Economy

Economy in focus, Argentina's pandemic strategy shifts for second wave – The Journal Pioneer

By Agustin Geist

BUENOS AIRES (Reuters) – Argentina’s President Alberto Fernandez was clear when COVID-19 first hit the country early last year: saving lives at all costs trumped any economic concerns.

Now facing a second wave of infections, the South American nation has adjusted its strategy to prioritize protecting its fragile economy. It is hoping greater experience dealing with the coronavirus, a nascent vaccine program, and short, regional lockdowns can help keep the virus in check.

The second wave comes at a delicate time for the center-left Peronist government. It is heading for mid-term elections in October to defend its majority in Congress, its popularity bruised by a strict, lengthy lockdown last year and the hard economic hit.

The grains producer is also in talks with the International Monetary Fund to revamp some $45 billion in loans it cannot pay back and needs to fire up economic growth to bring in much needed hard currency. And creditors are looking for signs of recovery after a sovereign debt restructuring last year.

The Fernandez administration wants to avoid imposing a blanket lockdown, instead using data on caseloads to establish short-term localized restrictions, reinforce sanitary measures, and maintain controls over borders, a government source said.

The government also wants to accelerate a vaccine roll-out delayed by shortage of supply, aiming to have all medical workers and those at high risk vaccinated before the fast-approaching southern winter.

Argentina’s economy contracted around 10% last year, the third straight year of recession, and Economy Minister Martin Guzman has said it “could not withstand” another total shutdown. Poverty levels rose to 42% in the second half of last year.

The country has recorded around 2.4 million coronavirus cases and over 56,000 deaths, and a second wave is building with recent daily cases at 80% of the peak and rising, a Reuters tally of official data shows. On Tuesday, infections reached a daily record.

“The second wave and incidence of cases could be even worse when the variants take hold,” said Tomás Orduna, an infectious disease specialist who advises the government, referring to the P1 ‘Brazilian’ variant and others racing through the region.

‘WARNING LIGHTS’

Argentine infectious diseases expert Martin Hojman said the southern hemisphere winter and reopening of activities would keep driving the second wave.

He said the rate of vaccinations – which has seen some 4.3 million doses administered so far in a country with a population of around 45 million – was not fast enough.

Leda Guzzi, a Buenos Aires-based infectious disease expert, said there had been a very substantial jump in cases over the last month, and pointed to the ‘R number’, which measures transmission rates, soaring in some areas.

“When this index is greater than 1.2 it means that cases are accelerating in a worrying way and that the warning lights should come on… This is happening in various jurisdictions and various departments,” she said.

Despite that, schools and restaurants in most places are open, and many Argentines say they do not want another strict lockdown.

“I think there must be a middle ground where the economy does not collapse and stores do not close and so many people are left on the street and without work,” said Ambar Rujal, a 19-year-old student in Buenos Aires.

Jorge Giacobbe, a Buenos Aires-based political analyst, said the government would not want to risk upsetting voters so close to October’s legislative elections.

“There are going to be restrictions, but the government knows that it cannot make harsh restrictions again. People will not allow it after having suffered such a strict quarantine in 2020,” he said.

(Reporting by Agustin Geist; Additional reporting by Eliana Raszewski; Editing by Adam Jourdan and Rosalba O’Brien)

Economy

Limiting Global Warming to 1.5C Would Avoid Two-Thirds of Economic Toll – Bloomberg

Climate inaction will depress the world’s economy more than previously estimated, according to a new study that takes into account the impacts of weather extremes and variability such as temperature spikes and intense rainfall.

A scenario in which global temperatures rise 3C on average will reduce the world’s gross domestic product by about 10%, doctoral researcher Paul Waidelich of ETH Zurich and colleagues write, with less developed countries paying the worst toll. By comparison, limiting global warming by 2050 to 1.5C — as sought by the Paris Agreement — will reduce that impact by about two-thirds.

Economy

PM: Millennials and Gen Z drive Canadian economy – CTV News Montreal

[unable to retrieve full-text content]

- PM: Millennials and Gen Z drive Canadian economy CTV News Montreal

- Canada’s budget 2024 and what it means for the economy Financial Post

- Federal budget is about ensuring fair economy for ‘everyone’: Trudeau Global News

Economy

Climate Change Will Cost Global Economy $38 Trillion Every Year Within 25 Years, Scientists Warn – Forbes

Topline

Climate change is on track to cost the global economy $38 trillion a year in damages within the next 25 years, researchers warned on Wednesday, a baseline that underscores the mounting economic costs of climate change and continued inaction as nations bicker over who will pick up the tab.

Key Facts

Damages from climate change will set the global economy back an estimated $38 trillion a year by 2049, with a likely range of between $19 trillion and $59 trillion, warned a trio of researchers from Potsdam and Berlin in Germany in a peer reviewed study published in the journal Nature.

To obtain the figure, researchers analyzed data on how climate change impacted the economy in more than 1,600 regions around the world over the past 40 years, using this to build a model to project future damages compared to a baseline world economy where there are no damages from human-driven climate change.

The model primarily considers the climate damages stemming from changes in temperature and rainfall, the researchers said, with first author Maximilian Kotz, a researcher at the Potsdam Institute for Climate Impact Research, noting these can impact numerous areas relevant to economic growth like “agricultural yields, labor productivity or infrastructure.”

Importantly, as the model only factored in data from previous emissions, these costs can be considered something of a floor and the researchers noted the world economy is already “committed to an income reduction of 19% within the next 26 years,” regardless of what society now does to address the climate crisis.

Global costs are likely to rise even further once other costly extremes like weather disasters, storms and wildfires that are exacerbated by climate change are considered, Kotz said.

The researchers said their findings underscore the need for swift and drastic action to mitigate climate change and avoid even higher costs in the future, stressing that a failure to adapt could lead to average global economic losses as high as 60% by 2100.

!function(n) if(!window.cnxps) window.cnxps=,window.cnxps.cmd=[]; var t=n.createElement(‘iframe’); t.display=’none’,t.onload=function() var n=t.contentWindow.document,c=n.createElement(‘script’); c.src=’//cd.connatix.com/connatix.playspace.js’,c.setAttribute(‘defer’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c) ,n.head.appendChild(t) (document);

(function()

function createUniqueId()

return ‘xxxxxxxx-xxxx-4xxx-yxxx-xxxxxxxxxxxx’.replace(/[xy]/g, function(c) 0,

v = c == ‘x’ ? r : (r & 0x3 );

const randId = createUniqueId();

document.getElementsByClassName(‘fbs-cnx’)[0].setAttribute(‘id’, randId);

document.getElementById(randId).removeAttribute(‘class’);

(new Image()).src = ‘https://capi.connatix.com/tr/si?token=546f0bce-b219-41ac-b691-07d0ec3e3fe1’;

cnxps.cmd.push(function ()

cnxps(

playerId: ‘546f0bce-b219-41ac-b691-07d0ec3e3fe1’,

storyId: ”

).render(randId);

);

)();

How Do The Costs Of Inaction Compare To Taking Action?

Cost is a major sticking point when it comes to concrete action on climate change and money has become a key lever in making climate a “culture war” issue. The costs and logistics involved in transitioning towards a greener, more sustainable economy and moving to net zero are immense and there are significant vested interests such as the fossil fuel industry, which is keen to retain as much of the profitable status quo for as long as possible. The researchers acknowledged the sizable costs of adapting to climate change but said inaction comes with a cost as well. The damages estimated already dwarf the costs associated with the money needed to keep climate change in line with the limits set out in the 2015 Paris Climate Agreement, the researchers said, referencing the globally agreed upon goalpost set to minimize damage and slash emissions. The $38 trillion estimate for damages is already six times the $6 trillion thought needed to meet that threshold, the researchers said.

Crucial Quote

“We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer,” said study author Anders Levermann. The researcher, also of the Potsdam Institute, explained there is a “considerable inequity of climate impacts” around the world and that “further temperature increases will therefore be most harmful” in tropical countries. “The countries least responsible for climate change” are expected to suffer greater losses, Levermann added, and they are “also the ones with the least resources to adapt to its impacts.”

What To Watch For

The fundamental inequality over who is impacted most by climate change and who has benefited most from the polluting practices responsible for the climate crisis—who also have more resources to mitigate future damages—has become one of the most difficult political sticking points when it comes to negotiating global action to reduce emissions. Less affluent countries bearing the brunt of climate change argue wealthy nations like the U.S. and Western Europe have already reaped the benefits from fossil fuels and should pay more to cover the losses and damages poorer countries face, as well as to help them with the costs of adapting to greener sources of energy. Other countries, notably big polluters India and China, stymie negotiations by arguing they should have longer to wean themselves off of fossil fuels as their emissions actually pale in comparison to those of more developed countries when considered in historical context and on a per capita basis. Climate financing is expected to be key to upcoming negotiations at the United Nations’s next climate summit in November. The COP29 summit will be held in Baku, the capital city of oil-rich Azerbaijan.

Further Reading

-

News21 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Investment20 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

Business20 hours ago

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

-

Art21 hours ago

Squatters at Gordon Ramsay's Pub Have 'Left the Building' After Turning It Into an Art Café – PEOPLE

-

Tech14 hours ago

Tech14 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Politics20 hours ago

Politics20 hours agoThe Earthquake Shaking BC Politics

-

Sports24 hours ago

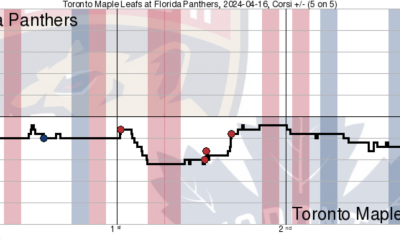

Sports24 hours agoGame in 10: Maple Leafs squander multi-goal lead to Florida, draw the Boston Bruins in the first round – Maple Leafs Hot Stove

-

Investment19 hours ago

Investment19 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth