Investment

Colleges See Best Gains in Decades Thanks to Private Investments – BNN

(Bloomberg) — Soaring returns at venture capital funds juiced results across U.S. university endowments, propelling one investment for Michigan State University’s $3.9 billion fund to an eye-popping 1,000% gain.

Universities saw their endowments swell by billions of dollars after a year which by one estimate could be the sector’s best since the mid-1980s. Powered by specific pandemic-related gains and a macro environment that’s been a boon to private investment funds, colleges are reaping returns that may not be seen again for a generation.

“There will probably be nothing like this in our lifetime,” said James Clarke, senior vice president of investments and treasurer of the Kansas University Endowment Association. “It almost felt like 2021 was the realization of the promises we were made about the internet 20 years ago — we spent our lives doing virtual meetings on Zoom with products delivered to our door and unlimited Netflix.”

About 30 venture funds that Kansas has invested in posted triple-digit gains, he said.

Surging Returns

Equities have been surging in recent years in part due to historically low interest rates pushing investors into higher-yielding options. At the same time, venture funds have benefited from a growing number of companies staying private for longer, as well as more money chasing the next big thing.

Venture’s focus on tech companies has also helped, as the pandemic accelerated technology trends such as remote work.

“It resulted in an accelerated adoption of online services, which a lot of people expect will continue,” said Anders Hall, chief investment officer of Vanderbilt University, which saw a 57% return. “Trends that were going to happen anyway, but happened more quickly.”

There were also gains more directly tied to the Covid-19 pandemic. The 65% return at Washington University in St. Louis through June 30 was helped by a co-investment in vaccine-developer Moderna Inc., which rose about 280% in the period.

The school’s global equity portfolio gained 71.5% and its buyout, venture capital, distressed debt and growth equity investments advanced 82%, said CIO Scott Wilson.

At Michigan State, which saw its endowment return 41%, some of the biggest growth came from investments in fintech such as blockchain, and other technology including services that support online payments, said CIO Phil Zecher.

“Our whole private investment portfolio did extraordinarily well with venture up over 100%,” he said.

Some of the performance is unrealized gains, said Hall of Vanderbilt, where returns boosted its fund to $10.9 billion. Venture funds won’t actually deliver the gains until they can exit the investments, usually through initial public offerings. Even then, some firms continue to hold onto public companies, such as Airbnb Inc. and DoorDash Inc., said Hall. He declined to comment about specifics in the school’s portfolio.

“The positions in the companies themselves are so big it’s going to take a lot time to unwind these,” said Allen Huang, director of investments at Michigan State. “There’s a lot of volatility in those prices when they’ve finally liquidated and returned to limited partners, the endowments, they could be less.”The endowment of Bowdoin College, a liberal arts college in Maine, returned 57%, boosting its value to $2.7 billion, said Clayton Rose, the school’s president. Public markets created a tailwind and many of the investments that performed well were made years ago, he said. He didn’t provide details.

Bowdoin was also helped by the fact that it had liquidity in the endowment during the worst of the pandemic and didn’t need to sell anything at the bottom of the market “in a distressed way that we would regret later,” said Rose, a former banker and Harvard Business School professor.

©2021 Bloomberg L.P.

Investment

'I was always so proud of it': Charlie Munger had a ready reply when asked to name the investment he liked most – Yahoo Finance

To say Charlie Munger lived a long, full and rich life is putting it both mildly and literally.

The Berkshire Hathaway sidekick of billionaire Warren Buffett died in November just weeks short of his 100th birthday. His estimated net worth? A mere $2.2 billion, according to Forbes.

Don’t miss

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

-

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here’s how

-

‘It’s not taxed at all’: Warren Buffett shares the ‘best investment’ you can make when battling rising costs — take advantage today

Indeed, Munger was an investing legend — and just as much a font of no-nonsense wisdom and wit. Regarding the extravagant purchases consumers love, he once quipped, “Who in the hell needs a Rolex watch?”

As investors, we arguably need to measure time in a different kind of way: that is, ticking off the moments until we trade big-ticket spending for even an ounce of Munger’s golden investment guidance.

In one video capturing Munger’s remarks from the 2022 Daily Journal ($DJCO) Annual Meeting, he shares the story of a big win … and the following year, a bad flop.

Munger’s best investment ever

Munger’s musings on the extremes of his financial life were sparked by a certain Wes in Miami, who asked him, “In your storied investment career, which investment did you like the most?”

“Well, that’s rather interesting,” Munger replied, his trusty Diet Coke can sitting in front of him. He mentioned the World Book Encyclopedia, which he remembered from his youth as a product sold door to door. “It was easy for a child who wasn’t necessarily a brilliant student.”

And as an investment, the World Book provided volume after volume of wealth. ”Berkshire made $50 million pre-tax per year out of that business for years and years and years. I was always so proud of it because I grew up with it and it helped me.”

The World Book triumph follows a pattern of Buffett and Munger buying into successful businesses whose products they loved, including Dairy Queen, See’s Candies, and yes, Coca-Cola.

Berkshire Hathaway also followed a model that almost seems old fashioned today: it invested in companies whose stocks were undervalued; that is, when the intrinsic value per share dips below the current market share price.

Read more: Suze Orman says Americans are poorer than they think — but having a dream retirement is so much easier when you know these 3 simple money moves

World Book only ceased to return monstrous profits when, as Munger noted, “a man named Bill Gates came along and decided he was going to give away a free encyclopedia with every damn bit of software.”

The World Book success story boils down to the kind of simple principle Munger loved so much: buy in companies whose products and profit potential you believe in, especially after you study the numbers and marketplace dominance.

“It’s still a marvelous product,” Munger said, “and it wasn’t good that we lost what World Book was doing for this civilization. World Book helped me get ahead in life.”

Charlie’s folly

But even the most successful market gurus have their crash-and-burn moments. Munger had no trouble recalling the dud that haunted him at the Daily Journal’s 2023 meeting: Alibaba “was one of the worst mistakes I’ve ever made.”

Munger said he was “over-charmed” by online retailing and “got a little out of focus” when it came time to invest his money in Alibaba. In fact, Munger acknowledged that he used leverage to buy the stock— a tactic he has frowned on in the past — because “the opportunities were so ridiculously good I thought it was desirable to do that.”

Munger initially bought about 165,000 Alibaba shares in the first quarter of 2021 and increased that to 602,060 shares in the fourth quarter. But he then cut that back to 300,000 shares in the first quarter of 2022.

The lesson Munger learned and that we can especially benefit from today is that the market’s bright shiny objects may distract us from doing our homework. E-commerce, he said, wasn’t a slam dunk but just another form of retail where a business has to prove its viability, just like a brick-and-mortar store.

This story should be familiar to anyone who has jumped on an IPO from a much-hyped company, only to see its stock falter days afterward. Trump Media, for example, recently dropped below $30 a share, compared to an IPO price that soared above $70.

As for his particular market tumble, Munger’s response was pure Munger: “I keep rubbing my own nose in my own mistakes like I’m doing now because I think it’s good for [me].”

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Investment

TFSAs, RRSPs and more could see changes in allowed investments – Investment Executive

“It’s a useful and probably much needed exercise,” said Carl Hinzmann, partner with Gowling WLG in Toronto. “If they can get the [qualified investments definitions] down to a singular definition, I think it would be significantly easier for the investment community that’s trying to provide advice and develop products.”

Holding a non-qualified or prohibited investment can lead to severe tax consequences: the plan would incur a 50% tax on the fair market value of the non-qualified or prohibited investment at the time it was acquired or changed status, and the investment’s income also would be taxable.

The consultation asked stakeholders to consider whether updated rules should favour Canada-based investments. Hinzmann likened this to the debate about whether pension funds should invest more domestically.

“I don’t think tax legislation is the appropriate way to tell pension funds to invest their money, so why [do that to] ordinary Canadians?” he said.

To achieve the goal of favouring Canadian investments, Hinzmann said the government could either require a certain percentage of domestic investments or treat domestic investments more favourably within a plan. Canada had a foreign content limit for RRSPs and RRIFs from 1971 to 2005, which ranged from 10% to 30%.

The budget acknowledged that the qualified investment rules “can be inconsistent or difficult to understand” due to their many updates since their introduction in 1966.

For example, different plans have slightly different rules for making investments in small businesses; certain types of annuities are qualified investments only for RRSPs, RRIFs and RDSPs; and certain pooled investment products are qualified investments only if they are registered with the Canada Revenue Agency.

“There’s no good policy reason” for the inconsistencies, Hinzmann said, adding that the purpose of the rules is to ensure registered plans hold stable, liquid products and that the planholder does not gain a personal tax advantage.

By having unwieldy, inconsistent rules, “all you’re really doing is increasing costs for the people offering these investment services to Canadians,” he said.

The budget asked for suggestions on how to improve the regime. In addition to questioning whether the rules should favour Canadian investments, the budget asked stakeholders to consider the pros and cons of harmonizing the small-business and annuities rules; whether crypto-backed assets should be considered qualified investments; and whether a registration process is indeed required for certain pooled investment products.

Hinzmann said the consultation’s highlighting of crypto-backed assets suggests the government may be questioning whether investment funds that hold cryptocurrency should be included in registered plans, though he acknowledged the government also could wish to expand the types of crypto products allowed.

Cryptocurrency itself is a non-qualifying investment in registered plans.

The qualified investments consultation ends July 15.

Qualified, non-qualifying and prohibited investments

Registered plans are allowed to hold a wide range of investments, including cash, GICs, bonds, mutual funds, ETFs, shares of a company listed on a designated exchange, and private shares under certain conditions. These are called qualified investments.

However, investments such as land, general partnership units and cryptocurrency are generally non-qualifying investments. (A cryptocurrency ETF is qualified if it’s listed on a designated exchange.)

A prohibited investment is property to which the planholder is “closely connected.” This includes a debt of the planholder or a debt or share of, or an interest in, a corporation, trust or partnership in which the planholder has an interest of 10% or more. A debt or a share of, or an interest in, a corporation, trust or partnership in which the planholder does not deal at arm’s length also is prohibited.

A registered plan that acquires or holds a non-qualified or prohibited investment is subject to a 50% tax on the fair market value of the investment at the time it was acquired or became non-qualified or prohibited. However, a refund of the tax is available if the property is disposed of, unless the planholder acquired the investment knowing it could become non-qualified or prohibited.

Income from a non-qualified investment is considered taxable to the plan at the highest marginal rate. Income earned by a prohibited investment is subject to an advantage tax of 100%, payable by the planholder.

A non-qualified investment that is also a prohibited investment is treated as prohibited.

Investment

Bill Morneau slams Freeland’s budget as a threat to investment, economic growth

|

|

Finance Minister Chrystia Freeland’s predecessor Bill Morneau says there was talk of increasing the capital gains tax when he was on the job — but he resisted such a change because he feared it would discourage investment by companies and job creators.

He said Canada can expect that investment drought now, in response to a federal budget that targets high-end capital gains for a tax hike.

“This was very clearly something that, while I was there, we resisted. We resisted it for a very specific reason — we were concerned about the growth of the country,” he said at a post-budget Q&A session with KPMG, one of the country’s large accounting firms.

Morneau, who served as Prime Minister Justin Trudeau’s finance minister from 2015 to 2020 before leaving after reports of a rift, said Wednesday that Freeland’s move to hike the inclusion rate from one-half to two-thirds on capital gains over $250,000 for individuals, and on all gains for corporations and trusts, is “clearly a negative to our long-term goal, which is growth in the economy, productive growth and investments.”

Morneau said the wealthy, business owners and corporations — the people most likely to face a higher tax burden as a result of Freeland’s change — will think twice about investing in Canada because they stand to make less money on their investments.

“We’ve created a disincentive and that’s very difficult. I think we always have to recognize any measure that creates a disincentive for investment not only impacts us within the country but also impacts foreign investors that are looking at our country,” he said.

“I don’t think there’s any way to sugarcoat it. It’s a challenge. It’s probably very troubling for many investors.”

KPMG accountants on hand for Morneau’s remarks said they’ve already received calls from some clients worried about how the capital gains change will affect their investments.

Praise from progressives

While Freeland’s move to tax the well-off to pay for new spending is catching heat from wealthy businesspeople like Morneau, and from the Canadian Chamber of Commerce, progressive groups said they were pleased by the change.

“We appreciate moves to increase taxes on the wealthiest Canadians and profitable corporations,” said the Canadian Labour Congress.

“We have been calling on the government to fix the unfair tax break on capital gains for a decade,” said Katrina Miller, the executive director of Canadians for Tax Fairness. “Today we are pleased to see them take action and decrease the tax gap between wage earners and wealthy investors.”

“This is how housing, pharmacare and a Canada disability benefit are afforded. If this is the government’s response to spending concerns, let’s bring it on. It’s about time we look at Canada’s revenue problem,” said the Canadian Centre for Policy Alternatives.

The capital gains tax change was pitched by Freeland as a way to make the tax system fairer — especially for millennials and Generation Z Canadians who face falling behind the economic status of their parents and grandparents.

“We are making Canada’s tax system more fair by ensuring that the very wealthiest pay their fair share,” Freeland said Tuesday after tabling her budget in Parliament.

WATCH: New investment to lead ‘housing revolution in Canada,’ Freeland says

Finance Minister and Deputy Prime Minister Chrystia Freeland said this year’s federal budget will pave the way for Canada to build more homes at a pace not seen since the Second World War. The new investment and changes to funding models will also cut through red tape and break down zoning barriers for people who want to build homes faster, she said

The capital gains tax, which the government says will raise about $19 billion over five years, is also being pitched as a way to help pay for the government’s ambitious housing plan.

The plan is geared toward young voters who have struggled to buy a home. Average housing prices in Canada are among the highest in the world and interest rates are at 20-year highs.

Tuesday’s budget document says some wealthy people who make money off asset sales and dividends — instead of income from a job — can face a lower tax burden than working and middle-class people.

Morneau, who comes from a wealthy family and married into another one, is on the board of directors of CIBC and Clairvest, a private equity management firm that manages about $4 billion in assets.

According to government data, only 0.13 per cent of Canadians — people with an average income of about $1.4 million a year — are expected to pay more on their capital gains as a result of this change.

But there’s also a chance less wealthy people will pay more as a result of the change.

Put simply, capital gains occur when you sell certain property for more than you paid for it.

While capital gains from the sale of a primary residence will remain untaxed, the tax change could affect the sales of cottages and other seasonal and investment properties, along with stocks and mutual funds sold at a profit.

A cottage bought years ago and sold for a gain of more than $250,000 would see part of the proceeds taxed at the new higher rate.

But there’s some protection for people who sell a small business or a farming or fishing property — the lifetime capital gains exemption is going up by about 25 per cent to $1.25 million for those taxpayers.

Freeland said Tuesday she anticipates some blowback.

“I know there will be many voices raised in protest. No one likes paying more tax, even — or perhaps particularly — those who can afford it the most,” she said.

“Tax policy is not only, or chiefly, the province of accountants or economists. It belongs to all of us because it is how we decide what kind of country we want to live in and what kind of country we want to build.”

Morneau had little praise for what his successor included in her fourth budget.

Morneau said Canada’s GDP per capita is declining, growth is limited and productivity is lagging other countries — making the country as a whole less wealthy than it was.

Canada has a growth problem, Morneau warns

The government is more interested in rolling out new costly social programs than introducing measures that will reverse some of those troubling national wealth trends, he said.

“Canada is not growing at the pace we need it to grow and if you can’t grow the size of the pie, it’s not easy to figure out how to share the proceeds,” he said.

“You think about that first before you add new programs and the government’s done exactly the opposite.”

The U.S. has a “dynamic investment culture,” something that has turbo-charged economic growth and kept unemployment at decades-low levels, Morneau said. Canada doesn’t have that luxury, he said.

He said Freeland hasn’t done enough to rein in the size of the federal government, which has grown on Trudeau’s watch.

The deficit is now roughly double what it was when he left office, Morneau noted.

“There wasn’t enough done to reduce spending,” he said, while offering muted praise for the government’s decision to focus so much of its spending on the housing conundrum. “The priority was appropriate.”

-

News22 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Investment20 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

Business20 hours ago

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

-

Art21 hours ago

Squatters at Gordon Ramsay's Pub Have 'Left the Building' After Turning It Into an Art Café – PEOPLE

-

Tech14 hours ago

Tech14 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Politics20 hours ago

Politics20 hours agoThe Earthquake Shaking BC Politics

-

Sports24 hours ago

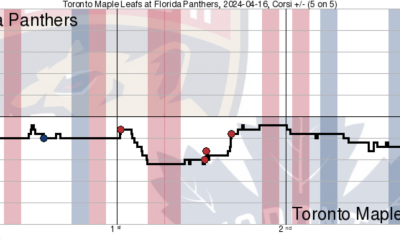

Sports24 hours agoGame in 10: Maple Leafs squander multi-goal lead to Florida, draw the Boston Bruins in the first round – Maple Leafs Hot Stove

-

Investment19 hours ago

Investment19 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth