Investment

Cryptocurrency Investing Predictions For 2022 – Forbes

Bitcoin…moon again?

Well, wasn’t 2021 sort of a moon launch? I think so. It hit all-time highs despite all the “legends” saying it’s a worthless seashell for tech dorks. Wrong! Hey, it’s not $68,000, but it’ll get there again.

Right?

“Bitcoin will reach at least $200,000 by 2025,” says Paycer UG founder & CTO Nils Gregersen in Hamburg, Germany. “But I am pretty sure we will see it fall to around $20,000 before hand.”

Yikes!

Okay, no panicking. I’ll buy it.

What about the rest of the cryptocurrency space? There’s more to this market today than Bitcoin. Cryptocurrency investing is the new stock market. Everybody knows that.

This year was a very interesting one for crypto. We saw trends coming and going very fast — with coins hyped up by influencers like Elon Musk — who gave Dogecoin a lift for a short time before it returned to being a dud coin.

“There is a lot of pump in the market at the moment,” says Gregersen. “I think in 2022 we are going to see a little cooldown in the market. Only the stronger projects will survive. For the memecoins and other shady projects, I think the air gets a little thinner for them,” he says, adding that regulations will have an impact on DeFi cryptocurrencies, within varying degrees of positives and negatives.

“DeFi will still be a thing in 2022. We have only seen the tip of the iceberg in terms of DeFi,” says Gregersen. “There are many new products to come that we can’t even imagine today.”

Some DeFi trends expected next year: Decentralized Autonomous Organizations (DAO) that offer unregulated, decentralized finance and a new regulated centralized- decentralized finance. Call it the yin and yang of DeFi, I guess. CeDeFi will offer less complex financial services based on DeFi but will hold hands with the regulators of financial markets and banking, in general. This might be the type of DeFi that Jim Cramer of Mad Money can get behind.

Ava Labs president John Wu also predicts DeFi will have a good 2022.

But he seems to like the GameFi space even more.

“DeFi will continue to lead in terms of total value in the ecosystem, but blockchain gaming will introduce more people to crypto because the learning and adoption curves in gaming are notably smaller than that of DeFi,” he says.

Yeah, I’m still playing video games on an X Box One. I don’t know about blockchain games. I have never stared into the eyes of any blockchain yet. I’ll have to do that this year.

Future game gamefi and entertainment digital technology. Teenager having fun play VR virtual reality … [+]

getty

“Gaming growth is outpacing new DeFi activity. Just wait until major developers and studios get involved,” Wu says.

GameFi is considered a subset of the metaverse as most game developers in the blockchain world are building their ecosystem to be more linked to the virtual world. Non-fungible tokens (NFT) are also an offshoot here — because diehard gamers will spend money for digital art, let alone weapons and other gear (or fake land) associated with a game.

The metaverse is in its infancy. So this gives crypto investors a chance to get in on the ground floor of some of the newcomers. I own Decentraland (MANA) as my metaverse play.

“Getting aboard the metaverse train today with all the connections to other aspects of blockchain evolution will be synonymous to getting aboard the Bitcoin train in its earliest days,” says Sven Wenzel, co-founder of Castello Coin, which operates in the digital art space. “An early investment in a metaverse token can amount to so much more in the longer term,” he says in comparing metaverse plays with the likes of Bitcoin.

Castello Coin and Decentraland all run on the Ethereum blockchain. It’s still the No. 2 cryptocurrency investment after Bitcoin. How will Ethereum look in 2022?

“I would invest in Ethereum. I would invest $200 every month in Ethereum,” says Gregersen.

Overall, market participants expect more people opening accounts with exchanges. That’s a long term bullish signal for cryptocurrencies.

I predict some of the more old school platforms (think E*Trade) will allow for investment in at least Bitcoin and Ethereum next year. That should get more people involved, especially those who can’t be bothered opening up a Gemini account, for instance.

POLAND – 2020/06/15: In this photo illustration an Ethereum logo seen displayed on a smartphone. … [+]

SOPA Images/LightRocket via Getty Images

The resilience of cryptocurrencies is expected to be a highlight again this coming year. We all have witnessed how our investments can snap back rather quickly from a 10% or 20% loss.

In the past, this would have triggered a sustained downturn and ‘crypto winter’, but better risk management on the professional investor side means the market just has a snow day instead. People will be buying the dips in 2022.

I know I will. After a 23 day battle with Covid, I’m ready to put some money to work in my Coinbase account again. I’ll probably load up on some Bitcoin. After these interviews, I might have to check in on MANA.

Besides investing ideas, Wu from Ava Labs thinks more traditional brand name corporations will enter the space in 2022.

“Look at the list of major media companies, sports leagues or content creators participating in digital assets at the start of the year versus the end of it,” he says. Deloitte and Mastercard recently linked up with Ava Labs to explore their Avalanche blockchain and its smart-contract enabled applications.

This year was a true zero-to-60 growth in new blockchain protocols like Solana (SOL) and Polkadot (DOT). Many Fortune 500 companies who used this year to explore what NFTs and digital assets can do for them will be two feet in, in 12 months’ time, Wu predicts.

“They’ve seen their peers succeed and so the risk of failure is low enough to make a move,” he says.

If you watched the World Series, you saw the FTX crypto exchange logo on the jerseys of the umpires. Yes, you can buy and sell NFTs on FTX, like the currently priced $615 Stephen Curry NFT: The 2974 Collection.

So 2021 was the year of NFTs, for sure. What will 2022 be the year of, if you had to pick one?

More new blockchain projects, especially for businesses, says Wu.

“I think you will see enterprise blockchain pilots move into the live stages a lot quicker than people expect,” he says.

Sorry, haters, the world will still be investing in digital assets in 2022. To steal an old adage from the world of Wall Street: the trend is your friend.

**The writer owns Bitcoin, Polkadot and Decentraland. Oh, and sadly, Dogecoin.**

Investment

Canada Pension Plan investment board to host public meeting in Calgary – CTV News Calgary

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Investment

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April – Yahoo Finance

The artificial intelligence (AI) space is red-hot right now. Companies across every industry are looking to capitalize on the technology, and are investing heavily to gain an edge over the competition. That’s true in the social media space, where advertisers are keen to get in front of the right audience for them.

While the social media landscape is jam-packed with competition, one company is separating itself from the pack. Meta Platforms (NASDAQ: META) is making strides across various aspects of the AI realm, and its performance over the competition shows.

Let’s dig in to why now is a lucrative opportunity to invest in Meta as the long-term AI narrative plays out.

The profit machine is up and running

One of the most appealing aspects of Meta is how efficiently management runs the business. In 2023, Meta grew revenue 16% year over year to $135 billion. However, the company increased income from operations by a whopping 62% year over year to $46.7 billion.

By expanding its operating margin, Meta recognized significant growth on the bottom line as well. Last year, the company generated $43 billion in free cash flow. With such a robust financial profile, Meta is well-positioned to invest profits back into the business as well as reward shareholders.

Investing for the future

During Meta’s fourth-quarter earnings call in February, investors learned how the company is deploying its cash heap. For starters, it has increased its share repurchase program by $50 billion. This is encouraging to see as it could imply that management views Meta stock as a good value.

But perhaps more exciting was the announcement of a quarterly dividend. Many high-growth tech companies are not in a financial position to pay a dividend — or instead choose to reinvest profits into research and development or marketing strategies. Meta’s new dividend certainly sets the company apart from many of its peers, and is a nice sweetener for long-term shareholders.

Another way Meta is using its cash flow is in the realm of artificial intelligence. Like many enterprises, Meta relies heavily on sophisticated graphics processing units (GPUs) from Nvidia. However, Meta has been hinting for a while that the company is investing in its own hardware. Earlier this month, Meta announced that an updated version of its training and inference chips, called MTIA, is now available.

This is important for a couple of reasons. Namely, in-house chips will allow Meta to “control the whole stack” and scale back its reliance on semiconductors from third parties. Additionally, given the company’s knowledge base of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips put Meta in a position to improve its targeted recommendation models and ad campaigns through the power of generative AI.

A compelling valuation

Meta competes with a number of players in the social media landscape. Alphabet is one of the company’s top competitors given that it operates the world’s top-two most visited websites: YouTube and Google. However, in 2023 Alphabet only grew its core advertising business by 6% year over year. By contrast, Meta’s advertising segment increased 16%.

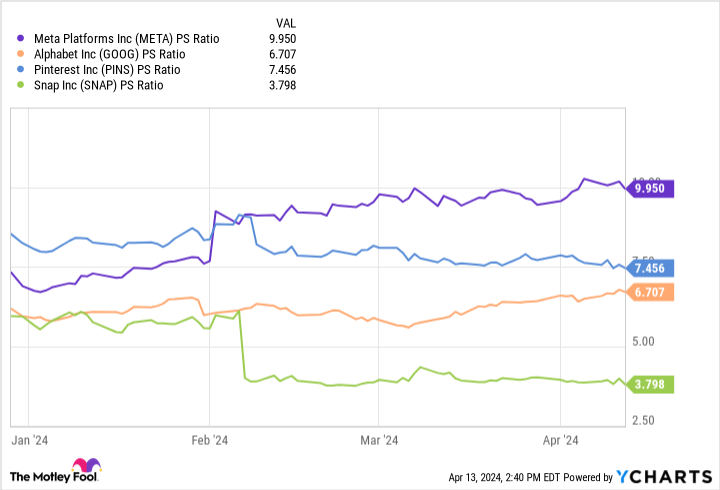

While Meta’s price-to-sales (P/S) ratio of 10 is higher than many of its social media peers, the company’s growth in the highly competitive and cyclical advertising landscape may warrant the premium.

Additionally, considering Meta’s price-to-free-cash-flow ratio of about 31 is actually trading relatively in line with its 10-year average of 32, the stock might not be as expensive as it appears.

Overall, I am optimistic about Meta’s aggressive ambitions in artificial intelligence — an investment that is yet to play out. The AI narrative is going to be a long-term story. But I see Meta as extremely well-equipped to take advantage of secular themes fueling AI, and benefiting across its entire business.

The combination of a dividend, share buybacks, consistent cash flow, and a compelling AI play make Meta stick out in a highly contested AI landscape. I think now is a great opportunity to scoop up shares in Meta and prepare to hold for the long term.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April was originally published by The Motley Fool

Investment

Goldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg

(Bloomberg) — The growth equity unit of Goldman Sachs Group Inc. has invested $47.5 million in Kontakt.io, a startup that helps hospital managers make decisions about patients, beds and equipment.

It’s the 39th investment in health care from the bank’s growth equity division and the deal is “a good example of what is coming down the pipe” for its portfolio, according to Christian Resch, the UK-based the Goldman partner who led the financing and will sit on Kontakt.io’s board.

Kontakt.io, formed in Poland in 2014, makes small bluetooth-connected devices that stick on hospital equipment and software for managing the data collected by the sensors. The idea is to track practically everything inside a hospital — from patient beds to ultrasound machines — to help managers make decisions about capacity and replacement. The startup wants to build out an AI system that can offer suggestions to managers. It bills for the entire tracking system, rather than solo sensors.

Philipp von Gilsa, Kontakt.io’s chief executive officer, said his business helps health-care operators curb inefficiencies and manage pressures like crippling nursing shortages. “Hospitals are extremely, extremely wasteful in how they treat their resources,” he said. “We help them address that and, at the end of the day, save money.”

Health-care and life sciences IT spend is expected to continue rising, growing 8.3% in 2023 to $245.8 billion, according to Gartner estimates. But that money hasn’t always found its way to startups, which have struggled to compete with entrenched medical suppliers and navigate byzantine health-care networks. While many startups offer tools for managing health records or apps for patient use, Kontakt.io is focused on operations. The company pointed to a 2019 study that found roughly a quarter of US health spending was wasted due to issues like fraud and administrative hassles.

Kontakt.io has largely grown without major outside capital. It first marketed to a range of sectors interested in tracking indoor data, but has since homed in on health care, which now provides 80% of its sales, according to von Gilsa.

The startup has “roughly 500” enterprise customers, he said, including HCA Healthcare Inc. and the UK’s National Health Service. Von Gilsa declined to share revenue but said 2022 sales exceeded the $7.5 million his company raised before Goldman’s funding, and revenues tripled in the last twelve months. Kontakt.io, he said, has been profitable for the last four years.

With the financing, which came solely from Goldman, von Gilsa plans to hire more engineers to build an automated system for hospital staff using artificial intelligence. Machines will offer recommendations for daily decisions like how to stock certain machines or when to move patients into surgery.

Some 4 million devices in circulation give the startup an edge in building this AI, according to von Gilsa, who said the large quantities of data gathered by Kontakt.io sensors can help train its models.

Larger rivals, like GE HealthCare Technologies Inc., have also touted recent AI features designed to streamline hospital operations. Goldman’s Resch said Kontakt.io’s integration of sensors and software gave the bank confidence in its prospects.

©2024 Bloomberg L.P.

-

Media16 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Media24 hours ago

Trump Media stock slides again to bring it nearly 60% below its peak as euphoria fades – National Post

-

Business24 hours ago

Tesla May Be Headed For Massive Layoffs As Woes Mount: Reports – InsideEVs

-

Tech20 hours ago

Tech20 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState20 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports19 hours ago

Sports19 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Sports24 hours ago

Sports24 hours agoPoints and payouts: Scottie Scheffler cements FedExCup top spot with Masters win, earns $3.6M – PGA TOUR – PGA TOUR

-

Science19 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada