Business

COVID-19 antiviral treatment arrives in Nova Scotia – CBC.ca

Nova Scotia says 900 treatment packages of the COVID-19 antiviral drug have landed in the province, but plans for prescribing Paxlovid are still being finalized.

The Health and Wellness Department said it is working to make the supply available “as soon as possible,” and details about the distribution of Pfizer’s Paxlovid are still being worked out with stakeholders including Nova Scotia Health.

Earlier this week, Health Canada approved the oral antiviral treatment designed to help the body fight off the virus, reduce symptoms from an infection and shorten the period of illness.

Dr. Lisa Barrett, who treats COVID-19 patients and will prescribe the therapeutic once it starts rolling out, said a plan for distribution could take another few weeks.

But she said the first 900 treatment packages will help 900 people. The drug is taken twice a day for five days.

It will be made available to the most vulnerable, including those who are not fully vaccinated for one reason or another and people over the age of 50 who have a risk factor such as being a transplant or cancer patient.

“We’re hoping that it’s going to make a difference for the most vulnerable people,” said Barrett in an interview on Thursday.

“This is for people at the highest risk of disease and we don’t want them to have to shield anymore at home.”

Barrett noted the medication is designed to reduce hospitalization and death. The hope is that it will help alleviate pressures on the health-care system, she said.

Recognizing the limitations

She also said the fact that the drug is only trickling into the province at this point does not concern her because it was studied on unvaccinated people who were at high risk with the Delta variant.

“It’s not clear yet if there is as much of a benefit to preventing hospitalization and death in people who are partly vaccinated, but not fully, against Omicron,” said Barrett.

“I want people to be aware we’re not completely devastated that we don’t have hundreds of thousands of doses of this because we think it’s helpful but not for the whole population.

“It’s good to recognize the limitations of the data and where we sit right now.”

Barrett said those in the vulnerable population group should be tested as soon as possible if they have symptoms and report any positive results to Public Health and their doctor.

Doctors will be able to refer their patients to receive the drug. Those referrals will be reviewed and the patient will be contacted about how to receive the treatment.

She said outbreaks in hospitals and long-term care homes will also be monitored as a way of identifying people at risk who may need the treatment.

Recent approval of drug ‘great news’

On Monday, Canada’s Chief Public Health Officer Dr. Theresa Tam said Health Canada’s approval was “great news” because Paxlovid could drive down severe outcomes in the current wave and beyond.

Paxlovid combines a new drug developed by Pfizer called nirmatrelvir with an existing antiretroviral drug named ritonavir, a low-dose HIV drug that helps nirmatrelvir remain active in the body longer.

After months of clinical trials, Pfizer reported in November that Paxlovid reduced the risk of hospitalization or death by 89 per cent compared to a placebo in non-hospitalized high-risk adults with COVID-19.

Business

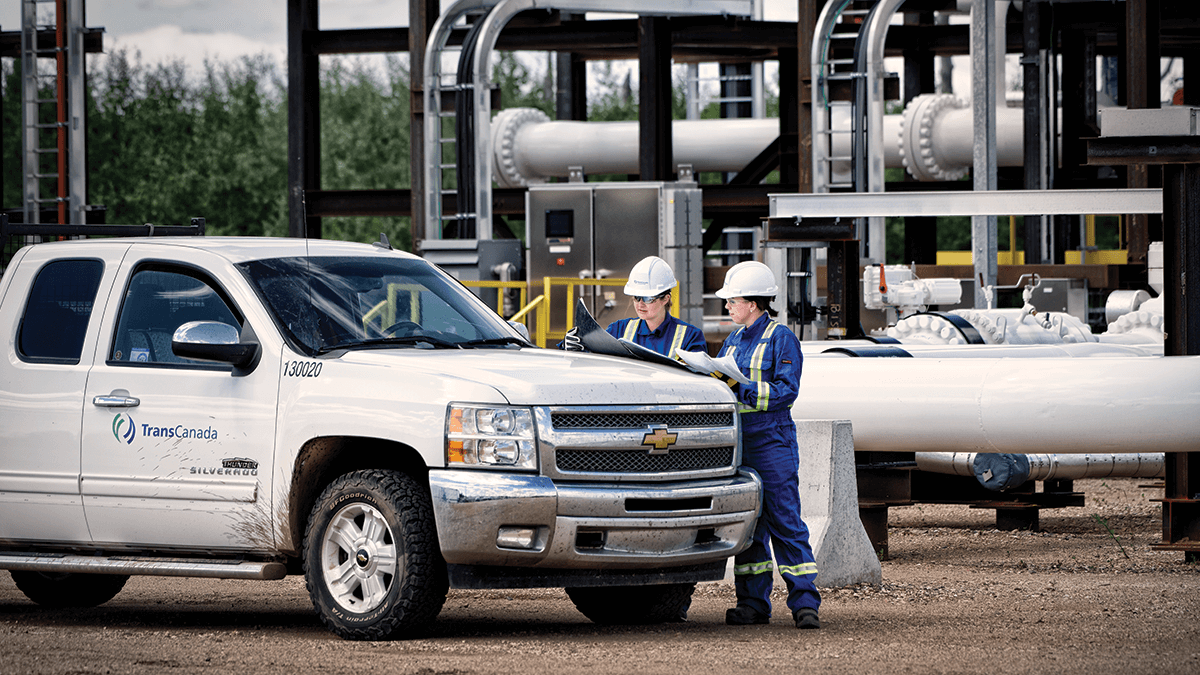

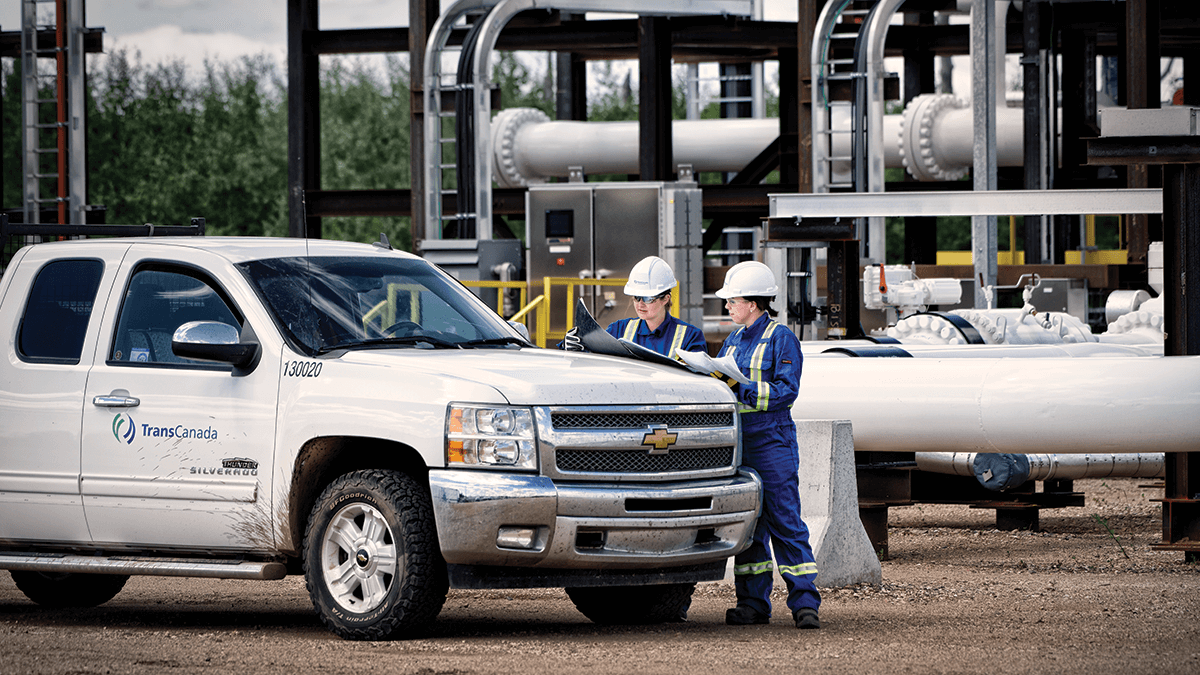

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

A wildfire burns near Edson, Alta., in this April 16, handout photo.HO/The Canadian Press

A section of TC Energy’s TRP-T NGTL gas pipeline system in Alberta ruptured and caught fire on Tuesday, sparking a wildfire in a remote area, the company said.

“An initial ignition of natural gas at the rupture site is now extinguished. We are working to support Alberta Wildfire in their response to contain a secondary fire,” the company said in a statement on its website.

TC said there were no injuries and it was working closely with first responders in the region.

How fire broke out at the TC gas pipeline near Edson, Alberta

The fire broke out about 40 km (25 miles) northwest of Edson, Alberta, in Yellowhead County. Canadian broadcaster Global News said there was a plume of flames and smoke visible from many kilometres away.

The Canada Energy Regulator (CER) said initial investigations indicated a rupture in a gas pipeline caused the fire, which was under control.

TC Energy said it has isolated and shut down the affected section of the NGTL system, and the remainder of the system is operating normally with no commercial impact.

The CER said it is sending inspectors to the area to monitor and oversee the company’s response and determine the impact of the incident.

NGTL is TC Energy’s natural gas gathering and transportation system that transports gas produced in Western Canadian Sedimentary Basin (WCSB) to markets in Canada and United States.

Business

Gas prices in GTA expected to rise 14 cents on Thursday – CityNews Toronto

Drivers in the GTA are bracing for a double-digit spike at the gas pumps on Thursday, as the price is expected to rise 14 cents at midnight.

Roger McKnight, chief petroleum analyst with En-Pro International Inc., tells CityNews the price at gas pumps is set to rise to 178.9 cents/litre at local stations. The price as of Wednesday is 164.9 cents/litre.

The last time gas prices were this high was back in August 2022.

McKnight says the spike is due to price increases for wholesale gas and only applies to gasoline. He adds the price for diesel will increase by 0.4 cents.

Earlier this month, the price rose to its highest levels in six months following the implementation of the federal carbon price, also referred to as the carbon tax.

That saw the carbon tax on gasoline go up by 3.3 cents per litre, while diesel increased by 4.1 cents per litre.

With files from John Marchesan of CityNews

Business

TC Energy responds to incident in Yellowhead County – TC Energy

Update #1

Media statement – April 16, 2024, 1:30 p.m. MDT

We can confirm that we are actively responding to an incident involving the NGTL natural gas system approximately 40 kilometres northwest of Edson, Alta in Yellowhead County.

TC Energy received notification about this incident at approximately 11 a.m. MT and immediately activated our emergency response procedures. We are coordinating with emergency first responders. The affected section of the pipeline has been isolated and shut down. There are no reported injuries. Our primary focus right now is the health and safety of responding personnel, surrounding communities and mitigating risk to the environment.

We are making all appropriate notifications to regulators, customers, stakeholders and Indigenous communities.

We will provide more information as soon as it becomes available.

Further inquiries can be sent to TC Energy media relations at media@tcenergy.com

-

Sports14 hours ago

Sports14 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState22 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech22 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Real eState23 hours ago

Sask. real estate company that lost investors’ millions reaches settlement

-

Politics19 hours ago

Politics19 hours agoPolitical interference in Canada’s pension funds is wrong

-

Business13 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca

-

Health24 hours ago

Health24 hours agoUpgrading the food at VGH for patient and planetary health

-

Sports20 hours ago

Sports20 hours ago‘BOTTCHER BOMBSHELL:’ Alberta curling foursome set to move forward without skip