Economy

Charting Global Economy: US Employment, Manufacturing Power Up – BNN

(Bloomberg) — Job growth and manufacturing in the U.S. powered ahead at end of the first quarter as a robust pace of coronavirus vaccinations, fewer restrictions on business and fiscal support generate a stronger tailwind for the economy.

Sweden, Norway and Russia are among countries on pace to return to pre-pandemic levels of growth by year-end, while Covid-19 infections continue to haunt emerging economies such as Brazil.

The pandemic may have expedited China’s bid to overcome the U.S. as the world’s largest economy later this decade.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

U.S.

Employers added the most jobs in seven months with improvement across most industries in March, as more vaccinations and fewer business restrictions supercharged the labor market recovery in the world’s largest economy.

Manufacturing expanded in March at the fastest pace since 1983, catapulted by the firmest orders and production readings in 17 years, adding to evidence of an economy poised to accelerate.

The average time it takes for production materials to reach U.S. factory floors is now the longest on record, the ISM report showed. The purchasing managers group said lead times stretched to 75 days in March from 67 days a month earlier. Shortages of basic materials, higher input prices and difficulties in transporting products are creating headaches for an otherwise robust factory sector.

Europe

Russia’s economy continued to rebound from its pandemic-induced recession in the fourth quarter of 2020, easing its contraction as President Vladimir Putin opted against imposing a second national lockdown.

By the end of 2021, Bloomberg Economics forecast output will exceed its pre-pandemic level in Sweden and Norway. That’s set to bring interest rate increases into view.

Home working is likely to remain after the pandemic finishes, according to a survey of 2,000 companies the U.K., most of which are planning to allow employees greater flexibility on where and when they do their jobs.

Asia

Since the 1970s, China has been racing to become the world’s largest economy. Its recovery from the pandemic means it could eclipse the U.S. this decade.

Returning to a high growth path will be the easy part for South Asian economies led by India, which confront much harder challenges in the form of increased inequalities and reduced access to education in the wake of the pandemic, according to the World Bank.

Emerging Markets

Brazil’s unemployment rate rose as another, more contagious wave of the coronavirus began spreading across the nation.

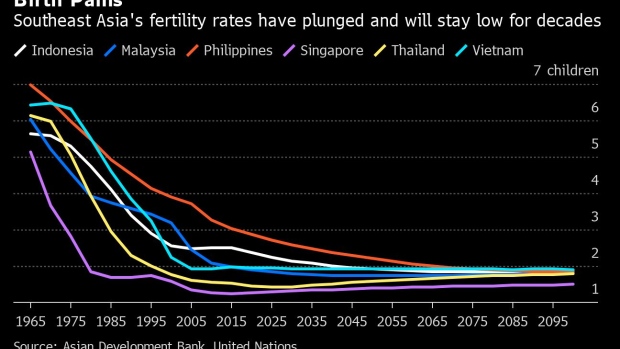

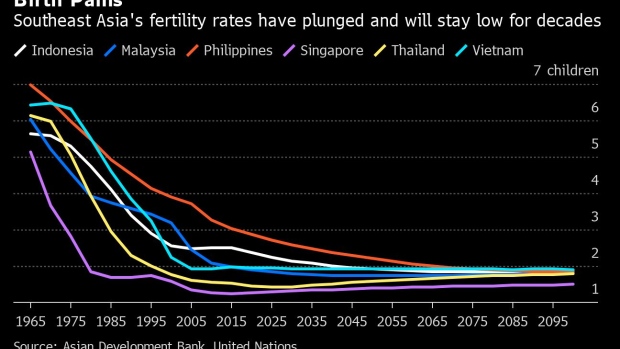

Countries across Asia are trying everything from fertility tours to baby bonuses to spur population growth in an aging world. Not so in Indonesia, where officials are trying to convince people to have fewer children.

World

Bloomberg Economics’ nowcasts of GDP growth across major economies show output for a significant chunk of the world economy poised to move above the pre-crisis peak, but with a widening divide as China and the U.S accelerate out of the slump, and European countries sink lower.

The International Monetary Fund is preparing to give its member countries the biggest resource injection in its history, $650 billion, to boost global liquidity and help emerging and low-income nations deal with mounting debt and Covid-19.

©2021 Bloomberg L.P.

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media8 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media10 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment9 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Health23 hours ago

Health23 hours agoType 2 diabetes is not one-size-fits-all: Subtypes affect complications and treatment options – The Conversation

-

Media22 hours ago

DJT Stock Jumps. The Truth Social Owner Is Showing Stockholders How to Block Short Sellers. – Barron's

-

Business22 hours ago

Tofino, Pemberton among communities opting in to B.C.'s new short-term rental restrictions – Vancouver Sun

-

Business21 hours ago

A sunken boat dream has left a bad taste in this Tim Hortons customer's mouth – CBC.ca

-

Sports23 hours ago

Sports23 hours agoStart time set for Game 1 in Maple Leafs-Bruins playoff series – Toronto Sun