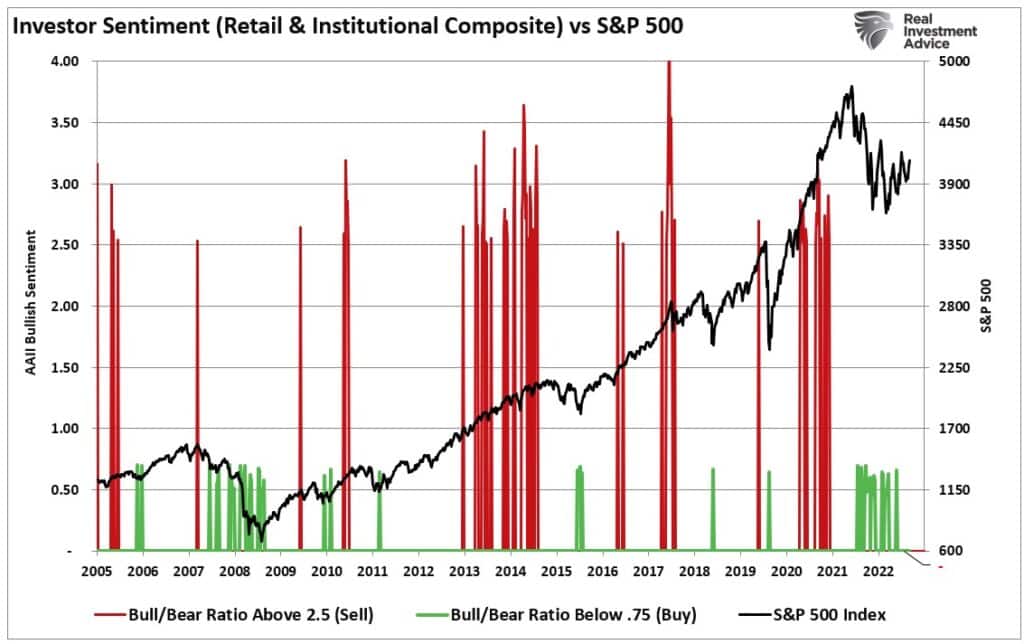

The chart below is a weekly composite index of investor sentiment. It only shows periods when investors are extremely bullish or bearish compared to the S&P 500 index.

Using sentiment as a timing indicator for investing isn’t advised, as extreme bullish or bearish sentiment can last for extended periods as price momentum trends higher or lower. However, understanding that extreme bullishness or bearishness tends to denote market excesses is essential to temper our emotional biases.

Most importantly, as investors, we need to recognize that while bullishness or bearishness at extremes is often wrong, investor sentiment is often correct in the middle of the trend.

When Investing, Star Wars Is Wrong

There are numerous scenes in the Star Wars films when characters are told to “search their feelings” to discover what they know to be true. The problem is that, as humans, we tend to extrapolate temporary events as permanent trends, mainly when investing. When markets rise, we believe the current trend will last indefinitely. When markets fall, they must be going to zero. Neither is true and is also the “fallacy” behind “buy and hold” investing and “compounded” market returns.

A brief review of market history shows that markets neither rise nor fall indefinitely, and periods of bullishness always lead to bearishness eventually. The chart shows the difference between the Dow Jones Industrial Average’s real value and what it would be if it grew at 5% annually (the buy and hold premise). The difference in ending values is due to the periods of falling returns reversing the previous periods of growth. Crucially, periods of declining values destroy the compounding effect.

However, while that differential between outcomes is terrible enough, the reality is far worse due to investors’ emotional bias. Each year, Dalbar produces an investor survey that reveals the average investors’ performance versus the market’s returns. To wit:

“The bar chart below shows the difference in performance as well as the growth of $100,000 between the average equity investor and the S&P 500 Index for the past 30 years (through 2022). It also compares the average annualized return of such an initial investment to the rate of inflation and a short-term bond index over that same period.“

Dalbar explains well why a reasonably significant performance differential exists between the average investor and the market.

“This research series studies investor performance in mutual funds. Its goal is to show how investors can improve portfolio performances by managing behaviors that cause them to act imprudently.

If you’ve been following Dalbar’s research over the years, you know that one consistent theme keeps cropping up. Namely, the set of longer-term data analyzed in these QAIB reports clearly shows that people are, more often than not, their own worst enemies when it comes to investing.

Often succumbing to short-term strategies such as market timing or performance chasing, many investors show a lack of knowledge and/or ability to exercise the necessary discipline to capture the benefits markets can provide over longer time horizons. In short, they too frequently wind up reacting to market maturations and lowering their longer-term returns.”

To simplify that analysis, investors succumb to their emotions of either bullishness or bearishness, often at the moment when an opposite action should be taken.

At the outset, I noted many negative headlines, prognostications, and a slew of data suggesting poor outcomes for equity markets. However, bullishness is rising contrary to what logic suggests.

Therefore, how should we consider current investor sentiment in our portfolio management process?

Right In The Middle, Wrong At Both Ends

As noted, investor sentiment, either bullish or bearish, tends to be right in the middle but wrong at extremes. If we revisit our weekly composite sentiment index, we see it is rising from an extreme low.

Reviewing the 2008 period, we see that sentiment can remain low for an extended period. However, once it rises more consistently, such tends to mark the equity market low. Such may be what we are seeing now.

However, while individuals succumb to emotions dictating investing actions, professional investors suffer from the same bias. The National Association Of Active Investment Managers (NAAIM) represents its members’ average exposure to U.S. equity markets. Historically, when that index falls below 40% exposure, such aligns with market bottoms (conversely, above 90% aligns with market peaks.)

Another measure of sentiment, the volatility index (VIX), also suggests the market low was in October. Extreme VIX readings occur at or near market lows as extreme “panic” drives selling. Bull markets are typically defined by a declining VIX from a previous peak. The 2022 selloff was a “correction” within an ongoing bull market because the VIX peaked around 30. With that index back on the decline, such also suggests that October was the correction low.

Excessive bullishness is missing, while extreme bearishness is fading but still prevalent.

Is the current rally since the beginning of the year a return of the bull market? Maybe. It could also be a “bear market rally” sucking investors back in before “the next shoe falls.”

Unfortunately, we won’t know until after the fact. However, rising bullishness from extremely low readings has often suggested a more protracted market advance “climbing a wall of worry.”

As Stephan Cassaday once quipped:

“More money has been lost trying to avoid bear markets than has been lost in any bear market.”

While it is easy to allow the many headlines, podcasts, and media prognostications to spin up our “emotional biases,” it is essential to remain focused on what the market is doing versus what we “think” it should be.

Investment

Own a cottage or investment property? Here's how to navigate the new capital gains tax changes – The Globe and Mail

Two brown Adirondack chairs on a wooden pier with a yellow canoe. Across the calm water is a brown cottage nestled among green trees. Canada flag is waving on a pole.flyzone/iStockPhoto / Getty Images

New rules for taxing capital gains mean quick decisions are required for cottages that families have owned for decades, and investment properties as well.

Until June 24, you can sell a second property or cottage and pay tax on just half your capital gain, however much it is. After that date, the recent federal budget proposes to increase the inclusion rate on capital gains greater than $250,000 to two-thirds. Capital gains of this size can easily be envisioned in the property market after the massive price gains of the past 10-plus years.

“From now until June, we might be seeing some hasty sales to bypass the increase in capital-gains tax for those people who have held a property for long enough to realize that gain above $250,000,” said Diana Mok, adjunct professor at the University of Western Ontario and an expert on real estate finance.

But maybe you don’t want to rush into anything. Historically, the capital-gains inclusion rate has many times been adjusted up and down. The rate went from half to two-thirds in the late 1980s and then up to three-quarters from 1990 to 1999. In 2000, it was chopped back to two-thirds and then again to 50 per cent.

The next opening for a change would be after the next federal election, which is expected by fall of 2025 unless the minority Liberal government falls earlier. People may want to hold on to secondary properties until after that election. “I think this is a huge reason that people will be focused on the Conservative Party,” said Lani Stern, broker and senior vice-president of sales at Sotheby’s International Realty Canada.

Mr. Stern said he’s advising clients to sell only if they already had plans to do so. The federal government’s budget documents suggest there’s an expectation of a bulge of capital gains-generated tax revenue in general this year as people try to get ahead of the higher inclusion rate.

A capital gain is the difference between the purchase price of a home, stock or other asset and the sale price. The inclusion rate is the portion of the gain that is taxable. Currently, the 50-per-cent inclusion rate on a $500,000 capital gain means a taxable gain of $250,000.

The taxable amount of a $500,000 gain under the new rules would be $291,750. That’s $125,000, or 50 per cent of $250,000, plus $166,750, which is 66.7 per cent of the other $250,000 portion of the $500,000 gain.

Your margin tax rate would determine how much tax you actually pay on these gains.

Draft legislation for the new capital-gains rules has yet to be issued. But John Oakey, vice-president of taxation at Chartered Professional Accountants of Canada, said he believes it will be possible for capital gains to be split on the sale of properties co-owned by spouses. Each spouse would be able to report up to $250,000 in capital gains at the 50-per-cent inclusion rate.

The higher inclusion rate was billed in the budget as a way of targeting high-net-worth individuals, but middle-class families could be caught up as well in selling family cottages bought decades ago at a fraction of their current value. A principal residence can still be sold tax-free, but the gain on a cottage or investment property is taxable.

“Whether/when to transfer cottages to the next generation is a perennial question for many Canadians,” Andrew Guilfoyle, partner at Chronicle Wealth, said by e-mail. “The time crunch could make this much more difficult to execute versus simply realizing capital gains in an investment account of public stocks, as there will be legal documents and valuations needed.”

Prof. Mok sees the impact of the higher capital-gains inclusion rate being felt more by long-term investors than those who are flipping properties. “I could hardly see even the hottest market in Canada, such as Toronto, gaining $250,000 within a year or two,” she said.

Longer-term real estate investors will adjust to the higher tax rate, Prof. Mok predicted. Her thinking on this is influenced by what happened in Toronto after the introduction of a municipal land-transfer tax in 2008. Some observers thought house prices would cool down or fall, but that never happened. Similarly, people will adjust to the new capital-gains tax rate.

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.

Investment

Looking for Once-in-a-Generation Investment Opportunities? Here Are 3 Magnificent Stocks to Buy Right Now – Yahoo Finance

I disagree with the adage that “opportunity only knocks once.” At least, I don’t think it’s always true with investing. That said, there are inflection points for some stocks after which things will never be the same.

Looking for these kinds of once-in-a-generation investment opportunities? Here are three magnificent stocks to buy right now.

1. Occidental Petroleum

You might be surprised to see an oil stock on this list. Aren’t companies based on fossil fuels in danger of becoming fossils themselves? Not if Occidental Petroleum (NYSE: OXY) has its way.

Occidental is at the forefront of developing direct air capture (DAC) technology. DAC extracts carbon dioxide directly from the air. Oxy CEO Vicki Hollub’s goal is to produce “net-zero” oil where the CO2 captured in the production of the oil effectively cancels out the emissions produced by using the oil. Hollub believes if DAC fulfills its potential, her company will be able to “produce oil and gas forever.”

Carbon capture could also open up a massive new opportunity for Occidental and other pioneers. ExxonMobil projects a carbon capture and storage market of $4 trillion by 2050. Unsurprisingly, the oil and gas giant is also investing heavily in the technology.

Occidental is potentially at another inflection point as well. Warren Buffett’s Berkshire Hathaway currently owns 28% of the company. Buffett has made clear Berkshire doesn’t want to acquire Oxy. However, I suspect the conglomerate will continue to aggressively buy shares of the oil producer — especially considering Berkshire secured regulatory approval to purchase up to 50% of the company. Occidental could become a near-subsidiary of the conglomerate even if doesn’t have majority ownership.

2. UiPath

I think artificial intelligence (AI) will create many once-in-a-generation investment opportunities. And those opportunities aren’t limited to the tech giants that typically capture the headlines. UiPath (NYSE: PATH) is a much smaller company with a market cap of under $11 billion that could be on the threshold of a new era.

UiPath is a leader in robotic process automation (RPA). The idea behind RPA is to automate online tasks to improve productivity. RPA isn’t new: UiPath was founded in 2005. However, generative AI could be a game-changer that leads to explosive growth.

A recent survey UiPath conducted with consulting firm Bain found that 70% of corporate executives believe AI-driven automation is “very important” or “critical” to the future of their industry. Eighty-four percent of executives believe AI “will radically change how businesses operate in the next five (5) years.”

UiPath is seizing this opportunity. The company recently launched preview versions of its AI-powered Autopilot for Studio product for developing process automation using natural language and Autopilot for Test Suite to improve productivity in testing. In March, UiPath introduced new generative AI capabilities for its platform.

3. Vertex Pharmaceuticals

Vertex Pharmaceuticals (NASDAQ: VRTX) commands a monopoly in treating the underlying cause of cystic fibrosis (CF). It’s in the early stages of the commercial launch of the first CRISPR gene-editing therapy, a one-time cure for two rare blood disorders. But those aren’t why I think this biotech stock is a once-in-a-generation investment opportunity.

The company could have another megablockbuster franchise waiting in the wings in treating pain. Vertex plans to file for regulatory approval of non-opioid pain drug VX-548 this summer and is already preparing for a near-term commercial launch. VX-548 could fill a big gap between anti-inflammatory drugs that are safe but not as effective and opioids that are effective but highly addictive. The biotech is also evaluating other promising non-opioid pain therapies in phase 1 and 2 clinical studies.

Vertex recently advanced inaxaplin into phase 3 testing for treating APOL1-mediated kidney disease (AMKD). It hopes to seek accelerated approval if an interim analysis at week 48 of the study looks good. There are no approved therapies that treat the underlying cause of AMKD. The disease affects more patients than CF.

There’s more. Vertex’s pipeline includes programs that hold the potential to cure type 1 diabetes. The company also recently announced the planned acquisition of Alpine Immune Sciences. Alpine expects to advance its lead candidate povetacicept into late-stage testing later this year in treating IgA nephropathy, another disease that affects more patients than CF and with no approved therapies for treating the underlying cause.

