David Rogers

Investment

EU makes first investment in hyperloop – GCR

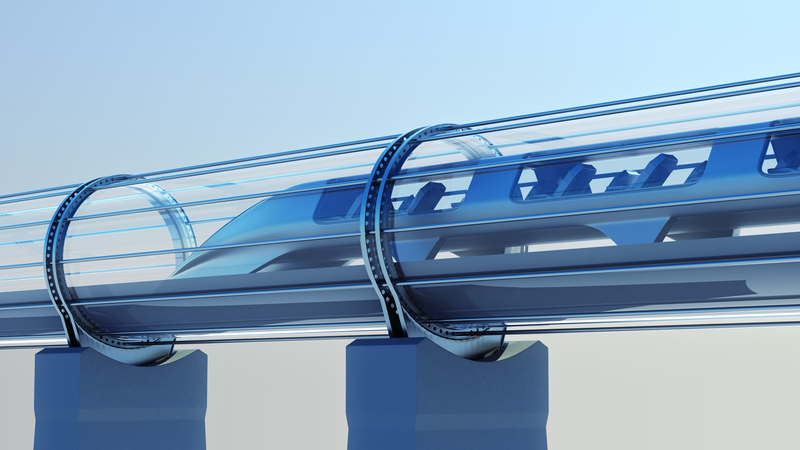

Dutch engineering spin-off Hardt Hyperloop has been awarded €15m by the European Commission, the first time that the EU has directly funded the development of the ultra-fast transport concept.

The grant was disbursed by the European Innovation Council Accelerator to help the Dutch engineer and its partners continue research and development.

Tim Houter, co-founder of Hardt, said in a press statement that the decision was a vote of confidence in his company and the technology.

“It’s great to have now gained the trust of the European Commission. Their support will help to accelerate the development of a European hyperloop network, bringing us much closer to significant carbon dioxide savings. European cities will be connected smarter, faster and cheaper.”

The funding will also progress the European Hyperloop Centre in Groningen, set to demonstrate lane-switching for a high-speed hyperloop system in 2023.

A pilot project to move freight between Amsterdam and Rotterdam is being investigated by companies, governments and network organisations. Houter said he hoped the route could be developed in the Netherlands within this decade.

The EU is particularly interested in hyperloop because of its fit with the European Green Deal, and the commission’s strategy for sustainable and smart mobility. According to Houter, a European-wide network could save 160 million tonnes of carbon on an annual basis, which would be “more than the entire emissions of the Netherlands”.

Hyperloop pods move autonomously through low-pressure tubes, propelled by fluctuating magnetic fields supplied by the “track” they float over.

Hardt Hyperloop was founded in 2016 by engineers at Delft Technical University. It was involved in building Europe’s first high-speed test facility, and has developed a lane-switching technology that is reckoned to be essential to the development of networks.

Its partners include Schiphol Airport, Nederlandse Spoorwegen, Deutsche Bahn, Koolen Industries, InnoEnergy, Freigeist, Bam, Tata Steel and IHC.

Further reading:

Continue Reading

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite little changed in late-morning trading, U.S. stock markets down

TORONTO – Canada’s main stock index was little changed in late-morning trading as the financial sector fell, but energy and base metal stocks moved higher.

The S&P/TSX composite index was up 0.05 of a point at 24,224.95.

In New York, the Dow Jones industrial average was down 94.31 points at 42,417.69. The S&P 500 index was down 10.91 points at 5,781.13, while the Nasdaq composite was down 29.59 points at 18,262.03.

The Canadian dollar traded for 72.71 cents US compared with 73.05 cents US on Wednesday.

The November crude oil contract was up US$1.69 at US$74.93 per barrel and the November natural gas contract was up a penny at US$2.67 per mmBTU.

The December gold contract was up US$14.70 at US$2,640.70 an ounce and the December copper contract was up two cents at US$4.42 a pound.

This report by The Canadian Press was first published Oct. 10, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

News22 hours ago

Tobacco giants would pay out $32.5B to provinces, smokers in ‘historic’ proposed deal

-

News22 hours ago

Here are the key numbers in the deal proposed by three tobacco giants

-

News22 hours ago

RCMP say girl’s death in Alberta lake could be criminal

-

News12 hours ago

Canadanewsmedia news October 18, 2024: Testy B.C. election campaign reaches final day

-

Health22 hours ago

Scientists show how sperm and egg come together like a key in a lock

-

News12 hours ago

Advocates urge Ontario to change funding for breast prostheses, ostomy supplies

-

News12 hours ago

US to probe Tesla’s ‘Full Self-Driving’ system after pedestrian killed in low visibility conditions

-

News22 hours ago

Elon Musk holds his first solo event in support of Trump in the Philadelphia suburbs