Economy

Gary Cohn wants $1 trillion to save the U.S. economy – Yahoo Canada Finance

GlobeNewswire

Global Aircraft Insulation Industry

Global Aircraft Insulation Market to Reach $10. 6 Billion by 2027. Amid the COVID-19 crisis, the global market for Aircraft Insulation estimated at US$7. 7 Billion in the year 2020, is projected to reach a revised size of US$10.New York, Oct. 27, 2020 (GLOBE NEWSWIRE) — Reportlinker.com announces the release of the report “Global Aircraft Insulation Industry” – https://www.reportlinker.com/p05797850/?utm_source=GNW 6 Billion by 2027, growing at a CAGR of 4.7% over the analysis period 2020-2027. Thermal, one of the segments analyzed in the report, is projected to record a 5.3% CAGR and reach US$6.7 Billion by the end of the analysis period. After an early analysis of the business implications of the pandemic and its induced economic crisis, growth in the Acoustic & Vibration segment is readjusted to a revised 4% CAGR for the next 7-year period. The U.S. Market is Estimated at $2.1 Billion, While China is Forecast to Grow at 7.3% CAGR The Aircraft Insulation market in the U.S. is estimated at US$2.1 Billion in the year 2020. China, the world`s second largest economy, is forecast to reach a projected market size of US$2.2 Billion by the year 2027 trailing a CAGR of 7.3% over the analysis period 2020 to 2027. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 2.5% and 4.2% respectively over the 2020-2027 period. Within Europe, Germany is forecast to grow at approximately 2.9% CAGR. Electric Segment to Record 3.6% CAGR In the global Electric segment, USA, Canada, Japan, China and Europe will drive the 3.2% CAGR estimated for this segment. These regional markets accounting for a combined market size of US$1.4 Billion in the year 2020 will reach a projected size of US$1.8 Billion by the close of the analysis period. China will remain among the fastest growing in this cluster of regional markets. Led by countries such as Australia, India, and South Korea, the market in Asia-Pacific is forecast to reach US$1.4 Billion by the year 2027, while Latin America will expand at a 4.5% CAGR through the analysis period. We bring years of research experience to this 9th edition of our report. The 282-page report presents concise insights into how the pandemic has impacted production and the buy side for 2020 and 2021. A short-term phased recovery by key geography is also addressed. Competitors identified in this market include, among others, * BASF SE * DowDuPont, Inc. * Duracote Corporation * Esterline Technologies Corporation * Evonik Industries AG * Polymer Technologies, Inc. * Rogers Corporation * Triumph Group, Inc. * Zodiac Aerospace SA * Zotefoams PLC Read the full report: https://www.reportlinker.com/p05797850/?utm_source=GNW I. INTRODUCTION, METHODOLOGY & REPORT SCOPE II. EXECUTIVE SUMMARY 1. MARKET OVERVIEW Global Competitor Market Shares Aircraft Insulation Competitor Market Share Scenario Worldwide (in %): 2019 & 2025 Impact of Covid-19 and a Looming Global Recession Market Overview Aircraft Thermal Acoustic Insulation Aircraft Thermal Acoustic Insulation Insulation Types Fiberglass Mineral Wool Ceramic-based Materials 2. FOCUS ON SELECT PLAYERS 3. MARKET TRENDS & DRIVERS Aircraft Industry Witnesses Rise in Demand for Lightweight Insulators Manufacturers Focus on Advanced Acoustic Rise in Demand for Fire Resistant Materials Growth in Commercial Aircraft Deliveries Props the Demand for Insulation Materials Rise in Passenger Traffic Pulls the Demand for Insulation Materials in Air Craft Industry Focus on Aeroacoustics Drives Demand for High Performance Materials Global Air Traffic passenger Growth 2016-2019 Foamed Plastics – The Dominant Material Industry Focuses on Thermo-acoustic Insulation Blankets for Aircrafts Rise in Demand for Materials with Low Thermal Conductivity Drive to Develop Advanced Thermal Acoustic Materials 4. GLOBAL MARKET PERSPECTIVE Table 1: Aircraft Insulation Global Market Estimates and Forecasts in US$ Million by Region/Country: 2020-2027 Table 2: Aircraft Insulation Global Retrospective Market Scenario in US$ Million by Region/Country: 2012-2019 Table 3: Aircraft Insulation Market Share Shift across Key Geographies Worldwide: 2012 VS 2020 VS 2027 Table 4: Thermal (Type) World Market by Region/Country in US$ Million: 2020 to 2027 Table 5: Thermal (Type) Historic Market Analysis by Region/Country in US$ Million: 2012 to 2019 Table 6: Thermal (Type) Market Share Breakdown of Worldwide Sales by Region/Country: 2012 VS 2020 VS 2027 Table 7: Acoustic & Vibration (Type) Potential Growth Markets Worldwide in US$ Million: 2020 to 2027 Table 8: Acoustic & Vibration (Type) Historic Market Perspective by Region/Country in US$ Million: 2012 to 2019 Table 9: Acoustic & Vibration (Type) Market Sales Breakdown by Region/Country in Percentage: 2012 VS 2020 VS 2027 Table 10: Electric (Type) Geographic Market Spread Worldwide in US$ Million: 2020 to 2027 Table 11: Electric (Type) Region Wise Breakdown of Global Historic Demand in US$ Million: 2012 to 2019 Table 12: Electric (Type) Market Share Distribution in Percentage by Region/Country: 2012 VS 2020 VS 2027 Table 13: Foamed Plastics (Material) World Market Estimates and Forecasts by Region/Country in US$ Million: 2020 to 2027 Table 14: Foamed Plastics (Material) Market Historic Review by Region/Country in US$ Million: 2012 to 2019 Table 15: Foamed Plastics (Material) Market Share Breakdown by Region/Country: 2012 VS 2020 VS 2027 Table 16: Fiberglass (Material) World Market by Region/Country in US$ Million: 2020 to 2027 Table 17: Fiberglass (Material) Historic Market Analysis by Region/Country in US$ Million: 2012 to 2019 Table 18: Fiberglass (Material) Market Share Distribution in Percentage by Region/Country: 2012 VS 2020 VS 2027 Table 19: Mineral Wool (Material) World Market Estimates and Forecasts in US$ Million by Region/Country: 2020 to 2027 Table 20: Mineral Wool (Material) Market Worldwide Historic Review by Region/Country in US$ Million: 2012 to 2019 Table 21: Mineral Wool (Material) Market Percentage Share Distribution by Region/Country: 2012 VS 2020 VS 2027 Table 22: Ceramic-based Materials (Material) Market Opportunity Analysis Worldwide in US$ Million by Region/Country: 2020 to 2027 Table 23: Ceramic-based Materials (Material) Global Historic Demand in US$ Million by Region/Country: 2012 to 2019 Table 24: Ceramic-based Materials (Material) Market Share Distribution in Percentage by Region/Country: 2012 VS 2020 VS 2027 III. MARKET ANALYSIS GEOGRAPHIC MARKET ANALYSIS UNITED STATES Market Facts & Figures US Aircraft Insulation Market Share (in %) by Company: 2019 & 2025 Market Analytics Table 25: United States Aircraft Insulation Market Estimates and Projections in US$ Million by Type: 2020 to 2027 Table 26: Aircraft Insulation Market in the United States by Type: A Historic Review in US$ Million for 2012-2019 Table 27: United States Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 28: Aircraft Insulation Market in the United States in US$ Million by Material: 2020-2027 Table 29: Aircraft Insulation Historic Demand Patterns in the United States in US$ Million by Material: 2012-2019 Table 30: United States Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 CANADA Table 31: Canadian Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020 to 2027 Table 32: Canadian Aircraft Insulation Historic Market Review by Type in US$ Million: 2012-2019 Table 33: Aircraft Insulation Market in Canada: Percentage Share Breakdown of Sales by Type for 2012, 2020, and 2027 Table 34: Canadian Aircraft Insulation Market Estimates and Forecasts in US$ Million by Material: 2020-2027 Table 35: Aircraft