Toronto will steal Vancouver’s title as Canada’s most expensive housing market by the end of the year, predicts a new forecast by Royal LePage.

Business

China's big bounce: Economy posts stronger-than-expected rebound – Aljazeera.com

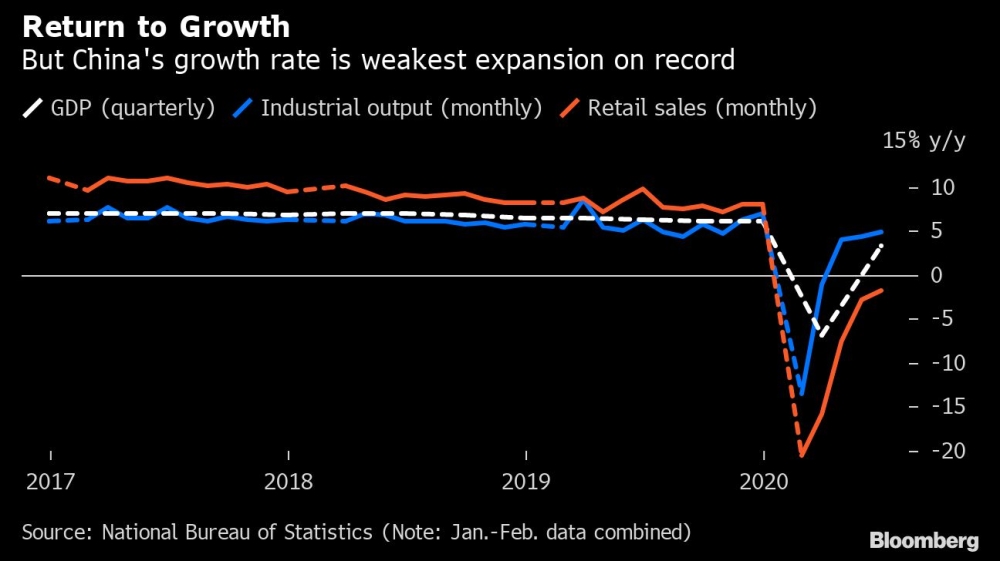

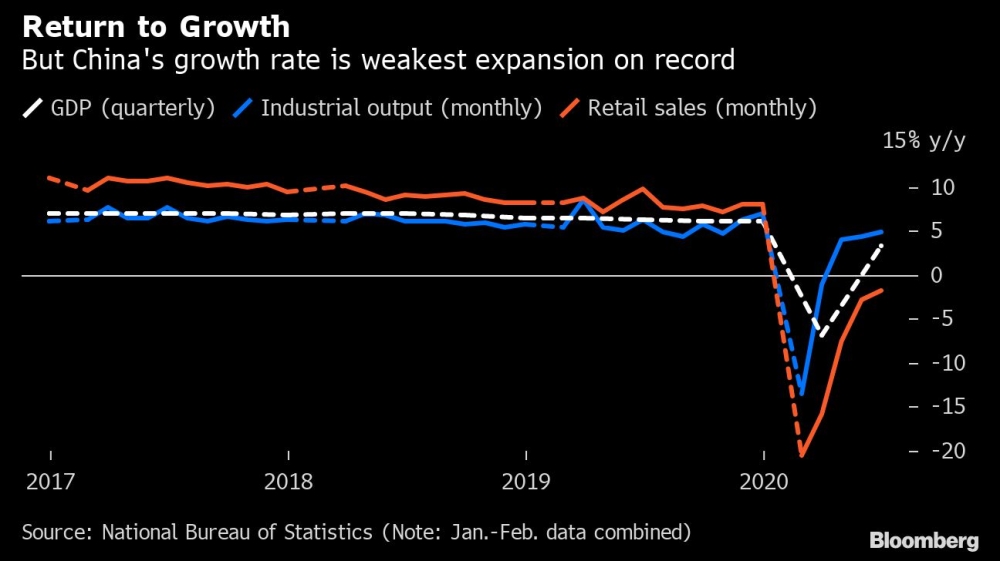

It would probably be hard to find a clearer example of what economists describe as a “V-shaped recovery” as the figures China released on Thursday.

China’s economy beat most analyst expectations and posted a rapid rebound in the second quarter as coronavirus lockdowns were eased, allowing factories, shops and restaurants to resume operations.

But continuing weakness in retail sales and investment, coupled with surging numbers of cases in one of China’s main export markets – the United States – and rising political tensions with Washington, mean Beijing’s path back to a tangible economic recovery for the majority of the country’s people could be a bumpy one.

China’s gross domestic product (GDP), the most commonly used measure of economic performance, expanded by 3.2 percent in the April-June period compared with the corresponding quarter last year. That was faster than the 2.5 percent average growth forecast in a poll of economists by Reuters news agency, according to data provider Refinitiv. A Bloomberg poll had predicted a growth rate of 2.4 percent.

The latest figure follows a historic 6.8 percent year-on-year plunge in the first three months of 2020. That was China’s first economic contraction since at least 1992, when it began publishing quarterly GDP data.

“The national economy overcame the adverse impact of the epidemic in the first half gradually and demonstrated a momentum of restorative growth and gradual recovery, further manifesting its development resilience and vitality,” China’s National Bureau of Statistics said in a statement accompanying the figures.

‘Mounting external risks’

But it added a note of caution.

“However, we should also be aware that some indicators are still in decline and the losses caused by the epidemic need to be recovered. Given the continuous spread of the epidemic globally, the evolving huge impact of the epidemic on the global economy and the noticeably mounting external risks and challenges, the national economic recovery was still under pressure,” the agency said.

Those declining indicators included retail sales, which fell by 1.8 percent in June compared with the same month last year, the fifth straight month of contraction and a worse performance than analyst projections of a mild recovery.

Fixed asset investment – the amount of money organisations spend on machinery, buildings, land or new technology, and which includes government infrastructure spending – fell by 3.1 percent year-on-year in the first half of 2020.

But many economists say the overall picture for China’s economy is brightening.

“The Q2 [second quarter] GDP outturn was very positive, showing that China’s economy has rebounded robustly from the severe impact of the pandemic in Q1 [first quarter] 2020. The manufacturing sector is now growing at a strong pace, with industrial output rising by 4.8% y/y [year-on-year] in June,” Rajiv Biswas, chief economist for the Asia Pacific region at research firm IHS Markit, told Al Jazeera.

“China is leading the global economic recovery from the pandemic, although the EU and US also showed a significant rebound in manufacturing and services output in June, according to the latest PMI surveys,” he added.

Analysts noted that even though retail sales posted another drop in June, the pace of declines appears to be slowing from a 16.2 percent contraction in March.

Employment improvement

Another source of optimism that domestic consumption could rebound in the coming months was an improvement in the unemployment data.

The urban unemployment rate fell to 5.7 percent in June, compared with 5.9 percent a month earlier.

Research firm Capital Economics says the latest figure means the government’s headline unemployment rate is just half of one percentage point higher than its level at the end of last year.

“More importantly, migrant workers, who are not properly captured in the surveyed rate yet make up a third of the urban workforce, have mostly resumed employment with the number working in urban areas less than 3 percent below pre-virus levels at the end of [the second quarter] compared with the 30 percent year-on-year decline at the end of February,” Capital Economics’ senior China economist Julian Evans-Pritchard said in a note sent to Al Jazeera.

But others were not quite as optimistic.

Banking giant HSBC said much of the growth in economic activity was a result of higher exports, mainly due to shipments of medical products and electronics such as laptops. Meanwhile, imports have been shrinking, especially in April and May, reinforcing the argument that domestic demand for goods and services remains weak.

And other factors are also likely keeping a lid on China’s economic performance, including a build-up of unsold goods or components in factories, together classified as inventory.

“We think high inventory pressure, weak profit growth and continued uncertainties over COVID-19 and US-China tensions are the main factors dampening the willingness of private sector businesses to expand investment,” Jingyang Chen, Greater China economist at HSBC, said in a note sent to Al Jazeera.

‘Vanished into thin air’

And with many parts of the world experiencing a resurgence in coronavirus cases, exports alone are unlikely to be able to sustain China’s growth over the rest of the year, some analysts say.

“Once again, China will have to rely on its own devices to keep growth up … The growth driver for [the second half of 2020] is unlikely to be external,” said Daiwa Capital Markets economists Kevin Lai and Eileen Lin.

In addition to the ongoing pandemic, Beijing’s worsening relations with Washington could threaten a phase-one trade deal signed between the two in January, and dampen China’s recovery, analysts say.

“Further trade talks have stalled completely. There is a risk that both sides will ditch the phase one deal, as tensions have expanded to include disputes over areas such as the pandemic, South China Sea, Hong Kong, Taiwan and Iran,” the Daiwa analysts said in a research note sent to Al Jazeera.

A new security law imposed on Hong Kong by Beijing has resulted in US President Donald Trump revoking Hong Kong’s special trading status in a retaliatory move against the Chinese government.

Meanwhile, one of China’s most important technology companies, telecommunications equipment giant Huawei, is being shut out of key markets in the US and, most recently, the United Kingdom, as they roll out their next-generation 5G mobile networks. Other US allies may be forced to follow suit.

National Security Council spokesman John Ullyot said on Wednesday that Trump has not ruled out further sanctions against top Chinese officials, including Hong Kong Chief Executive Carrie Lam, in response to their handling of the political unrest in the semi-autonomous territory

The Hong Kong Autonomy Act, which Trump signed on Tuesday, allows him to impose sanctions and visa restrictions on Chinese officials and financial institutions involved in the imposition of China’s new national security law in Hong Kong.

“The atmosphere for both sides to take stock of what was written under Phase One and to look at what should be on the agenda for Phase Two has vanished into thin air, in our view,” Daiwa’s analysts added.

Business

Tesla to lay off 10% of its workforce as sales fall – CBC News

Tesla will lay off more than 10 per cent of its global workforce, an internal memo seen by Reuters on Monday shows, as it grapples with falling sales and an intensifying price war for electric vehicles.

The world’s largest automaker by market value had 140,473 employees globally as of December 2023, its latest annual report shows. The memo did not say how many jobs would be affected.

Some staff in California and Texas have already been notified of layoffs, a source familiar with the matter told Reuters, declining to be named due to the sensitivity of the subject.

“As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity,” Tesla CEO Elon Musk said in the memo.

“As part of this effort, we have done a thorough review of the organization and made the difficult decision to reduce our headcount by more than 10 per cent globally,” it said.

Tesla did not immediately respond to a request for comment.

Stock has fallen about 31 per cent so far this year

Its shares were down 1.3 per cent in premarket trading.

The stock has fallen about 31 per cent so far this year, underperforming legacy automakers such as Toyota Motor and General Motors, whose shares have rallied 45 per cent and 20 per cent respectively thanks to a slow consumer transition away from traditional internal combustion engine vehicles.

Front Burner21:54Tesla woes and Canada’s big EV bet

Tesla is having its worst year since the pandemic. The company is selling fewer cars, and its stock is plummeting. And it’s not just Tesla. We’re seeing a cool down in North America’s EV industry as a whole. Why is this happening? And as Canada pours billions of dollars into the industry, will that bet pay off? Senior CBC business reporter Peter Armstrong explains.

Energy giant BP has also cut over a tenth of the workforce in its EV charging business after a bet on rapid growth in commercial EV fleets didn’t pay off, Reuters reported on Monday, underscoring the broader impact of slowing EV demand.

“Tesla is maturing as a company and isn’t the growth story that it used to be,” said Craig Irwin, senior research analyst at Roth Capital.

“Layoffs imply management expects weak demand to persist.”

Layoffs could be a cost trim ahead of new models

Still, Pedro Pacheco, vice-president of research and automotive at Gartner, said the cuts could simply be a sign of the company trimming costs ahead of releasing new models, as sales slow down from the strong growth propelled by the launch of the Model Y and Model 3.

Tesla reported this month that its global vehicle deliveries in the first quarter fell for the first time in nearly four years, as price cuts failed to stir demand.

The EV maker has been slow to refresh its aging models as high interest rates have sapped consumer appetite for big-ticket items, while rivals in China, the world’s largest auto market, are rolling out cheaper models.

Reuters reported this month that Tesla had cancelled a long-promised inexpensive car that investors have been counting on to drive mass market growth. Musk denied the report, but did not identify any specific inaccuracies.

The company is looking to shore up its margins, which have been dented by repeated price cuts, especially in China where it faces stiff competition from local rivals including market leader BYD, which briefly overtook the U.S. company as the world’s largest EV maker in the fourth quarter, and new entrant Xiaomi.

Tesla recorded a gross profit margin of 17.6 per cent in the fourth quarter, the lowest in more than four years.

Tesla had previously laid off four per cent of its workforce in New York in February last year as part of a performance review cycle and before a union campaign was to be launched by its employees.

Tech publication Electrek first reported the latest job cuts.

Business

Toronto house prices to top Vancouver, says forecast

|

|

Toronto, Montreal to see biggest gains, beating Vancouver and Calgary, predicts Royal LePage

After stronger-than-expected sales and price gains in the first quarter of this year, the real estate company has bumped up its forecast for home prices in markets across the country.

According to the Royal LePage House Price Survey, which draws data from 63 of Canada’s largest housing markets, the aggregate price of a home nationally rose 4.3 per cent year over year in the first quarter of 2024 to $812,100.

“Clearly, more and more buyers are motivated by the need to get ahead of rising home prices, rather than adopting the strategy of waiting for mortgage rates to fall.”

Royal LePage said within the first three months of the year the Canadian housing market saw solid price appreciation and sales activity, a trend it only expects to accelerate when the Bank of Canada makes its first interest rate cut later this year.

Their updated forecast predicts that the aggregate national home price will rise by 9 per cent in the fourth quarter of 2024, year over year.

But some regions will fare better than others.

Prices in the Greater Toronto Area are expected to rise 10 per cent in the fourth quarter, the greater appreciation of all major markets in the country, after climbing 5.2 per cent in the first quarter to $1,177,700.

“At the end of 2023, we forecast modest price gains in the first half of this year and stronger appreciation in the third quarter, following one or more expected rate cuts. What we’ve seen so far is a boost in sales volumes and prices even greater than predicted,” Karen Yolevski, chief operating officer of Royal LePage Real Estate Services Ltd, said of the Toronto market.

Montreal is expected to be another high flyer, with prices forecast to rise 8.5 per cent in the fourth quarter, the second highest appreciation in Canada.

Activity in the Greater Vancouver Area, however, has been more muted, with prices rising 3.4 per cent in the first quarter to $1,238,200, says Royal LePage.

“Heading into spring, the Vancouver market has been steadily gaining momentum, though not at the feverish pace that other markets across Canada have seen as of late,” said Randy Ryalls, general manager of Royal LePage Sterling Realty.

“The gentle upswing in activity we’ve experienced in the first few months of the year is expected to continue throughout the months ahead, likely resulting in a moderate increase to home prices,” he said.

Royal LePage forecasts that Vancouver home prices will rise 5.5 per cent in the fourth quarter.

“While Vancouver remains the nation’s most expensive market today, Royal LePage predicts that the aggregate price of a home in the GTA will surpass Greater Vancouver in the second half of 2024,” said the report.

The Alberta city, which bucked the trend of declining prices last year, saw its aggregate home price rise 9.7 per cent to $676,400 in the first quarter, the biggest appreciation in the country.

“While activity levels remain strong and prices continue to rise in Alberta, our research indicates that buyer demand, relative to available inventory, is strongest in the two largest urban centres in the country,” said Soper. “We now expect Toronto and Montreal to log the highest home price appreciation this year.”

Calgary home prices are expected to increase 8 per cent in the fourth quarter.

Almost 90 per cent of regions tracked by Royal LePage posted higher prices at the beginning of the year, but housing markets have still not fully recovered from the post-pandemic correction, the report says.

The aggregate price of a home in Canada is still 5.2 per cent below the peak reached in the first quarter of 2022. That said, prices remain far above pre-pandemic levels.

Good news on the rental front, sort of. The dizzyingly annual ascent of rent prices in Canada slowed in March, with the average rent decreasing 0.6 per cent from the month before, says Urbanation’s monthly report.

The decline was partly down to seasonal forces but also because renters are shifting out of the really expensive cities like Vancouver and Toronto, said Rentals.ca.

Rents averaged $2,181 in March, up 8.8 per cent from a year ago — a cooler pace than the 10.5 per cent growth recorded in February.

Average rents in Canada are up 21 per cent from March 2020, the month the global COVID-19 pandemic began.

- The IMF and World Bank spring meetings kick off in Washington, D.C. where finance ministers, central bankers and policymakers meet to discuss the global economy.

- Gildan Activewear Inc. chief executive Vince Tyra will present an investor update today, marking his first 90 days in the job. The presentation comes as activist investor Browning West seeks to replace a majority of directors on the company’s board in a move to reinstate founder Glenn Chamandy as chief executive of the clothing company.

- Today’s Data: Canada housing starts for March, manufacturing sales, U.S. retail sales, NAHB housing market index

- Earnings: EQB Inc., M&T Bank Corp, Charles Schwab Corp, Goldman Sachs Group Inc

Are you worried about having enough for retirement? Do you need to adjust your portfolio? Are you wondering how to make ends meet? Drop us a line at aholloway@postmedia.com with your contact info and the general gist of your problem and we’ll try to find some experts to help you out while writing a Family Finance story about it (we’ll keep your name out of it, of course). If you have a simpler question, the crack team at FP Answers led by Julie Cazzin or one of our columnists can give it a shot.

McLister on Mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Read them here

Business

Ontario to add more than 300 weekly GO Transit trips by the end of the month

|

|

Ontario will introduce more than 300 new weekly GO Transit trips by the end of the month, something Metrolinx describes as “the single biggest enhancement of GO rail service since 2013.”

The changes will include 15-minute weekend service frequency on parts of the Lakeshore West and Lakeshore East lines.

It will also mean additional trains on the Kitchener, Stouffville, and Milton lines starting April 28.

Premier Doug Ford made the announcement in Milton, Ont. alongside Transportation Minister Prabmeet Sarkaria.

“This means more options and greater convenience on Milton, Lakeshore West, Lakeshore East, Kitchener, Stouffville and the UP Express Lane lines,” the premier told reporters.

“Today’s announcement represents a 15 per cent increase in GO service.”

Here’s what is changing:

- Lakeshore West: Service will increase to 15-minute frequency on weekend afternoons and evenings between Oakville GO and Union Station

- Lakeshore East: Service will increase to 15-minute frequency on weekend afternoons and evenings between Durham College Oshawa GO and Union Station.

- Kitchener: There will be 30-minute weekday service in the midday and evenings between Bramalea GO and Union Station. Some weekend trips will be increased to 10 cars.

- Stouffville: Evening train service seven days a week

- Milton: One additional morning rush hour trip to and from Milton to Union Station

- UP Express: Every second train (every 30 minutes) will be non-stop between Union Station and Pearson International Airport seven days a week.

The government also said that some trips along Lakeshore West, Lakeshore East, Milton, Kitchener, Barrie and Stouffville will be adjusted to depart up to nine minutes earlier or later to “better align with actual travel times, and new and connecting services.”

In a statement, CEO of Metrolinx Phil Verster called the additional trips “the single biggest enhancement of GO rail service since 2013,” adding that it will bring the total number of weekly rail trips to 2,307.

“This will give our customers more flexibility and makes it easier to choose transit first,” he said.

Announcement unrelated to Milton by-election, premier says

Ford said the timing of Monday’s announcement was unrelated to a by-election taking place in Milton on May 2, despite a suggestion from the Ontario Liberal Party.

The Liberal candidate for the riding said in a statement that all-way, all-day GO train service for Milton was something that both he and Leader Bonnie Crombie has fought for.

“Don’t be surprised by today’s abrupt change of heart, Doug is only doing it for himself,” Galen Naidoo Harris, Ontario Liberal candidate for Milton, said.

“This riding has had a Conservative MPP since 2018 and it’s only now, when this seat is at risk, that Doug Ford has managed to find Milton on the map.”

Ford said that his government is making announcements “every single day in every region of this province.”

-

Media16 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Business24 hours ago

Tesla May Be Headed For Massive Layoffs As Woes Mount: Reports – InsideEVs

-

Tech20 hours ago

Tech20 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState20 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports19 hours ago

Sports19 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Science20 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Art22 hours ago

Art Bites: The Movement to Remove Renoir From Museums

-

Investment17 hours ago

Investment17 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca