Article content

There’s a price shocker coming at the pumps.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/TL4VHNYYD5CB3M5FMT3Z376PT4.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/TL4VHNYYD5CB3M5FMT3Z376PT4.JPG)

The Canada Energy Regulator’s Energy Futures report projects a significant increase in power demand because of a shift toward heating Canadian homes and businesses with electricity, the widespread adoption of electric vehicles and the production of hydrogen using clean power.Darryl Dyck/The Globe and Mail

Canadians’ use of fossil fuels will fall by more than 40 per cent by 2050, according to a new report by the Canada Energy Regulator, driven largely by a move away from gasoline and diesel as consumers switch to electric vehicles and long-haul transport looks to hydrogen.

The regulator’s annual flagship Energy Futures report explores how new technologies and climate policy will affect Canadian energy consumption and production trends over the next 30 years. While it emphasizes Canada cannot meet its climate goals on it current path, critics say the CER needs to do more to outline how the country can reach net-zero emissions by 2050.

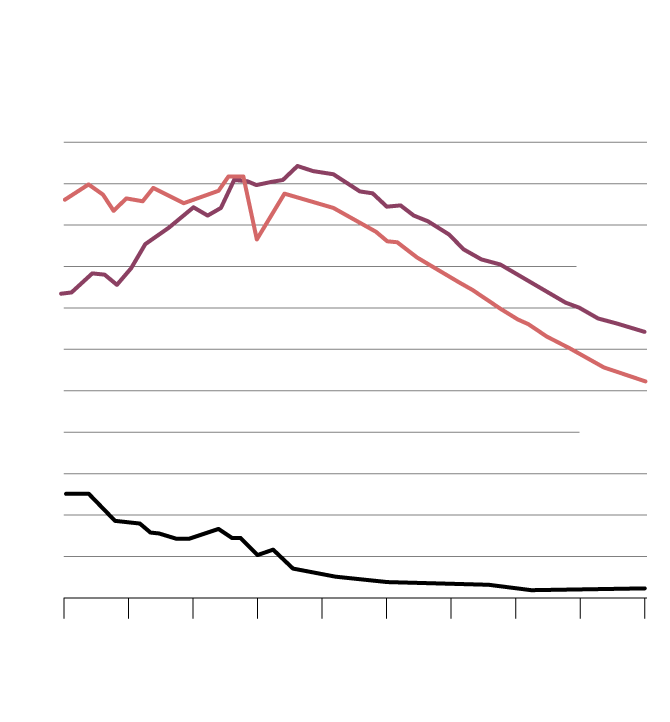

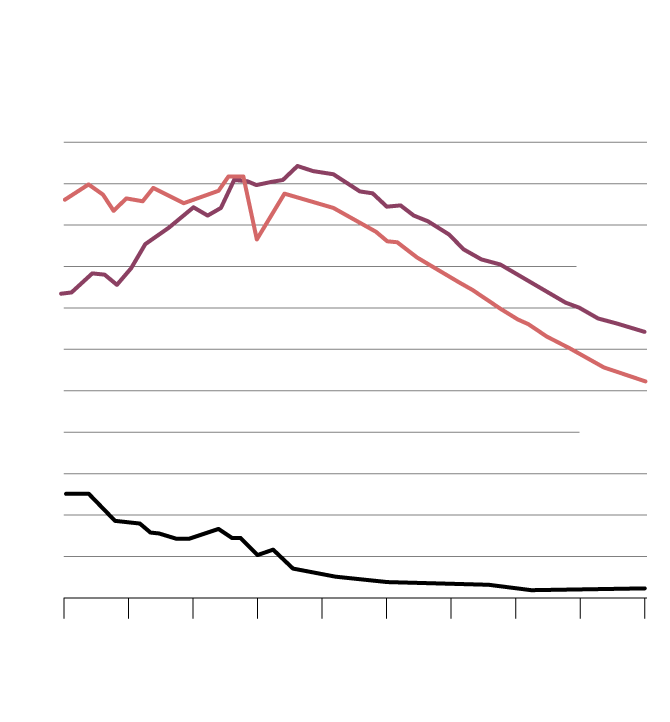

The report models two scenarios. The evolving policies scenario assumes that action to reduce greenhouse gas emissions will continue to increase at a pace similar to recent history, while the current policies scenario models limited action beyond policies that are in place today.

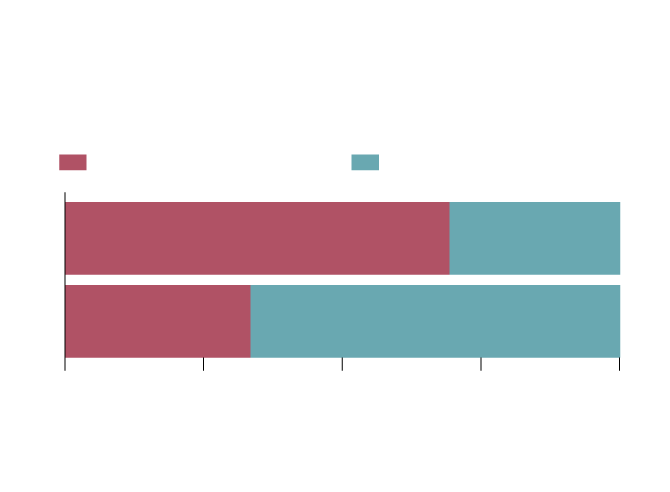

Total Canadian energy use,

evolving policies scenario

Per cent share in 2021 vs. 2050

Unabated fossil fuels

Low and non-emitting

the globe and mail

Source: canada energy regulator

Total Canadian energy use,

evolving policies scenario

Per cent share in 2021 vs. 2050

Unabated fossil fuels

Low and non-emitting

the globe and mail

Source: canada energy regulator

Total Canadian energy use, evolving policies scenario

Per cent share in 2021 vs. 2050

Unabated fossil fuels

Low and non-emitting

the globe and mail, Source: canada energy regulator

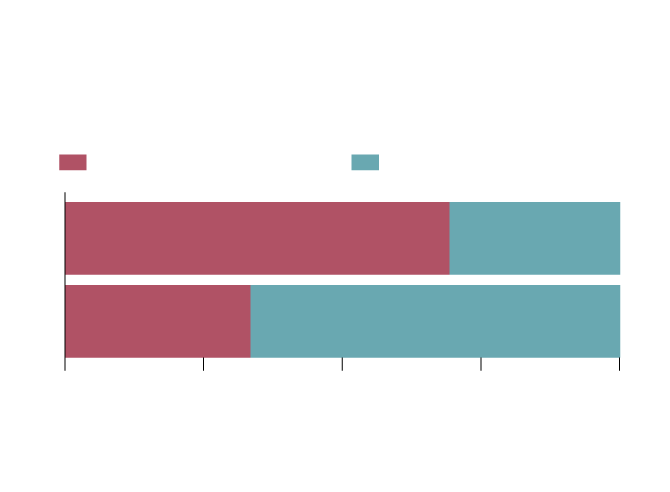

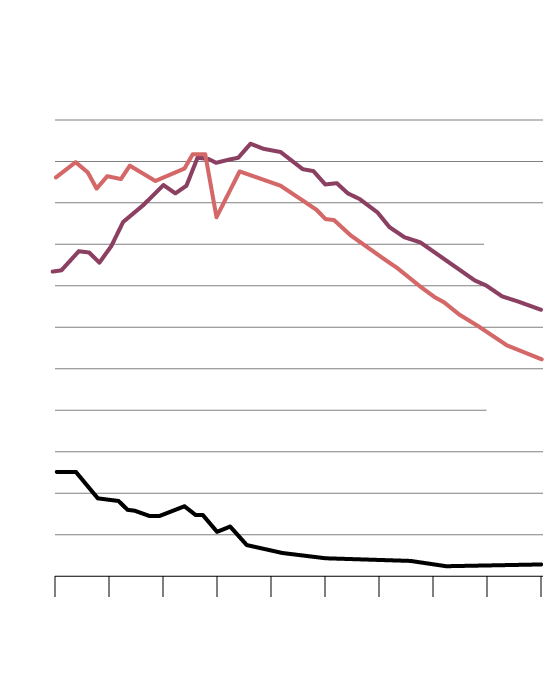

Fossil fuel demand by type,

evolving policies scenario

In petajoules

Natural

gas

RPPs and

NGLs

the globe and mail, Source: canada energy regulator

Fossil fuel demand by type,

evolving policies scenario

In petajoules

Natural

gas

RPPs and

NGLs

the globe and mail, Source: canada energy regulator

Fossil fuel demand by type, evolving policies scenario

In petajoules

Natural

gas

RPPs and

NGLs

the globe and mail, Source: canada energy regulator

Oil production remains relatively stable under the assumptions in the report, but grows more slowly than in the past decade. In the evolving policy scenario, production rises 16 per cent to a peak of 5.8 million barrels a day in 2032. It then declines, but remains resilient despite increasingly ambitious climate policies and relatively low assumed oil prices of US$40 a barrel by 2050.