Should you invest $1,000 in Vertex Pharmaceuticals right now?

Before you buy stock in Vertex Pharmaceuticals, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vertex Pharmaceuticals wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 18, 2024

Keith Speights has positions in Berkshire Hathaway, ExxonMobil, and Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Berkshire Hathaway, UiPath, and Vertex Pharmaceuticals. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Looking for Once-in-a-Generation Investment Opportunities? Here Are 3 Magnificent Stocks to Buy Right Now was originally published by The Motley Fool

Investment

Down 80%, Is Carnival Stock a Once-in-a-Generation Investment Opportunity?

|

|

In the five years leading up to its all-time high in January 2018, Carnival (NYSE: CCL) was a winning investment. Its shares jumped 86% during that time.

It’s been a different story since then, though. This cruise stock currently sits 80% below its peak price. That’s even after shares soared 76% since the start of 2023 (as of April 18).

Does this setup on the dip make Carnival a once-in-a-generation investment opportunity? Here’s what investors need to know.

Smooth sailing

Carnival’s business is giving its shareholders plenty of reasons to be optimistic. In fiscal 2023, which ended Nov. 30, the company reported revenue of $21.6 billion, a record figure that was up 77% year over year. This number exceeded the previous record, which came in fiscal 2019.

The momentum carried over into the first quarter of 2024. During that 12-week stretch, the company hit a first-quarter record for sales. Key to this strong momentum is, without a surprise, robust demand from consumers.

“This has been a fantastic start to the year. We delivered another strong quarter that outperformed guidance on every measure, while concluding a monumental wave season that achieved all-time high booking volumes at considerably higher prices,” CEO Josh Weinstein highlighted in the latest earnings press release.

Warren Buffett, who many consider the greatest investor ever, once said that he believes the mark of a wonderful business is one that can raise prices with minimal pushback from customers. Carnival is currently demonstrating this characteristic.

It will be interesting to see if the recent trends are simply a one-hit wonder or a more sustainable development. The bulls are definitely hoping it’s the latter.

But this is a business that is recovering nicely from the worst days of the pandemic. At one point, Carnival was forced to halt its operations temporarily to prevent the spread of COVID-19. Revenue took a huge hit, dropping 91% between fiscal 2019 and fiscal 2021.

Now that the company has bounced back and looks to be on solid footing, I’m sure it’s starting to catch the attention of investors. Shares still trade at a reasonable forward P/E of 14.

Rough waters

It’s easy to say this with the benefit of hindsight, but I don’t necessarily think it’s shocking to see Carnival putting up such strong numbers right now. Unless you were convinced that demand for cruise travel would permanently fall off a cliff, I bet you expected that this business would experience a reversion to the mean.

For what it’s worth, Wall Street believes the good times won’t last very long. Analysts see annual revenue gains shrinking going forward, with fiscal 2026 sales rising by just 1.9% compared to the prior year.

It’s easy for investors to become short-sighted and focus too much on financial results from one year or one quarter. But it’s best to think about the bigger picture, turning our attention to the long term.

To be clear, I still believe Carnival is an extremely risky business to own. As of Feb. 29, the company had a massive debt load of $31 billion. A lot of this capital was raised to buy the company time throughout the pandemic. Management has used cash to pay down the principal. But that’s a huge burden that adds tremendous financial risk should there be economic weakness.

Speaking of the economy, demand for cruise trips demonstrates cyclicality, as it’s a discretionary purchase. I’m concerned about how Carnival will fare in a potential recessionary scenario, which could happen unpredictably.

It might be smooth sailing for Carnival right now, but there are always rough waters to worry about. I don’t believe this is a once-in-a-generation investment opportunity.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 18, 2024

Neil Patel and his clients have no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

Down 80%, Is Carnival Stock a Once-in-a-Generation Investment Opportunity? was originally published by The Motley Fool

-

Business12 hours ago

Honda to build electric vehicles and battery plant in Ontario, sources say – Global News

-

Science13 hours ago

Science13 hours agoWill We Know if TRAPPIST-1e has Life? – Universe Today

-

Investment16 hours ago

Down 80%, Is Carnival Stock a Once-in-a-Generation Investment Opportunity?

-

Health12 hours ago

Health12 hours agoSimcoe-Muskoka health unit urges residents to get immunized

-

News17 hours ago

Honda expected to announce multi-billion dollar deal to assemble EVs in Ontario

-

Art23 hours ago

‘Luminous’ truck strap artwork wins prestigious Biennale prize in first for New Zealand – The Guardian

-

Sports22 hours ago

Sports22 hours agoJets score 7, hold off Avalanche in Game 1 of West 1st Round – NHL.com

-

Science18 hours ago

Science18 hours agoWatch The World’s First Flying Canoe Take Off