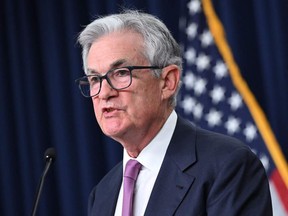

WASHINGTON — The United States Federal Reserve raised its key interest rate Wednesday for the 11th time in 17 months, a streak of hikes that are intended to curb inflation but that also carry the risk of going too far and triggering a recession.

Business

Fed raises interest rates again as inflation fight continues

Some Fed officials have said they worry that the still-brisk pace of job growth will lead workers to demand higher pay to make up for two years of inflationary prices. Sharp wage gains can perpetuate inflation if companies respond by raising prices for their customers.

The steady easing of inflation pressures has lifted hopes that the Fed can pull off a difficult “soft landing,” in which its rate hikes would continue to cool inflation without sending the economy tumbling into a painful recession.

Economists at Goldman Sachs Inc. have downgraded the likelihood of recession to just 20 per cent, from 35 per cent earlier this year. Those at Deutsche Bank, among the first large banks to forecast a recession, have also been encouraged by the economy’s direction, though they still expect a downturn later this year.

Hiring has remained healthy, with employers having added 209,000 jobs in June, with the jobless rate reaching an ultra-low 3.6 per cent. That’s about where it was when the Fed began raising rates in March 2022 — a sign of economic resilience that almost no one had foreseen.

Year-over-year inflation in June was three per cent, according to the government, down sharply from a peak of 9.1 per cent in June 2022. One cautionary note is that an inflation measure preferred by the Fed, which excludes volatile food and energy costs, was still up 4.6 per cent in May from a year earlier.

When the Fed’s policymakers last met in June, they signalled that they expected to raise rates twice more. By the time they meet again Sept. 19-20, they will have much more economic data in hand: Two more inflation reports, two reports on hiring and unemployment and updated figures on consumer spending and wages. Some economists think the Fed might decide to forgo a rate increase in September before weighing a possible hike at its meeting in November.

Other experts say they think the recent mild inflation readings can be sustained. Rental cost increases, which have already fallen, should drop further as more apartment buildings are completed.

Though the Fed began tightening credit before central banks in many other developed countries did, most others are now following suit. The European Central Bank is expected to announce its own quarter-point rate hike on Thursday. Though inflation has declined in the 20 countries that use the euro, it remains higher there than in the United States.

On Friday, the U.S. government will release fresh data on consumer spending in June and an update on the Fed’s preferred inflation gauge. The inflation measure is expected to slow to just three per cent compared with a year earlier. That would match the figure most recently reported in the government’s better-known consumer price index. And it would be down sharply from a 3.8 per cent year-over-year increase in May.

Business

Japan’s SoftBank returns to profit after gains at Vision Fund and other investments

TOKYO (AP) — Japanese technology group SoftBank swung back to profitability in the July-September quarter, boosted by positive results in its Vision Fund investments.

Tokyo-based SoftBank Group Corp. reported Tuesday a fiscal second quarter profit of nearly 1.18 trillion yen ($7.7 billion), compared with a 931 billion yen loss in the year-earlier period.

Quarterly sales edged up about 6% to nearly 1.77 trillion yen ($11.5 billion).

SoftBank credited income from royalties and licensing related to its holdings in Arm, a computer chip-designing company, whose business spans smartphones, data centers, networking equipment, automotive, consumer electronic devices, and AI applications.

The results were also helped by the absence of losses related to SoftBank’s investment in office-space sharing venture WeWork, which hit the previous fiscal year.

WeWork, which filed for Chapter 11 bankruptcy protection in 2023, emerged from Chapter 11 in June.

SoftBank has benefitted in recent months from rising share prices in some investment, such as U.S.-based e-commerce company Coupang, Chinese mobility provider DiDi Global and Bytedance, the Chinese developer of TikTok.

SoftBank’s financial results tend to swing wildly, partly because of its sprawling investment portfolio that includes search engine Yahoo, Chinese retailer Alibaba, and artificial intelligence company Nvidia.

SoftBank makes investments in a variety of companies that it groups together in a series of Vision Funds.

The company’s founder, Masayoshi Son, is a pioneer in technology investment in Japan. SoftBank Group does not give earnings forecasts.

___

Yuri Kageyama is on X:

The Canadian Press. All rights reserved.

Business

Trump campaign promises unlikely to harm entrepreneurship: Shopify CFO

Shopify Inc. executives brushed off concerns that incoming U.S. President Donald Trump will be a major detriment to many of the company’s merchants.

“There’s nothing in what we’ve heard from Trump, nor would there have been anything from (Democratic candidate) Kamala (Harris), which we think impacts the overall state of new business formation and entrepreneurship,” Shopify’s chief financial officer Jeff Hoffmeister told analysts on a call Tuesday.

“We still feel really good about all the merchants out there, all the entrepreneurs that want to start new businesses and that’s obviously not going to change with the administration.”

Hoffmeister’s comments come a week after Trump, a Republican businessman, trounced Harris in an election that will soon return him to the Oval Office.

On the campaign trail, he threatened to impose tariffs of 60 per cent on imports from China and roughly 10 per cent to 20 per cent on goods from all other countries.

If the president-elect makes good on the promise, many worry the cost of operating will soar for companies, including customers of Shopify, which sells e-commerce software to small businesses but also brands as big as Kylie Cosmetics and Victoria’s Secret.

These merchants may feel they have no choice but to pass on the increases to customers, perhaps sparking more inflation.

If Trump’s tariffs do come to fruition, Shopify’s president Harley Finkelstein pointed out China is “not a huge area” for Shopify.

However, “we can’t anticipate what every presidential administration is going to do,” he cautioned.

He likened the uncertainty facing the business community to the COVID-19 pandemic where Shopify had to help companies migrate online.

“Our job is no matter what comes the way of our merchants, we provide them with tools and service and support for them to navigate it really well,” he said.

Finkelstein was questioned about the forthcoming U.S. leadership change on a call meant to delve into Shopify’s latest earnings, which sent shares soaring 27 per cent to $158.63 shortly after Tuesday’s market open.

The Ottawa-based company, which keeps its books in U.S. dollars, reported US$828 million in net income for its third quarter, up from US$718 million in the same quarter last year, as its revenue rose 26 per cent.

Revenue for the period ended Sept. 30 totalled US$2.16 billion, up from US$1.71 billion a year earlier.

Subscription solutions revenue reached US$610 million, up from US$486 million in the same quarter last year.

Merchant solutions revenue amounted to US$1.55 billion, up from US$1.23 billion.

Shopify’s net income excluding the impact of equity investments totalled US$344 million for the quarter, up from US$173 million in the same quarter last year.

Daniel Chan, a TD Cowen analyst, said the results show Shopify has a leadership position in the e-commerce world and “a continued ability to gain market share.”

In its outlook for its fourth quarter of 2024, the company said it expects revenue to grow at a mid-to-high-twenties percentage rate on a year-over-year basis.

“Q4 guidance suggests Shopify will finish the year strong, with better-than-expected revenue growth and operating margin,” Chan pointed out in a note to investors.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:SHOP)

The Canadian Press. All rights reserved.

Business

RioCan cuts nearly 10 per cent staff in efficiency push as condo market slows

TORONTO – RioCan Real Estate Investment Trust says it has cut almost 10 per cent of its staff as it deals with a slowdown in the condo market and overall pushes for greater efficiency.

The company says the cuts, which amount to around 60 employees based on its last annual filing, will mean about $9 million in restructuring charges and should translate to about $8 million in annualized cash savings.

The job cuts come as RioCan and others scale back condo development plans as the market softens, but chief executive Jonathan Gitlin says the reductions were from a companywide efficiency effort.

RioCan says it doesn’t plan to start any new construction of mixed-use properties this year and well into 2025 as it adjusts to the shifting market demand.

The company reported a net income of $96.9 million in the third quarter, up from a loss of $73.5 million last year, as it saw a $159 million boost from a favourable change in the fair value of investment properties.

RioCan reported what it says is a record-breaking 97.8 per cent occupancy rate in the quarter including retail committed occupancy of 98.6 per cent.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:REI.UN)

The Canadian Press. All rights reserved.

-

News23 hours ago

‘Do the work’: Ottawa urges both sides in B.C. port dispute to restart talks

-

News23 hours ago

Man facing 1st-degree murder in partner’s killing had allegedly threatened her before

-

News19 hours ago

‘I get goosebumps’: Canadians across the country mark Remembrance Day

-

News19 hours ago

Surrey police transition deal still in works, less than three weeks before handover

-

News17 hours ago

From transmission to symptoms, what to know about avian flu after B.C. case

-

News18 hours ago

Bitcoin has topped $87,000 for a new record high. What to know about crypto’s post-election rally

-

News17 hours ago

Wisconsin Supreme Court grapples with whether state’s 175-year-old abortion ban is valid

-

News19 hours ago

Twin port shutdowns risk more damage to Canadian economy: business groups