Economy

Opinion: Say hi to the new weak, stagnant economy. It'll be here for a while – The Globe and Mail

Shoppers walk past a boarded up storefront on Saint-Catherine Street in downtown Montreal, Dec. 19, 2023.Christinne Muschi/The Canadian Press

Craig Alexander has served as chief economist at Deloitte Canada, the Conference Board of Canada and Toronto-Dominion Bank.

The Canadian economy is struggling with high interest rates and a housing affordability crisis. Yet the message from the Bank of Canada is one of tough love. The central bank is not willing to lower interest rates until the war against inflation is decisively won. This has far-reaching implications.

The most immediate implication is that the Canadian economy will remain weak this year. While it does look like a soft landing is being achieved, with a recession avoided, the bad news is that the economy is likely to stagnate and there will be pockets of domestic weakness that will add to some of Canada’s leading economic challenges.

The latest economic data drives home this point. While the economy managed to post meagre growth of 1.0 per cent at an annualized rate in the fourth quarter of 2023, the slim gain was largely the product of strong export growth that speaks to the relative economic strength of the U.S. economy. In contrast, Canadian consumer spending on a per-person basis fell and domestic demand contracted by 0.7 per cent annualized in the final quarter of last year.

High interest rates and their impact on demand are deterring business investment in machinery and equipment, which contracted at a 5.7 per cent annualized rate in the fourth quarter, the fifth drop in six quarters. This is disheartening because Canada needs more investment in capital per worker to boost productivity. In 2023, labour productivity fell by 1.8 per cent, marking a third consecutive annual decline. This is a problem because productivity is the primary source of a rising standard of living. Before the COVID-19 pandemic, labour productivity growth was responsible for 90 per cent of the rise in income per capita.

Elevated borrowing costs are also adding to Canada’s housing affordability crisis. The Bank of Canada is worried about cutting interest rates because it fears that lower rates will reignite Canadian residential real estate markets, which could push up shelter costs and make it more difficult to return inflation to 2 per cent. While this is a distinct possibility, it should also be acknowledged that high mortgage rates are reducing the pool of homebuyers, keeping more individuals in rental markets that are overheating. Rents rose 7.9 per cent year-over-year in January.

Montreal real estate market sees ‘dynamic start’ to 2024 as February home sales rise

High interest rates are also making it more expensive for rental property owners to finance their buildings – mortgage interest costs were up 27.4 per cent year-over-year in January – and this too is adding to rent increases. Higher capital costs for builders, reflecting elevated interest rates, has also weighed down residential construction, which fell 10.2 per cent in 2023, at a time when inadequate supply of homes is contributing to the affordability crisis.

The combination of weak demand and high borrowing costs is also causing businesses financial strains. Business insolvencies have soared in recent months, surging 48.8 per cent in January, reaching a 17-year high and 163 per cent above prepandemic levels.

These are examples of the economic costs being incurred to lower inflation and they are trends that are likely to persist in the near term. Eventually, the economic weakness will sufficiently dampen inflation to motivate the central bank to begin cutting interest rates.

Financial markets are betting that the central bank will ease policy in June or July, but some commentators are warning that we might not see interest rate relief until the fall. It should be stressed, however, that the future pace of monetary policy easing is likely to be gradual. If so, it will take many months, and likely well into 2025, for interest rates to drop to a level that no longer applies brakes to the economy.

Make no mistake, the Bank of Canada will win the war against inflation, and this is a good thing. High inflation deeply erodes the standard of living of Canadians. Inflation is also highly regressive, hurting low-income Canadians the most. The brutal inflation shock we have just lived through demonstrates why price stability is so important.

But returning us to low and stable inflation is creating its own set of economic scars, and it is adding to some of Canada’s structural economic challenges of weak business investment, poor productivity and housing affordability problems.

