Economy

Fate of global economy rests more than ever on finding a vaccine – BNNBloomberg.ca

As sections of the global economy tip-toe toward reopening, it’s becoming clearer that a full recovery from the worst slump since the 1930s will be impossible until a vaccine or treatment is found for the deadly coronavirus.

Consumers will stay on edge and companies will be held back as temperature checks and distancing rules are set to remain in workplaces, restaurants, schools, airports, sports stadiums and more.

China — the first major economy consumed by the virus and the first to emerge on the other side — has been able to revive production but not demand. The lesson for other economies: it’ll be a stop-start path back toward normal.

There’s also the risk of new flare ups. Some 108 million people in China’s northeast region have been put back under varying degrees of lockdown amid a new cluster of infections. Doctors there are also seeing the coronavirus manifest differently, suggesting that it may be changing in unknown ways.

In South Korea – where the virus was controlled without a hard lockdown — consumer spending remains weak as infections continue to pop up.

Sweden’s highly contested response left much of the economy open, yet the country is still headed for its worst recession since World War II.

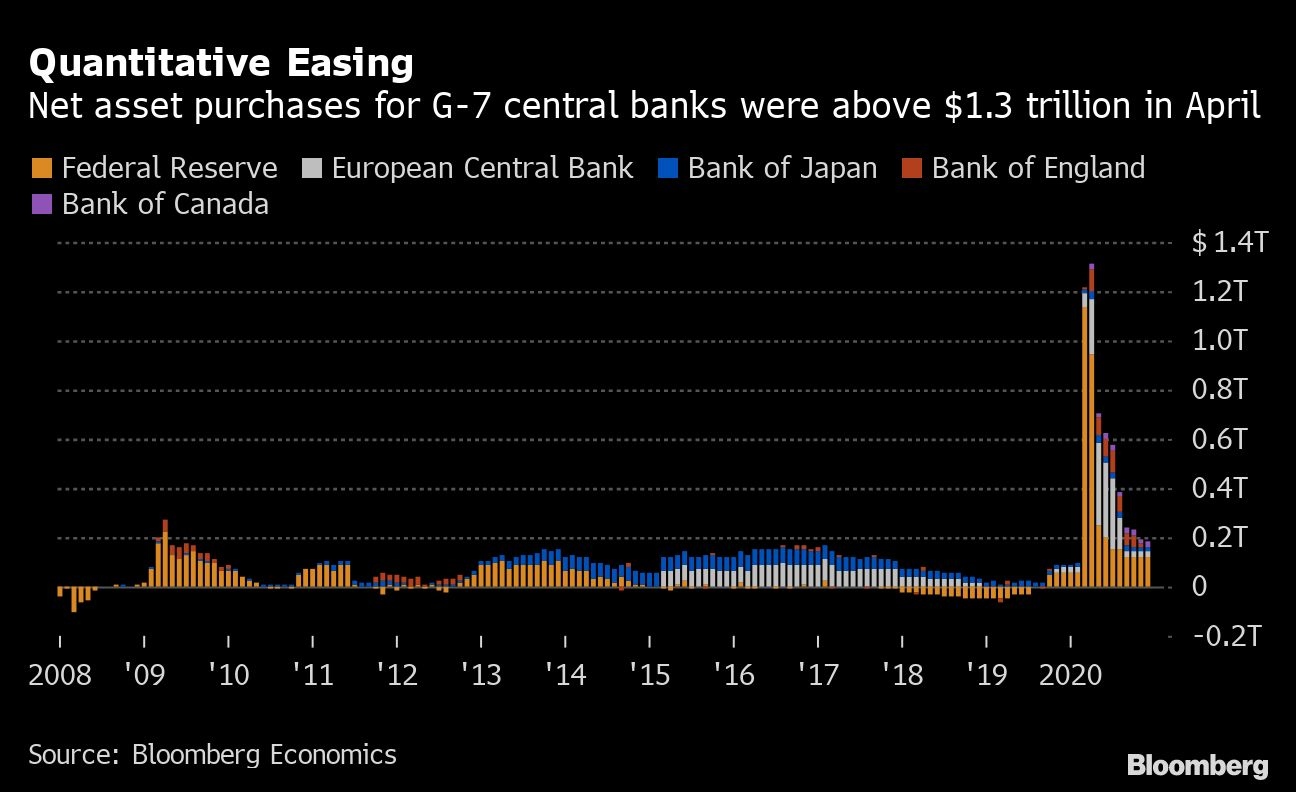

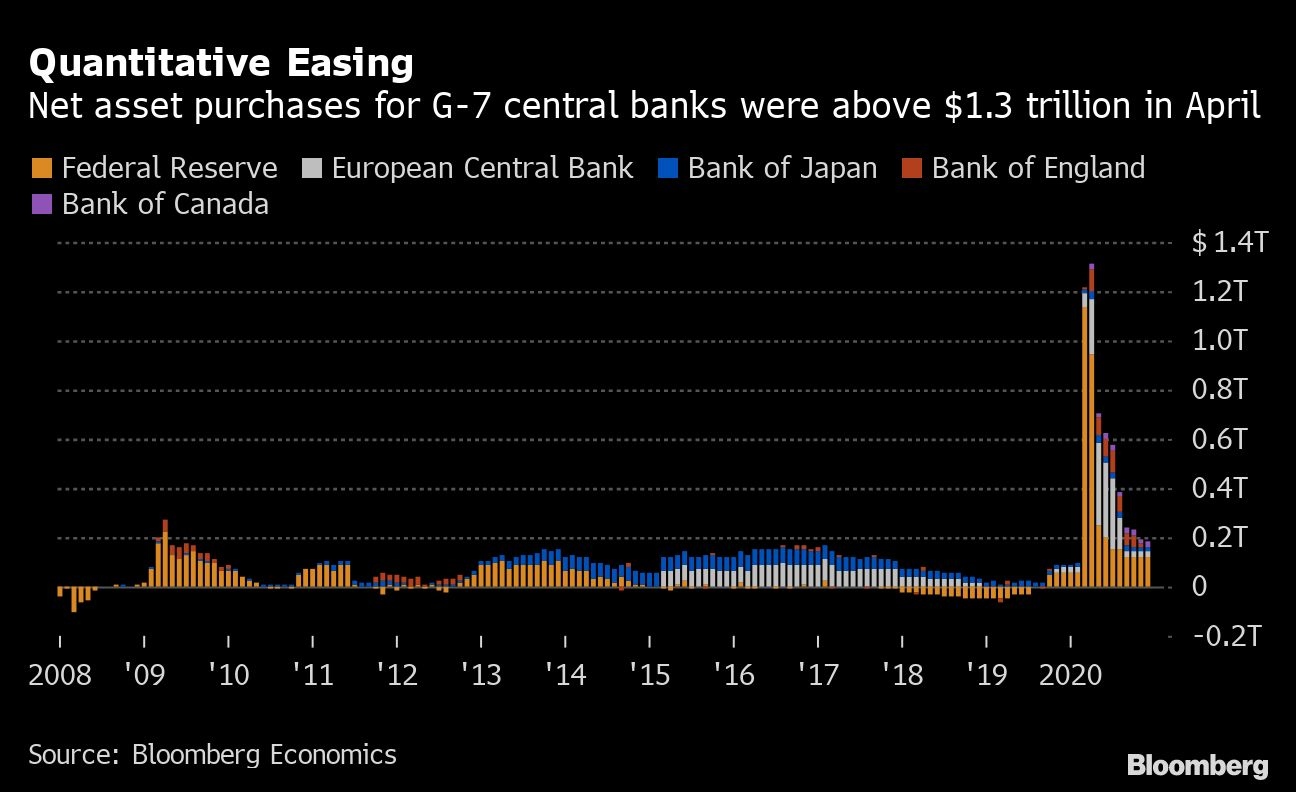

That means global policy makers — who have already announced trillions of dollars of fiscal and monetary support — will need to keep the stimulus flowing to avoid yet more company failures and job losses. Federal Reserve Chairman Jerome Powell has warned that a full recovery will need to wait until the scientists deliver, a warning echoed by his Australian counterpart.

“If we don’t get breakthroughs on the medical front, then I think it’s going to be quite a slow recovery,” Australia’s central bank chief, Philip Lowe, said this week. “We’ve got a lot resting on the shoulders of the scientists here.”

Harvard University professor Carmen Reinhart, who is the incoming chief economist of the World Bank, had a similar message. “We’re not going to have something akin to full normalization unless we (a) have a vaccine and (b) — and this is a big if — that vaccine is accessible to the global population at large,” she told the Harvard Gazette.

With global infections topping five million and a death toll of over 330,000, there’s an air of desperation for good news on either a vaccine or effective anti-viral.

Shares in Cambridge, Massachusetts-based Moderna Inc. hit a record on Monday on early data from a small trial of the company’s coronavirus vaccine. It gave up some of those gains in later days as investors weighed the early nature of the vaccine data.

A survey of money managers by Bank of America Corp. found the biggest tail risk is a second wave of the virus that means restrictions will have to be imposed again. Only 10% expect a rapid rebound, the bank said in a note titled “V is for Vaccine”.

The race for a cure has a geopolitical edge too. U.S. President Donald Trump has vowed a Manhattan Project-style effort dubbed “Operation Warp Speed” to develop a cure, while China’s President Xi Jinping has pledged to make one universally available once it’s developed.

The fusion of when successful drugs can be found and when economies can get back to normal is dominating sentiment in financial markets.

“There is a global bounty on the virus,” said Stephen Jen, who runs hedge fund and advisory firm Eurizon SLJ Capital in London. “I don’t see how it is wiser for investors to bet on the virus than to bet on science, technology, and unlimited political and financial capital in the world to contain and defeat the virus.”

Health experts caution that the process for developing an effective immunity will take time – possibly years. And even then it will need distribution on an unprecedented scale, according to Anita Zaidi, Director of Vaccine Development and Surveillance at the Bill & Melinda Gates Foundation.

“I am optimistic we can develop a vaccine by the end of 2020,” she said during a discussion hosted by Bloomberg New Economy. “I am not very hopeful that we can deploy a vaccine for mass use by the end of 2020 because of the unprecedented scale needed to immunize the whole world.”

Deutsche Bank AG economists are working on the basis that a vaccine or a cure won’t be widely available for the next year and a half.

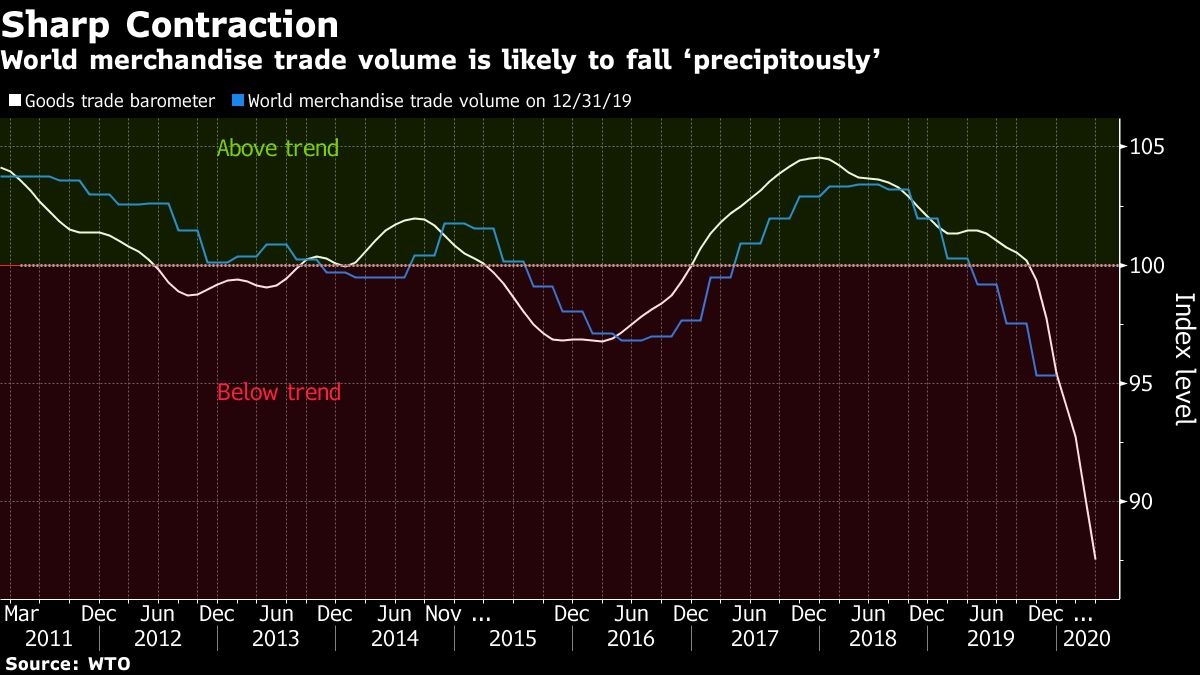

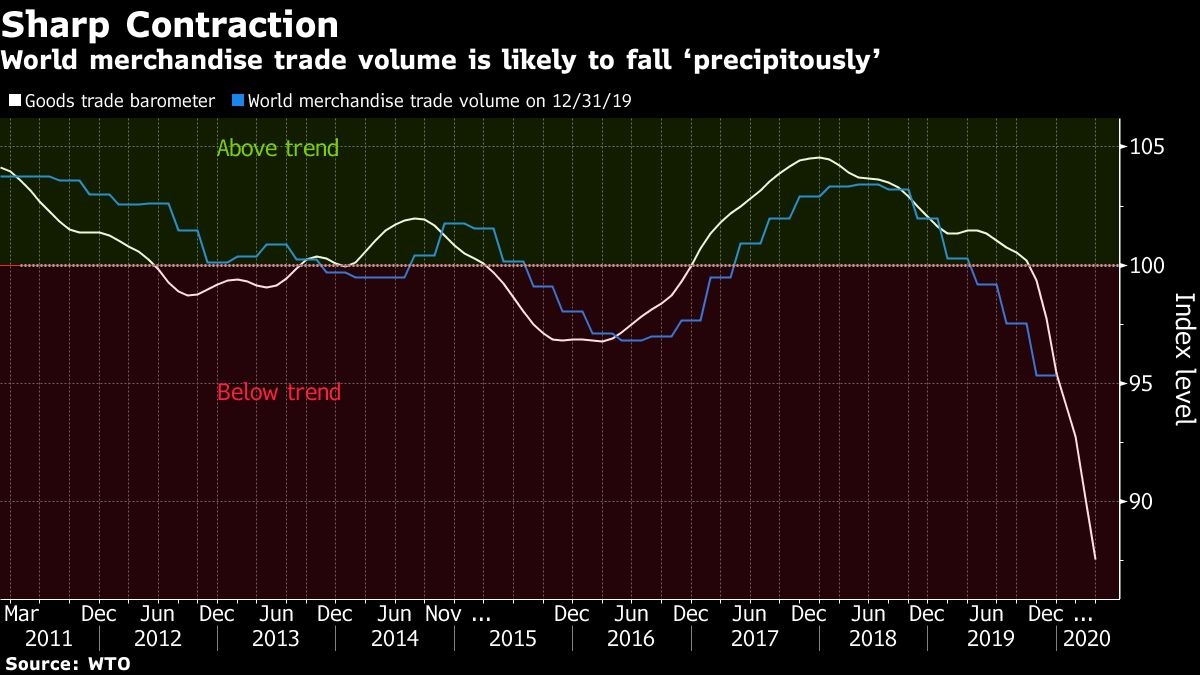

In the meantime, the cogs of global commerce are in limbo. The International Monetary Fund has warned the “Great Lockdown” recession would be the steepest in almost a century. More than 1 billion workers are at high risk of a pay cut or losing their job, the International Labour Organization warned in April. World merchandise trade volume is likely to fall “precipitously” in the first half of 2020, according to the World Trade Organization.

Critically, consumer confidence is shattered. One example: U.K. retail sales dropped by almost a fifth in April.

Bloomberg Economics estimates the lockdowns triggered a drop in activity of around 30% and their research found that the first steps to relax controls will have a more positive impact on activity than later ones.

Central bank chiefs, who have had to resort to considering scenarios instead of hard forecasts, are staying in crisis mode.

Powell has pledged to keep using the Fed’s tools. The Bank of Japan, in an emergency meeting on Friday, launched a new lending program worth 30 trillion yen ($279 billion) to support small businesses as a key inflation gauge slid below zero in April for the first time in more than three years. India’s central bank cut interest rates in an unscheduled announcement on Friday to their lowest since 2000.

While the world waits for a vaccine, workers employed in areas like tourism will need to be reskilled and shifted to where there’s demand, a process that will take time, said Shaun Roache, Asia-Pacific chief economist at S&P Global Ratings.

“Without a medical solution, either a vaccine or effective therapy, persistent behavior change would lead to large structural shifts in the economy,” he said.

Big employers are already adapting to the new, new normal. Facebook Inc. plans to hire more remote workers in areas where the company doesn’t have an office, and let some current employees work from home permanently. JPMorgan Chase & Co. expects to keep its offices half full at the most for the “foreseeable future.”

The circuit breaker to all of this would be a scientific breakthrough, said Torsten Slok, Deutsche Bank Securities Chief Economist.

“A vaccine would change everything,” he said.

Economy

U.S. economic growth slowed more than expected in first quarter

|

|

The U.S. economy grew at its slowest pace in nearly two years as a jump in imports to meet still-strong consumer spending widened the trade deficit, but an acceleration in inflation reinforced expectations that the Federal Reserve would not cut interest rates before September.

The slowdown in growth reported by the Commerce Department in a snapshot of first-quarter gross domestic product on Thursday also reflected a slower pace of inventory accumulation by businesses and downshift in government spending. Domestic demand remained strong last quarter.

“This report comes in with mixed messages,” said Olu Sonola, head of economic research at Fitch. “If growth continues to slowly decelerate, but inflation strongly takes off again in the wrong direction, the expectation of a Fed interest rate cut in 2024 is starting to look increasingly more out of reach.”

Gross domestic product increased at a 1.6 per cent annualized rate last quarter, the Commerce Department’s Bureau of Economic Analysis said. Growth was largely supported by consumer spending. Economists polled by Reuters had forecast GDP rising at a 2.4 per cent rate, with estimates ranging from a 1.0 per cent pace to a 3.1 per cent rate.

The economy grew at a 3.4 per cent rate in the fourth quarter. The first quarter growth’s pace was below what U.S. central bank officials regard as the non-inflationary growth rate of 1.8 per cent.

Inflation surged, with the personal consumption expenditures (PCE) price index excluding food and energy increasing at a 3.7 per cent rate after rising at 2.0 per cent pace in the fourth quarter.

The so-called core PCE price index is one of the inflation measures tracked by the Fed for its 2 per cent target. The central bank has kept its policy rate in the 5.25 per cent-5.50 per cent range since July. It has raised the benchmark overnight interest rate by 525 basis points since March of 2022.

Consumer spending grew at a still-solid 2.5 per cent rate, slowing from the 3.3 per cent growth pace rate notched in the fourth quarter.

Economists worry that lower-income households have depleted their pandemic savings and are largely relying on debt to fund purchases. Recent data and comments from bank executives indicated that lower-income borrowers were increasingly struggling to keep up with their loan payments.

Business inventories increased at a $35.4-billion rate after rising at a $54.9-billion pace in the fourth quarter. Inventories subtracted 0.35 percentage point from GDP growth.

The trade deficit chopped off 0.86 percentage point from GDP growth. Excluding inventories, government spending and trade, the economy grew at a 3.1 per cent rate after expanding at a 3.3 per cent rate in the fourth quarter.

Economy

U.S. growth slowed sharply last quarter to 1.6% pace, reflecting an economy pressured by high rates – BNN Bloomberg

WASHINGTON — The U.S. economy slowed sharply last quarter to a 1.6 per cent annual pace in the face of high interest rates, but consumers — the main driver of economic growth — kept spending at a solid pace.

Thursday’s report from the Commerce Department said the gross domestic product — the economy’s total output of goods and services — decelerated in the January-March quarter from its brisk 3.4 per cent growth rate in the final three months of 2023.

A surge in imports, which are subtracted from GDP, reduced first-quarter growth by nearly 1 percentage point. Growth was also held back by businesses reducing their inventories. Both those categories tend to fluctuate sharply from quarter to quarter.

By contrast, the core components of the economy still appear sturdy. Along with households, businesses helped drive the economy last quarter with a strong pace of investment.

The import and inventory numbers can be volatile, so “there is still a lot of positive underlying momentum,” said Paul Ashworth, chief North America economist at Capital Economics.

The economy, though, is still creating price pressures, a continuing source of concern for the Federal Reserve. A measure of inflation in Friday’s report accelerated to a 3.4 per cent annual rate from January through March, up from 1.8 per cent in the last three months of 2023 and the biggest increase in a year. Excluding volatile food and energy prices, so-called core inflation rose at a 3.7 per cent rate, up from 2 per cent in fourth-quarter 2023.

From January through March, consumer spending rose at a 2.5 per cent annual rate, a solid pace though down from a rate of more than 3 per cent in each of the previous two quarters. Americans’ spending on services — everything from movie tickets and restaurant meals to airline fares and doctors’ visits — rose 4 per cent, the fastest such pace since mid-2021.

But they cut back spending on goods such as appliances and furniture. Spending on that category fell 0.1 per cent, the first such drop since the summer of 2022.

The state of the U.S. economy has seized Americans’ attention as the election season has intensified. Although inflation has slowed sharply from a peak of 9.1 per cent in 2022, prices remain well above their pre-pandemic levels.

Republican critics of President Joe Biden have sought to pin responsibility for high prices on Biden and use it as a cudgel to derail his re-election bid. And polls show that despite the healthy job market, a near-record-high stock market and the sharp pullback in inflation, many Americans blame Biden for high prices.

Last quarter’s GDP snapped a streak of six straight quarters of at least 2 per cent annual growth. The 1.6 per cent rate of expansion was also the slowest since the economy actually shrank in the first and second quarters of 2022.

The economy’s gradual slowdown reflects, in large part, the much higher borrowing rates for home and auto loans, credit cards and many business loans that have resulted from the 11 interest rate hikes the Fed imposed in its drive to tame inflation.

Even so, the United States has continued to outpace the rest of the world’s advanced economies. The International Monetary Fund has projected that the world’s largest economy will grow 2.7 per cent for all of 2024, up from 2.5 per cent last year and more than double the growth the IMF expects this year for Germany, France, Italy, Japan, the United Kingdom and Canada.

Businesses have been pouring money into factories, warehouses and other buildings, encouraged by federal incentives to manufacture computer chips and green technology in the United States. On the other hand, their spending on equipment has been weak. And as imports outpace exports, international trade is also thought to have been a drag on the economy’s first-quarter growth.

Kristalina Georgieva, the IMF’s managing director, cautioned last week that the “flipside″ of strong U.S. economic growth was that it was ”taking longer than expected” for inflation to reach the Fed’s 2 per cent target, although price pressures have sharply slowed from their mid-2022 peak.

Inflation flared up in the spring of 2021 as the economy rebounded with unexpected speed from the COVID-19 recession, causing severe supply shortages. Russia’s invasion of Ukraine in February 2022 made things significantly worse by inflating prices for the energy and grains the world depends on.

The Fed responded by aggressively raising its benchmark rate between March 2022 and July 2023. Despite widespread predictions of a recession, the economy has proved unexpectedly durable. Hiring so far this year is even stronger than it was in 2023. And unemployment has remained below 4 per cent for 26 straight months, the longest such streak since the 1960s.

Inflation, the main source of Americans’ discontent about the economy, has slowed from 9.1 per cent in June 2022 to 3.5 per cent. But progress has stalled lately.

Though the Fed’s policymakers signaled last month that they expect to cut rates three times this year, they have lately signaled that they’re in no hurry to reduce rates in the face of continued inflationary pressure. Now, a majority of Wall Street traders don’t expect them to start until the Fed’s September meeting, according to the CME FedWatch tool.

Economy

Germans Debate Longer Hours and Later Retirement as Economic Growth Falters – Bloomberg

German politicians and business leaders, despairing a weak economy, are lately broaching a once taboo topic: claiming their compatriots don’t work enough. They may have a point.

German Finance Minister Christian Lindner fired the latest salvo in this fractious debate last week when he said that “in Italy, France and elsewhere they work a lot more than we do.” Economy Minister Robert Habeck, a Green Party representative, grumbled in March about workers striking, something a country beset by labor shortages “cannot afford.” (Later that month train drivers secured a 35-hour workweek instead of 38, for the same pay.) Signaling his opposition to a four-day work week, Deutsche Bank AG Chief Executive Officer Christian Sewing in January urged Germans “to work more and work harder.”

-

Real eState23 hours ago

Montreal tenant forced to pay his landlord’s taxes offers advice to other renters

-

Media22 hours ago

B.C. online harms bill on hold after deal with social media firms

-

Investment23 hours ago

Investment23 hours agoMOF: Govt to establish high-level facilitation platform to oversee potential, approved strategic investments

-

Politics23 hours ago

Politics23 hours agoPolitics Briefing: Younger demographics not swayed by federal budget benefits targeted at them, poll indicates

-

News22 hours ago

Just bought a used car? There’s a chance it’s stolen, as thieves exploit weakness in vehicle registrations

-

Science22 hours ago

Science22 hours agoGiant prehistoric salmon had tusk-like spikes used for defence, building nests: study

-

Tech22 hours ago

Tech22 hours agoCalgary woman who neglected elderly father spared jail term

-

Real eState21 hours ago

Luxury Real Estate Prices Hit a Record High in the First Quarter