Written by Itay Sagie, a lecturer and strategic adviser to startups and investors. He is also co-founder of VCforU.com, which helps over 17,000 startups with their investor one-pagers while hundreds of investors use the platform for deal flow. Sagie is also the Israeli adviser at Allied Advisers, a boutique investment bank from Silicon Valley. You can connect with him on LinkedIn and follow him on Twitter at @itaysagie.

When COVID-19 hit us around five months ago, we initially thought it would have no effect outside China.

We soon discovered that it had turned into a massive global pandemic, which brought down entire industries such as travel and hospitality. As tech entrepreneurs and investors, we are experiencing a great deal of uncertainty around where the market will go: Would customers be willing to pay for our products or services, how has COVID-19 affected them, and for how long?

Subscribe to the Crunchbase Daily

Uncertainty leads to reduced spending in all aspects of our lives, including VC investing. To avoid panic, many of the VC funds, which are obligated to invest their capital, have openly announced they are open for business and that startups should not stop approaching them. Some publications have even said that early-stage startups will not be hit as much since they have a grace period of a few years before reaching the market.

A closer look at the data reveals the actual impact COVID-19 has had on the VC landscape. In this article we will review several trends we analyzed, based on Crunchbase data.

Method: Utilizing Crunchbase, we analyzed U.S. VC investments in seed, Series A and Series B rounds, from the past three months–March 18-June 17, 2020–and compared it to the same period in 2019. This revealed some interesting insights. 1

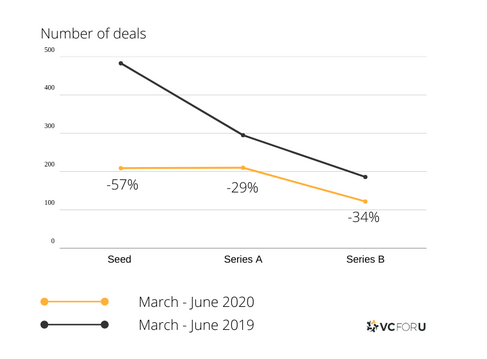

COVID-19 slashed the number of VC rounds in the U.S. by 44 percent

As expected, COVID-19 did hit the VC investment landscape. Over the course of the past three months, only 541 VC deals were made in the seed to Series B stages, compared with 964 deals in the same period in 2019–a 44 percent decrease in deals. The change varies across investment types, having the biggest impact on seed-stage deals, which dropped by 57 percent, down from 483 deals in 2019 within the three-month time period, to 209 deals in the March-June 2020 period.

Source: VCforU analysis based on Crunchbase data

Check size effect of COVID-19 greatly varies across industries

Looking at the impact of COVID on check sizes, on average the check sizes did not change. However, when analyzing each industry separately, we see a completely different picture. See the average check size across all industries: 2

Source: VCforU analysis based on Crunchbase data

As visible on the chart above, on average there was little to no effect on round size. VC-backed seed rounds in the U.S. are $4 million on average, these numbers climb up to $21 million and $62 million for Series A and Series B, respectively.

A look at the data by industry shows there is a different trend in each sector across investment types.

Source: VCforU analysis based on Crunchbase data

As visible from the chart above, Series A data companies have seen an increase in check sizes by 90 percent rising to $25 million average Series A check size in 2020 from $13 million Series A check size in 2019. Artificial intelligence startups also saw a significant increase in check sizes within the VC-backed seed stage, rising to an average of $4.3 million in 2020 from $3.3 million in 2019.

Source: VCforU analysis based on Crunchbase data

As visible from the chart, it is no surprise that the travel tech industry has suffered the most due to COVID-19 in both the number of deals and check sizes. Health companies have also become more attractive in 2020, bringing in 19 percent larger checks in seed rounds and 18 percent larger checks on Series B rounds compared to 2019.

Series B tech funding has taken a big hit

A noticeable trend is that three out of four industries have seen a decline in series B deals. Only health companies did not experience this decline in Series B check sizes. This can be explained by the fact that health companies need more late-stage capital before reaching sales, while tech companies reach the market earlier. I also believe that investors today are more conservative and wish to see the later-stage companies being less reliant on investors and more sales-driven; focusing on good unit economics and sustainable growth. This leaves more capital to boost the fewer early-stage investments with more capital, giving their portfolio companies the competitive advantage of growth capital while the competition is downsizing and simply trying to survive.

Travel tech has taken the biggest hit of all

As one can imagine, the number of VC-backed deals in the travel tech industry has decreased dramatically, down 400 percent, from 15 seed to Series B deals during March-June 2019 to three deals March-June 2020.

Source: VCforU analysis based on Crunchbase data

As we showed earlier, the check size of travel tech companies has been massively hit. VC-backed Series A check sizes in the sector have dropped 84 percent, from $14.68 million in 2019 to $2.3 million in 2020.

Summary and hopes for the future

As I have experience firsthand, working with partners in the U.S., Israel, Europe and Asia, COVID-19 has impacted all our lives on a massive global scale. These days we rarely leave our cities, let alone fly internationally. Global investors may invest without seeing the startup, but that will be very rare.

Customers may buy your product without meeting you in person, however, making a large B2B sale without meeting the client is difficult. We all hope to see the world go back to “normal” as soon as possible. I personally have high hopes that a vaccine or therapy will be available within a year, after which we will have a new “normal” on our hands.

As innovative entrepreneurs and investors, we need to adapt and see this as an opportunity to identify new trends which will take over. These may be remote work, remote health, e-commerce, automation, data privacy trends that will continue to rise, alternative ways to invest our capital and more. Those who will innovate and adapt themselves to the new norm, will succeed despite and even thanks to the pandemic.

Illustration: Dom Guzman