Economy

Canadian economy expands 3.3% in second-quarter, shrinks in July – BNN Bloomberg

The Canadian economy accelerated in the second quarter as the nation benefited from surging commodity prices and got a boost from the lifting of COVID-related lockdowns, though signs are emerging momentum is waning.

Gross domestic product rose at a 3.3 per cent annualized rate after a revised 3.1 per cent increase in the first three months of the year, Statistics Canada reported Wednesday. Growth was led by stronger household consumption and business spending on inventories.

The numbers paint a picture of an economy running hot for much of the first half of 2022, even as the U.S. and other countries stumbled, but is now entering a period of much slower growth in the face of decades-high inflation and rising interest rates.

The latest monthly readings show the economy contracted by 0.1 per cent in July, after a weak 0.1 per cent gain in June and flat growth in May, adding to evidence of slowing economic momentum.

Economists anticipate Canada’s growth rate will fall to below 1.5 per cent annualized in the second half of this year and into 2023, with some even predicting a recession possible amid one of the most aggressive hiking cycles ever by the Bank of Canada.

A median estimate in a Bloomberg survey of economists expected a 4.4 per cent annualized growth rate in the second quarter. The Bank of Canada forecast 4.0 per cent in their July Monetary Policy Report.

The weaker-than-expected reading reflects strong growth in imports. The part of household and business spending that is used to buy goods and services from other countries is not counted as domestic output.

RATE HIKES

The nation’s central bank has already increased its overnight policy rate by 2.25 percentage points since March, and is expected to continue hiking through the rest of the year. Investors are almost fully pricing in another 75 basis point increase at the Bank of Canada’s next policy decision on Sept. 7.

Canadians are also facing higher prices for virtually everything, with wage gains not keep up with the pace of inflation, which has hovered around 8 per cent in recent months.

To be sure, higher prices didn’t stop households from accelerating their spending in the first half. Household consumption jumped by an annualized 9.7 per cent in the second quarter.

Canada’s resource-rich economy in the first half also benefited from surging commodity prices, driving incomes higher and stoking demand.

Growth in nominal output rose 4.2 per cent on a non-annualized basis due to rising prices for national produced goods and services — the strongest increase outside of the pandemic recovery since 1981. Worker compensation was up a robust 2.0 per cent.

Businesses took advantage of the buoyant demand and strong commodity prices to accumulate inventories, totaling $47 billion. Inventory buildup was the biggest contributor to growth in the second quarter.

Business investment in structures and machinery and equipment also came in at a very strong 14 per cent annualized pace.

U.S. DECOUPLING

The strong demand helped Canada experience a rare economic decoupling from the U.S. Over the past six months, the U.S. expansion went into reverse with back-to-back quarterly contractions, even as Canada record one of the strongest six-month periods of growth in recent decades.

But that outperformance, at least compared to the U.S., represents in part a catching-up. Canada suffered through more strict lockdowns than the U.S., where the full recovery in GDP was faster.

Economists anticipate the Canadian and U.S. economies will converge in the second half of this year, and grow by about the same pace over the next couple of years.

In Canada, the impact of higher interest rates is already being felt, the data show. Residential investment fell by an annualized 28 per cent rate in the second quarter, the second-largest drop since the early 1960s. The largest quarterly decline in housing investment was during the depths of the pandemic.

The bulk of the gains in household consumption, meanwhile, were in services and semi-durables. Spending on interest-sensitive durable goods fell.

TRADE DRAG

Strong consumer demand in the first half, meanwhile, isn’t fully translating into more economic activity. Much of the spending is going abroad, with imports shooting up an annualized 31 per cent in the second quarter.

While exports also jumped by an annualized 11 per cent, shipments abroad failed to keep up with the pace of imports. Overall, the trade sector acted as a drag on growth, lowering growth by an annualized 5.2 percentage points.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Economy

IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost – BNN Bloomberg

(Bloomberg) — The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

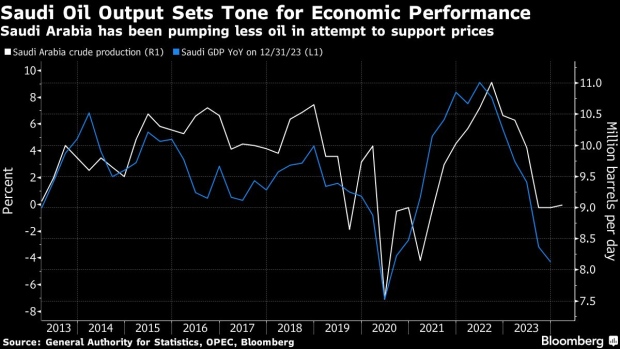

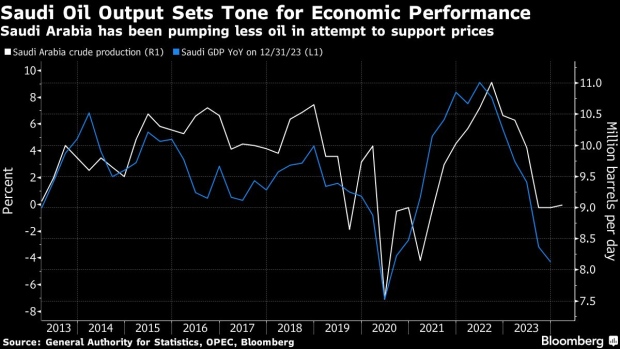

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

©2024 Bloomberg L.P.

Economy

IMF Boss Says ‘All Eyes’ on US Amid Risks to Global Economy – BNN Bloomberg

(Bloomberg) — The head of the International Monetary Fund warned the US that the global economy is closely watching interest rates and industrial policies given the potential spillovers from the world’s biggest economy and reserve currency.

“All eyes are on the US,” Kristalina Georgieva said in an interview on Bloomberg’s Surveillance on Thursday.

The two biggest issues, she said, are “what is going to happen with inflation and interest rates” and “how is the US going to navigate this world of more intrusive government policies.”

The sustained strength of the US dollar is “concerning” for other currencies, particularly the lack of clarity on how long that may last.

“That’s what I hear from countries,” said the leader of the fund, which has about 190 members. “How long will the Fed be stuck with higher interest rates?”

Georgieva was speaking on the sidelines of the IMF and World Bank’s spring meetings in Washington, where policymakers have been debating the impacts of Washington and Beijing’s policies and their geopolitical rivalry.

Read More: A Resilient Global Economy Masks Growing Debt and Inequality

Georgieva said the IMF is optimistic that the conditions will be right for the Federal Reserve to start cutting rates this year.

“The Fed is not yet prepared, and rightly so, to cut,” she said. “How fast? I don’t think we should gear up for a rapid decline in interest rates.”

The IMF chief also repeated her concerns about China devoting too much capital and labor toward export-oriented manufacturing, causing other countries, including the US, to retaliate with protectionist policies.

China Overcapacity

“If China builds overcapacity and pushes exports that create reciprocity of action, then we are in a world of more fragmentation not less, and that ultimately is not good for China,” Georgieva said.

“What I want to see China doing is get serious about reforms, get serious about demand and consumption,” she added.

A number of countries have recently criticized China for what they see as excessive state subsidies for manufacturers, particularly in clean energy sectors, that might flood global markets with cheap goods and threaten competing firms.

US Treasury Secretary Janet Yellen hammered at the theme during a recent trip to China, repeatedly calling on Beijing to shift its economic policy toward stimulating domestic demand.

Chinese officials have acknowledged the risk of overcapacity in some areas, but have largely portrayed the criticism as overblown and hypocritical, coming from countries that are also ramping up clean energy subsidies.

(Updates with additional Georgieva comments from eighth paragraph.)

©2024 Bloomberg L.P.

-

Investment21 hours ago

Investment21 hours agoUK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

-

Sports19 hours ago

Sports19 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Business18 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media1 hour ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art17 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment18 hours ago

Investment18 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech20 hours ago

Tech20 hours agoSave $700 Off This 4K Projector at Amazon While You Still Can – CNET

-

Tech19 hours ago

Tech19 hours ago'Kingdom Come: Deliverance II' Revealed In Epic New Trailer And It Looks Incredible – Forbes