Investment

Ferrari fever? Classic cars roar into investment funds

MILAN, April 15 (Reuters) – In 1977, a Ferrari owner offloaded his 1962 250 GTO because his wife complained it was too noisy, recounts Andrea Modena, head of Ferrari’s classic car division. It was either her or the car.

“Nowadays, I’m not sure the wife would have won out.”

Times have indeed changed. In 2018, the same Ferrari model became the most expensive car ever sold when it fetched $48 million at auction. Last year, that record was flattened by a 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupé that raced to 135 million euros ($149 million).

These kind of megadeals are at the vanguard of billions of dollars of annual spending on classic cars globally in a wave of investment in this alternative asset.

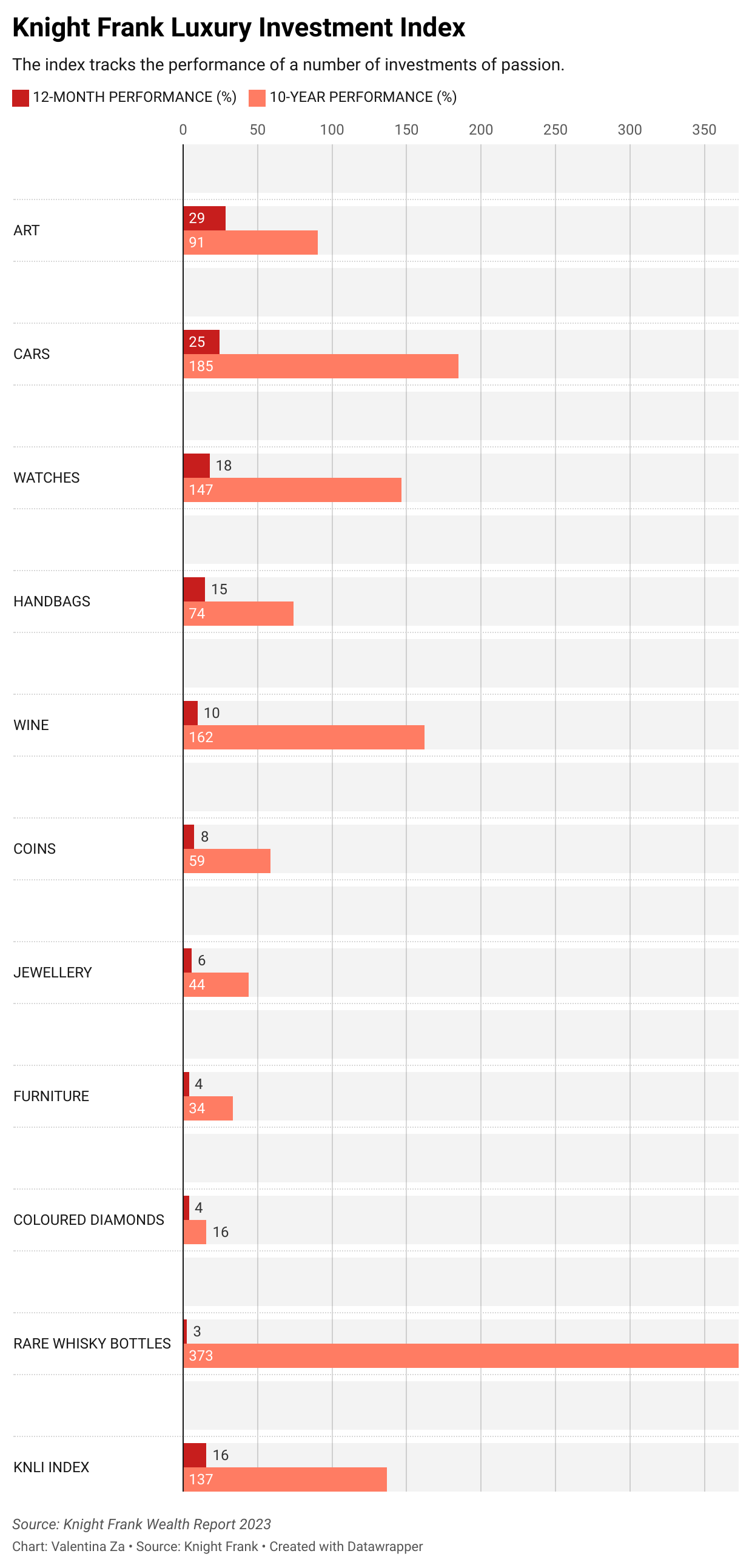

Vintage cars have risen 185% in value over the past decade, outstripping the growth of luxury rivals wine, watches and art, and ranking second only to rare whiskies, according to Knight Frank’s 2023 wealth report.

The market has expanded beyond a comparatively small community of collectors to include investors drawn by the prospect of high returns plus a lack of correlation with mainstream portfolio assets such as stocks and bonds.

“We’ve been monitoring the market for a long time,” said Giorgio Medda, CEO and global head of asset management at Italy’s Azimut (AZMT.MI). “The track record of the past 30 years tells us classic cars have become a financial asset class we want our clients to have in their portfolios.”

This year, the asset manager is launching what it describes as the world’s first “evergreen” fund to invest in vintage vehicles, and says it’ll only bet on cars worth more than 1 million euros each.

Advised by Alberto Schon, head of Ferrari and Maserati dealer Rossocorsa, the fund says it will pick vehicles with a unique history.

While Azimut’s fund will have no end date and can receive new money indefinitely, small Swiss asset manager Hetica Capital launched a 50 million euro ‘closed-end’ fund in 2021, which it also said was the first of its kind.

The Hetica fund, which is targeting returns of 9%-15% after seven years, has bought a dozen cars so far and aims to get to 30-35 cars by the fifth year, leaving the last two years to sell the vehicles and pay investors.

The plans are bold.

“We’ve seen more than 100 attempts at setting up funds in the past. Nobody managed to build both a diversified investor base and a diversified car portfolio,” said Dietrich Hatlapa, founder of classic car research house HAGI, which supplies the sector data used by Knight Frank.

It’s also not a sector for the financially faint-hearted.

Registered in Luxembourg, both the Azimut and Hetica funds have a minimum entry investment bar of 125,000 euros.

“We get loads of calls from people who’re looking to invest 1,000-2,000 euros and we have to turn them down,” said Walter Panzeri who runs Hetica’s Klassik Fund.

Moreover, a small scratch or dent, or a replacement part, can deal a heavy financial blow. For example, replacing just the bumper of a rare vintage car can cost $15,000, said Modena.

KEEPING THE CARS ALIVE

Running costs for car collections, including hefty storage and insurance fees, could easily amount annually to 5-6% of the portfolio’s value, according to Florian Zimmermann, who started buying vintage cars when he worked at Mercedes-Benz and has since built a collection of 300 vehicles with a partner.

“It’s getting harder and harder to find the proper mechanics to keep these cars alive. And you have to spend quite an amount of money to keep all these cars in running condition,” he said.

Indeed investment funds managing car portfolios can be a money-spinner for the classic car divisions of automakers, which not only provide repairs and parts, but also certify the authenticity of vehicles to take part in shows and competitions.

The certification process alone can cost around 20,000 euros, according to Peter Becker of Mercedes-Benz Classic who said only the carmaker’s experts, with access to its archives, could confirm the originality of a classic model.

Nonetheless, the classic car market is expanding as the number of wealthy people also rises; the value of vintage cars grew 25% in 2022, their strongest performance in nine years and second only to art’s 29% increase, according to Knight Frank.

Classic vehicle insurer Hagerty estimates there are about $80 billion collector vehicle transactions a year globally, including all auctions and private sales.

While North America remains the largest market for auctions, with Hagerty recording $3.4 billion in auction sales in 2022 versus $774 million in 2007, Zimmermann said a growing number of buyers had emerged in recent years in the Middle East, India and China.

‘THEY’LL BE CULT OBJECTS’

The global race to renounce combustion engine cars will only serve to heighten interest in these relics of a vanishing era, say some market players.

“Electrification will favour classic cars,” said Cristiano Bolzoni, head of Maserati’s vintage car unit Maserati Classiche. “Over time they will become cult objects.”

Ferraris are the most prized vintage autos, according to Adolfo Orsi, founder of the Classic Car Auction Yearbook which has been tracking auction sales data since 1990, who described them as “absolutely the blue-chips of this sector”.

Ferraris commanded an average value at auction of $589,000 in 2021-22, followed by Mercedes-Benz cars on $378,000 and Porsches with $348,000.

“The classic car community has changed tremendously over the past five to 10 years,” Zimmermann said. “Once it was only people who knew the cars inside out. But over time others simply thought: I like these cars, I can afford one and I don’t lose money by buying it.”

Investment

Tesla shares soar more than 14% as Trump win is seen boosting Elon Musk’s electric vehicle company

NEW YORK (AP) — Shares of Tesla soared Wednesday as investors bet that the electric vehicle maker and its CEO Elon Musk will benefit from Donald Trump’s return to the White House.

Tesla stands to make significant gains under a Trump administration with the threat of diminished subsidies for alternative energy and electric vehicles doing the most harm to smaller competitors. Trump’s plans for extensive tariffs on Chinese imports make it less likely that Chinese EVs will be sold in bulk in the U.S. anytime soon.

“Tesla has the scale and scope that is unmatched,” said Wedbush analyst Dan Ives, in a note to investors. “This dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players.”

Tesla shares jumped 14.8% Wednesday while shares of rival electric vehicle makers tumbled. Nio, based in Shanghai, fell 5.3%. Shares of electric truck maker Rivian dropped 8.3% and Lucid Group fell 5.3%.

Tesla dominates sales of electric vehicles in the U.S, with 48.9% in market share through the middle of 2024, according to the U.S. Energy Information Administration.

Subsidies for clean energy are part of the Inflation Reduction Act, signed into law by President Joe Biden in 2022. It included tax credits for manufacturing, along with tax credits for consumers of electric vehicles.

Musk was one of Trump’s biggest donors, spending at least $119 million mobilizing Trump’s supporters to back the Republican nominee. He also pledged to give away $1 million a day to voters signing a petition for his political action committee.

In some ways, it has been a rocky year for Tesla, with sales and profit declining through the first half of the year. Profit did rise 17.3% in the third quarter.

The U.S. opened an investigation into the company’s “Full Self-Driving” system after reports of crashes in low-visibility conditions, including one that killed a pedestrian. The investigation covers roughly 2.4 million Teslas from the 2016 through 2024 model years.

And investors sent company shares tumbling last month after Tesla unveiled its long-awaited robotaxi at a Hollywood studio Thursday night, seeing not much progress at Tesla on autonomous vehicles while other companies have been making notable progress.

Tesla began selling the software, which is called “Full Self-Driving,” nine years ago. But there are doubts about its reliability.

The stock is now showing a 16.1% gain for the year after rising the past two days.

The Canadian Press. All rights reserved.

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

News9 hours ago

Affordability or bust: Nova Scotia election campaign all about cost of living

-

News9 hours ago

Canada’s Denis Shapovalov wins Belgrade Open for his second ATP Tour title

-

News9 hours ago

11 new cases of measles confirmed in New Brunswick, bringing total cases to 25

-

News9 hours ago

First World War airmen from New Brunswick were pioneers of air warfare

-

News9 hours ago

Talks to resume in B.C. port dispute in bid to end multi-day lockout

-

News9 hours ago

Museum to honour Chinese Canadian troops who fought in war and for citizenship rights

-

News9 hours ago

The Royal Canadian Legion turns to Amazon for annual poppy campaign boost