Economy

Charting the Global Economy: China, Turkey Shock With Rate Cuts – BNN Bloomberg

(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Central bankers in China and Turkey bucked a global trend of raising interest rates, with officials easing policy amid signs of an economic slowdown in those countries.

China is battling a worsening property downturn as well as sluggish retail sales and rising youth unemployment. In Turkey, where inflation is running at the fastest pace in 24 years, policy makers said they’re only responding to a possible slowdown in manufacturing.

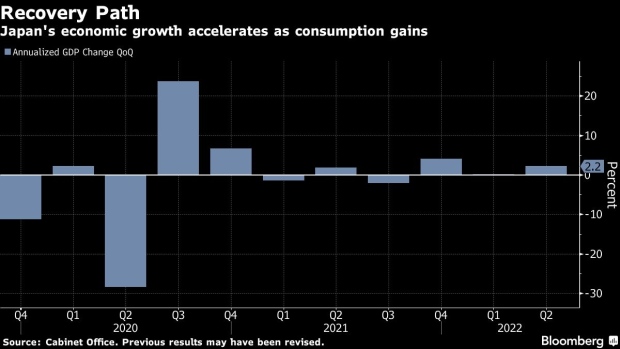

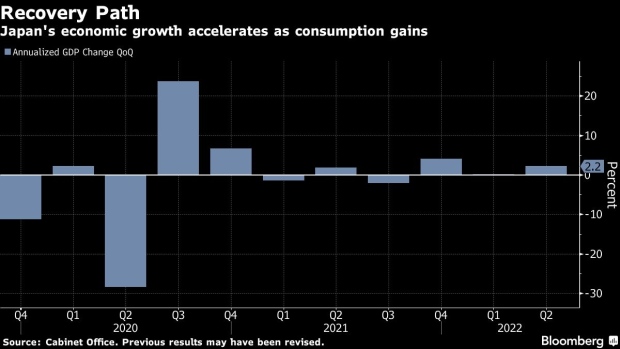

Elsewhere, growth is diverging. The euro-area and Chile are under heightened recession risk, while strong consumer spending in Japan propelled the country to its pre-pandemic size in the second quarter. Still, Japan’s economy has been slower to recover than other nations, economists said.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

Asia

China’s economic slowdown deepened in July due to a worsening property slump and continued coronavirus lockdowns, with an unexpected cut in interest rates unlikely to turn things around while those twin drags remain. Retail sales, industrial output and investment all slowed last month and missed economists’ estimates. China’s central bank cut both one-year and seven-day lending rates by 10 basis points.

Japan recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses. Gross domestic product for the world’s third-largest economy grew at an annualized pace of 2.2% in the second quarter.

Emerging Markets

Turkey’s central bank delivered a shock cut to interest rates despite inflation soaring to a 24-year high and the lira trading near a record low. The Monetary Policy Committee signaled it’s only responding to a possible slowdown in manufacturing and not embarking on a monetary-easing cycle, saying “the updated level of policy rate is adequate under the current outlook,” according to a statement.

Chile’s economy is teetering on the brink of recession after unexpectedly flatlining in the second quarter amid soaring inflation and heightened political uncertainty over a new constitution.

Europe

The euro-area economy grew slightly less than initially estimated in the second quarter as signs continue to emerge that momentum is unraveling. Analysts worry that energy shortages will drive record inflation higher still, tipping the continent into a recession.

UK inflation accelerated last month to the highest in 40 years, intensifying a squeeze on consumers and adding to pressure for action from the government and Bank of England. The consumer price gauge rose 10.1% in July from a year earlier after a 9.4% gain the month before.

UK job vacancies fell for the first time since August 2020 as real wages dropped at the sharpest pace on record, indicating a tightening inflation squeeze on consumers and businesses.

US

US retail sales stagnated last month on declines in auto purchases and gasoline prices, though gains in other categories suggested consumer spending remains resilient.

Employers battling to fill job vacancies in the tight US labor market this year have had a silver lining, as it were: decades-high inflation was bringing retired people back to the workforce. But recent data suggest the trend may already be petering out.

World

European investment in China is holding up for now despite deteriorating political relations between the two trading partners, with businesses looking for ways to work around any decoupling threat.

While Turkey and China’s central banks grabbed the headlines this week with rate cuts, at least six of their peers increased borrowing costs, including a record 300 basis-point hike by Ghana.

©2022 Bloomberg L.P.

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media12 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media14 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment13 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

News24 hours ago

Ontario Legislature keffiyeh ban remains, though Ford and opposition leaders ask for reversal – CBC.ca

-

Sports18 hours ago

Sports18 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com

-

Business24 hours ago

RCMP national security team investigating Yellowhead County pipeline rupture: Alberta minister – Global News

-

Investment22 hours ago

Investment22 hours agoWant to Outperform 88% of Professional Fund Managers? Buy This 1 Investment and Hold It Forever. – The Motley Fool

-

Health22 hours ago

Health22 hours agoToronto reports 2 more measles cases. Use our tool to check the spread in Canada – Toronto Star