Economy

Charting the global economy: Robust data surprises less frequent – BNN

A swift rebound in global economic activity following the easing of pandemic-related restrictions on businesses initially delivered stronger-than-expected results. Now, moderation is setting in.

In the U.S., the world’s biggest economy, the latest jobs report showed employment growth is cooling after months of robust hiring. A gauge of economic data surprises out of Europe has shown the biggest slide.

Here are some of the charts that appeared on Bloomberg this week, offering insight into the latest developments in the global economy:

World

The economic rebound from the virus lockdowns proved much stronger than anticipated, with Citigroup Inc.’s surprise index soaring to record levels in the past few months. But as the third quarter ends, the pace is flagging, and better-than-expected data are becoming rarer.

U.S.

Job gains slowed in September and many Americans quit looking for work, suggesting the economic recovery is downshifting as the country struggles without a COVID-19 vaccine or fresh government aid.

Europe

Sweden has kept its restrictions largely intact since mid-March, offering a glimpse of what that might look like for other European economies who are battling new outbreaks of the coronavirus.

White-collar employees in the U.K. are ignoring their prime minister’s pleas to work from home.

Asia

China’s Greater Bay Area is supposed to rival clusters like Tokyo Bay and San Francisco-Silicon Valley. But distrust of Beijing is throwing up obstacles.

High debt, low growth: Are we all Japanese now? Asia’s second-largest economy holds lessons for the world as the COVID-19 pandemic destroys jobs and rocks whole industries

Emerging Markets

For tens of millions, the pandemic has exposed just how fragile economic status is worldwide. In many ways, nowhere has that been more apparent than in Latin America, where a resurgence of poverty is bringing a vicious wave of hunger in a region that was supposed to have mostly eradicated that kind of malnutrition decades ago.

The economic fallout of the coronavirus pandemic has taken a greater toll on Mexican women then men. Some 3.2 million female workers lost their jobs in the six-month period through August, or 64 per cent of the total.

Trade

The transatlantic trade conflict isn’t showing signs of winding down any time soon, and a ruling from the World Trade Organization means that a fresh round of retaliatory tariffs could jeopardize the nascent economic recoveries in both the U.S. and the European Union.

Shipowners are facing rising labor costs as widespread COVID-related restrictions limit movement of seafarers and make crew swaps more expensive.

Economy

Nigeria’s Economy, Once Africa’s Biggest, Slips to Fourth Place – BNN Bloomberg

(Bloomberg) — Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Africa’s most industrialized nation will remain the continent’s largest economy until Egypt reclaims the mantle in 2027, while Nigeria is expected to remain in fourth place for years to come, the data released this week shows.

Nigeria and Egypt’s fortunes have dimmed as they deal with high inflation and a plunge in their currencies.

Bola Tinubu has announced significant policy reforms since he became Nigeria’s president at the end of May 2023, including allowing the currency to float more freely, scrapping costly energy and gasoline subsidies and taking steps to address dollar shortages. Despite a recent rebound, the naira is still 50% weaker against the greenback than what it was prior to him taking office after two currency devaluations.

Read More: Why Nigeria’s Currency Rebounded and What It Means: QuickTake

Egypt, one of the emerging world’s most-indebted countries and the IMF’s second-biggest borrower after Argentina, has also allowed its currency to float, triggering an almost 40% plunge in the pound’s value against the dollar last month to attract investment.

The IMF had been calling for a flexible currency regime for many months and the multilateral lender rewarded Egypt’s government by almost tripling the size of a loan program first approved in 2022 to $8 billion. This was a catalyst for a further influx of around $14 billion in financial support from the European Union and the World Bank.

Read More: Egypt Avoided an Economic Meltdown. What Next?: QuickTake

Unlike Nigeria’s naira and Egypt’s pound, the value of South Africa’s rand has long been set in the financial markets and it has lost about 4% of its value against the dollar this year. Its economy is expected to benefit from improvements to its energy supply and plans to tackle logistic bottlenecks.

Algeria, an OPEC+ member has been benefiting from high oil and gas prices caused first by Russia’s invasion of Ukraine and now tensions in the Middle East. It stepped in to ease some of Europe’s gas woes after Russia curtailed supplies amid its war in Ukraine.

©2024 Bloomberg L.P.

Economy

Limiting Global Warming to 1.5C Would Avoid Two-Thirds of Economic Toll – Bloomberg

Climate inaction will depress the world’s economy more than previously estimated, according to a new study that takes into account the impacts of weather extremes and variability such as temperature spikes and intense rainfall.

A scenario in which global temperatures rise 3C on average will reduce the world’s gross domestic product by about 10%, doctoral researcher Paul Waidelich of ETH Zurich and colleagues write, with less developed countries paying the worst toll. By comparison, limiting global warming by 2050 to 1.5C — as sought by the Paris Agreement — will reduce that impact by about two-thirds.

Economy

PM: Millennials and Gen Z drive Canadian economy – CTV News Montreal

[unable to retrieve full-text content]

- PM: Millennials and Gen Z drive Canadian economy CTV News Montreal

- Canada’s budget 2024 and what it means for the economy Financial Post

- Federal budget is about ensuring fair economy for ‘everyone’: Trudeau Global News

-

Tech17 hours ago

Tech17 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science23 hours ago

Science23 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

News19 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Investment23 hours ago

Investment23 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

Science22 hours ago

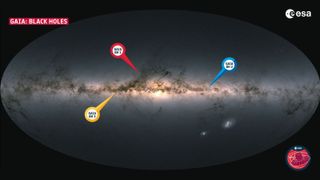

Science22 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Politics22 hours ago

Politics22 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health13 hours ago

Health13 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech19 hours ago

Tech19 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca