Economy

Even Europe’s Economic Engine Is Starting 2021 Hooked on Aid

|

|

On Tuesday, Merkel privately warned that another 10 weeks of lockdown might be necessary to curb the new variant of the coronavirus currently driving higher infection numbers.

Germany’s economy is limping into 2021 heavily bruised by the pandemic, deeply reliant on government aid — and in better shape than most of the euro zone.

The nation will probably say on Thursday that gross domestic product contracted less than 6% last year, and may signal that it actually grew in the final quarter. In contrast, economists estimate full-year declines of around 9% for France and Italy and more than 11% for Spain.

While the first quarter of this year has started poorly, with lockdowns extended and the euro zone as a whole headed into a double-dip recession, Germany’s Bundesbank is staying optimistic that a steady recovery will kick in as vaccinations rise.

How Europe’s largest economy has pulled through so far is reflected in companies like Munich-based Dr. Sasse AG, which employs almost 7,000 workers offering facilities and cleaning services in four countries. Despite taking as much as a 10% hit to sales last year and putting swathes of its workforce on shorter hours, its founder says they’ve survived “with a black eye.”

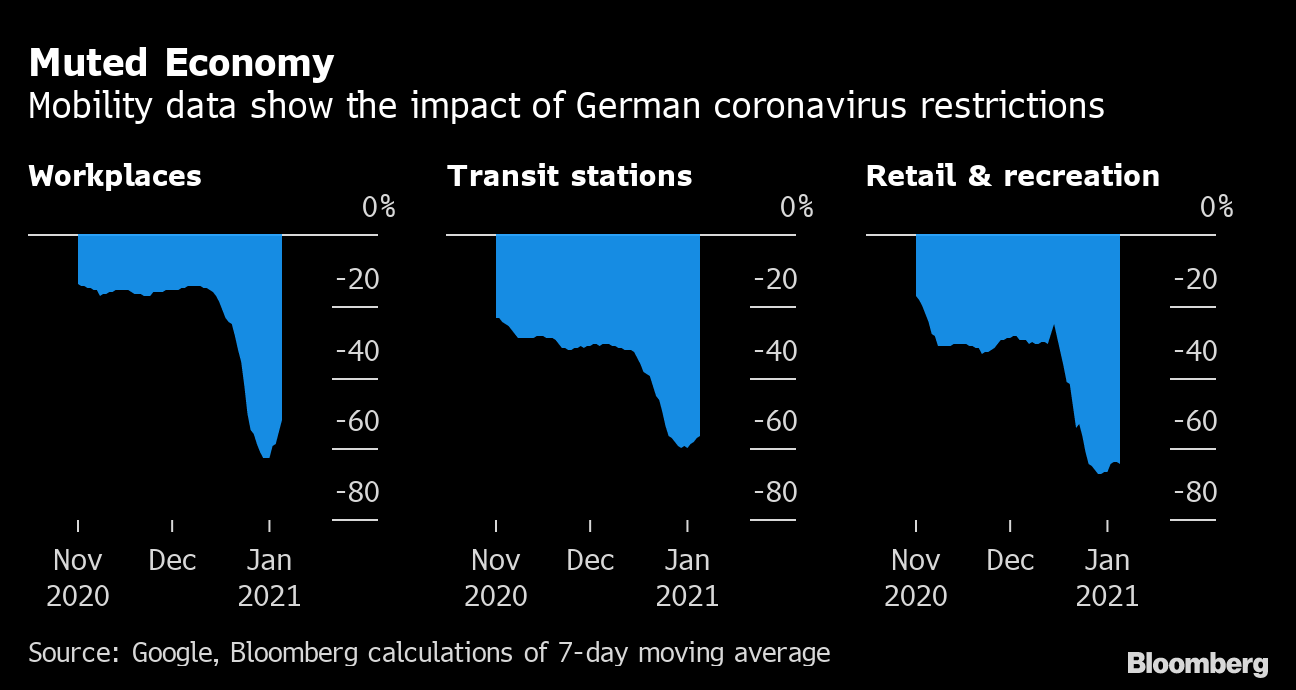

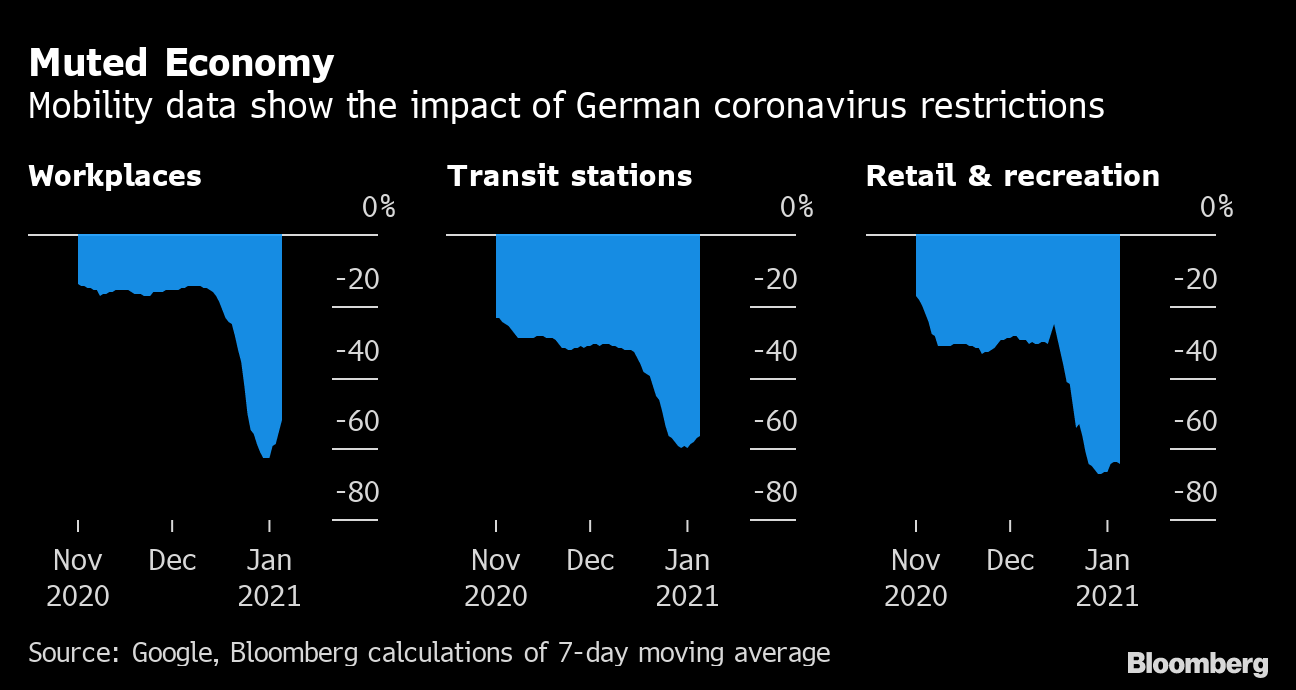

Muted Economy

Mobility data show the impact of German coronavirus restrictions

Source: Google, Bloomberg calculations of 7-day moving average

.chart-js display: none;

“The next few years are going to be very demanding as well,” Eberhard Sasse, who is also president of the Association of Bavarian Chambers of Industry and Commerce, said in an interview. “2021 won’t be a year of crisis, but one where we’re going to have to drive change very actively.”

When Chancellor Angela Merkel pledged last March to do “whatever Germany needs” to get through the coronavirus pandemic, Sasse recorded a video message — with his wife and two daughters — telling employees of the family-owned firm he would mobilize all financial resources available to ensure survival.

Sasse said businesses in his region are hopeful that manufacturing will help the economy pick up.

Photographer: Gisela Schober/Getty Images

What that meant was massive reliance on government support to pay wages, and a refocusing of operations to pull in revenue wherever possible.

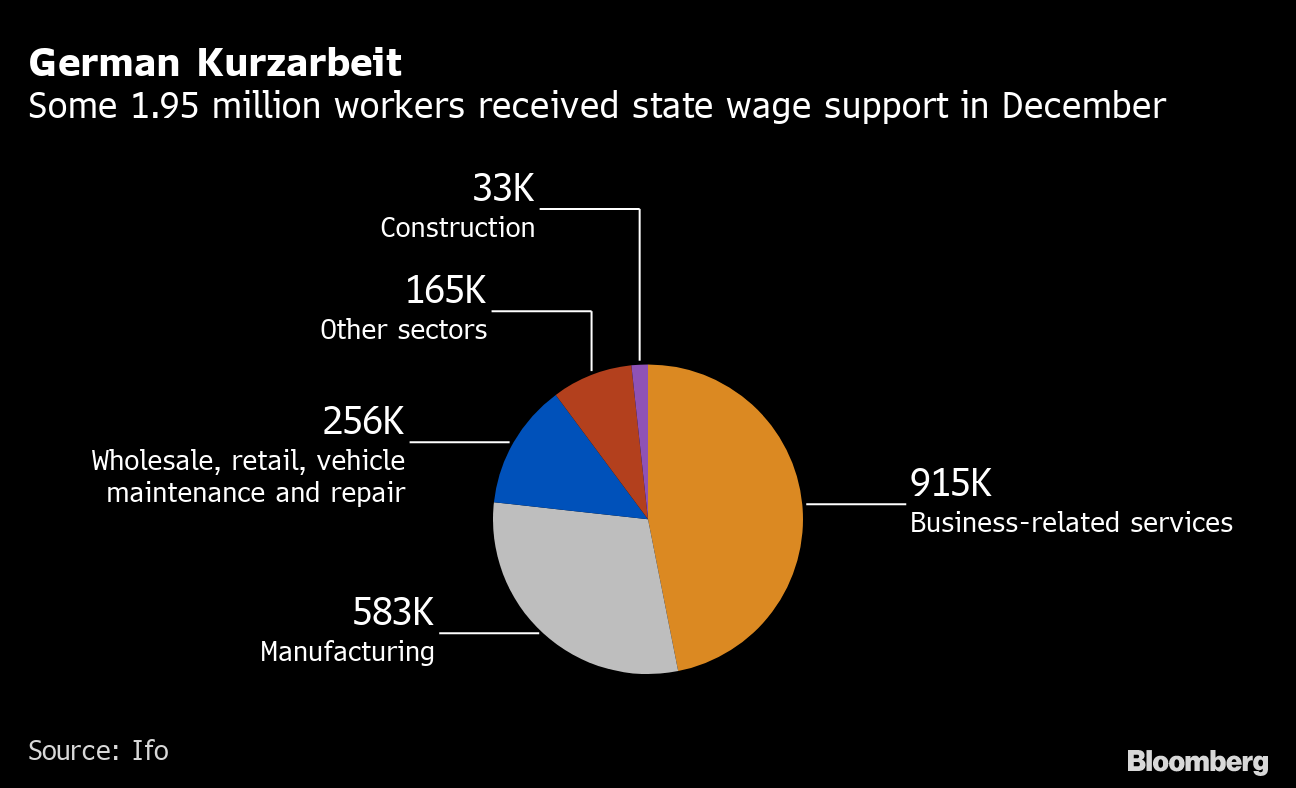

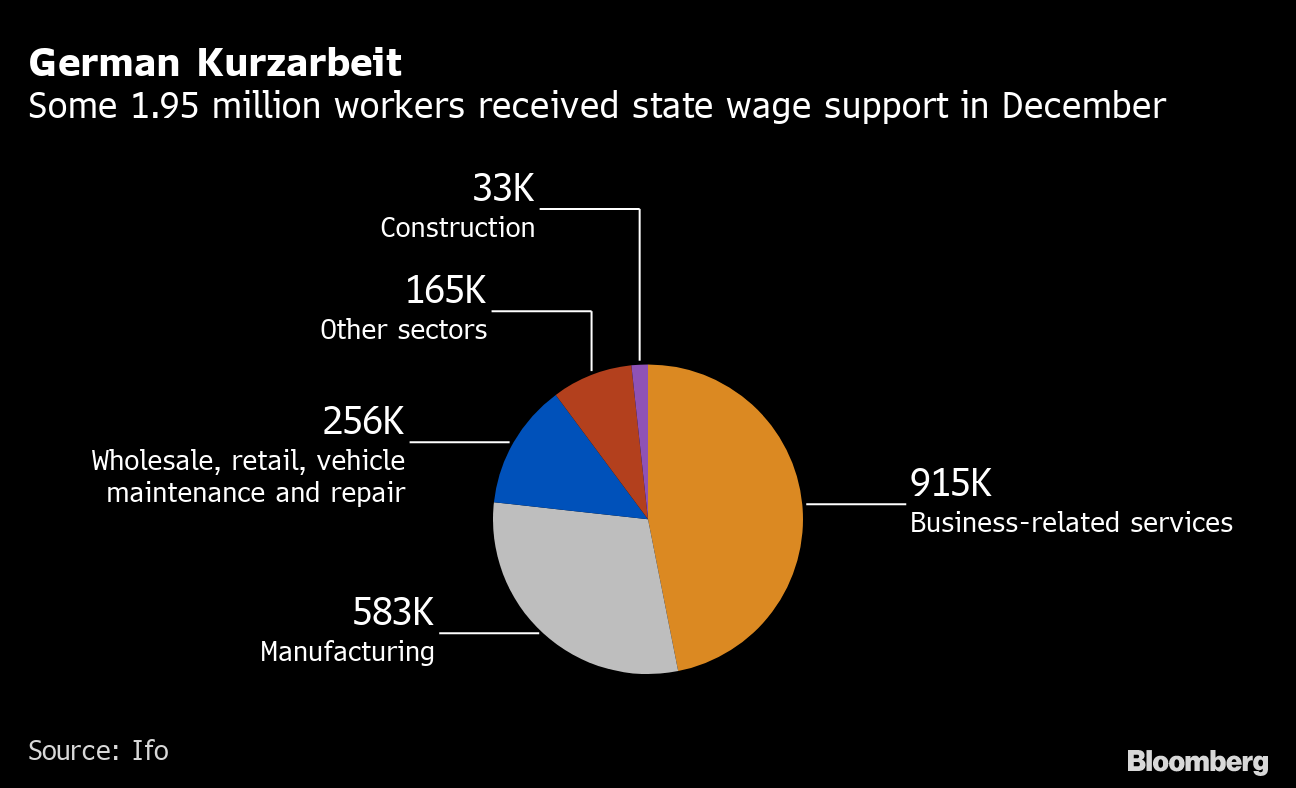

That’s helped by one of the region’s most generous fiscal packages, described by Finance Minister Olaf Scholz as having “oomph.” The “kurzarbeit” program spent 22.1 billion euros ($27 billion) last year subsidizing payroll for companies working at reduced levels.

Such support will have to continue. Restaurants, hotels and non-essential shops will remain closed until at least the end of January, and people in virus hot spots are confined to a 15-kilometer (9-mile) radius around their homes.

On Tuesday, Merkel privately warned that another 10 weeks of lockdown might be necessary to curb the new variant of the coronavirus currently driving higher infection numbers.

But Germany’s manufacturing sector, which makes up about a fifth of the economy and has boosted output when services turned into a major drag, has played a significant part in cushioning the blow. It’ll also help drive the recovery when global demand rebounds.

Surveys by IHS Markit have shown “historically high” optimism for factory output in the current year. Bundesbank President Jens Weidmann says there’s no reason yet to give up on projections that the economy will expand 3% this year, and most recent private-sector forecasts foresee an even stronger rebound.

Sasse saw sharp divergences between his divisions. With flights grounded because of the pandemic and traffic recovering only very slowly, the unit that services airports including Frankfurt, Munich and Edinburgh has suffered badly.

Dr. Sasse AG’s aviation unit that services 11 commercial airports in Germany and the U.K. has been suffering badly.

Photographer: Alex Tino Friedel/Dr. Sasse AG

At the height of the crisis, about half of the nearly 900 employees that are usually busy staffing departure gates or supporting security clearance were on shorter hours. Most but not all of the damage was absorbed by the kurzarbeit program.

The company also ran down overtime accounts, asked workers to take vacation during the worst periods of lockdown and reassigned staff to other parts of the business.

German Kurzarbeit

Some 1.95 million workers received state wage support in December

Source: Ifo

.chart-js display: none;

That meant throwing all the effort once more behind the cleaning business that he started in 1976. Retirement homes, hospitals, schools, offices, buses and trains all suddenly needed new hygiene protocols and frequent disinfecting.