Economy

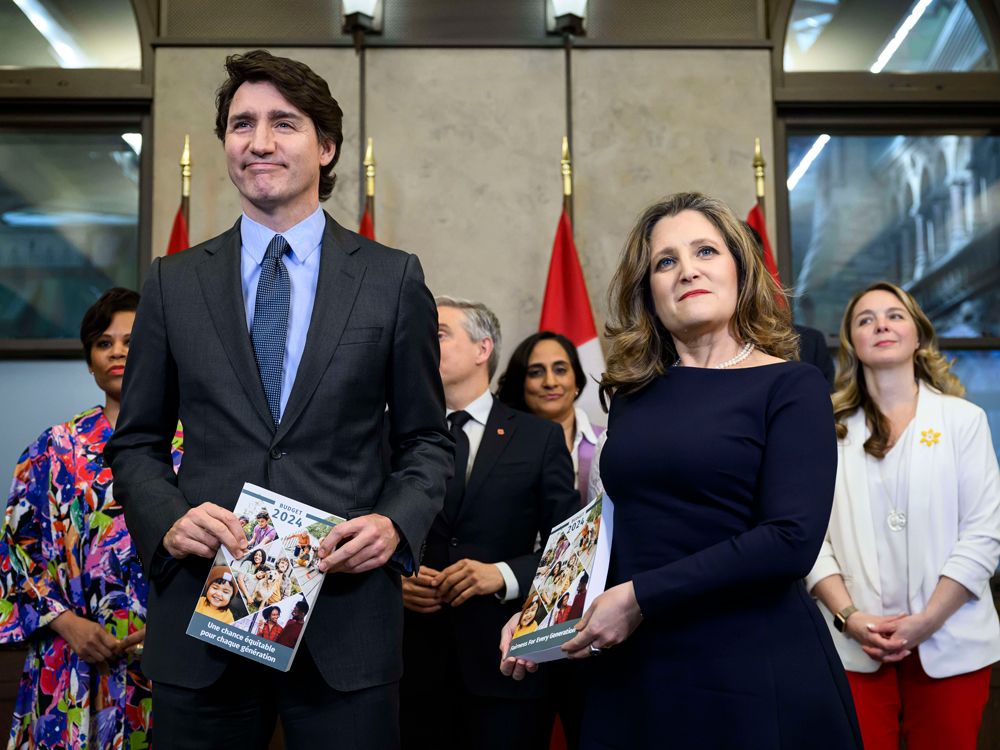

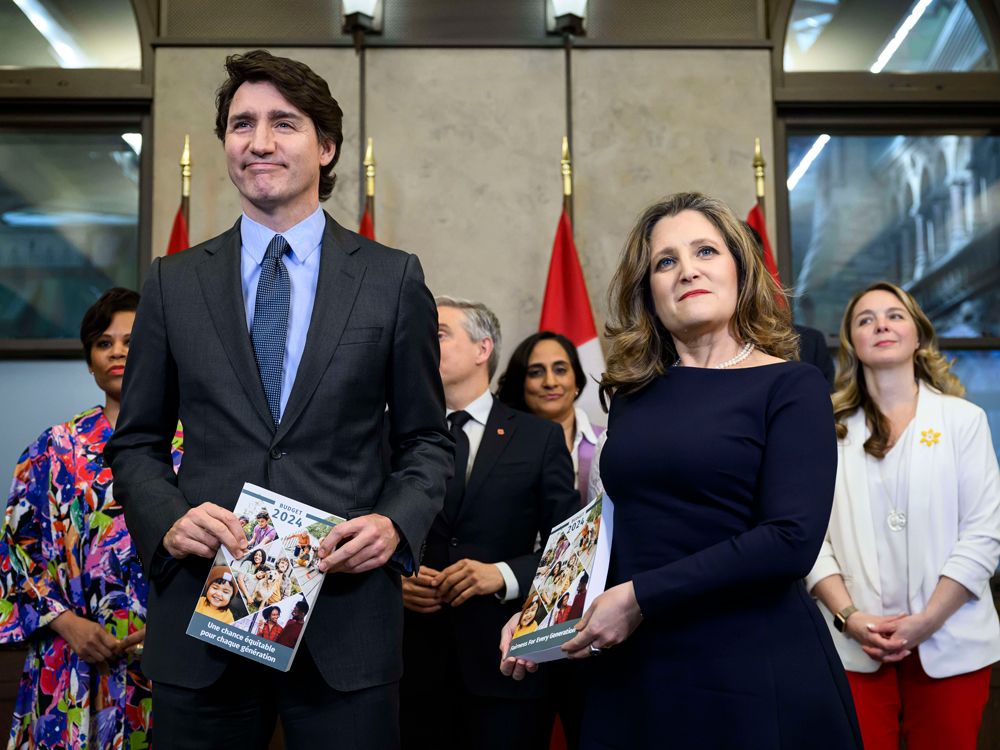

PM: Millennials and Gen Z drive Canadian economy – CTV News Montreal

[unable to retrieve full-text content]

- PM: Millennials and Gen Z drive Canadian economy CTV News Montreal

- Canada’s budget 2024 and what it means for the economy Financial Post

- Federal budget is about ensuring fair economy for ‘everyone’: Trudeau Global News

Economy

Climate Change Will Cost Global Economy $38 Trillion Every Year Within 25 Years, Scientists Warn – Forbes

Topline

Climate change is on track to cost the global economy $38 trillion a year in damages within the next 25 years, researchers warned on Wednesday, a baseline that underscores the mounting economic costs of climate change and continued inaction as nations bicker over who will pick up the tab.

Key Facts

Damages from climate change will set the global economy back an estimated $38 trillion a year by 2049, with a likely range of between $19 trillion and $59 trillion, warned a trio of researchers from Potsdam and Berlin in Germany in a peer reviewed study published in the journal Nature.

To obtain the figure, researchers analyzed data on how climate change impacted the economy in more than 1,600 regions around the world over the past 40 years, using this to build a model to project future damages compared to a baseline world economy where there are no damages from human-driven climate change.

The model primarily considers the climate damages stemming from changes in temperature and rainfall, the researchers said, with first author Maximilian Kotz, a researcher at the Potsdam Institute for Climate Impact Research, noting these can impact numerous areas relevant to economic growth like “agricultural yields, labor productivity or infrastructure.”

Importantly, as the model only factored in data from previous emissions, these costs can be considered something of a floor and the researchers noted the world economy is already “committed to an income reduction of 19% within the next 26 years,” regardless of what society now does to address the climate crisis.

Global costs are likely to rise even further once other costly extremes like weather disasters, storms and wildfires that are exacerbated by climate change are considered, Kotz said.

The researchers said their findings underscore the need for swift and drastic action to mitigate climate change and avoid even higher costs in the future, stressing that a failure to adapt could lead to average global economic losses as high as 60% by 2100.

!function(n) if(!window.cnxps) window.cnxps=,window.cnxps.cmd=[]; var t=n.createElement(‘iframe’); t.display=’none’,t.onload=function() var n=t.contentWindow.document,c=n.createElement(‘script’); c.src=’//cd.connatix.com/connatix.playspace.js’,c.setAttribute(‘defer’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c) ,n.head.appendChild(t) (document);

(function()

function createUniqueId()

return ‘xxxxxxxx-xxxx-4xxx-yxxx-xxxxxxxxxxxx’.replace(/[xy]/g, function(c) 0,

v = c == ‘x’ ? r : (r & 0x3 );

const randId = createUniqueId();

document.getElementsByClassName(‘fbs-cnx’)[0].setAttribute(‘id’, randId);

document.getElementById(randId).removeAttribute(‘class’);

(new Image()).src = ‘https://capi.connatix.com/tr/si?token=546f0bce-b219-41ac-b691-07d0ec3e3fe1’;

cnxps.cmd.push(function ()

cnxps(

playerId: ‘546f0bce-b219-41ac-b691-07d0ec3e3fe1’,

storyId: ”

).render(randId);

);

)();

How Do The Costs Of Inaction Compare To Taking Action?

Cost is a major sticking point when it comes to concrete action on climate change and money has become a key lever in making climate a “culture war” issue. The costs and logistics involved in transitioning towards a greener, more sustainable economy and moving to net zero are immense and there are significant vested interests such as the fossil fuel industry, which is keen to retain as much of the profitable status quo for as long as possible. The researchers acknowledged the sizable costs of adapting to climate change but said inaction comes with a cost as well. The damages estimated already dwarf the costs associated with the money needed to keep climate change in line with the limits set out in the 2015 Paris Climate Agreement, the researchers said, referencing the globally agreed upon goalpost set to minimize damage and slash emissions. The $38 trillion estimate for damages is already six times the $6 trillion thought needed to meet that threshold, the researchers said.

Crucial Quote

“We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer,” said study author Anders Levermann. The researcher, also of the Potsdam Institute, explained there is a “considerable inequity of climate impacts” around the world and that “further temperature increases will therefore be most harmful” in tropical countries. “The countries least responsible for climate change” are expected to suffer greater losses, Levermann added, and they are “also the ones with the least resources to adapt to its impacts.”

What To Watch For

The fundamental inequality over who is impacted most by climate change and who has benefited most from the polluting practices responsible for the climate crisis—who also have more resources to mitigate future damages—has become one of the most difficult political sticking points when it comes to negotiating global action to reduce emissions. Less affluent countries bearing the brunt of climate change argue wealthy nations like the U.S. and Western Europe have already reaped the benefits from fossil fuels and should pay more to cover the losses and damages poorer countries face, as well as to help them with the costs of adapting to greener sources of energy. Other countries, notably big polluters India and China, stymie negotiations by arguing they should have longer to wean themselves off of fossil fuels as their emissions actually pale in comparison to those of more developed countries when considered in historical context and on a per capita basis. Climate financing is expected to be key to upcoming negotiations at the United Nations’s next climate summit in November. The COP29 summit will be held in Baku, the capital city of oil-rich Azerbaijan.

Further Reading

Economy

Canada's budget 2024 and what it means for the economy – Financial Post

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

-

Tech21 hours ago

Tech21 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Sports21 hours ago

Sports21 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

Science24 hours ago

Science24 hours agoAstronomers discover Milky Way's heaviest known black hole – Xinhua

-

News19 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Media23 hours ago

NPR's liberal bias: Editor exposes media's lack of viewpoint diversity – USA TODAY

-

News16 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Tech19 hours ago

Tech19 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Investment15 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum