Article content

(Bloomberg) — Asset managers love them, while clients seem increasingly wary of them: Article 8 funds.

Asset managers love them, while clients seem increasingly wary of them: Article 8 funds.

(Bloomberg) — Asset managers love them, while clients seem increasingly wary of them: Article 8 funds.

It’s a category within Europe’s ESG investing rulebook that saw huge growth last quarter, as the asset-management industry slapped an Article 8 — also known as “light green” — tag on well over 600 funds that previously weren’t classified as sustainable, according to data provided by Morningstar Inc. At the same time, clients withdrew more than $30 billion from such products. A stricter environmental, social and governance classification — Article 9 — saw $6 billion of inflows.

When an asset manager sells a fund as Article 8, they’re promising clients that their money will go toward “promoting” sustainability. It’s a concept that was enshrined in the EU’s Sustainable Finance Disclosure Regulation, which started being enforced in March 2021 as the world’s boldest anti-greenwash rulebook to date. But 16 months on, there’s hardly any agreement within the fund industry as to what “promoting” sustainability means. What’s more, even regulators in the EU don’t really see eye to eye.

For investment clients trying to decide where to get the most bang for their ESG buck, it’s now “impossible” to do a meaningful comparison across products, according to Morningstar.

Meanwhile, there continue to be questions around the ESG-ness of Article 8. A Morningstar data analysis found that roughly two-thirds of Article 8 funds target between zero and 10% minimum exposure to sustainable investments.

A new regulatory framework is taking effect that will require financial advisers to make sure they’re taking ESG retail clients’ expectations into account, and explaining the characteristics of financial products in a way that doesn’t lead to misunderstandings. It’s an amendment to the revised Markets in Financial Instruments Directive that law firm Simmons & Simmons, which advises asset managers, has already suggested will add a new layer of risk to the asset-management industry.

“Because of patchy data and a lack of direct comparability between products, financial advisers will struggle to fulfill their new obligations,” according to Morningstar.

NEWS ROUNDUP

Social Taxonomy Shelved | The next milestone in Europe’s efforts to create a global benchmark for ESG investing has been shelved indefinitely as officials balk at devoting resources to a process that’s already marred by deep political division.

Meta Reacts to Data Pact | Meta Platforms Inc. reiterated its threat to pull its popular Facebook and Instagram services from the European Union if a new transatlantic data transfer pact doesn’t materialize. Its latest warning comes amid an imminent data flow ban it already faces from Ireland’s data-protection watchdog, which oversees the tech giants based in the country.

Fashion Probe | The UK’s competition watchdog started a probe into potentially misleading environmental claims made by fashion brands Asos Plc, Boohoo Group Plc and George at Asda, over greenwashing concerns.

ISSB Faces Criticism | The organization aiming to set worldwide climate reporting requirements for decades to come is under fire for putting corporate interests ahead of the planet’s.

Pimco Downgrades ESG Funds | Pacific Investment Management Co. and NN Investment Partners have cut the ESG status of a number of their funds after European authorities clarified rules guiding such classifications.

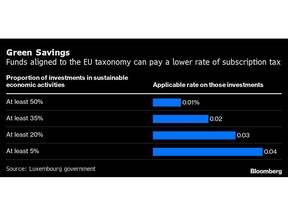

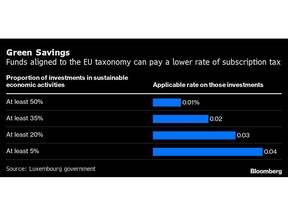

No Tax Break | In Luxembourg, the world’s biggest hub for ESG asset managers, firms have been unable to take advantage of a tax break intended to reward their efforts to do more sustainable investing.

Banks Fall Short | The world’s biggest banks are coming up short in their efforts to rein in global warming, according to an investor group representing more than $50 trillion of assets.

EU Climate Benchmarks | Investment funds tracking EU-regulated climate benchmarks jumped 25% last quarter, as asset managers look for ways to combat greenwashing.

EU Deal to Cut Gas Use | European Union countries reached a political agreement to cut their gas use by 15% through next winter as the prospect of a full cutoff from Russian supplies grows increasingly likely.

Gas and Nuclear | EU lawmakers voted to allow natural gas and nuclear energy to be labeled as green investments, removing the last major barrier to potentially billions of euros of funding from environmental investors.

US Climate Deal | In a breakthrough that surprised much of Washington, Senate Majority Leader Chuck Schumer and Senator Joe Manchin announced that they agreed on a plan that includes a record $370 billion in spending to fight climate change.

US States Target Banks | West Virginia will restrict BlackRock Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., Morgan Stanley and Wells Fargo & Co. from state banking contracts after the Republican state treasurer found that the companies engage in a so-called boycott of the fossil-fuels industry.

FSB Warns Banks | Financial institutions should brace for greater scrutiny as the world moves toward a low-carbon economy, the Financial Stability Board said in a report.

EU Targets Insurers | The EU’s top insurance regulator wants national authorities to tighten supervision amid evidence companies are using artificial intelligence to drive up prices unrelated to the risk or cost of service.

BLOOMBERG RESEARCH

Guarding Against Greenwashing | As ESG has increasingly affected investment decisions in Europe, the need for transparent and comparable data has become pivotal. Public-company disclosures can differ drastically, as reporting standards are new and often changing. Bloomberg and MSCI were the most frequently named as the No. 1 or No. 2 source of ESG data among European funds that were surveyed.

Most traders named multiple providers, suggesting they value various data inputs, and there’s room for competition. Almost a quarter of traders surveyed believe greenwashing accounts for more than 50% of ESG. Small funds were surprisingly more pessimistic, as they showed more support for ESG throughout the study.

What percentage of ESG is greenwashing?

US Climate Bill’s Impact | Vestas Wind Systems AS, First Solar Inc., SolarEdge Technologies Inc. and other clean-energy equipment suppliers may see elevated US demand for wind and solar energy in 2023-2025 — with potential upgrades to consensus sales expectations — if the Inflation Reduction Act becomes law.

Carbon Border Tax | This will be a “make or break” year for launching a carbon tariff on imported goods, according to BloombergNEF. The European Commission has proposed levying a tariff on iron and steel, aluminum, fertilizers and cement. In addition, the European Parliament wants to include organic basic chemicals, plastics and hydrogen. With introduction planned for next year, “consensus on devilish questions around coverage, timeline and exports is lacking,” analyst Antoine Vagneur-Jones wrote in a July 27 report.

OFF THE SHELF

ESG Meets Real World | ESG has become a punching bag for the far right, disgruntled corporate executives and even industry insiders.

Taxonomies | Floods, droughts and food shortages are just some of the effects of climate change, while exploitation and corruption drive social injustice around the world. Governments tackling these issues are realizing that to solve them, they need first to define and measure them. Some are turning to so-called taxonomies that establish which economic practices and products are harmful to the planet and which aren’t. The idea is that the price of goods and services must reflect the human and environmental cost of both production and disposal, which in turn would spur much-needed change. But designing a code is fiendishly difficult.

OTHER ESG-F0CUSED FIXTURES

Run NSUB ESG to subscribe to the ESG newsletters listed below:

|

|

As the Gulf region gains strategic importance in the tech war between the U.S. and China, Microsoft is making a big move into one of the Middle East’s oil-rich countries.

On Monday evening, Microsoft announced a $1.5 billion investment in Group 42 Holdings (G42), the Abu Dhabi-based AI company that has become a major force in the United Arab Emirates’ effort to be a global leader in artificial intelligence. The minority stake will give Brad Smith, Microsoft’s vice chair and president, a seat on G42’s board of directors.

The deal signifies more than a commercial collaboration between two AI titans — it serves as evidence of two countries’ strategic positioning amid rising geopolitical tensions.

The funding comes as U.S. politicians’ grow increasingly concerned about G42’s ties with China. In January, the bipartisan House Select Committee on the Chinese Communist Party sent a letter to Commerce Secretary Gina Raimondo, urging the Department of Commerce to investigate G42 for inclusion on the Bureau of Industry and Security’s Entity List, which would bar the Emirati company from accessing sensitive U.S. technologies.

Such a move would put G42 under the same security concerns umbrella as Huawei, which was placed on the Entity List in 2019. Huawei has since been restricted from acquiring critical U.S. technologies, including high-end chips and certain Android services.

Microsoft’s investment this week appears to be an indication of which superpower G42 has aligned itself with.

Though a long-time economic and military ally of the U.S., the UAE has in recent times diverged from Washington’s foreign policy, and expanded its partnerships with China, a development that worries Washington.

Last year, the UAE’s president, Mohamed bin Zayed Al Nahyan, attended Russia’s flagship economic forum, which was largely shunned by Western countries in protest of the Ukraine war. The UAE has also increased military cooperation with China, and has even planned their first joint air force training last year.

On the business side, the UAE is attracting a wave of Chinese venture capitalists and entrepreneurs who are increasingly excluded from the U.S. market. Managers of Chinese funds have also turned to the UAE and its affluent Middle Eastern neighbors for capital as limited partners in the U.S. retreat from China. Capitalizing on the UAE’s commitment to electrify its economy, China’s electric vehicle manufacturers have been aggressively touting plug-in models in the market. Last year, premium EV maker Nio secured $738.5 million investment from an Abu Dhabi-backed fund.

Given the two countries’ burgeoning economic alliance, it’s no surprise that G42, which is spearheading the UAE’s AI development, has also forged ties with Chinese firms. These commercial relationships, however, have greatly concerned the U.S.

In its letter to Raimondo, the House Select Committee on the CCP noted that G42 maintains relationships with entities like Huawei, the Beijing Genomics Institute (BGI) and Tencent.

The Committee also highlighted the background of G42’s CEO Peng Xiao, who previously held a senior position at a subsidiary of DarkMatter, a company that develops “spyware and surveillance tools that can be used to spy on dissidents, journalists, politicians, and U.S. companies,” the committee wrote.

Given these alleged Chinese ties, the committee is concerned that G42 can be a way for Chinese firms to access U.S. technologies that are otherwise under export controls. The Committee is in particular wary of its “extensive commercial relationships” with U.S. tech companies including Microsoft, Dell, and OpenAI.

Microsoft investment in G42 is an uncommon example of a deal that’s received overt backing from their respective governments. According to the companies’ statement, this “commercial partnership is backed by assurances to the U.S. and UAE governments through a first-of-its-kind binding agreement to apply world-class best practices to ensure the secure, trusted, and responsible development and deployment of AI.”

If the deal goes through, it will designate Microsoft as G42’s official cloud partner. Under the agreement, the Emirati company’s data platform and other key infrastructure will migrate to Microsoft Azure, which will power G42’s product development. G42 already has a partnership with OpenAI that commenced in 2023.

The partnership with Microsoft appears to be part of an ongoing effort at G42 to tone down its Chinese influence. The firm divested its China-related investments, including its shares in TikTok parent ByteDance, this February. Xiao also said late last year that the firm planned to phase out Chinese hardware, saying, “We cannot work with both sides.”

What Microsoft gains in return is extensive access to the region’s market. Its AI business and Azure will get access to a range of industries like financial services, healthcare, energy, government and education. The partnership will also see the pair launching a $1 billion fund “for developers to boost AI skills” in the UAE and the broader region.

As tech companies have learned in the past few years, it has become increasingly difficult to avoid choosing sides between the U.S and China — whether in terms of technology vendors, users or investors. The developments around G42 demonstrate that even a country like the UAE, which has sought to maintain a neutral stance, may ultimately be forced to take a side.

/* OOVVUU Targeting */

const path = ‘/news/world/united-states’;

const siteName = ‘thestar.com’;

let domain = ‘thestar.com’;

if (siteName === ‘thestar.com’)

domain = ‘thestar.com’;

else if (siteName === ‘niagarafallsreview.ca’)

domain = ‘niagara_falls_review’;

else if (siteName === ‘stcatharinesstandard.ca’)

domain = ‘st_catharines_standard’;

else if (siteName === ‘thepeterboroughexaminer.com’)

domain = ‘the_peterborough_examiner’;

else if (siteName === ‘therecord.com’)

domain = ‘the_record’;

else if (siteName === ‘thespec.com’)

domain = ‘the_spec’;

else if (siteName === ‘wellandtribune.ca’)

domain = ‘welland_tribune’;

else if (siteName === ‘bramptonguardian.com’)

domain = ‘brampton_guardian’;

else if (siteName === ‘caledonenterprise.com’)

domain = ‘caledon_enterprise’;

else if (siteName === ‘cambridgetimes.ca’)

domain = ‘cambridge_times’;

else if (siteName === ‘durhamregion.com’)

domain = ‘durham_region’;

else if (siteName === ‘guelphmercury.com’)

domain = ‘guelph_mercury’;

else if (siteName === ‘insidehalton.com’)

domain = ‘inside_halton’;

else if (siteName === ‘insideottawavalley.com’)

domain = ‘inside_ottawa_valley’;

else if (siteName === ‘mississauga.com’)

domain = ‘mississauga’;

else if (siteName === ‘muskokaregion.com’)

domain = ‘muskoka_region’;

else if (siteName === ‘newhamburgindependent.ca’)

domain = ‘new_hamburg_independent’;

else if (siteName === ‘niagarathisweek.com’)

domain = ‘niagara_this_week’;

else if (siteName === ‘northbaynipissing.com’)

domain = ‘north_bay_nipissing’;

else if (siteName === ‘northumberlandnews.com’)

domain = ‘northumberland_news’;

else if (siteName === ‘orangeville.com’)

domain = ‘orangeville’;

else if (siteName === ‘ourwindsor.ca’)

domain = ‘our_windsor’;

else if (siteName === ‘parrysound.com’)

domain = ‘parrysound’;

else if (siteName === ‘simcoe.com’)

domain = ‘simcoe’;

else if (siteName === ‘theifp.ca’)

domain = ‘the_ifp’;

else if (siteName === ‘waterloochronicle.ca’)

domain = ‘waterloo_chronicle’;

else if (siteName === ‘yorkregion.com’)

domain = ‘york_region’;

let sectionTag = ”;

try

if (domain === ‘thestar.com’ && path.indexOf(‘wires/’) = 0)

sectionTag = ‘/business’;

else if (path.indexOf(‘/autos’) >= 0)

sectionTag = ‘/autos’;

else if (path.indexOf(‘/entertainment’) >= 0)

sectionTag = ‘/entertainment’;

else if (path.indexOf(‘/life’) >= 0)

sectionTag = ‘/life’;

else if (path.indexOf(‘/news’) >= 0)

sectionTag = ‘/news’;

else if (path.indexOf(‘/politics’) >= 0)

sectionTag = ‘/politics’;

else if (path.indexOf(‘/sports’) >= 0)

sectionTag = ‘/sports’;

else if (path.indexOf(‘/opinion’) >= 0)

sectionTag = ‘/opinion’;

} catch (ex)

const descriptionUrl = ‘window.location.href’;

const vid = ‘mediainfo.reference_id’;

const cmsId = ‘2665777’;

let url = `https://pubads.g.doubleclick.net/gampad/ads?iu=/58580620/$domain/video/oovvuu$sectionTag&description_url=$descriptionUrl&vid=$vid&cmsid=$cmsId&tfcd=0&npa=0&sz=640×480&ad_rule=0&gdfp_req=1&output=vast&unviewed_position_start=1&env=vp&impl=s&correlator=`;

url = url.split(‘ ‘).join(”);

window.oovvuuReplacementAdServerURL = url;

CHICAGO (AP) — Ukraine Prime Minister Denys Shmyhal kicked off a United States visit Tuesday with multiple stops in Chicago aimed at drumming up investment and business in the war-torn country.

He spoke to Chicago-area business leaders before a joint news conference with Penny Pritzker, the U.S. special representative for Ukraine’s economic recovery, and her brother, Illinois Gov. J.B. Pritzker.

function buildUserSwitchAccountsForm()

var form = document.getElementById(‘user-local-logout-form-switch-accounts’);

if (form) return;

// build form with javascript since having a form element here breaks the payment modal.

var switchForm = document.createElement(‘form’);

switchForm.setAttribute(‘id’,’user-local-logout-form-switch-accounts’);

switchForm.setAttribute(‘method’,’post’);

switchForm.setAttribute(‘action’,’https://www.thestar.com/tncms/auth/logout/?return=https://www.thestar.com/users/login/?referer_url=https%3A%2F%2Fwww.thestar.com%2Fnews%2Fworld%2Funited-states%2Fukraine-prime-minister-calls-for-more-investment-in-war-torn-country-during-chicago-stop-of%2Farticle_15ada14e-b83e-5396-9b2d-0997cf4689bd.html’);

switchForm.setAttribute(‘style’,’display:none;’);

var refUrl = document.createElement(‘input’); //input element, text

refUrl.setAttribute(‘type’,’hidden’);

refUrl.setAttribute(‘name’,’referer_url’);

refUrl.setAttribute(‘value’,’https://www.thestar.com/news/world/united-states/ukraine-prime-minister-calls-for-more-investment-in-war-torn-country-during-chicago-stop-of/article_15ada14e-b83e-5396-9b2d-0997cf4689bd.html’);

var submit = document.createElement(‘input’);

submit.setAttribute(‘type’,’submit’);

submit.setAttribute(‘name’,’logout’);

submit.setAttribute(‘value’,’Logout’);

switchForm.appendChild(refUrl);

switchForm.appendChild(submit);

document.getElementsByTagName(‘body’)[0].appendChild(switchForm);

function handleUserSwitchAccounts()

window.sessionStorage.removeItem(‘bd-viafoura-oidc’); // clear viafoura JWT token

// logout user before sending them to login page via return url

document.getElementById(‘user-local-logout-form-switch-accounts’).submit();

return false;

buildUserSwitchAccountsForm();

console.log(‘=====> bRemoveLastParagraph: ‘,0);

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

Latest investment in private health care in P.E.I. raising concerns – CBC.ca

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Investors are growing increasingly weary of AI – TechCrunch

Budget 2024 sets up a ‘hard year’ for the Liberals. Here’s what to expect – Global News

Psychology group says infinite scrolling and other social media features are ‘particularly risky’ to youth mental health – NBC News

So You Own Algonquin Stock: Is It Still a Good Investment? – The Motley Fool Canada