News

Canada’s Hydro One seeks bigger M&A targets to boost customers

|

|

Ontario‘s largest electric utility, Hydro One Ltd, is seeking acquisitions worth up to C$500 million ($397 million) to boost its customer base and consolidate the fragmented industry, a spokeswoman told Reuters.

The government of Ontario, Canada‘s most populous province, is eager to bring down electricity costs for customers. To achieve that, the province is encouraging Hydro One to obtain customers through acquisition, according to sources.

“We believe this consolidation of our business benefits the community, Ontario and Hydro One as it makes the provincial grid more efficient, while reducing costs across the system,” the Hydro One spokeswoman said.

Dealmaking will mainly focus on expanding service areas and customers, replacing aging infrastructure and improving grid reliability, said one of the sources.

Ontario’s electricity distribution network is highly fragmented with 60 companies, 55 of which hold less than a 2% share of the industry, according to data from provincial regulator the Ontario Energy Board (OEB).

Hydro One, which has a market value of C$17.9 billion, declined to say how much it plans to increase its customer base from the current 1.4 million.

While the company has by far the largest market share in the province, with 35.5% of the industry total, Toronto Hydro-Electric System Ltd and Alectra Utilities Corp are top competitors, with 21.8% and 18.1% of the market, respectively.

LOWER BILLS

Two of Hydro One’s smaller deals, worth a total C$132 million, won regulatory approval last year, encouraging the company to hunt for more opportunities.

“I think government over time has been trying to encourage consolidation,” said Gavin MacFarlane, vice president-senior credit officer at Moody’s.

The company, which had over C$2 billion in net cash as of December 31, 2020, according to its last annual report, plans to fund acquisitions using its balance sheet, said the spokeswoman.

Hydro One last month estimated spending of C$1.91 billion on capital investment for 2021, but the spokeswoman declined to comment on how much would be spent on mergers and acquisitions.

Dealmaking in Canadian power companies has accounted for $2.3 billion this year to date compared with $4.3 billion for the entirety of 2020, with Hydro One making up 2% of deals, according to data from Dealogic.

Hydro One most recently acquired the business assets of Peterborough Distribution Inc and Orillia Power Distribution Corp for a total value of C$104 million.

Hydro One told Reuters that customers in Peterborough and Orillia saw a 1% reduction in the base distribution part of their bills after the acquisitions.

“We believe there are further opportunities in Ontario for consolidation and we are open to pursuing these opportunities as they arise,” said the spokeswoman.

Hydro One, 47.3% owned by the government of Ontario, has been beefing up its mergers and acquisitions team by hiring experts from banks and other advisory firms, three sources told Reuters and the company confirmed.

Among Hydro One’s recent hires was new Vice President, Growth Matt Vines, an investment banker hired from Bank of Montreal in August who previously worked in M&A for Canadian Imperial Bank of Commerce.

While the spokeswoman for Hydro One said the company was “strengthening” its corporate strategy team, she declined to share the size of the current team with Reuters.

($1 = 1.2635 Canadian dollars)

(Reporting by Maiya Keidan in Toronto and Shariq Khan in Bengaluru; Editing by Denny Thomas and Steve Orlofsky)

News

Drinking water quality: Canada's plan for forever chemicals – CTV News

As the United States sets its first national limits on toxic forever chemicals in drinking water, researchers say Canada is lagging when it comes to regulations.

Still, they acknowledged that Canada is making progress in trying to reduce and prevent the contamination of water in the country.

From carpeting to non-stick cookware, so-called forever chemicals, or perfluoroalkyl and polyfluoroalkyl substances (PFAS), have been widely found in consumer products since the 1950s.

These chemicals are designed to be so strong that they don’t break down fully in the environment. They’re used to make products non-stick, oil- and water-repellent and resistant to temperature change.

Growing evidence shows PFAS are in Canadian freshwater sources and drinking water, according to Health Canada. Studies have linked PFAS to serious health problems, such as cancer, low birth weight and liver disease.

The U.S. Environmental Protection Agency (EPA) finalized its drinking water regulation for six PFAS last week. Under the new regulation, utilities are required to limit certain forever chemicals, including two common types —perfluorooctane sulfonic acid (PFOS) and perfluorooctanoic acid (PFOA) — to four parts per trillion, or four nanograms per litre. As well, water providers must test for these PFAS and alert the public when levels are too high.

Similarly, Health Canada proposed new limits for PFAS in drinking water in February 2023. There are currently drinking water quality guidelines for PFOA and PFOS in Canada.

Under the current guidelines, the limit is 200 ng/L for PFOA, which is 50 times more than the U.S. limit of 4 ng/L. At 600 ng/L for PFOS, the maximum allowable amount in Canada for this type of forever chemical is 150 times more than the U.S limit.

In light of the changes south of the border, CTVNews.ca asked Health Canada whether there were any plans to change the limits, or to follow the American lead on the issue.

In a recent email to CTVNews.ca, Health Canada spokesperson Mark Johnson said the department has proposed a drinking water objective with a much lower limit of 30 ng/L for all PFAS detected in drinking water.

Canada’s strategy

Despite Canada’s proposed drinking water limit for PFAS being about eight times higher than the ones for the United States, many factors are probably at play, according to an expert.

Satinder Kaur Brar, a civil engineering professor and James and Joanne Love Chair in Environmental Engineering at York University in Toronto, has been doing work for the past few decades on various contaminants including PFAS in waters and wastewaters.

“Definitely U.S. EPA has taken a leap forward in this direction,” she said in a video interview with CTVNews.ca, noting no international standards exist. “So I would say that if we have set up higher limits here for the Canadian citizens, definitely we are exposing them more, or making them more vulnerable to these chemicals.”

Canada’s recently proposed limits only deal with drinking water, not other contaminated sources such as food, soils, sediments and air, Brar pointed out. She points to political leaders as being among those to blame for what some may perceive as holes in the proposed policy changes.

“I would say that the political will is also lacking because political will also plays an important role in bringing out these regulations,” she said. “We have left out many important environmental compartments, which are all interlinked and contributing to the overall … presence of PFAS in water.”

‘Stringent enough’?

And when it comes to laws and regulations, a senior environmental law researcher and paralegal says Canada has made strides in tackling the problem, but it’s lagging behind some countries such as the U.S.

“So while the U.S. EPA numbers are set much lower than Canada’s, what we see in Canada is at least a progression from the current guidelines, and that’s not a bad thing,” Fe de Leon, with the Canadian Environmental Law Association in Toronto, said in a video interview with CTVNews.ca.

“The question is whether it’s stringent enough to deal with the scope of impacts that these chemicals have on the environment and particularly human health.”

Health Canada’s Johnson said the final drinking water objective for PFAS will be published later this year, replacing current guidelines. Provinces and territories use these guidelines and objectives to create drinking water quality requirements for all Canadians, he said.

Provincial and territorial authorities have been monitoring treated drinking water in some regions, and the federal government has been monitoring PFAS in freshwater since 2013, Johnson added.

“Current data regarding PFAS in Canadian freshwater sources and drinking water suggest that PFAS are present at levels below the new proposed objective,” Johnson said in an emailed statement. “However, the concentrations of PFAS in freshwater and drinking water may be higher near facilities that use large amounts of these chemicals, locations where firefighting foams containing PFAS were used to put out a fire, and landfills and wastewater treatment plants.”

‘The biggest issue’

A major problem is a lack of information on the forever chemicals affecting Canadians, many of whom may be unaware of what these chemicals are, where they’re found and the impact they can have on our health and the world around us.

“The biggest issue right now is complete disclosure of how many of these chemicals are actually found in the Canadian market and are being released into the environment,” Brar said. “We don’t have a good handle on that.”

Over the last few years, she said, more sites across Canada have been “impacted substantially” by PFAS. “So this is absolutely necessary that the government moves ahead and takes action on these chemicals, and create their own strategy.”

A chemical engineering professor who leads a team that conducts research on the impacts of these chemicals says he believes that both Canada and the U.S. have made their boldest moves so far to address the problem.

“The net effect is that both the U.S. and Canada are trying to limit … these chemicals in drinking water to levels that are extremely low and barely measurable,” said Franco Berruti, director at the Institute for Chemicals and Fuels from Alternative Resources at Western University in London, Ont., in a video interview with CTVNews.ca. “At the end of the day …they will have the similar effect.”

Barriers to a solution

Berruti said there isn’t a simple solution to the problem of controlling the impact of forever chemicals. One of the barriers to regulating them is the many unknowns about PFAS.

“It’s not just a question of two or three chemicals that are considered toxic that one would regulate. But we are talking about thousands and thousands of these chemicals. We don’t even know how to analyze these chemicals,” he said.

The technologies that exist to reduce or eliminate PFAS “are very limited,” Berruti added.

Scientists are still studying different aspects of the problem, including investigating which forever chemicals are more problematic and measurable.

Out of more than 12,000 types of PFAS, Berruti estimates that only 40 may be measurable.

“To set the limits without having the ways of measuring those … extremely low concentrations doesn’t mean anything until the methodologies are there to demonstrate that those limits are reached,” he said.

While Canada doesn’t produce PFAS, Berruti said, the country should closely monitor the imports of products that are contaminated with the chemicals.

Industry concerns

Health advocates praised the U.S. move to create its first drinking water limits on PFAS, but the news wasn’t universally celebrated.

Among the concerns raised were those from water utilities, which said customers will end up paying more for water since treatment systems are expensive to install.

Actions taken in Canada have also been met with challenges and criticism.

In May 2023, Health Canada issued a draft recommendation to label PFAS, an entire class of chemicals, as toxic under the Canadian Environmental Protection Act.

Cassie Barker, the toxics program manager at Environmental Defence, said in March that it was important to label the entire class, not only each individual substance, as toxic, The Canadian Press reported. When Canada designated and banned some types of PFAS in 2012, Barker said, it became a “whack-a-mole” situation, because other products used to replace them also posed health risks.

In response to the proposed PFAS toxic designation, the Chemistry Industry Association of Canada wrote to Environment and Climate Change Canada in June 2023 asking that PFAS not be labelled toxic as an entire class of substances, and instead be designated on a case-by-case basis, based on proven risk.

PFAS currently used by Canadian industry “have not been shown to be of high risk” and sweeping prohibitions could cause economic hardship to the industry, it wrote in its letter.

In the States, growing awareness has led to lawsuits against manufacturers.

For example, 3M settled a series of lawsuits last June that could exceed US$12.5 billion, involving more than 300 U.S. municipalities where the chemicals were found in drinking water. The company said it plans to stop making PFAS by 2025.

In the same month, DuPont de Nemours Inc. and spinoffs Chemours Co. and Corteva Inc. reached a US$1.18-billion deal over similar complaints by about 300 drinking water providers.

And legal action has occurred in Canada as well.

According to the business law firm Osler, a class action was certified in 2021 against the National Research Council of Canada over PFAS in the surface water and groundwater at the NRC’s facility in Mississippi Mills, Ont.

With files from The Associated Press and The Canadian Press

News

CTV National News: Tax hike coming for Canadians? – CTV News

[unable to retrieve full-text content]

CTV National News: Tax hike coming for Canadians? CTV News

Source link

News

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

Finance Minister Chrystia Freeland today tabled a 400-page-plus budget her government is pitching as a balm for anxious millennials and Generation Z.

The budget proposes $52.9 billion in new spending over five years, including $8.5 billion in new spending for housing. To offset some of that new spending, Ottawa is pitching policy changes to bring in new revenue.

Here are some of the notable funding initiatives and legislative commitments in budget 2024.

Ottawa unloading unused offices to meet housing targets

One of the biggest pillars of the budget is its housing commitments. Before releasing the budget, the government laid out what it’s calling Canada’s Housing Plan — a pledge to “unlock” nearly 3.9 million homes by 2031.

The government says two million of those would be net new homes and it believes it can contribute to more than half of them.

It plans to do that by:

- Converting underused federal offices into homes. The budget promises $1.1 billion over ten years to transform 50 per cent of the federal office portfolio into housing.

- Building homes on Canada Post properties. The government says the 1,700-plus Canada Post offices across the country can be used to build new homes while maintaining postal services. The federal government says it’s assessing six Canada Post properties in Quebec, Alberta and British Columbia for development potential “as a start.”

- Rethinking National Defence properties. The government is promising to look at redeveloping properties and buildings on National Defence lands for military and civilian use.

- Building apartments. Ottawa is pledging a $15 billion top-up to the Apartment Construction Loan Program, which says it will build 30,000 new homes across Canada.

Taxing vacant land?

As part of its push on housing, the federal government also says it’s looking at vacant land that could be used to build homes.

It’s not yet committing to new measures but the budget says the government will consider introducing a new tax on residentially zoned vacant land.

The government said it plans to launch consultations on the measure later this year.

Help for students

There’s also something in the budget for students hunting for housing.

The government says it will update the formula used by the Canada Student Financial Assistance Program to calculate housing costs when determining financial need, to better reflect the cost of housing in the current climate.

The government estimates this could deliver more aid for rent to approximately 79,000 students each year, at an estimated cost of $154.6 million over five years.

The government is also promising to extend increased student grants and interest-free loans, at an estimated total cost of $1.1 billion this year.

Increase in taxes on capital gains

To help cover some of its multi-billion dollar commitments, the government is proposing a tax hike on capital gains — the profit individuals make when assets like stocks and second properties are sold.

The government is proposing an increase in the taxable portion of capital gains, up from the current 50 per cent to two thirds for annual capital gains over $250,000.

Finance Minister and Deputy Prime Minister Chrystia Freeland said this year’s federal budget will pave the way for Canada to build more homes at a pace not seen since the Second World War. The new investment and changes to funding models will also cut through red tape and break down zoning barriers for people who want to build homes faster, she said

Freeland said the change would impact the wealthiest 0.1 per cent.

There’s still some protection for small businesses. There’s been a lifetime capital gains exemption which allows Canadians to exempt up to $1,016,836 in capital gains tax-free on the sale of small business shares and farming and fishing property. This June the tax-free limit will be increased to $1.25 million and will continue to be indexed to inflation thereafter, according to the budget.

The federal government estimates this could bring in more than $19 billion over five years, although some analysts are not convinced.

Disability benefit amounts to $200 per month

Parliament last year passed the Canada Disability Benefit Act, which promised to send a direct benefit to low-income, working-age people with disabilities.

Budget 2024 proposes funding of $6.1 billion over six years, beginning this fiscal year, and $1.4 billion per year ongoing, for a new Canada Disability Benefit.

Advocates had been hoping for something along the lines of $1,000 per month per person. They’ll be disappointed.

According to the budget document, the maximum benefit will amount to $2,400 per year for low income individuals with disabilities between the ages of 18 and 64 — about $200 a month.

The government said it plans for the Canada Disability Benefit Act to come into force in June 2024 and for payments to start in July 2025.

Carbon rebate for small businesses coming

The federal government has heard an earful from small business advocates who accuse it of reneging on a promise to return a portion of carbon pricing revenues to small businesses to mitigate the tax’s economic costs.

The budget proposes to return fuel charge proceeds from 2019-20 through 2023-24 to an estimated 600,000 businesses with 499 or fewer employees through a new refundable tax credit.

The government said this would deliver $2.5 billion directly to Canada’s small- and medium-sized businesses.

Darts and vape pods will cost more

Pitching it as a measure to cut the number of people smoking and vaping, the Liberals are promising to raise revenues on tobacco and smoking products.

- Just Asking wants to know: What questions do you have about quitting smoking or vaping? Do you think sin taxes will encourage smoking cessation? Fill out the details on this form and send us your questions ahead of our show on April 20.

Starting Wednesday, the total tobacco excise duty will be $5.49 per carton. The government estimates this could increase federal revenue by $1.36 billion over five years starting in 2024-25.

The budget also proposes to increase the vaping excise duty rates by 12 per cent effective July 1. That means an increase of 12 to 24 cents per pod, depending on where you live.

Ottawa hopes this increase in sin taxes will bring in $310 million over five years, starting in 2024-25.

More money for CBC

Heritage Minister Pascale St-Onge has mused about redefining the role of the public broadcaster before the next federal election. But before that happens, CBC/Radio-Canada is getting a top-up this year.

The budget promises $42 million more in 2024-25 for CBC/Radio-Canada for “news and entertainment programming.” CBC/Radio-Canada received about $1.3 billion in total federal funding last year.

The government says it’s doing this to ensure that Canadians across the country, including rural, remote, Indigenous and minority language communities, have access to independent journalism and entertainment.

Last year, the CBC announced a financial shortfall, cut 141 employees and eliminated 205 vacant positions. In a statement issued Tuesday, CBC spokesperson Leon Mar said the new funding means the corporation can balance its budget “without significant additional reductions this year.”

Boost for Canada’s spy agency

As the government takes heat over how it has handled the threat of foreign election interference, it’s promising more money to bolster its spy service.

The Canadian Security Intelligence Service is in line to receive $655.7 million over eight years, starting this fiscal year, to enhance its intelligence capabilities and its presence in Toronto.

The budget also promises to guarantee up to $5 billion in loans for Indigenous communities to participate in natural resource development and energy projects in their territories.

These loans would be provided by financial institutions or other lenders and guaranteed by the federal government, meaning Indigenous borrowers who opt in could benefit from lower interest rates, the budget says.

-

News20 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Business19 hours ago

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

-

Investment19 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

Art20 hours ago

Squatters at Gordon Ramsay's Pub Have 'Left the Building' After Turning It Into an Art Café – PEOPLE

-

News23 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Tech24 hours ago

Tech24 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Tech12 hours ago

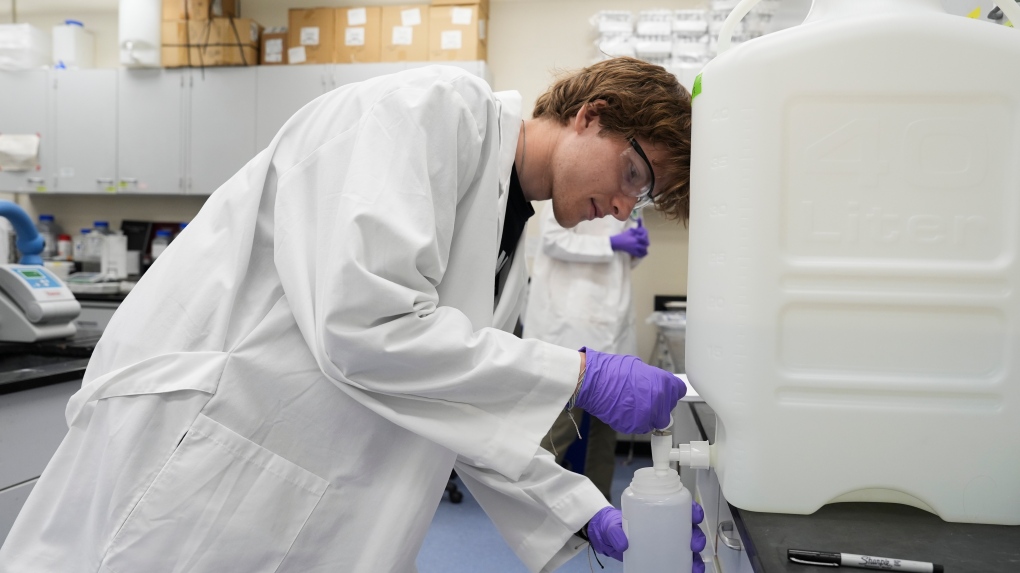

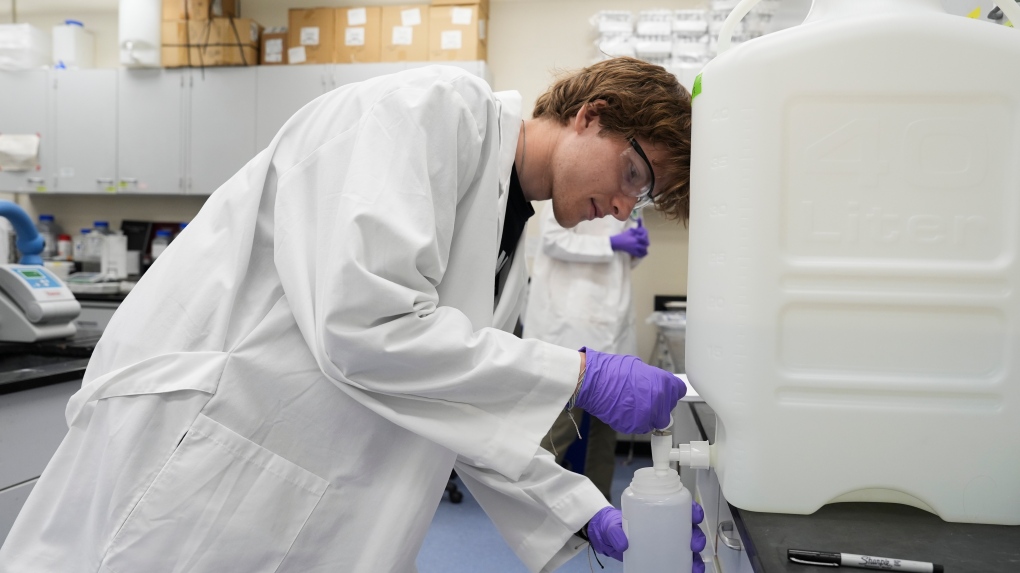

Tech12 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Art23 hours ago

‘The money is not real – it’s a feckless level of wealth’: the inside story of the biggest art fraud in American history – The Guardian