In the other scenario, production in 2050 is only about four per cent below today’s levels.

But as more crude becomes available for export, Canada’s ability to get it to market will be tested. Pipeline systems – even with their planned expansions – and rail lines will be jammed with oil into the mid-2030s, exceeding capacity altogether under the current policy scenario.

Canadian oil output to peak seven years sooner than previously forecast, energy regulator says

While there’s more wiggle room under the evolving policy scenario, production will still take up more than 94 per cent of transport capacity until mid-2030.

“By historical standards, it’s extremely full. And so that doesn’t provide a lot of flexibility for upsets in the system for things like maintenance, or if production goes a little bit higher, or if there are any surprises in terms of capacity of existing pipeline systems,” said Darren Christie, the regulator’s chief economist.

The report doesn’t delve into world oil demand projections, but notes that Canadian production levels will hinge on global climate policies.

On the natural gas side, the evolving scenario has production gradually declining to 13.1 billion cubic feet per day by 2050, about 17 per cent lower than current levels. British Columbia will increase its share of production, overtaking Alberta as the top natural gas producer in 2028.

It’s not just fossil fuel demand that is set to decrease. Total energy demand in Canada will fall by more than 20 per cent by 2050 under the evolving policy scenario, with more than two-thirds of it met by low- and non-emitting sources (up from one-third today).

Will Alberta squander a $61-billion cleantech opportunity?

Global energy transition could be a $61-billion opportunity for Alberta, new study finds

Much of the heavy lifting on emissions reduction will be done by carbon capture, utilization and storage projects, which force CO2 emissions deep into the ground to keep them out of the atmosphere.

Under the evolving scenario, fossil fuel use where emissions are not captured is projected to fall by 62 per cent in the next 30 years. By 2050, roughly half of all natural gas usage is tied to carbon capture and storage projects.

Mr. Christie said the report signals the need for more changes to Canada’s energy mix to reduce emissions to zero by 2050, but environmental groups say it should have gone further.

The Climate Action Network, a coalition of 130 groups across Canada, argued the CER should have looked to the International Energy Agency’s Net Zero by 2050 road map, released in the spring. That report modelled scenarios that assume global oil demand has already peaked.

Nichole Dusyk, a senior analyst at the Pembina Institute think tank, agreed the CER should have included a third scenario to help guide Canada on its path to net zero.

“It shows us almost a cautionary tale in terms of where we’re headed and that we need to go somewhere different. Where it fails is it doesn’t show us the other path that we actually want to take,” she said in an interview.

She also said that the report doesn’t align with federal government policies, including a pledge to get Canada’s power grid to net-zero emissions by 2035.

The report did, however, include a deep dive into electricity. And, despite the drop in total energy demand under the evolving policy scenario, it projects a significant increase in power demand because of a shift toward heating Canadian homes and businesses with electricity, the widespread adoption of electric vehicles and the production of hydrogen using clean power.

Power generation also gets significantly less carbon-intensive, with 95 per cent of it coming from low- and non-emitting sources by 2050 – up from 82 per cent today.

At the same time, the report highlights the need for more cross-provincial power transmission, particularly in Western Canada.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

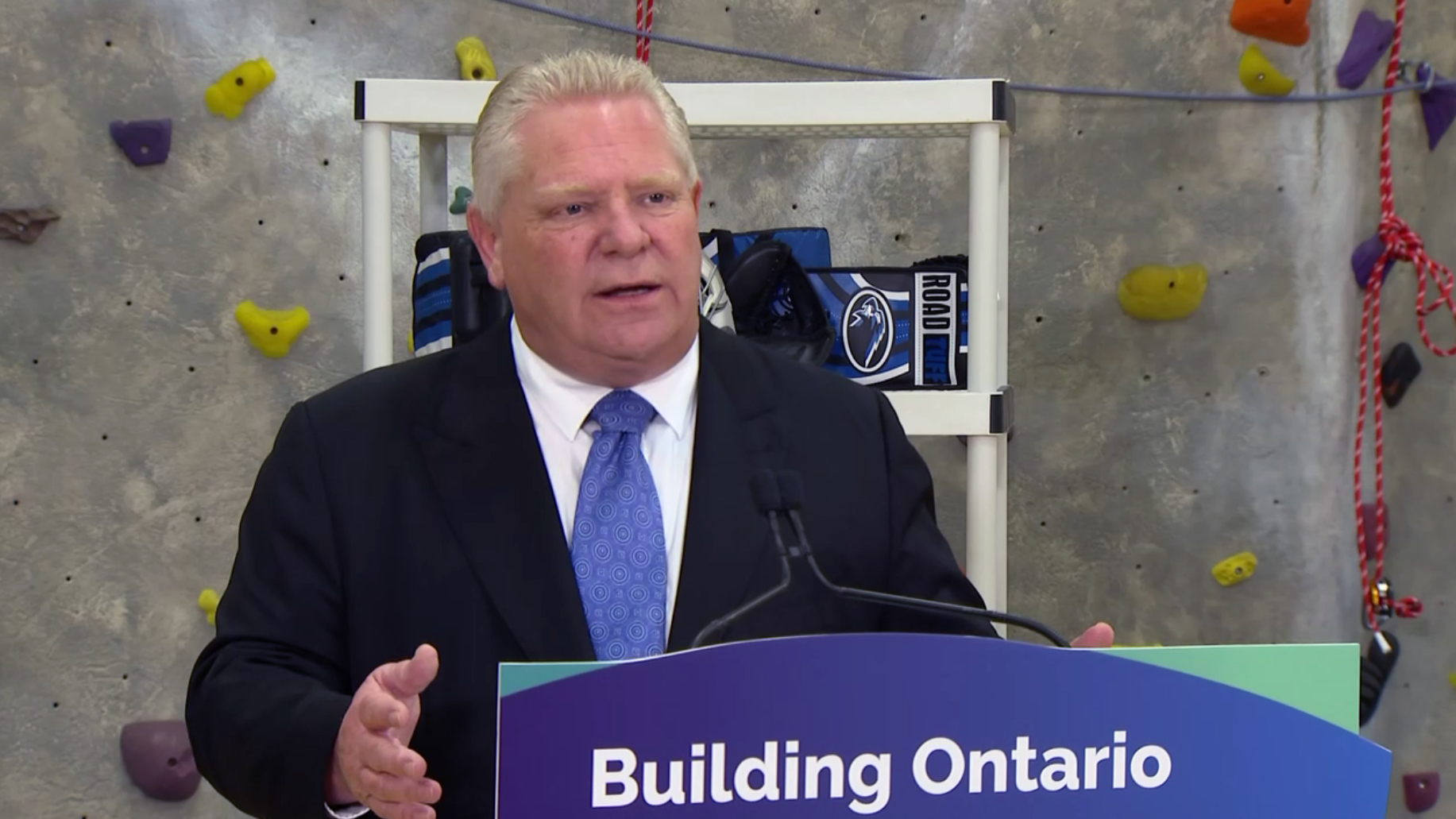

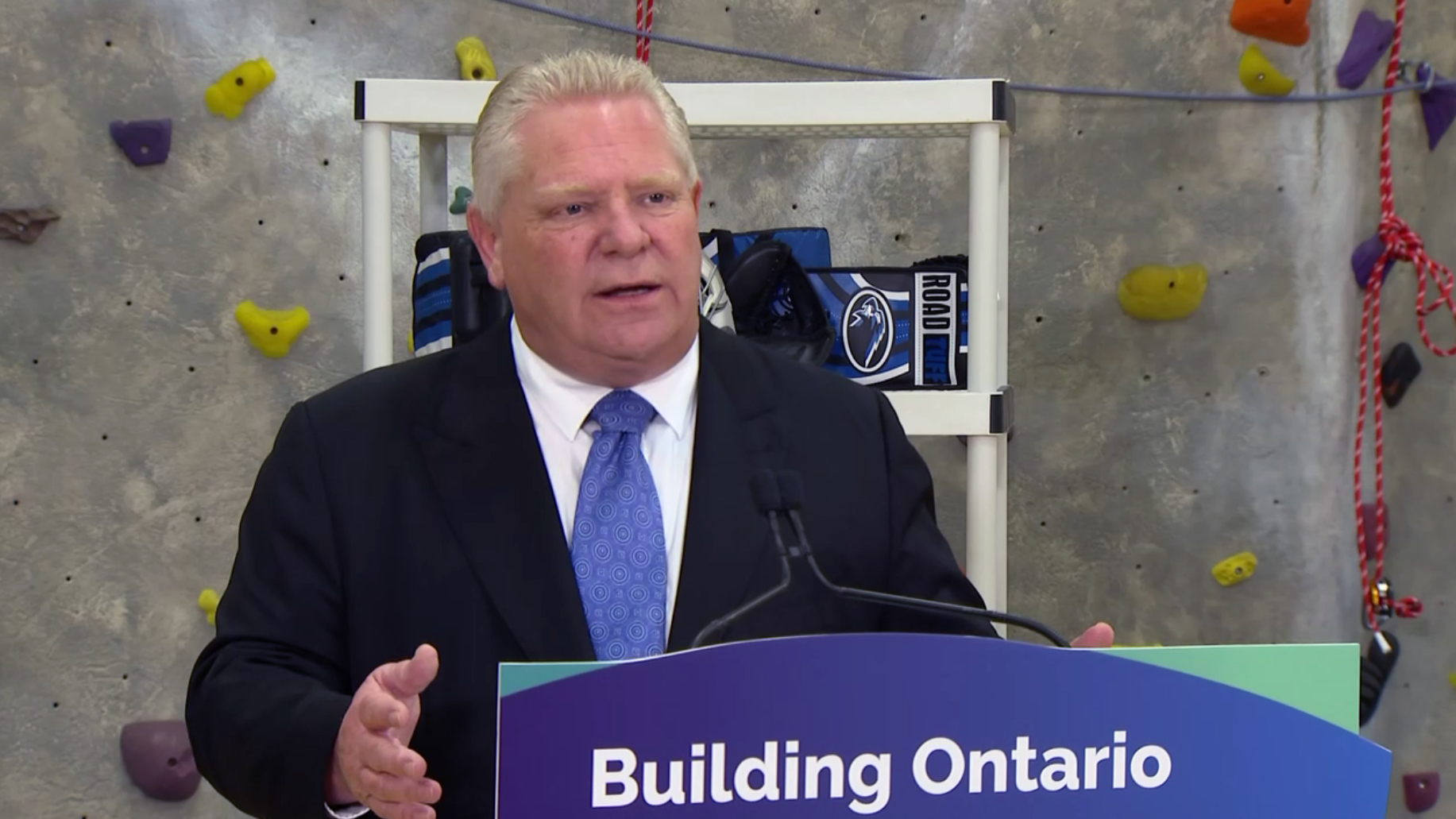

Premier Doug Ford lashed out at the gas companies for the double-digit overnight increase in the price of gas across the GTA, calling it unacceptable and disgusting.

Speaking at an unrelated announcement in Oakville, Ont., on Thursday, Ford took a moment to vent on behalf of “16 million people” across the province.

“You go out last night and you’re sitting there for 20 minutes in the lineup to get gas. It’s unacceptable,” said Ford. “Everywhere I was going it was a $1.59. You wake up this morning and it’s $1.80. It’s absolutely disgusting.”

Prices at the pumps surged 14 cents overnight to 178.9 cents/litre at most GTA stations. Analysts attribute the increase to the annual changeover from winter gas to summer gas.

“That is why prices are going up so significantly all at once is essentially we’re seeing discounts on winter gasoline to get rid of it but now that we’ve made the jump, summer gasoline inventories are much lower and thus a much higher price,” Patrick De Haan, the head of petroleum analysis at Gas Buddy tells CityNews.

That explanation, Ford said, was simply a way for the gas companies to gouge people.

“It’s absolutely disgusting what the oil companies are doing,” said an agitated Ford as he questioned whether the gas companies are waiting for the tanks to drain at gas stations before filling them up with the new summer formulation. “Or are you using the old gas and charging the higher cost.”

“I have my opinion that it’s not physically possible to drain every single gas station to put the fresh stuff in. So either you’re putting the fresh stuff in last month or you’re gouging the people right now.”

Ford went on to say that after consulting with some friends in the United States, he found that gas prices were trending around $3.80 per gallon. “Folks, let’s do the math – it’s a $1.80 (a litre) that’s $7.20 (a US gallon).”

Mike Eppel, 680 News Radio Toronto Senior Business Editor, says it also comes down to a refining capacity issue in this country.

“So there’s lots of oil, that’s not the issue – oil supplies are high. It’s the refining capacity. We haven’t had a refinery built in eastern Canada since whenever – you can’t get a pipeline built. And anytime there is any disruption in the system, up goes the price for gas.”

Ford did not limit his anger on rising gas prices to just the oil companies, closing his rant by taking a shot at the federal government’s carbon tax, which took effect on April 1 and pushed gas prices up three cents a litre.

“This goes back to the federal government sticking their hands in the people’s pockets, they don’t care that we have some of the highest prices in North America on the carbon tax, they jack it up 17.5 per cent,” explained Ford. “And then of course the oil companies thought they’d hop on board, no one’s going to notice, because if I remember … just a few months ago I remember filling up for $1.30 to $1.34. Did the barrel of oil go up 30 per cent? The answer is no. So where is the 30 per cent.”

While the price of gas is expected to fall by four cents/litre on Friday, prices will continue to fluctuate with no real relief in sight until June or July.

Google has fired 28 employees after a number of staffers protested the company’s cloud contract with the Israeli government.

The workers were terminated after staging protests inside Google’s offices in New York and Sunnyvale, California, per CNN.

Article content

In a statement, Google’s parent company Alphabet said that “physically impeding other employees’ work and preventing them from accessing our facilities is a clear violation of our policies, and completely unacceptable behavior.”

Recommended from Editorial

The protests were organized by the No Tech For Apartheid campaign and protesters held signs that read “No More Genocide For Profit” and “We Stand with Palestinian, Arab and Muslim Googlers.”

The company said it would continue to investigate and take action as needed, reports The Guardian.

The protesters say that Project Nimbus, a $1.2 billion contract granted to Google and Amazon.com in 2021, provides cloud services to the Israeli government and aids in the creation of military applications.

A form letter on the campaign’s website demands that Amazon CEO Andy Jassy, Amazon Web Services CEO Adam Selipsky, Google CEO Sundar Pichai and Google Cloud CEO Thomas Kurian “end all ties with Israeli apartheid and cut the Project Nimbus contract.”

Article content

Google says the Nimbus contract “is not directed at highly sensitive, classified, or military workloads relevant to weapons or intelligence services.” It added that Google Cloud “supports numerous governments around the world, including the Israeli government.”

“We have been very clear that the Nimbus contract is for workloads running on our commercial cloud by Israeli government ministries, who agree to comply with our Terms of Service and Acceptable Use Policy.”

The No Tech for Apartheid campaign called the firings a “flagrant act of retaliation” and a “clear indication that Google values its $1.2 billion contract with the genocidal Israeli government and military more than its own workers.”

The campaign added that some of the individuals fired did not directly participate in the protests.

Despite what its critics allege, Israel has attempted to warn and shield civilians as the IDF hunts the Hamas terrorists who hid themselves among Gaza’s civilian population and infrastructure after the group’s October 7 attack. As well, critics who call Israel an apartheid state ignore the freedoms enjoyed by the democratic country’s Arab citizens, who play major roles in business, the judiciary and even the Knesset.

Our website is the place for the latest breaking news, exclusive scoops, longreads and provocative commentary. Please bookmark nationalpost.com and sign up for our newsletters here.

Share this article in your social network

Gas prices have not been this high since August 2022

There’s a price shocker coming at the pumps.

Advertisement 2

Article content

Gas in Ontario, including the GTA, will go up 14 cents a litre overnight for customers filling up on Thursday, says Dan McTeague, the president of Canadians for Affordable Energy.

Article content

“So going from $1.65.9 (per litre) going to $1.79.9,” said McTeague adding the increase will affect the entire province except for northwestern Ontario, which gets its prices from the prairies market.

“That’s the highest level since August, 2022, almost two years ago,” he added.

Recommended from Editorial

McTeague said the reason for the price hike is that stations are switching over to summer-blend gasoline.

“Around this time of year prices go up to reflect the new blend of gasoline, which is more expensive to make,” he explained. “Butane is used in the winter, for gasoline, whereas in the summer it’s alkyaltes. Alkyaltes are extremely expensive.”

Advertisement 3

Article content

“In the winter you want your ignition to start quickly in cold temperatures, you uses volatile butane. You take that out in the summer. That’s a big difference. This is going to be around for awhile and it could get higher,” McTeague said.

McTeague also blamed the rise in gas prices in Canada on the carbon tax increase, the rising price of oil, and the weak Canadian dollar.

“It just makes a bad situation worse,” he said. “It’s just another brick in the wall, another load on the camel’s bank. The cost of denying our resources, blocking pipelines, is one of the most significant reasons why the Canadian dollar is so weak.”

Article content

Cytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

Supervised consumption sites urgently needed, says study – Sudbury.com

Aaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

Trump faces political risks as trial begins – NBC News

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

Canada's 2024 budget announces 'halal mortgages'. Here's what to know – National Post

Comments