News

Canada-US border reopening: Business sector reacts – CTV News

OTTAWA –

Monday’s reopening of the Canada-U.S. land border is sparking a mixed reaction among Canadian business leaders: They’re excited that people and not just goods will be crossing the border again but are wary of remaining red tape.

The Canadian Chamber of Commerce and the Business Council of Canada say the Canadian requirement for returning travellers to provide a recent, negative molecular test is an unnecessary obstacle to kick-starting business travel and tourism.

They say proof of vaccination is all that should be needed and the test requirement should be scrapped.

They argue that the continued testing requirement is too cumbersome for Canadian business travellers wanting a quick visit to an American destination, and too expensive for families who want a vacation or reunion with loved ones.

“If we believe, as we should, that being fully vaccinated is the best way of minimizing risk, we should be trusting the vaccination systems. We should be monitoring what’s taking place in terms of outbreaks in the two countries,” chamber president Perrin Beatty said in an interview.

“It’s a competitive disadvantage to Canada and North America to have rules that are inconsistent with where most of the world is moving to,” said Goldy Hyder, the president of the Business Council of Canada.

While the U.S. will not require travellers to show a negative COVID-19 test, the Canadian government is not waiving that requirement for citizens and permanent residents when they enter Canada.

That means that when the land border opens for the first time to non-essential travellers since March 2020, it will not be accompanied by an end to a negative COVID-19 test requirement for Canadian travellers.

Beatty said the response to the 9/11 terrorist attacks in the United States 20 years ago offers the government a good lesson in risk management.

After the attacks on the Twin Towers in New York City and the Pentagon, the Canada-U.S. border was slammed shut. It quickly reopened because both governments realized that trade and the flow of goods and people across the border all needed to resume, but with tighter security measures in place.

Canada and the U.S. realized they couldn’t stamp out terrorism, so they “adopted a risk management approach that said, ‘What we will do is we’ll focus on the areas of highest risk. We’ll use intelligence,”‘ said Beatty.

“But the government treated COVID in a very different way, one that was unco-ordinated, and one that wasn’t based on risk management.”

Meredith Lilly, the Simon Reisman Chair in trade policy at Carleton University’s Norman Paterson School of International Affairs, said it might be some time before the impact of border closures and various lockdowns will be known on a key aspect of international trade — labour mobility.

“We have all just been subjected to the world’s largest experiment in digitalization. Many of us have been forced to learn how to operate in the digital environment and not travel to do work that once required us to be in person,” said Lilly.

“I don’t know that we yet fully understand the consequences of ΓǪ whether that is going to impact the liberalization of labour mobility, where people were mega-commuting and where we saw labour mobility as kind of a big, important part of 21st-century globalized trade.”

Lilly said the aftermath of the 9/11 attacks and the new border security and anti-terrorism measures that followed could prove instructive in the years ahead.

For example, she said day trips between the two countries dropped dramatically, the result of what became known as “the unfriendly border phenomenon in which travellers opt to forgo trips out of reluctance to face heightened scrutiny.

The expense and inconvenience of getting a PCR test could prove discouraging. That could have a damaging effect on tourism, leading to a decline in shorter, more spontaneous trips, said Lilly.

Larger companies might be able to absorb the cost of tests, but smaller businesses might not be able to shoulder them, she added.

Hyder said the government needs to have more faith in the ability of vaccines to stop the spread of COVID-19 or at least weaken its impact on people who might contract it.

“We have to have a new approach to the way we manage risk and we see risk. And I think Canadians should be rewarded with their compliance on the vaccines,” said Hyder.

“If the only people moving around are fully vaccinated people, it is time that we trust the vaccine, and we recognize that the endemic nature of this means we have to coexist with this.”

Brian Kingston, the president of the Canadian Vehicle Manufacturers Association, said the auto industry is ready to take advantage of whatever new flexibility unrestricted land travel will allow, given that the integrated industry and its supply chain straddles the Canada-U.S. border.

“We saw continued movement of parts and finished vehicles throughout the pandemic, which is all very positive. However, we have had challenges with the movement of personnel,” said Kingston, citing engineers and researchers.

“There have been challenges with respect to the rules around the border, in particular the definition of what is an essential worker and the exemptions that were provided.”

While travelling by plane was always an option, the fact that so much of the industry is clustered around the Windsor-Detroit border meant that simply created planning headaches while generating extra expense, he said.

“Something comes up. You have to visit a facility, or fix a piece of machinery. It was just an extra burden to have to go to an airport and fly into the U.S.,” said Kingston.

“Having that in the rear-view mirror — it’s great.”

This report by The Canadian Press was first published Nov. 6, 2021.

News

CTV National News: Tax hike coming for Canadians? – CTV News

[unable to retrieve full-text content]

CTV National News: Tax hike coming for Canadians? CTV News

Source link

News

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

Finance Minister Chrystia Freeland today tabled a 400-page-plus budget her government is pitching as a balm for anxious millennials and Generation Z.

The budget proposes $52.9 billion in new spending over five years, including $8.5 billion in new spending for housing. To offset some of that new spending, Ottawa is pitching policy changes to bring in new revenue.

Here are some of the notable funding initiatives and legislative commitments in budget 2024.

Ottawa unloading unused offices to meet housing targets

One of the biggest pillars of the budget is its housing commitments. Before releasing the budget, the government laid out what it’s calling Canada’s Housing Plan — a pledge to “unlock” nearly 3.9 million homes by 2031.

The government says two million of those would be net new homes and it believes it can contribute to more than half of them.

It plans to do that by:

- Converting underused federal offices into homes. The budget promises $1.1 billion over ten years to transform 50 per cent of the federal office portfolio into housing.

- Building homes on Canada Post properties. The government says the 1,700-plus Canada Post offices across the country can be used to build new homes while maintaining postal services. The federal government says it’s assessing six Canada Post properties in Quebec, Alberta and British Columbia for development potential “as a start.”

- Rethinking National Defence properties. The government is promising to look at redeveloping properties and buildings on National Defence lands for military and civilian use.

- Building apartments. Ottawa is pledging a $15 billion top-up to the Apartment Construction Loan Program, which says it will build 30,000 new homes across Canada.

Taxing vacant land?

As part of its push on housing, the federal government also says it’s looking at vacant land that could be used to build homes.

It’s not yet committing to new measures but the budget says the government will consider introducing a new tax on residentially zoned vacant land.

The government said it plans to launch consultations on the measure later this year.

Help for students

There’s also something in the budget for students hunting for housing.

The government says it will update the formula used by the Canada Student Financial Assistance Program to calculate housing costs when determining financial need, to better reflect the cost of housing in the current climate.

The government estimates this could deliver more aid for rent to approximately 79,000 students each year, at an estimated cost of $154.6 million over five years.

The government is also promising to extend increased student grants and interest-free loans, at an estimated total cost of $1.1 billion this year.

Increase in taxes on capital gains

To help cover some of its multi-billion dollar commitments, the government is proposing a tax hike on capital gains — the profit individuals make when assets like stocks and second properties are sold.

The government is proposing an increase in the taxable portion of capital gains, up from the current 50 per cent to two thirds for annual capital gains over $250,000.

Finance Minister and Deputy Prime Minister Chrystia Freeland said this year’s federal budget will pave the way for Canada to build more homes at a pace not seen since the Second World War. The new investment and changes to funding models will also cut through red tape and break down zoning barriers for people who want to build homes faster, she said

Freeland said the change would impact the wealthiest 0.1 per cent.

There’s still some protection for small businesses. There’s been a lifetime capital gains exemption which allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small business shares and farming and fishing property. This June the tax-free limit will be increased to $1.25 million and will continue to be indexed to inflation thereafter, according to the budget.

The federal government estimates this could bring in more than $19 billion over five years, although some analysts are not convinced.

Disability benefit amounts to $200 per month

Parliament last year passed the Canada Disability Benefit Act, which promised to send a direct benefit to low-income, working-age people with disabilities.

Budget 2024 proposes funding of $6.1 billion over six years, beginning this fiscal year, and $1.4 billion per year ongoing, for a new Canada Disability Benefit.

Advocates had been hoping for something along the lines of $1,000 per month per person. They’ll be disappointed.

According to the budget document, the maximum benefit will amount to $2,400 per year for low income individuals with disabilities between the ages of 18 and 64 — about $200 a month.

The government said it plans for the Canada Disability Benefit Act to come into force in June 2024 and for payments to start in July 2025.

Carbon rebate for small businesses coming

The federal government has heard an earful from small business advocates who accuse it of reneging on a promise to return a portion of carbon pricing revenues to small businesses to mitigate the tax’s economic costs.

The budget proposes to return fuel charge proceeds from 2019-20 through 2023-24 to an estimated 600,000 businesses with 499 or fewer employees through a new refundable tax credit.

The government said this would deliver $2.5 billion directly to Canada’s small- and medium-sized businesses.

Darts and vape pods will cost more

Pitching it as a measure to cut the number of people smoking and vaping, the Liberals are promising to raise revenues on tobacco and smoking products.

- Just Asking wants to know: What questions do you have about quitting smoking or vaping? Do you think sin taxes will encourage smoking cessation? Fill out the details on this form and send us your questions ahead of our show on April 20.

Starting Wednesday, the total tobacco excise duty will be $5.49 per carton. The government estimates this could increase federal revenue by $1.36 billion over five years starting in 2024-25.

The budget also proposes to increase the vaping excise duty rates by 12 per cent effective July 1. That means an increase of 12 to 24 cents per pod, depending on where you live.

Ottawa hopes this increase in sin taxes will bring in $310 million over five years, starting in 2024-25.

More money for CBC

Heritage Minister Pascale St-Onge has mused about redefining the role of the public broadcaster before the next federal election. But before that happens, CBC/Radio-Canada is getting a top-up this year.

The budget promises $42 million more in 2024-25 for CBC/Radio-Canada for “news and entertainment programming.” CBC/Radio-Canada received about $1.3 billion in total federal funding last year.

The government says it’s doing this to ensure that Canadians across the country, including rural, remote, Indigenous and minority language communities, have access to independent journalism and entertainment.

Last year, the CBC announced a financial shortfall, cut 141 employees and eliminated 205 vacant positions. In a statement issued Tuesday, CBC spokesperson Leon Mar said the new funding means the corporation can balance its budget “without significant additional reductions this year.”

Boost for Canada’s spy agency

As the government takes heat over how it has handled the threat of foreign election interference, it’s promising more money to bolster its spy service.

The Canadian Security Intelligence Service is in line to receive $655.7 million over eight years, starting this fiscal year, to enhance its intelligence capabilities and its presence in Toronto.

The budget also promises to guarantee up to $5 billion in loans for Indigenous communities to participate in natural resource development and energy projects in their territories.

These loans would be provided by financial institutions or other lenders and guaranteed by the federal government, meaning Indigenous borrowers who opt in could benefit from lower interest rates, the budget says.

News

Canada's 2024 budget announces 'halal mortgages'. Here's what to know – National Post

Article content

The 2024 federal budget says the Liberal government plans to introduce “halal mortgages” as a way to increase access to home ownership.

Here’s what “halal mortgage” means and what that effort might look like:

Article content

What does Canada’s 2024 budget say?

The plan mentions the creation of “alternative financing products, including halal mortgages” as a means to “enable Muslim Canadians, and other diverse communities, to further participate in the housing market.”

Article content

Ottawa is “exploring” measures that could change “the tax treatment of these products” or provide a “new regulatory sandbox for financial service providers,” it says.

Recommended from Editorial

The government began consultations in March 2024 with financial services providers and “diverse communities” as it sets out to expand mortgage policies to include alternative financing, the budget adds. The Liberal government says it will make announcement detailing what such a plan would look like this the fall.

Why are regular mortgages not considered halal?

Islamic law, or Sharia, prohibits Muslims from charging or receiving interest because they are seen as exploitative and immoral. Instead of giving loans, Islamic banks use different payment structures to avoid charging interest.

What are halal mortgages?

Sharia-compliant mortgages include payment structures that take interest out of the equation. There are three common types of halal mortgages: ijara, Musharaka, and Murabaha.

Article content

Ijara is a rent-to-own model in which a bank buys the asset and leases it back out to the customer over a set period. The payments go toward both the capital and provide a profit for the financial institution.

Musharaka, a form of partnership with the financier, involves both parties owning the property until the equity is gradually transferred and the partnership dissolves.

Murabaha is a credit system in which the ownership is immediately sold to the customer, with profits included in the final offer. The buyer’s credit history, deposit and terms of the agreement are factored in.

Because these structures are considered more risky, they are often more expensive than a traditional interest loan. Canada’s big banks do not currently provide halal mortgages, which the Liberal government hopes to change. According to Canadian Press, lack of halal financial options have left many Muslims waiting for smaller firms to allow them to make investments and buy homes.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our daily newsletter, Posted, here.

Share this article in your social network

-

Tech22 hours ago

Tech22 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Sports21 hours ago

Sports21 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

News19 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Media23 hours ago

NPR's liberal bias: Editor exposes media's lack of viewpoint diversity – USA TODAY

-

News16 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Tech19 hours ago

Tech19 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Investment15 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

Sports18 hours ago

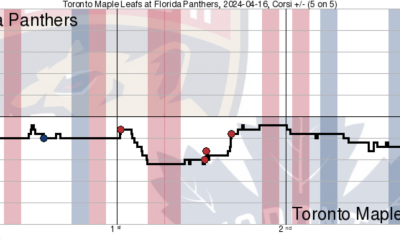

Sports18 hours agoGame in 10: Maple Leafs squander multi-goal lead to Florida, draw the Boston Bruins in the first round – Maple Leafs Hot Stove