Business

'Family farms will be lost': Hog farmers fear bankruptcies, pork shortage as meat-packing plants close – Financial Post

Bottlenecks at pork slaughterhouses due to COVID-19 are creating a cash crisis for farmers, raising fears of bankruptcies at the farm level and threatening the flow of Canadian meat to grocery store coolers.

A cluster of coronavirus outbreaks has bedevilled meat-packing plants in recent weeks, forcing the temporary shutdown of some facilities and the imposition of strict social distancing and safety measures in others.

Olymel, the country’s largest pork processor, was forced to close a plant in Yamamiche, Que., for 14 days after nine employees tested positive for the virus. The company reopened that plant last week and has introduced new safety protocols at three of its six slaughterhouses.

While the measures are necessary to keep employees safe and prevent a total shutdown of facilities, they are also dramatically reducing the number of animals moving through the plants, creating a backlog on farms that is costing farmers between $30 and $50 per animal — or roughly half their value, according to the Canadian Pork Council. Most of the country’s 13 pork processing plants are now operating at reduced capacity as infection control measures are carried out.

The organization is seeking aid from the federal government to keep farmers afloat.

“We are asking the government for an emergency payment of $20 per hog so that pork producers can continue to pay bills, feed pigs and keep producing food for Canadian families,” said Rick Bergmann, chair of the council. “Without it, family farms will be lost. In turn we will continue to see disruption in the food supply chain, and increased food insecurity as supplies tighten and food becomes even more expensive.”

Olymel is the country’s largest pork processor.

The federal government is working with the provinces to support farmers and ensure availability of meat products, according to Marie-Claude Bibeau, the federal Minister of Agriculture and Agri-Food.

“We understand the repercussions the short-term capacity reduction in certain meat processing facilities is having on livestock producers,” the minister said in an emailed statement.

Canada exports about 70 per cent of its pork production annually and relies on imports for some domestic needs. The country could expand its imports to backfill domestic production, although other countries are at risk of running into the same problems in their slaughterhouses, said Gary Stordy, director of government and corporate affairs at the Canadian Pork Council.

“We have to remember also, that countries around the world are putting export restrictions on food,” he said.

The volume of hogs slaughtered in Canada fell by 16.2 per cent for the week ending April 14, as Canadian farmers struggled with a combination of depressed market prices, rising feed costs and lower returns on oversized hogs.

Indeed, as processing plants take fewer animals, farmers are being forced to pay more to continue to feed them. The hogs in turn are getting larger — a problem for farmers who are paid less for animals that have grown beyond an agreed-upon size.

Most of Canada’s 13 pork processing plants are now operating at reduced capacity as infection control measures are carried out.

“There is a weight and size producers are expected to deliver and they get penalized if they aren’t within those specifications,” Stordy said.

At the same time, a swath of meat processing plants have also been forced to close south of the border due to COVID-19 outbreaks, exacerbating an already significant oversupply of American hogs. That’s driven down market prices to roughly US$45 per hog from a more typical US$55 a hog for this time of year, said Ken Ball, a senior commodity futures adviser at PI Financial. Canadian hog prices are tied by formula to U.S. prices.

“The system was taxed even before this and now even the plants that are open are slowing down,” Ball said. “Eventually market hogs will build up and swamp the market.”

Hog prices typically rally to US$80 or more between May and July, he added.

“The concern now is that seasonal rally just won’t happen this year,” he said. “And without that rally, farmers are going to be hurt even more.”

Olymel now has three of six plants operating at full capacity, said Richard Vigneault, spokesperson for the firm. The Yamamiche facility, which usually processes 28,000 hogs each week, moved 4,000 as it reopened last week and is expected to hit 17,000 this week, he said.

“We have implemented a lot of measures to reduce to zero if possible the risk of contamination,” he said. “We are all trying to adapt and adjust and cope with this situation as best we can.”

Financial Post

Business

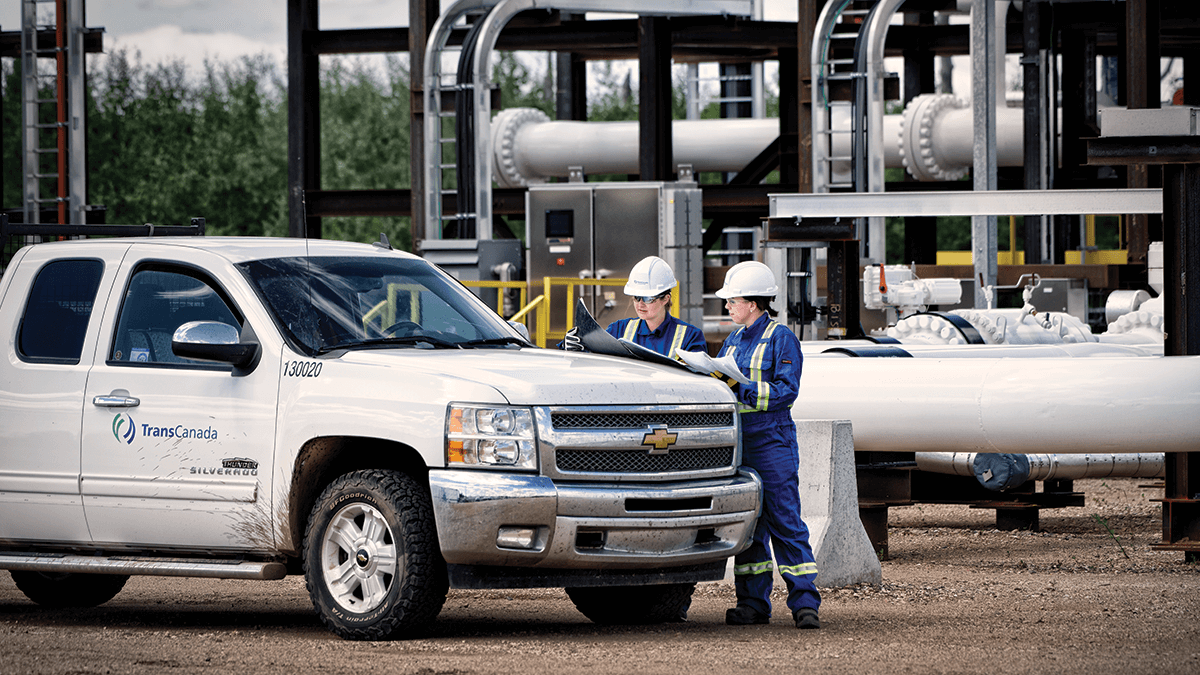

TC Energy responds to incident in Yellowhead County – TC Energy

Update #1

Media statement – April 16, 2024, 1:30 p.m. MDT

We can confirm that we are actively responding to an incident involving the NGTL natural gas system approximately 40 kilometres northwest of Edson, Alta in Yellowhead County.

TC Energy received notification about this incident at approximately 11 a.m. MT and immediately activated our emergency response procedures. We are coordinating with emergency first responders. The affected section of the pipeline has been isolated and shut down. There are no reported injuries. Our primary focus right now is the health and safety of responding personnel, surrounding communities and mitigating risk to the environment.

We are making all appropriate notifications to regulators, customers, stakeholders and Indigenous communities.

We will provide more information as soon as it becomes available.

Further inquiries can be sent to TC Energy media relations at media@tcenergy.com

Business

Traders Place Bets On $250 Oil – OilPrice.com

Oil traders were making big bets amid geopolitical uncertainties, Bloomberg data shows, as 3 million barrels worth of options contracts snapped up by speculators.

While the move is largely seen as a Hail Mary, about 3,000 lots of June $250 call options in US crude oil traded for just 1 cent each on Tuesday—trades that Bloomberg likened to a lottery ticket due to the unlikely event that it would actually pay out. But certainly one that would pay out handsomely, if it paid out at all.

The trades, according to Bloomberg, were apparently paired with $25 put options.

Bullish oil options have risen to record levels, with the premiums for calls over puts hitting the highest levels since October as geopolitical tensions between Israel and Iran continue to run hot.

The Brent crude oil benchmark is currently trading near $90 per barrel, with WTI trading above $85. The last time Brent traded near $90 per barrel was last October.

Oil prices are trading down on the day on Tuesday, however, after the Federal Reserve Vice Chair Phillip Jefferson said that the U.S. central bank was prepared to keep its tight monetary policy should inflation not slow as much as anticipated. The economic development was not enough to send oil prices down significantly but was enough to offset what could have been a spike after the Biden Administration said it would slap Iran with additional sanctions for its attack on Israel, with geopolitical tensions continuing to add an element of supply fear into the oil markets.

The oil markets now await Israel’s response to Iran’s attack to decide how much risk premium for crude oil there will be.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Business

After 5 years, Budget 2024 lays out promised small business carbon rebate – Global News

The federal government plans to “urgently return” money collected through the carbon price’s fuel charge to small businesses, making good on a commitment from 2019 to return that money.

Billed as the Canada Carbon Rebate for Small Businesses, the plan involves more than $2.5 billion that has been collected through the federal fuel charge in provinces where Ottawa’s carbon price applies over the last five years.

This includes Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

While the plan is described in its name as a “rebate,” the wording in the federal budget describes it as a “refundable tax credit” that will be directly returned to eligible businesses through direct payments from the Canada Revenue Agency, “separately from CRA tax refunds.”

An estimated 600,000 businesses with 499 or fewer employees will be eligible.

Given the cost of living focus in Budget 2024, TD Bank senior economist Francis Fong says he has his doubts about whether this extra money flowing back to small businesses will result in significantly lower prices.

“I think it’s going to be difficult to separate the impact of higher carbon taxes as they rise year after year after year with this kind of broader cost of living affordability crisis that we’re currently facing,” Fong told Global News.

“So will this go a long way in helping to address affordability challenges? I suspect the answer is no, but it’ll go some way in mitigating that.”

As outlined in the budget document, to receive the refund businesses will have to file their 2023-24 taxes by July 15, 2024.

The Canadian Federation of Independent Business has long called for the money collected in the fuel charge to be given back to small businesses.

However, the CFIB has previously called on the government to reverse the rate of the fuel charge set aside for businesses from nine per cent to five per cent. This follows a commitment to double the rural rebate top-up, which still needs to be passed by the House of Commons.

This refund structure is already built into the federal carbon pricing legislation. The overwhelming majority of refunds from the money collected through carbon pricing, roughly 90 per cent, goes to households, with the updated structure for the new rebate laying out that five per cent will go to small and medium-sized businesses, and the remainder will be returned to Indigenous communities.

Environment and Climate Change Canada is still working with Indigenous communities on how best to manage the return of those portions of the fuel charge proceeds.

The inclusion of the small business rebate in the federal budget follows a heated political debate on the most recent carbon price increase from $65 per tonne to $80 per tonne. The opposition Conservatives and seven premiers all called for the increase to be at least paused citing cost of living concerns.

In response, Prime Minister Justin Trudeau referenced a March 2023 Parliamentary Budget Officer report saying eight out of 10 Canadians receive more than they pay through the recently renamed Canada Carbon Rebate, which is the portion that goes to households.

As part of the budget, a new amendment is being proposed to require banks to follow government naming conventions on direct deposits like the Canada Carbon Rebate. That would mean banks need to show the deposits arriving into consumers’ bank accounts under that name.

What about other tax credits?

As part of the suite of climate change-related measures in the budget, the government plans to implement the previously announced Clean Electricity Tax Credit, to the tune of $7.2 billion over the first five years of the program.

Between 2029-30 and 2034-35, the government intends to increase the value of the tax credit to $25 billion.

The government’s goal is for Canada to have a net-zero electricity gird by 2035.

In an effort to spur investment in low emission electricity, this document sets out to establish a 15 per cent tax credit for private companies to build new or expand generation in wind, solar, hydroelectric, geothermal, waste biomass and nuclear power.

The tax credit is also open to natural gas, as long as the project incorporates carbon capture and storage.

Some provinces, like Saskatchewan, have Crown corporations that provide electricity generations. As outlined in the budget, these provinces are eligible to apply for the tax credit as long as they publicly commit to achieving net-zero electricity by 2035 and pass any savings on to ratepayers by lowering electricity bills. The deadline for this is March 31, 2025.

This could add to the political fight on climate policy between Ottawa and Saskatchewan, as that province’s stated goal on achieving net-zero electricity is 2050, 15 years after the federal target.

What’s new with home heating affordability plans?

Home heating is another central driver of fuel charge revenue, with $903.5 million targeted at trying to reduce costs but the bulk of this funding will not be in place until the next fiscal year.

The government plans on establishing an $800-million program to provide direct funding for low-to-middle income households on the installation of energy-efficient retrofits on their heating systems. This fund is set to rollout over five years, starting in 2025-26.

An additional $73.5 million is set aside to modernize various energy efficiency programs for apartment building owners, and $30 million to develop a standardized approach to home energy labelling to help home buyers better understand how efficient a property is.

Home heating became a key driver in the renewed opposition to the federal carbon price, when Trudeau announced a three-year pause on the carbon price for home heating oil. The pause applies nationally, but critics argue it disproportionately benefits Atlantic Canada.

This led to Saskatchewan ending its collection and remittance of the carbon price on home heating, which Statistics Canada said reduced inflation in that province.

To go along with the heating oil pause, Trudeau also pledged to work with the provinces to help buy heat pumps for lower income households that use heating oil, as a means of reducing the emission intensity and fuel charge after the pause concludes.

More on Money

-

Sports12 hours ago

Sports12 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState20 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech19 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Science23 hours ago

Science23 hours agoSpace exploration: A luxury or a necessity? – Phys.org

-

Politics17 hours ago

Politics17 hours agoPolitical interference in Canada’s pension funds is wrong

-

Sports23 hours ago

Sports23 hours agoRECAP: Red Wings' 5-4 comeback OT victory against Canadiens the result of belief, resiliency | Detroit Red Wings – NHL.com

-

News21 hours ago

Former mayor appealing sexual assault conviction dies of cancer

-

Business11 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca