Economy

Charting the Global Economy: Economic Pain Lingering Into 2021 – Bloomberg

The economic distress of the Covid-19 pandemic is picking up where it left off at the end of 2020.

The latest high-frequency data show activity in the advanced economies softened in the first two weeks of the new year. In the U.S., government figures showed retail sales fell for a third month in December as a resurgent virus prompted another tightening of business restrictions. Europe is facing the possibility that output will shrink in consecutive quarters.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

U.S.

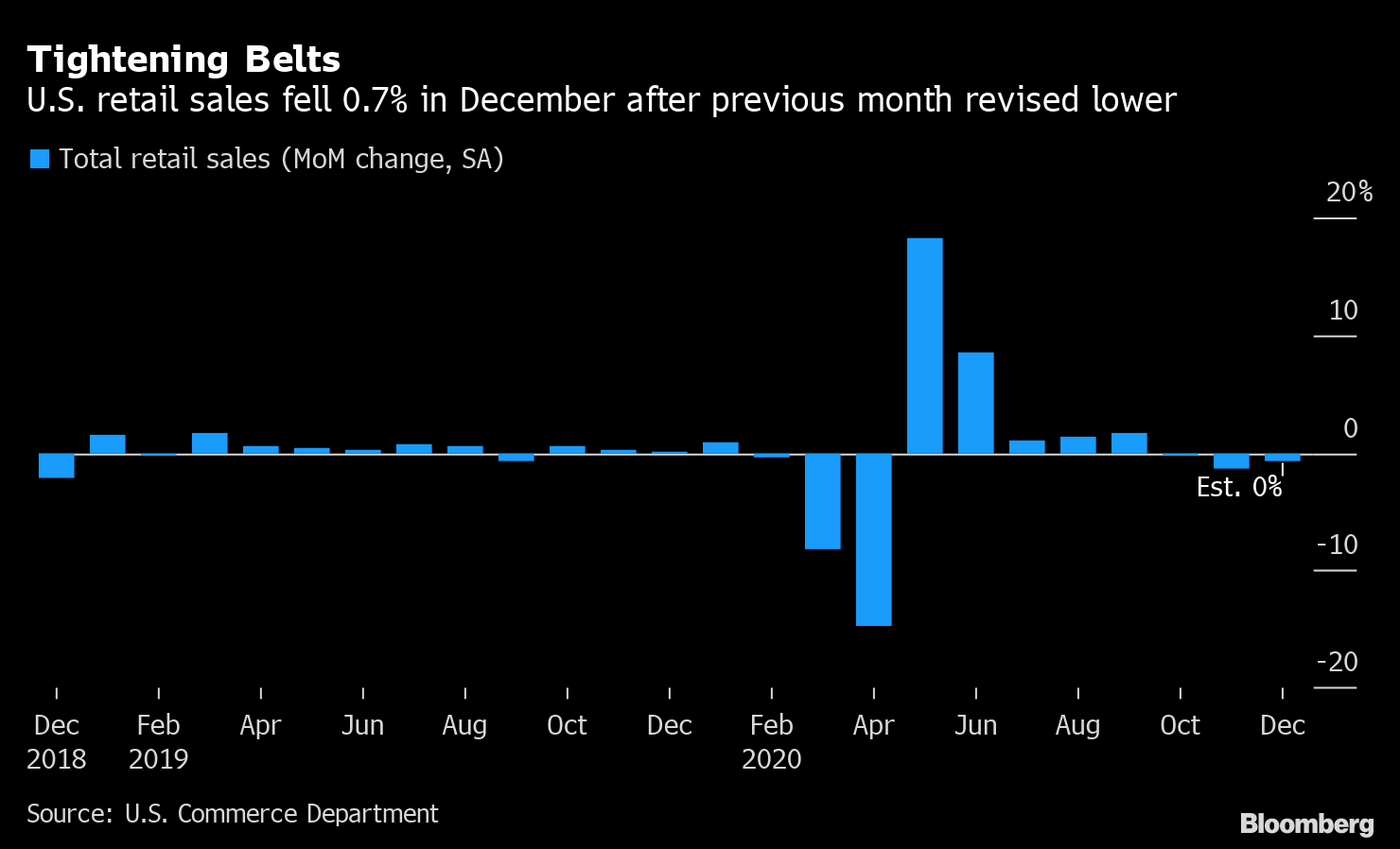

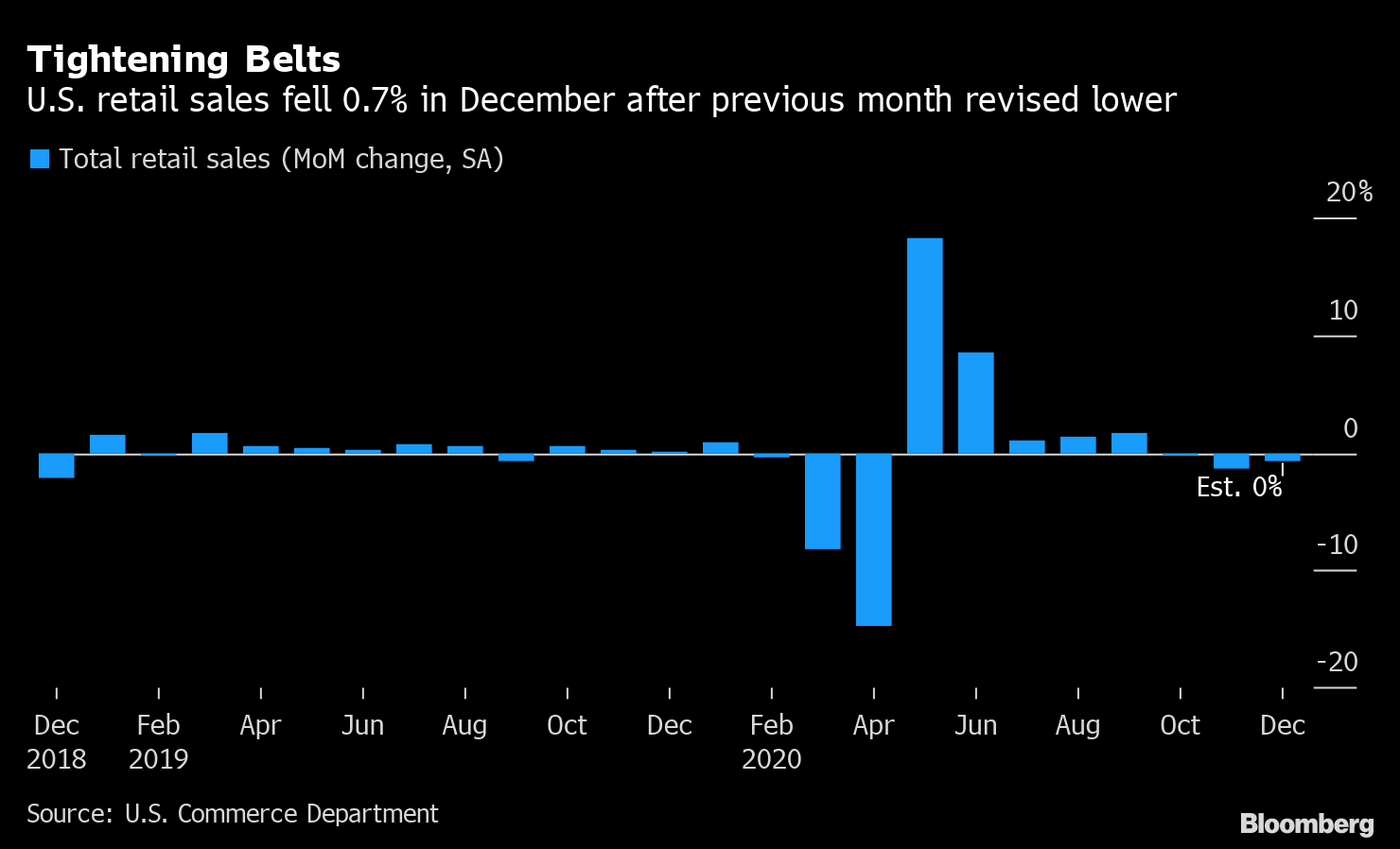

Tightening Belts

U.S. retail sales fell 0.7% in December after previous month revised lower

Source: U.S. Commerce Department

.chart-js display: none;

Retail sales declined at the close of the holiday-shopping season, wrapping up a painful year for the nation’s merchants as the pandemic forced store closures and kept consumers at home. The value of receipts for all of 2020 rose just 0.6%, the weakest performance in 11 years.

Meanwhile, the U.S. factory sector continues to show promise. The rate of job openings, or number of available positions as a share of total employment in the non-durable goods industry plus the vacancies, hit 5.1% in November, the fifth straight record in data back to 2000.

Europe

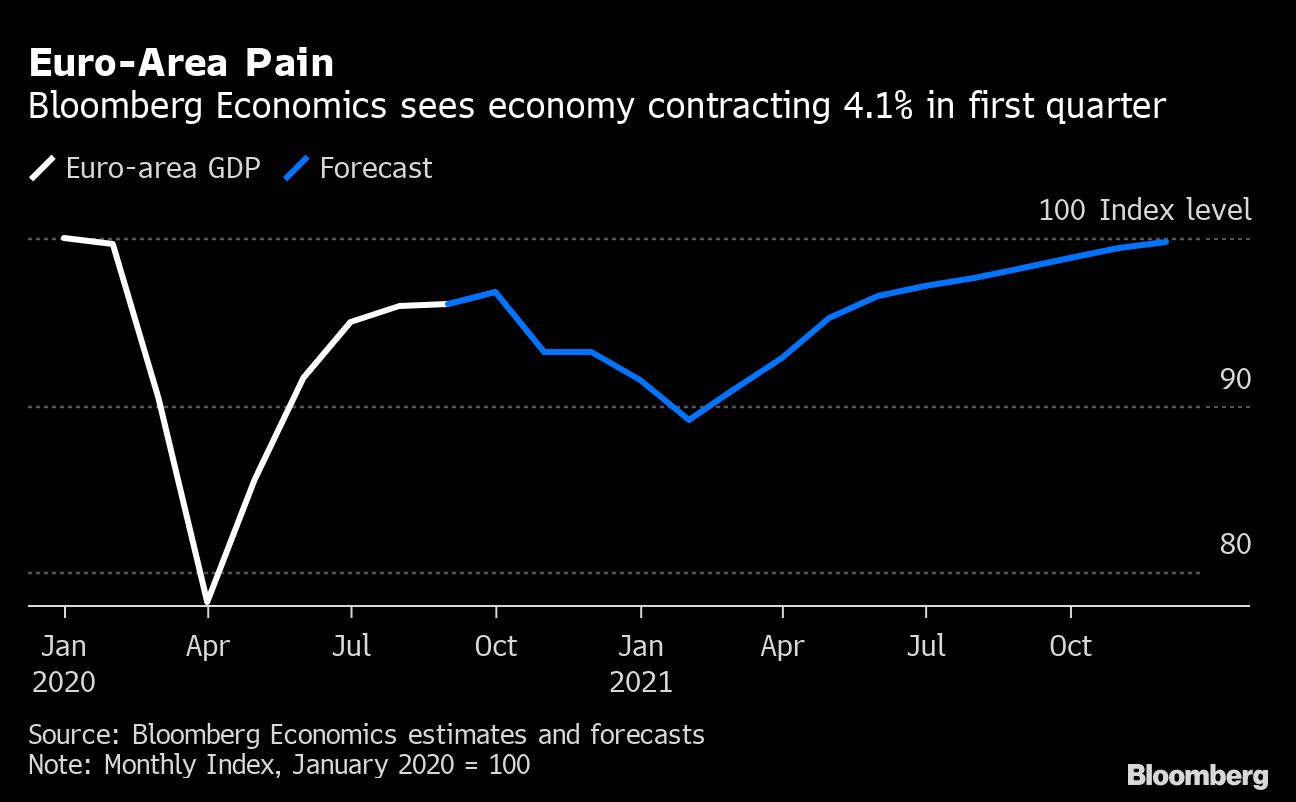

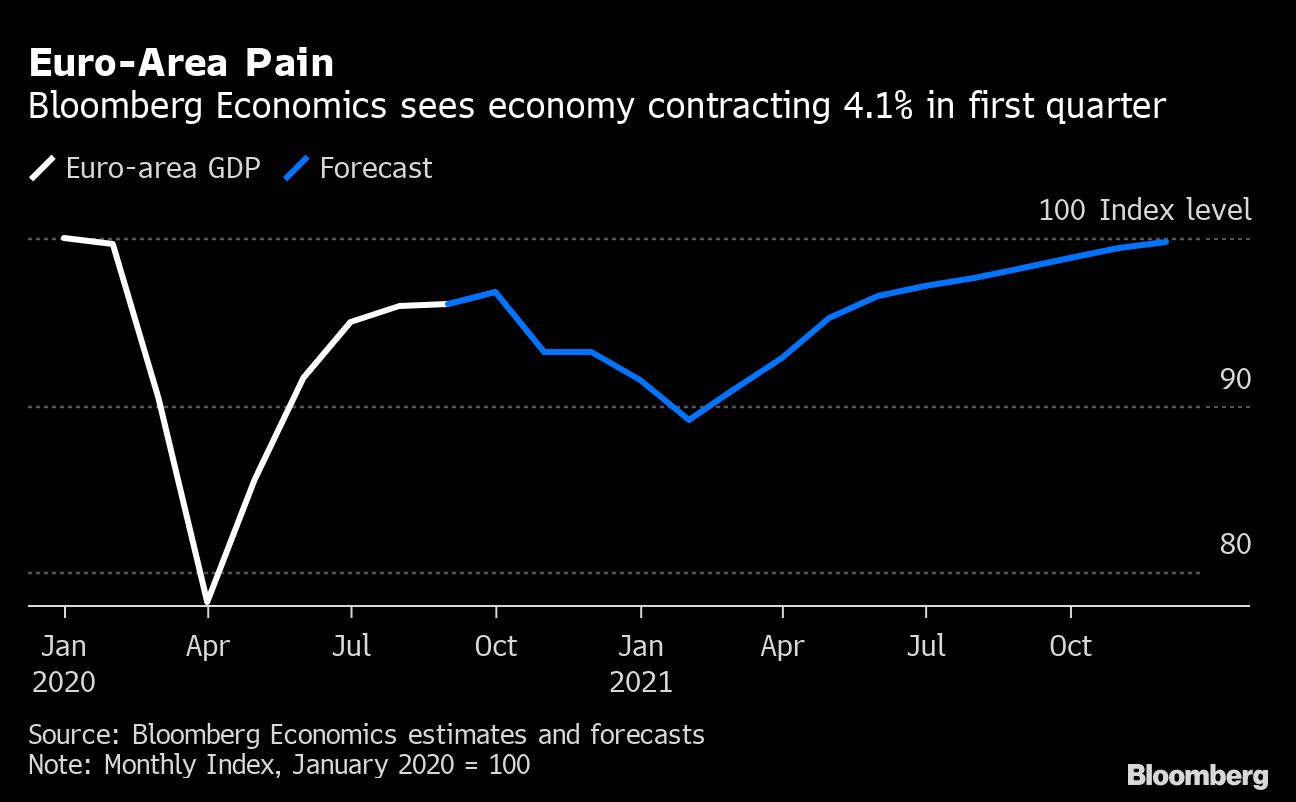

Euro-Area Pain

Bloomberg Economics sees economy contracting 4.1% in first quarter

Source: Bloomberg Economics estimates and forecasts

Note: Monthly Index, January 2020 = 100

.chart-js display: none;

Under pessimistic assumptions on the duration of new lockdown restrictions to contain the spread of Covid-19, Bloomberg Economics lowered its first-quarter estimate for the euro-area economy to a 4.1% contraction, after a 1.5% drop in the final three months of 2020.

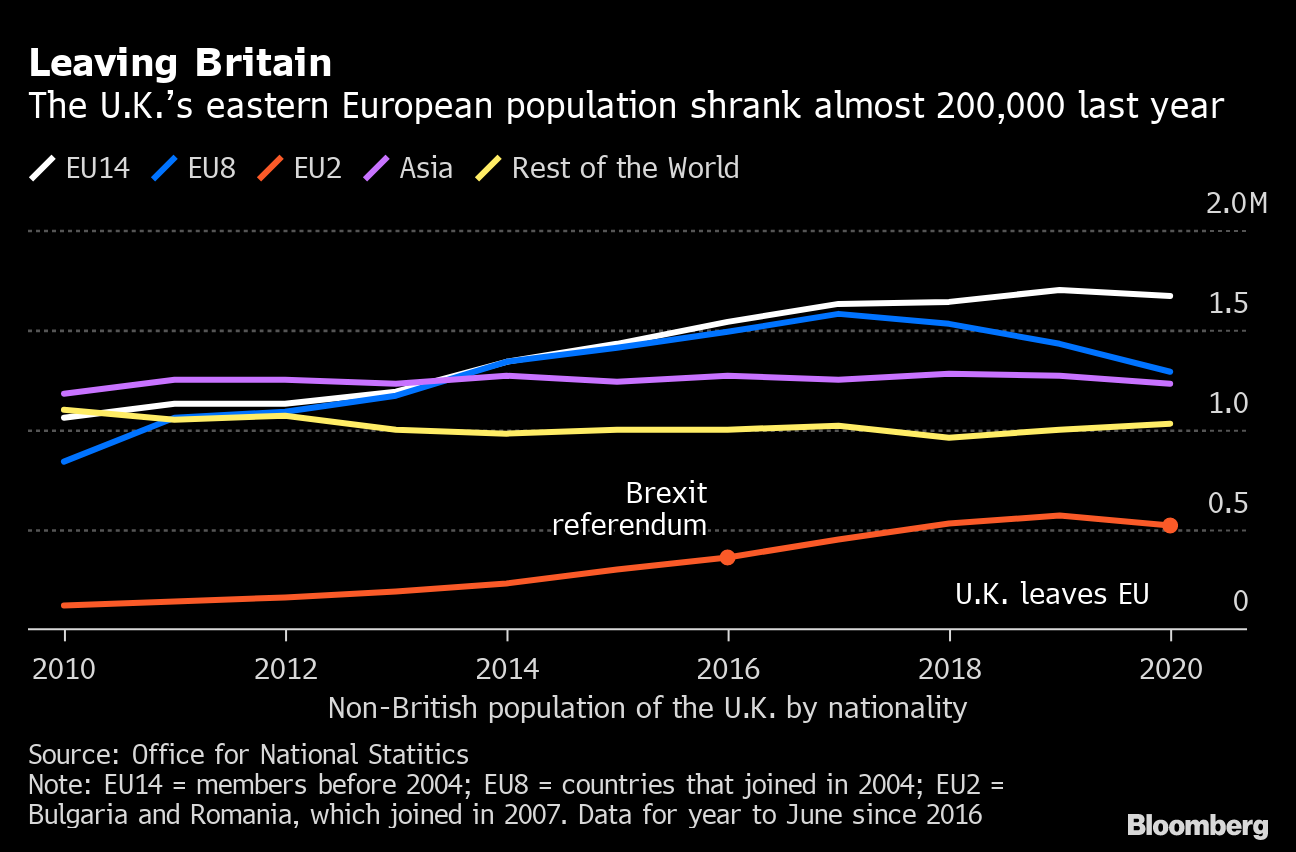

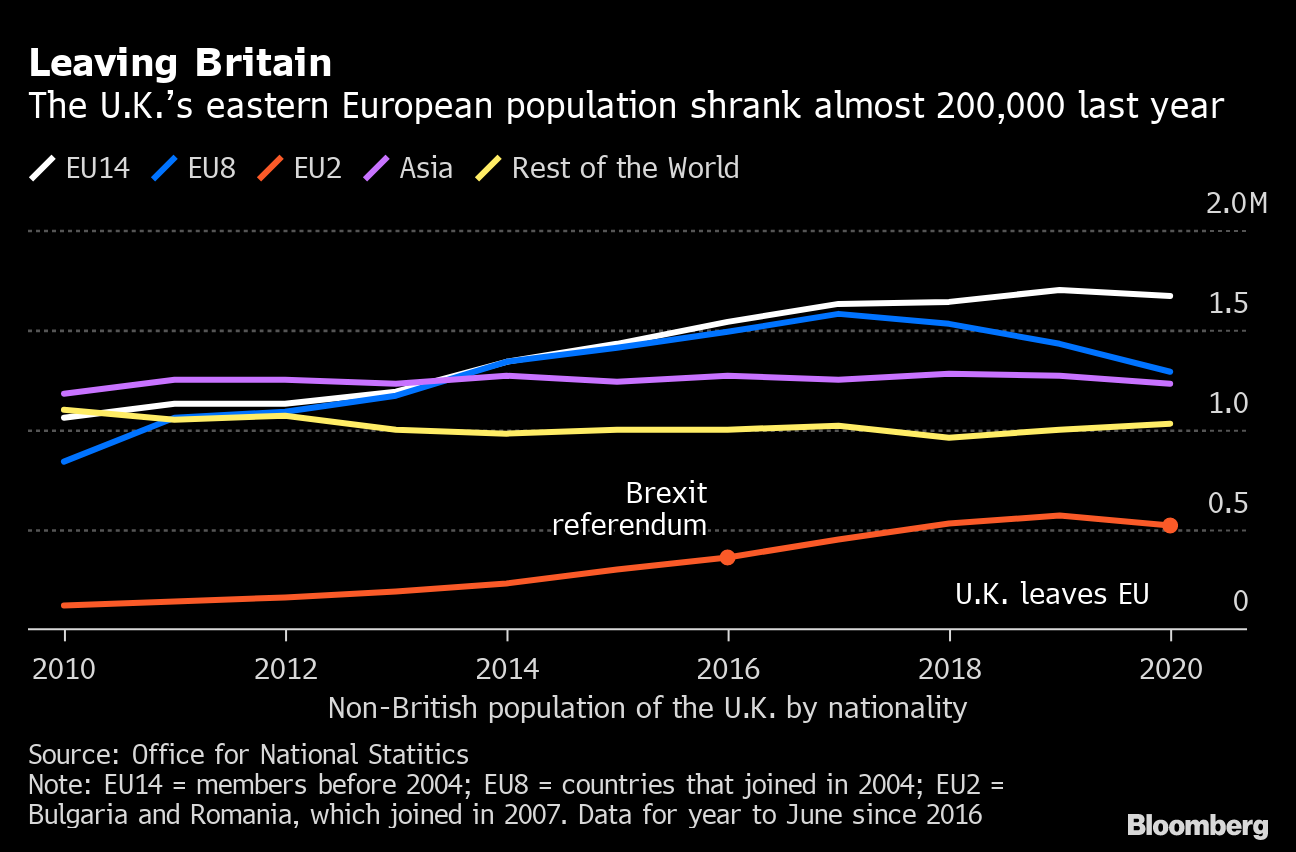

Leaving Britain

The U.K.’s eastern European population shrank almost 200,000 last year

Source: Office for National Statitics

Note: EU14 = members before 2004; EU8 = countries that joined in 2004; EU2 = Bulgaria and Romania, which joined in 2007. Data for year to June since 2016

.chart-js display: none;

The number of eastern Europeans living in the U.K. last year slumped to levels last seen in 2015 ahead of the end of the Brexit transition and as the coronavirus lockdowns closed huge parts of the economy.

Asia

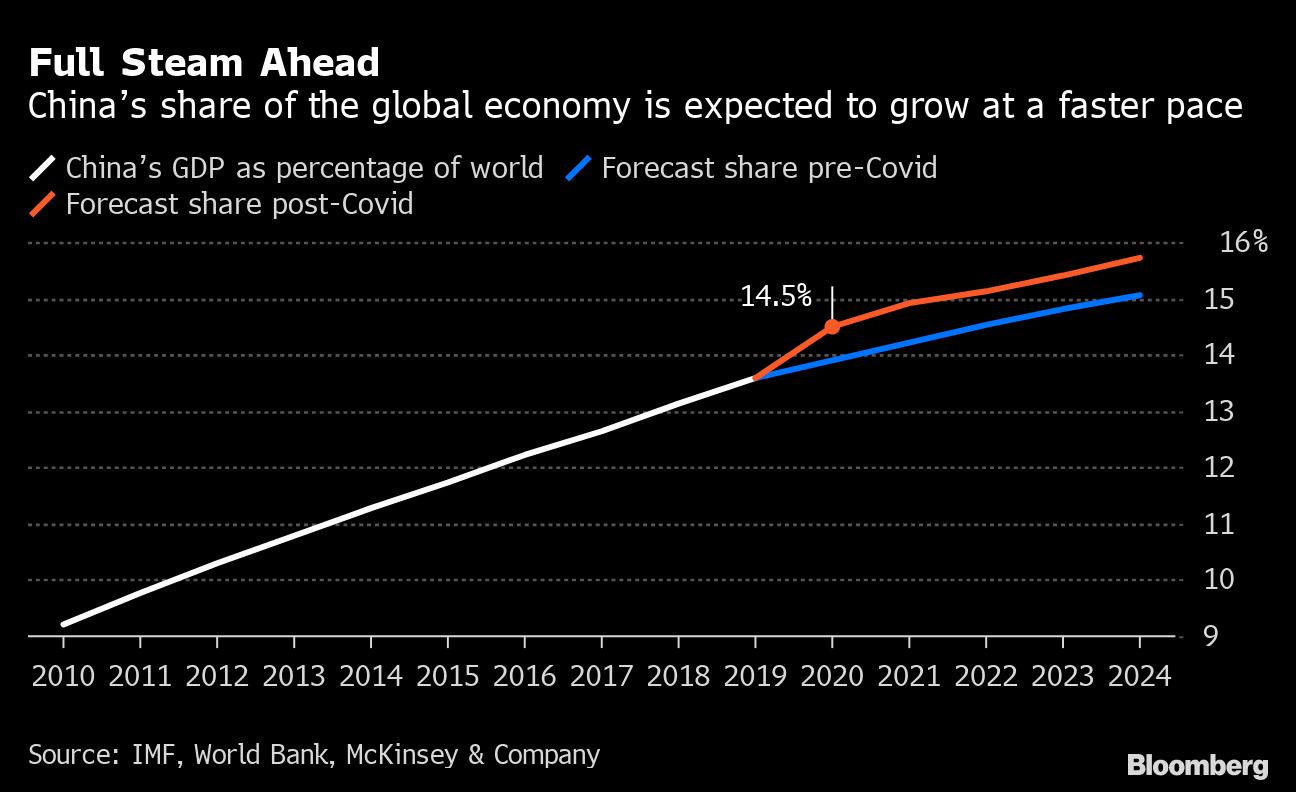

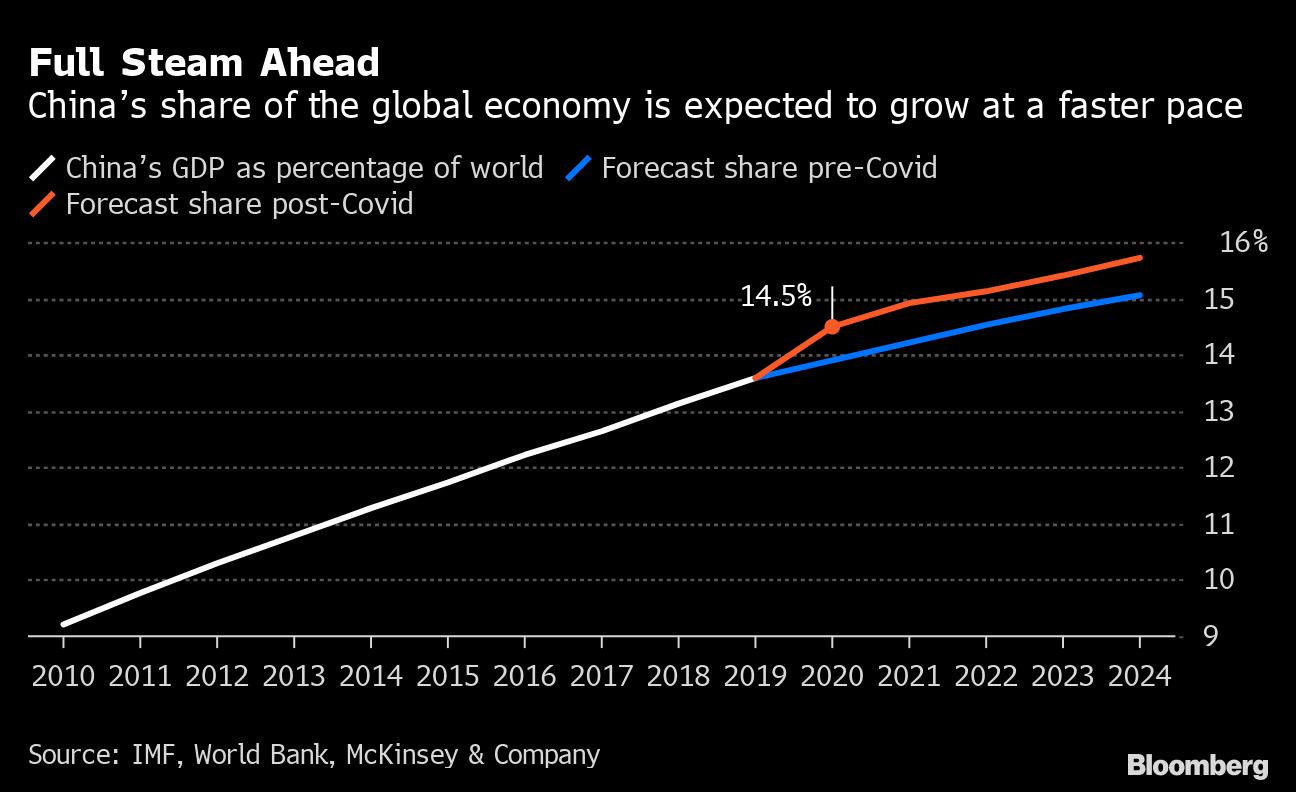

Full Steam Ahead

China’s share of the global economy is expected to grow at a faster pace

Source: IMF, World Bank, McKinsey & Company

.chart-js display: none;

China’s economic ascent is accelerating barely a year after its first coronavirus lockdowns, as its success in controlling Covid-19 allows it to boost its share of global trade and investment.

Emerging Markets

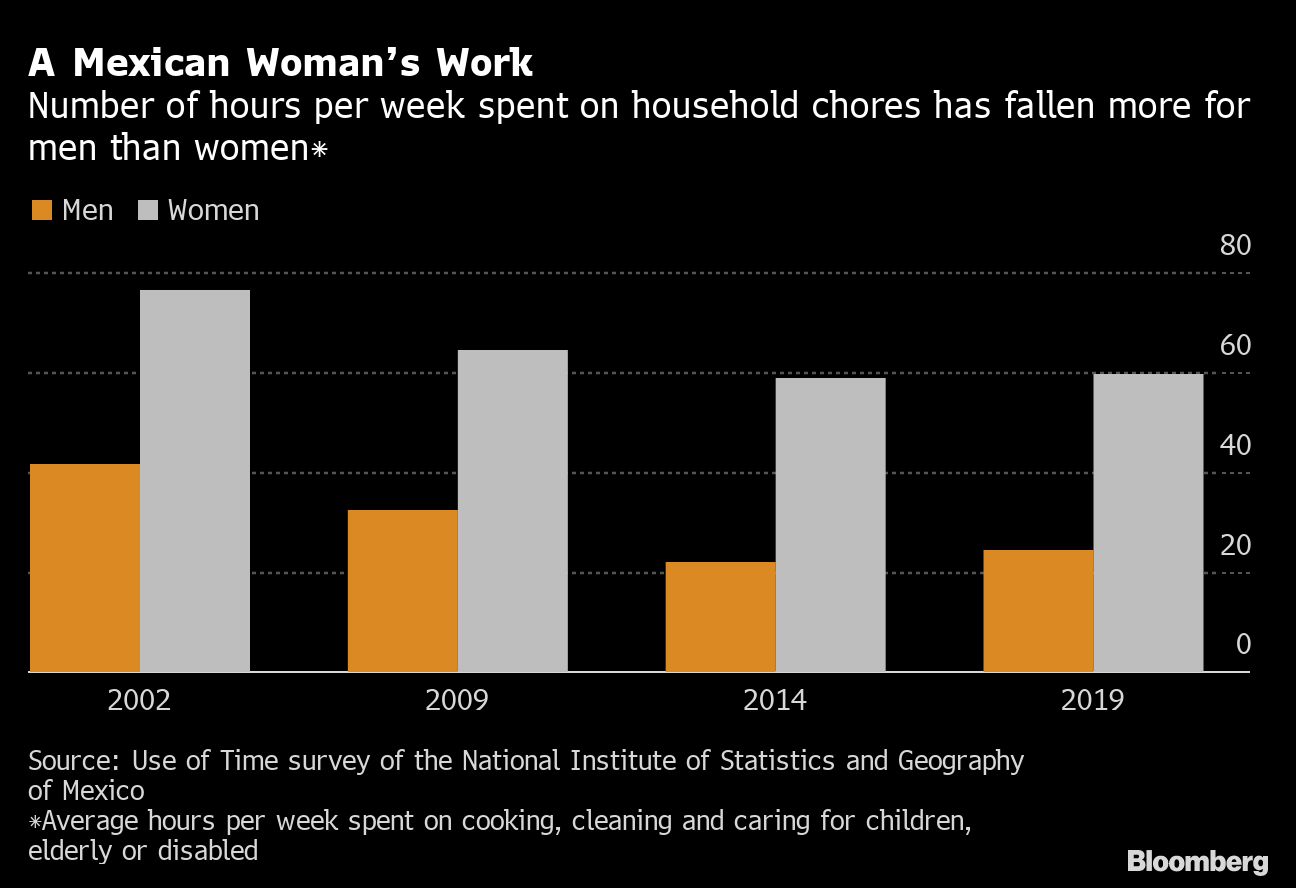

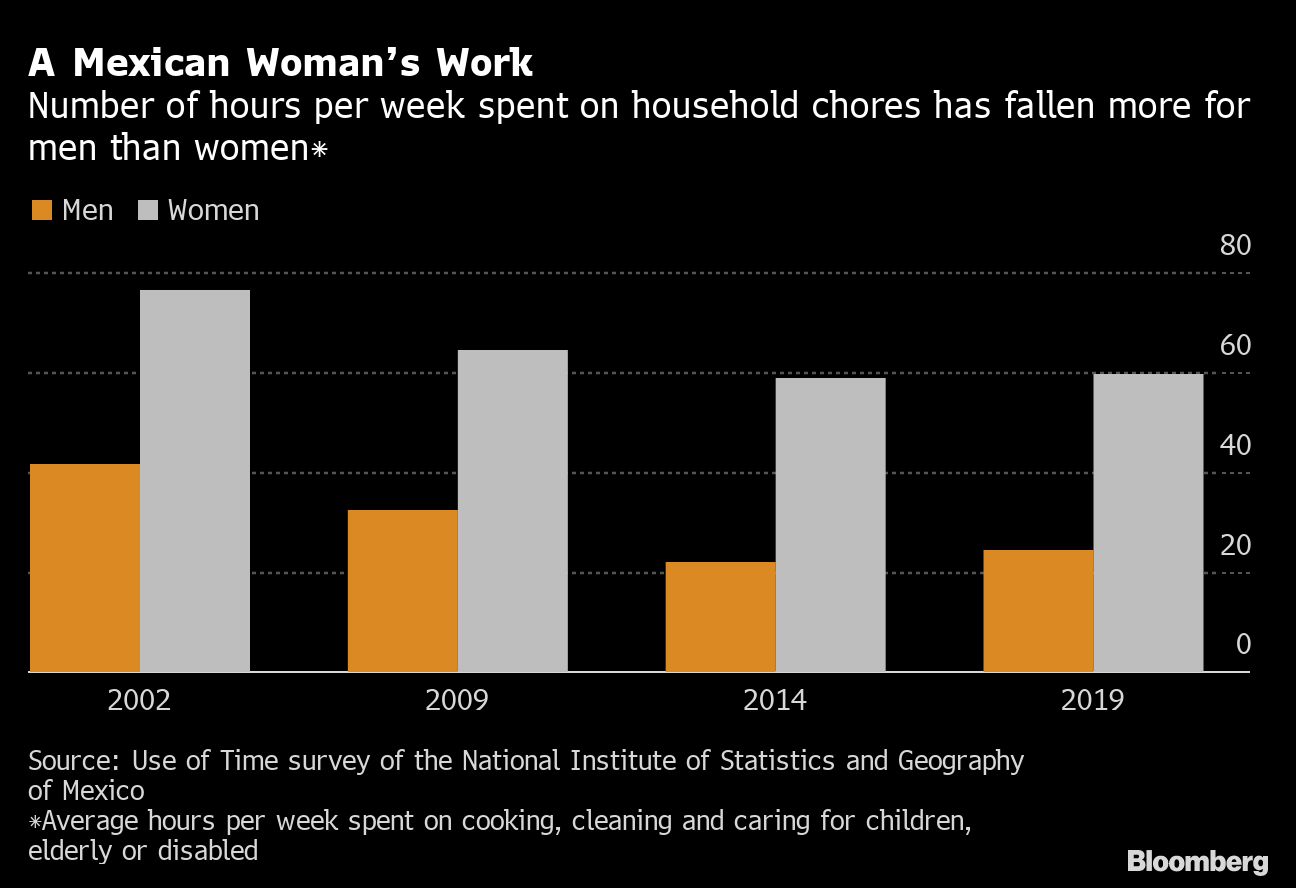

A Mexican Woman’s Work

Number of hours per week spent on household chores has fallen more for men than women*

Source: Use of Time survey of the National Institute of Statistics and Geography of Mexico

*Average hours per week spent on cooking, cleaning and caring for children, elderly or disabled

.chart-js display: none;

The women of Mexico already faced the worst economic prospects in Latin America. Now the pandemic threatens to sink them even further, aggravating chronic inequality and dragging down the country’s fortunes.

World

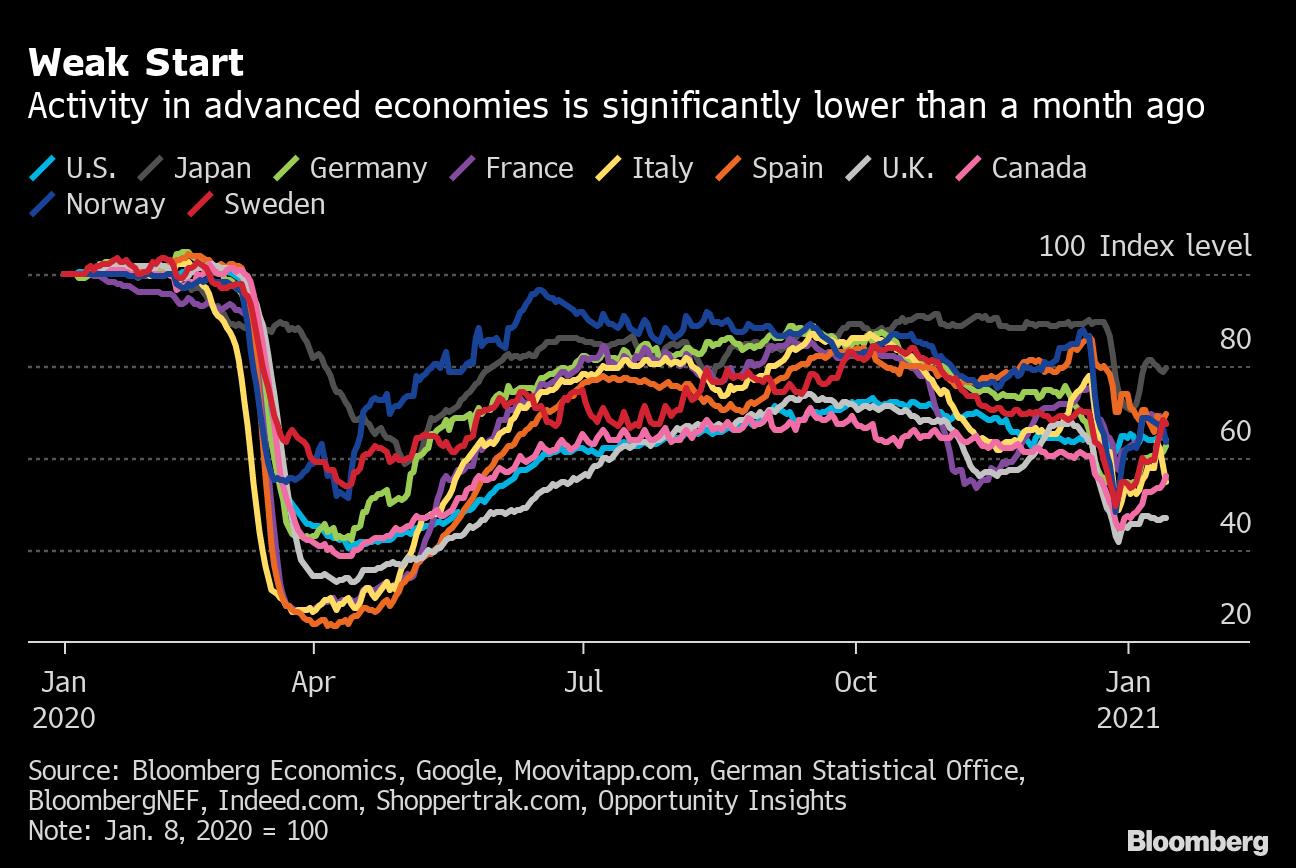

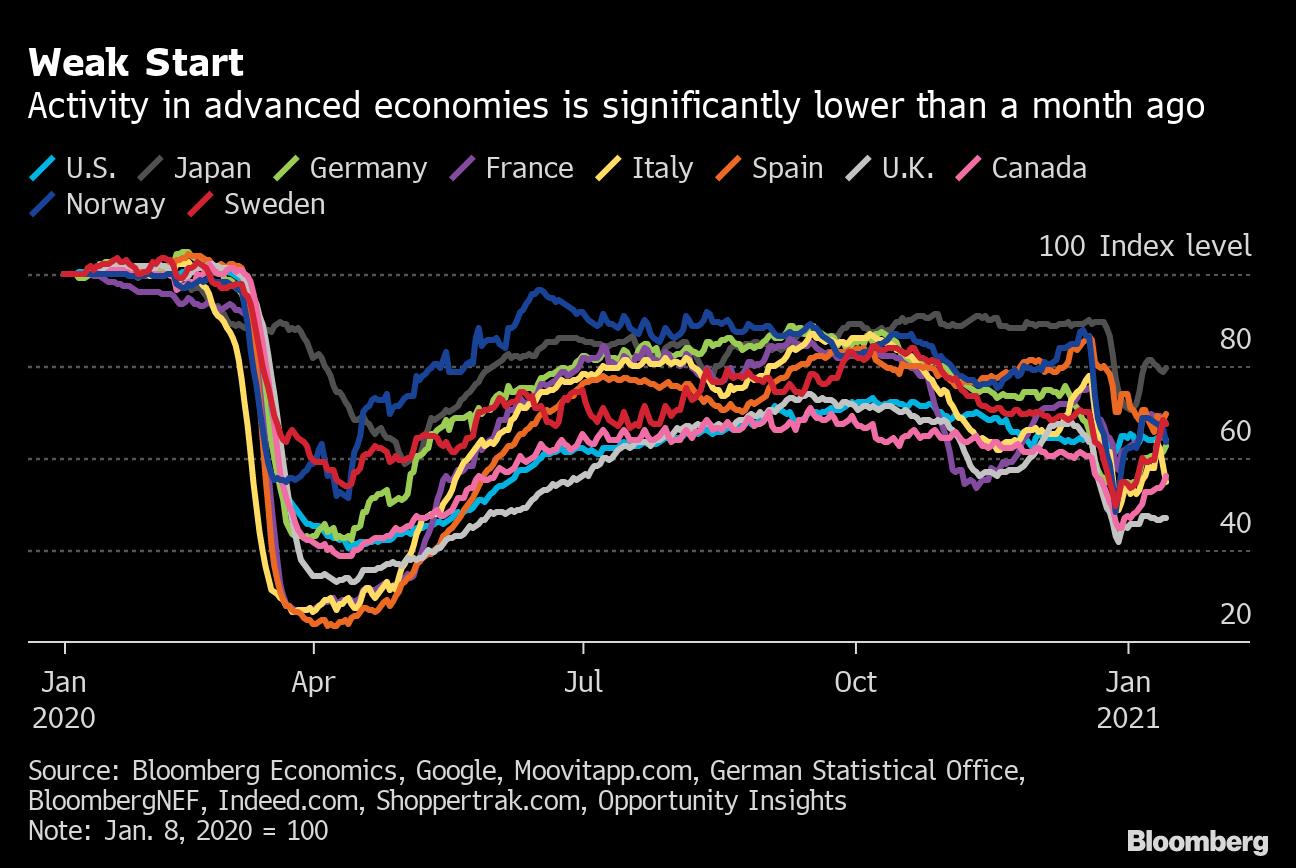

Weak Start

Activity in advanced economies is significantly lower than a month ago

Source: Bloomberg Economics, Google, Moovitapp.com, German Statistical Office, BloombergNEF, Indeed.com, Shoppertrak.com, Opportunity Insights

Note: Jan. 8, 2020 = 100

.chart-js display: none;

After the holiday slump, activity in several of the world’s largest advanced economies extended their recovery in the second week of January. Yet compared with early December, Bloomberg Economics gauges that integrate data such as mobility, energy consumption and public transport usage remain significantly lower.

America First

U.S. seen as most attractive business location among G-7

Source: Stiftung Familienunternehmen

.chart-js display: none;

The U.K. dropped behind the U.S. as the best international business location for the first time since the ranking was created by Germany’s Foundation for Family Businesses in 2006. Even so, it’s still ahead of other Group-of-Seven countries, with Italy at the bottom of the list.

— With assistance by Maeva Cousin, Tom Orlik, David Powell, Bjorn Van Roye, Jamie Rush, Maria Eloisa Capurro, Sophie Caronello, Enda Curran, Max De Haldevang, Tom Hancock, Lucy Meakin, Iain Rogers, and Jordan Yadoo

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Sports24 hours ago

Sports24 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Media4 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Business22 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media6 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art22 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment22 hours ago

Investment22 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech24 hours ago

Tech24 hours ago'Kingdom Come: Deliverance II' Revealed In Epic New Trailer And It Looks Incredible – Forbes

-

Media19 hours ago

DJT Stock Jumps. The Truth Social Owner Is Showing Stockholders How to Block Short Sellers. – Barron's