The fear that the expected rebound in 2021 will disappoint still suffuses parts of Germany. Some economists have warned that 2021 could turn into a “year of disillusionment.”

“People have realized that the economic crisis won’t be overcome any time soon because of the ongoing second wave of infections,” German Institute for Economic Research President Marcel Fratzscher wrote in a Jan. 4 blog post. A “vicious cycle” of company failures, higher unemployment and weak demand “could materialize much more easily than many realize.”

Two thirds of German inner-city retailers see a risk of failure, according to a survey by industry association HDE, and three out of four said government aid isn’t sufficient to avoid bankruptcy. While the sector lost 36 billion euros in sales last year, only 90 million euros in direct aid were paid out, it said.

The risk is that such weaknesses, coupled with higher unemployment, will start spilling into manufacturing, diminishing the sector’s ability to power the rest of the economy.

Sasse said businesses in his region are hopeful that manufacturing will help the economy pick up. For his own company, he’d be happy as long as sales remain steady, allowing him to continue with digitalization projects to make the business future-proof.

“The coronavirus pandemic will be very much a catalyst for change,” he said. “Much like the rest of the German economy, we can’t simply sit and wait for the crisis to be over.”

— With assistance by Iain Rogers, and Zoe Schneeweiss

Source: – Bloomberg

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media13 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media15 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment14 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Sports18 hours ago

Sports18 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com

-

Investment23 hours ago

Investment23 hours agoWant to Outperform 88% of Professional Fund Managers? Buy This 1 Investment and Hold It Forever. – The Motley Fool

-

Business14 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Real eState6 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

Health23 hours ago

Health23 hours agoToronto reports 2 more measles cases. Use our tool to check the spread in Canada – Toronto Star