Insulation Market in Canada: Historic Analysis in US$ Million by Material for the period 2012-2019 Table 36: Canadian Aircraft Insulation Market Shares in Percentages by Material: 2012 VS 2020 VS 2027 JAPAN Table 37: Japanese Market for Aircraft Insulation: Annual Sales Estimates and Projections in US$ Million by Type for the Period 2020-2027 Table 38: Aircraft Insulation Market in Japan: Historic Sales Analysis in US$ Million by Type for the Period 2012-2019 Table 39: Japanese Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 40: Japanese Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 41: Aircraft Insulation Demand Patterns in Japan in US$ Million by Material: 2012-2019 Table 42: Japanese Aircraft Insulation Market Share in Percentages by Material: 2012 VS 2020 VS 2027 CHINA Table 43: Chinese Aircraft Insulation Market Growth Prospects in US$ Million by Type for the Period 2020-2027 Table 44: Aircraft Insulation Historic Market Analysis in China in US$ Million by Type: 2012-2019 Table 45: Chinese Aircraft Insulation Market by Type: Percentage Breakdown of Sales for 2012, 2020, and 2027 Table 46: Chinese Demand Estimates and Forecasts for Aircraft Insulation Market in US$ Million by Material: 2020-2027 Table 47: Aircraft Insulation Historic Demand Scenario in China in US$ Million by Material: 2012-2019 Table 48: Chinese Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 EUROPE Market Facts & Figures European Aircraft Insulation Market: Competitor Market Share Scenario (in %) for 2019 & 2025 Market Analytics Table 49: European Aircraft Insulation Market Demand Scenario in US$ Million by Region/Country: 2020-2027 Table 50: Aircraft Insulation Market in Europe: A Historic Market Perspective in US$ Million by Region/Country for the Period 2012-2019 Table 51: European Aircraft Insulation Market Share Shift by Region/Country: 2012 VS 2020 VS 2027 Table 52: European Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020-2027 Table 53: Aircraft Insulation Market in Europe in US$ Million by Type: A Historic Review for the Period 2012-2019 Table 54: European Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 55: Aircraft Insulation Demand Potential in Europe in US$ Million by Material: 2020-2027 Table 56: European Aircraft Insulation Historic Market Analysis in US$ Million by Material: 2012-2019 Table 57: Aircraft Insulation Market in Europe : Breakdown of Sales by Material for 2012, 2020, and 2027 FRANCE Table 58: Aircraft Insulation Market in France by Type: Estimates and Projections in US$ Million for the Period 2020-2027 Table 59: French Aircraft Insulation Historic Market Scenario in US$ Million by Type: 2012-2019 Table 60: French Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 61: Aircraft Insulation Recent Past, Current & Future Market Analysis in France in US$ Million by Material: 2020-2027 Table 62: French Aircraft Insulation Market: Historic Review in US$ Million by Material for the Period 2012-2019 Table 63: French Aircraft Insulation Market Share Shift by Material: 2012 VS 2020 VS 2027 GERMANY Table 64: Aircraft Insulation Market in Germany: Recent Past, Current and Future Analysis in US$ Million by Type for the Period 2020-2027 Table 65: German Aircraft Insulation Historic Market Analysis in US$ Million by Type: 2012-2019 Table 66: German Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 67: German Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 68: Aircraft Insulation Market in Germany: Historic Demand Analysis in US$ Million by Material for the Period 2012-2019 Table 69: German Aircraft Insulation Market Share Distribution by Material: 2012 VS 2020 VS 2027 ITALY Table 70: Italian Aircraft Insulation Market Growth Prospects in US$ Million by Type for the Period 2020-2027 Table 71: Aircraft Insulation Historic Market Analysis in Italy in US$ Million by Type: 2012-2019 Table 72: Italian Aircraft Insulation Market by Type: Percentage Breakdown of Sales for 2012, 2020, and 2027 Table 73: Italian Demand Estimates and Forecasts for Aircraft Insulation Market in US$ Million by Material: 2020-2027 Table 74: Aircraft Insulation Historic Demand Scenario in Italy in US$ Million by Material: 2012-2019 Table 75: Italian Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 UNITED KINGDOM Table 76: United Kingdom Market for Aircraft Insulation: Annual Sales Estimates and Projections in US$ Million by Type for the Period 2020-2027 Table 77: Aircraft Insulation Market in the United Kingdom: Historic Sales Analysis in US$ Million by Type for the Period 2012-2019 Table 78: United Kingdom Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 79: United Kingdom Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 80: Aircraft Insulation Demand Patterns in the United Kingdom in US$ Million by Material: 2012-2019 Table 81: United Kingdom Aircraft Insulation Market Share in Percentages by Material: 2012 VS 2020 VS 2027 SPAIN Table 82: Spanish Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020 to 2027 Table 83: Spanish Aircraft Insulation Historic Market Review by Type in US$ Million: 2012-2019 Table 84: Aircraft Insulation Market in Spain: Percentage Share Breakdown of Sales by Type for 2012, 2020, and 2027 Table 85: Spanish Aircraft Insulation Market Estimates and Forecasts in US$ Million by Material: 2020-2027 Table 86: Aircraft Insulation Market in Spain: Historic Analysis in US$ Million by Material for the period 2012-2019 Table 87: Spanish Aircraft Insulation Market Shares in Percentages by Material: 2012 VS 2020 VS 2027 RUSSIA Table 88: Russian Aircraft Insulation Market Estimates and Projections in US$ Million by Type: 2020 to 2027 Table 89: Aircraft Insulation Market in Russia by Type: A Historic Review in US$ Million for 2012-2019 Table 90: Russian Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 91: Aircraft Insulation Market in Russia in US$ Million by Material: 2020-2027 Table 92: Aircraft Insulation Historic Demand Patterns in Russia in US$ Million by Material: 2012-2019 Table 93: Russian Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 REST OF EUROPE Table 94: Rest of Europe Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020-2027 Table 95: Aircraft Insulation Market in Rest of Europe in US$ Million by Type: A Historic Review for the Period 2012-2019 Table 96: Rest of Europe Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 97: Aircraft Insulation Demand Potential in Rest of Europe in US$ Million by Material: 2020-2027 Table 98: Rest of Europe Aircraft Insulation Historic Market Analysis in US$ Million by Material: 2012-2019 Table 99: Aircraft Insulation Market in Rest of Europe: Breakdown of Sales by Material for 2012, 2020, and 2027 ASIA-PACIFIC Table 100: Asia-Pacific Aircraft Insulation Market Estimates and Forecasts in US$ Million by Region/Country: 2020-2027 Table 101: Aircraft Insulation Market in Asia-Pacific: Historic Market Analysis in US$ Million by Region/Country for the Period 2012-2019 Table 102: Asia-Pacific Aircraft Insulation Market Share Analysis by Region/Country: 2012 VS 2020 VS 2027 Table 103: Aircraft Insulation Market in Asia-Pacific by Type: Estimates and Projections in US$ Million for the Period 2020-2027 Table 104: Asia-Pacific Aircraft Insulation Historic Market Scenario in US$ Million by Type: 2012-2019 Table 105: Asia-Pacific Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 106: Aircraft Insulation Recent Past, Current & Future Market Analysis in Asia-Pacific in US$ Million by Material: 2020-2027 Table 107: Asia-Pacific Aircraft Insulation Market: Historic Review in US$ Million by Material for the Period 2012-2019 Table 108: Asia-Pacific Aircraft Insulation Market Share Shift by Material: 2012 VS 2020 VS 2027 AUSTRALIA Table 109: Aircraft Insulation Market in Australia: Recent Past, Current and Future Analysis in US$ Million by Type for the Period 2020-2027 Table 110: Australian Aircraft Insulation Historic Market Analysis in US$ Million by Type: 2012-2019 Table 111: Australian Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 112: Australian Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 113: Aircraft Insulation Market in Australia: Historic Demand Analysis in US$ Million by Material for the Period 2012-2019 Table 114: Australian Aircraft Insulation Market Share Distribution by Material: 2012 VS 2020 VS 2027 INDIA Table 115: Indian Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020 to 2027 Table 116: Indian Aircraft Insulation Historic Market Review by Type in US$ Million: 2012-2019 Table 117: Aircraft Insulation Market in India: Percentage Share Breakdown of Sales by Type for 2012, 2020, and 2027 Table 118: Indian Aircraft Insulation Market Estimates and Forecasts in US$ Million by Material: 2020-2027 Table 119: Aircraft Insulation Market in India: Historic Analysis in US$ Million by Material for the period 2012-2019 Table 120: Indian Aircraft Insulation Market Shares in Percentages by Material: 2012 VS 2020 VS 2027 SOUTH KOREA Table 121: Aircraft Insulation Market in South Korea: Recent Past, Current and Future Analysis in US$ Million by Type for the Period 2020-2027 Table 122: South Korean Aircraft Insulation Historic Market Analysis in US$ Million by Type: 2012-2019 Table 123: Aircraft Insulation Market Share Distribution in South Korea by Type: 2012 VS 2020 VS 2027 Table 124: Aircraft Insulation Market in South Korea: Recent Past, Current and Future Analysis in US$ Million by Material for the Period 2020-2027 Table 125: South Korean Aircraft Insulation Historic Market Analysis in US$ Million by Material: 2012-2019 Table 126: Aircraft Insulation Market Share Distribution in South Korea by Material: 2012 VS 2020 VS 2027 REST OF ASIA-PACIFIC Table 127: Rest of Asia-Pacific Market for Aircraft Insulation: Annual Sales Estimates and Projections in US$ Million by Type for the Period 2020-2027 Table 128: Aircraft Insulation Market in Rest of Asia-Pacific: Historic Sales Analysis in US$ Million by Type for the Period 2012-2019 Table 129: Rest of Asia-Pacific Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 130: Rest of Asia-Pacific Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 131: Aircraft Insulation Demand Patterns in Rest of Asia-Pacific in US$ Million by Material: 2012-2019 Table 132: Rest of Asia-Pacific Aircraft Insulation Market Share in Percentages by Material: 2012 VS 2020 VS 2027 LATIN AMERICA Table 133: Latin American Aircraft Insulation Market Trends by Region/Country in US$ Million: 2020-2027 Table 134: Aircraft Insulation Market in Latin America in US$ Million by Region/Country: A Historic Perspective for the Period 2012-2019 Table 135: Latin American Aircraft Insulation Market Percentage Breakdown of Sales by Region/Country: 2012, 2020, and 2027 Table 136: Latin American Aircraft Insulation Market Growth Prospects in US$ Million by Type for the Period 2020-2027 Table 137: Aircraft Insulation Historic Market Analysis in Latin America in US$ Million by Type: 2012-2019 Table 138: Latin American Aircraft Insulation Market by Type: Percentage Breakdown of Sales for 2012, 2020, and 2027 Table 139: Latin American Demand Estimates and Forecasts for Aircraft Insulation Market in US$ Million by Material: 2020-2027 Table 140: Aircraft Insulation Historic Demand Scenario in Latin America in US$ Million by Material: 2012-2019 Table 141: Latin American Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 ARGENTINA Table 142: Argentinean Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020-2027 Table 143: Aircraft Insulation Market in Argentina in US$ Million by Type: A Historic Review for the Period 2012-2019 Table 144: Argentinean Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 145: Aircraft Insulation Demand Potential in Argentina in US$ Million by Material: 2020-2027 Table 146: Argentinean Aircraft Insulation Historic Market Analysis in US$ Million by Material: 2012-2019 Table 147: Aircraft Insulation Market in Argentina: Breakdown of Sales by Material for 2012, 2020, and 2027 BRAZIL Table 148: Aircraft Insulation Market in Brazil by Type: Estimates and Projections in US$ Million for the Period 2020-2027 Table 149: Brazilian Aircraft Insulation Historic Market Scenario in US$ Million by Type: 2012-2019 Table 150: Brazilian Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 151: Aircraft Insulation Recent Past, Current & Future Market Analysis in Brazil in US$ Million by Material: 2020-2027 Table 152: Brazilian Aircraft Insulation Market: Historic Review in US$ Million by Material for the Period 2012-2019 Table 153: Brazilian Aircraft Insulation Market Share Shift by Material: 2012 VS 2020 VS 2027 MEXICO Table 154: Aircraft Insulation Market in Mexico: Recent Past, Current and Future Analysis in US$ Million by Type for the Period 2020-2027 Table 155: Mexican Aircraft Insulation Historic Market Analysis in US$ Million by Type: 2012-2019 Table 156: Mexican Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 157: Mexican Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 158: Aircraft Insulation Market in Mexico: Historic Demand Analysis in US$ Million by Material for the Period 2012-2019 Table 159: Mexican Aircraft Insulation Market Share Distribution by Material: 2012 VS 2020 VS 2027 REST OF LATIN AMERICA Table 160: Rest of Latin America Aircraft Insulation Market Estimates and Projections in US$ Million by Type: 2020 to 2027 Table 161: Aircraft Insulation Market in Rest of Latin America by Type: A Historic Review in US$ Million for 2012-2019 Table 162: Rest of Latin America Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 163: Aircraft Insulation Market in Rest of Latin America in US$ Million by Material: 2020-2027 Table 164: Aircraft Insulation Historic Demand Patterns in Rest of Latin America in US$ Million by Material: 2012-2019 Table 165: Rest of Latin America Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 MIDDLE EAST Table 166: The Middle East Aircraft Insulation Market Estimates and Forecasts in US$ Million by Region/Country: 2020-2027 Table 167: Aircraft Insulation Market in the Middle East by Region/Country in US$ Million: 2012-2019 Table 168: The Middle East Aircraft Insulation Market Share Breakdown by Region/Country: 2012, 2020, and 2027 Table 169: The Middle East Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020 to 2027 Table 170: The Middle East Aircraft Insulation Historic Market by Type in US$ Million: 2012-2019 Table 171: Aircraft Insulation Market in the Middle East: Percentage Share Breakdown of Sales by Type for 2012,2020, and 2027 Table 172: The Middle East Aircraft Insulation Market in US$ Million by Material: 2020-2027 Table 173: Aircraft Insulation Market in the Middle East: Historic Analysis in US$ Million by Material for the period 2012-2019 Table 174: The Middle East Aircraft Insulation Market Shares in Percentages by Material: 2012 VS 2020 VS 2027 IRAN Table 175: Iranian Market for Aircraft Insulation: Annual Sales Estimates and Projections in US$ Million by Type for the Period 2020-2027 Table 176: Aircraft Insulation Market in Iran: Historic Sales Analysis in US$ Million by Type for the Period 2012-2019 Table 177: Iranian Aircraft Insulation Market Share Analysis by Type: 2012 VS 2020 VS 2027 Table 178: Iranian Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 179: Aircraft Insulation Demand Patterns in Iran in US$ Million by Material: 2012-2019 Table 180: Iranian Aircraft Insulation Market Share in Percentages by Material: 2012 VS 2020 VS 2027 ISRAEL Table 181: Israeli Aircraft Insulation Market Estimates and Forecasts in US$ Million by Type: 2020-2027 Table 182: Aircraft Insulation Market in Israel in US$ Million by Type: A Historic Review for the Period 2012-2019 Table 183: Israeli Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 184: Aircraft Insulation Demand Potential in Israel in US$ Million by Material: 2020-2027 Table 185: Israeli Aircraft Insulation Historic Market Analysis in US$ Million by Material: 2012-2019 Table 186: Aircraft Insulation Market in Israel: Breakdown of Sales by Material for 2012, 2020, and 2027 SAUDI ARABIA Table 187: Saudi Arabian Aircraft Insulation Market Growth Prospects in US$ Million by Type for the Period 2020-2027 Table 188: Aircraft Insulation Historic Market Analysis in Saudi Arabia in US$ Million by Type: 2012-2019 Table 189: Saudi Arabian Aircraft Insulation Market by Type: Percentage Breakdown of Sales for 2012, 2020, and 2027 Table 190: Saudi Arabian Demand Estimates and Forecasts for Aircraft Insulation Market in US$ Million by Material: 2020-2027 Table 191: Aircraft Insulation Historic Demand Scenario in Saudi Arabia in US$ Million by Material: 2012-2019 Table 192: Saudi Arabian Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 UNITED ARAB EMIRATES Table 193: Aircraft Insulation Market in the United Arab Emirates: Recent Past, Current and Future Analysis in US$ Million by Type for the Period 2020-2027 Table 194: United Arab Emirates Aircraft Insulation Historic Market Analysis in US$ Million by Type: 2012-2019 Table 195: Aircraft Insulation Market Share Distribution in United Arab Emirates by Type: 2012 VS 2020 VS 2027 Table 196: Aircraft Insulation Market in the United Arab Emirates: Recent Past, Current and Future Analysis in US$ Million by Material for the Period 2020-2027 Table 197: United Arab Emirates Aircraft Insulation Historic Market Analysis in US$ Million by Material: 2012-2019 Table 198: Aircraft Insulation Market Share Distribution in United Arab Emirates by Material: 2012 VS 2020 VS 2027 REST OF MIDDLE EAST Table 199: Aircraft Insulation Market in Rest of Middle East: Recent Past, Current and Future Analysis in US$ Million by Type for the Period 2020-2027 Table 200: Rest of Middle East Aircraft Insulation Historic Market Analysis in US$ Million by Type: 2012-2019 Table 201: Rest of Middle East Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 202: Rest of Middle East Aircraft Insulation Market Estimates and Projections in US$ Million by Material: 2020-2027 Table 203: Aircraft Insulation Market in Rest of Middle East: Historic Demand Analysis in US$ Million by Material for the Period 2012-2019 Table 204: Rest of Middle East Aircraft Insulation Market Share Distribution by Material: 2012 VS 2020 VS 2027 AFRICA Table 205: African Aircraft Insulation Market Estimates and Projections in US$ Million by Type: 2020 to 2027 Table 206: Aircraft Insulation Market in Africa by Type: A Historic Review in US$ Million for 2012-2019 Table 207: African Aircraft Insulation Market Share Breakdown by Type: 2012 VS 2020 VS 2027 Table 208: Aircraft Insulation Market in Africa in US$ Million by Material: 2020-2027 Table 209: Aircraft Insulation Historic Demand Patterns in Africa in US$ Million by Material: 2012-2019 Table 210: African Aircraft Insulation Market Share Breakdown by Material: 2012 VS 2020 VS 2027 IV. COMPETITION Total Companies Profiled: 42 Read the full report: https://www.reportlinker.com/p05797850/?utm_source=GNW About Reportlinker ReportLinker is an award-winning market research solution. Reportlinker finds and organizes the latest industry data so you get all the market research you need – instantly, in one place. __________________________ CONTACT: Clare: clare@reportlinker.com US: (339)-368-6001 Intl: +1 339-368-6001

Economy

Poland has EU's second highest emissions in relation to size of economy – Notes From Poland

[unable to retrieve full-text content]

Poland has EU’s second highest emissions in relation to size of economy Notes From Poland

Source link

Economy

IMF's Georgieva warns "there's plenty to worry about'' in world economy — including inflation, debt – Yahoo Canada Finance

WASHINGTON (AP) — The head of the International Monetary Fund said Thursday that the world economy has proven surprisingly resilient in the face of higher interest rates and the shock of war in Ukraine and Gaza, but “there is plenty to worry about,” including stubborn inflation and rising levels of government debt.

“ Inflation is down but not gone,” Kristalina Georgieva told reporters at the spring meeting of the IMF and its sister organization, the World Bank. In the United States, she said, “the flipside” of unexpectedly strong economic growth is that it ”taking longer than expected” to bring inflation down.

Georgieva also warned that government debts are growing around the world. Last year, they ticked up to 93% of global economic output — up from 84% in 2019 before the response to the COVID-19 pandemic pushed governments to spend more to provide healthcare and economic assistance. She urged countries to more efficiently collect taxes and spend public money. “In a world where the crises keep coming, countries must urgently build fiscal resilience to be prepared for the next shock,” she said.

On Tuesday, the IMF said it expects to the global economy to grow 3.2% this year, a modest upgrade from the forecast it made in January and unchanged from 2023. It also expects a third straight year of 3.2% growth in 2025.

ADVERTISEMENT

The world economy has proven unexpectedly sturdy, but it remains weak by historical standards: Global growth averaged 3.8% from 2000 to 2019.

One reason for sluggish global growth, Georgieva said, is disappointing improvement in productivity. She said that countries had not found ways to most efficiently match workers and technology and that years of low interest rates — that only ended after inflation picked up in 2021 — had allowed “firms that were not competitive to stay afloat.”

She also cited in many countries an aging “labor force that doesn’t bring the dynamism” needed for faster economic growth.

The United States has been an exception to the weak productivity gains over the past year. Compared to Europe, Georgieva said, America makes it easier for businesses to bring innovations to the marketplace and has lower energy costs.

She said countries could help their economies by slashing bureaucratic red tape and getting more women into the job market.

Paul Wiseman, The Associated Press

Economy

Nigeria’s Economy, Once Africa’s Biggest, Slips to Fourth Place – BNN Bloomberg

(Bloomberg) — Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Africa’s most industrialized nation will remain the continent’s largest economy until Egypt reclaims the mantle in 2027, while Nigeria is expected to remain in fourth place for years to come, the data released this week shows.

Nigeria and Egypt’s fortunes have dimmed as they deal with high inflation and a plunge in their currencies.

Bola Tinubu has announced significant policy reforms since he became Nigeria’s president at the end of May 2023, including allowing the currency to float more freely, scrapping costly energy and gasoline subsidies and taking steps to address dollar shortages. Despite a recent rebound, the naira is still 50% weaker against the greenback than what it was prior to him taking office after two currency devaluations.

Read More: Why Nigeria’s Currency Rebounded and What It Means: QuickTake

Egypt, one of the emerging world’s most-indebted countries and the IMF’s second-biggest borrower after Argentina, has also allowed its currency to float, triggering an almost 40% plunge in the pound’s value against the dollar last month to attract investment.

The IMF had been calling for a flexible currency regime for many months and the multilateral lender rewarded Egypt’s government by almost tripling the size of a loan program first approved in 2022 to $8 billion. This was a catalyst for a further influx of around $14 billion in financial support from the European Union and the World Bank.

Read More: Egypt Avoided an Economic Meltdown. What Next?: QuickTake

Unlike Nigeria’s naira and Egypt’s pound, the value of South Africa’s rand has long been set in the financial markets and it has lost about 4% of its value against the dollar this year. Its economy is expected to benefit from improvements to its energy supply and plans to tackle logistic bottlenecks.

Algeria, an OPEC+ member has been benefiting from high oil and gas prices caused first by Russia’s invasion of Ukraine and now tensions in the Middle East. It stepped in to ease some of Europe’s gas woes after Russia curtailed supplies amid its war in Ukraine.

©2024 Bloomberg L.P.

-

Tech19 hours ago

Tech19 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

News21 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Politics24 hours ago

Politics24 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health15 hours ago

Health15 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Science24 hours ago

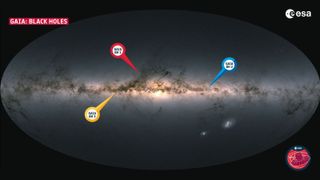

Science24 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Tech21 hours ago

Tech21 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

-

News14 hours ago

2024 federal budget's key takeaways: Housing and carbon rebates, students and sin taxes – CBC News

-

Tech20 hours ago

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life