The first morning audience listened to former US secretary of state Mike Pompeo who warned the investors that it had become “impossible to separate geopolitical risk from capital allocation”.

A week later, at another event down the street in Miami, former Trump White House chief of staff Reince Priebus was the keynote speaker at JPMorgan’s flagship event for high-yield bond dealmakers. When the futures and derivatives industry convened up the coast in Boca Raton the following month, a prominent historian was brought in to lecture attendees on the “era of rising political turbulence”.

At the Milken Institute conference in Beverly Hills in May, one of the world’s largest gatherings of top money managers and their clients, there were speakers from the US state department, the White House National Security Council, West Point and Nato, a former major general and multiple current and former world leaders.

Investors, it seems, cannot stop talking about politics.

On the surface, it is not hard to see why given the flurry of elections taking place around the world — from the drama of the Biden-Trump debate, to the prospect of a far-right government in France to the votes in Mexico and India. Investors have nervously watched conflict in the Middle East, nuclear sabre-rattling from Russian President Vladimir Putin and escalating tensions in the South China Sea.

For some in the industry, this is more than just a deluge of alarming headlines. Increasingly, many senior executives believe the world is going through not just a temporary bout of political volatility, but a structural shift that will have a long-term impact on the investment world.

“Over the past 20 or 30 years, [geopolitics] has been deflationary, created lower risk and made it easier to invest,” says Ali Dibadj, chief executive of Janus Henderson, the British-American investment group that manages about $353bn in assets. “Going forward it is the complete opposite: it is probably inflationary; it is probably going to create more risk; and it is going to make it harder to invest.”

An industry that over the past two decades has been hoovering up mathematicians to devise new trading strategies is now leaning on political scientists for guidance. Most investors are used to dealing with pockets of instability and conflict, but many say the sheer number of recent shocks — even in traditionally stable democracies — and the long-term nature of conflicts represent a sea change.

Last year BlackRock, the world’s largest asset manager, added “geopolitical fragmentation” to its list of the most important trends impacting on global growth and markets, putting it on a par with new technology, global demographic shifts and climate change. When Optiver, the market making firm, kicked off 2024 with a list of “top tail risks” for financial markets, more than half were focused on politics, from a contested US presidential election result to escalation in the war between Russia and Ukraine.

Yet for all the apparent angst, financial markets have shown few signs of worry, especially in the US.

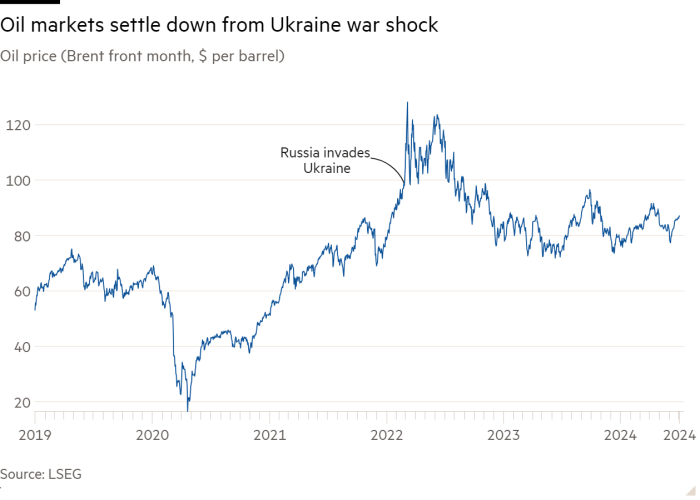

A barrel of Brent crude oil costs less than it did the day before Russia invaded Ukraine. Stock indexes across the developed world have surged to record highs. The biggest winner of the rally has been Nvidia, the US chip designer that generated almost half of its revenues in 2023 from China and Taiwan and has repeatedly cautioned about the negative impact of US-China trade tensions. Government bond investors have shrugged off repeated warnings about spiralling US debt levels.

The dichotomy raises some important questions. If investors are really so worried about politics, what is the best way to adapt trading strategies? Should asset managers and dealmakers be doing more to adjust to a new world of heightened political tensions, or will markets be able to quietly absorb shocks the same way they have in recent decades?

“I don’t recall a time where there were so many hot conflicts that affected so many markets,” says Harvey Sawikin, co-founder of Firebird, a hedge fund that specialises in investing in eastern Europe. Even experts, he says, can “get very complacent about a country, and get blindsided”.

The most obvious way some investment companies have adjusted is by rushing to bring in more geopolitical expertise, either in-house or through outside consultants.

“Those people are in high demand,” says Seth Bernstein, chief executive of AllianceBernstein. “Every Wall Street firm is bringing around people like that for [investors] to meet . . . there’s a profound realignment happening, and it does spook the hell out of me.”

Alice Squires, partner and co-head of investor advisory at Rothschild & Co, agrees that experts who can give clients a bespoke perspective are “very much in vogue now” as globally focused managers need to stay on top of an unprecedented number of potential problems.

“We are faced with the fact that there are risks arising from Russia and Ukraine, as well as China and Taiwan, tensions from Kosovo . . . to politically unstable regions in South America,” she says, also highlighting the conflict in Gaza and multiple tense elections.

Theodore Bunzel, head of geopolitical advisory at Lazard, says the firm set up a dedicated political unit in 2022 as clients were increasingly demanding advice on how to navigate investments in regions such as China. He says the team has been expanding rapidly since and was advising Lazard’s own asset management division as well as its financial advisory clients.

“In the past, the impulse was to remove politics from corporate decision making,” Bunzel says, but that is becoming impossible due to “tension between large, interconnected powers”.

Goldman Sachs followed suit last year with a geopolitical advisory unit led by partners George Lee and Jared Cohen, while PR firm Brunswick — best known for advising clients on mergers and acquisitions situations — has hired a string of advisers with geopolitical expertise including a former president of the World Bank, a former director-general of the World Trade Organization, and a former director of the US National Security Agency.

Many more firms have been recruiting individual experts to provide internal advice. Boutique investment bank Centerview recently hired Richard Haass, the former head of the Council on Foreign Relations, as a senior counsellor. Lord Mark Sedwill, the former head of the British civil service, is a member of the risk committee at Rothschild, while Schroders has brought in former British ambassador to China, Sir Sebastian Wood, and Sir Nicholas Carter, former chief of the defence staff in the UK, to advise on geopolitics and navigating international conflict.

Having the experts “on the payroll” gives a necessary, complementary skillset to investment teams, says Peter Harrison, chief executive of Schroders. “As politics becomes more fractured . . . It’s good to just bring a non-investment perspective into what’s happening in the world.

“One thing that I think we’ve all learnt over the last 10 years is that seeing geopolitics clearly is really hard,” he says. “Heading into more uncertainty, [Carter] will be helping our portfolio managers [with] how you manage uncertainty, how you manage war, and how war unfolds.”

Even though most benchmark stock indexes like the S&P 500 have remained buoyant, there are some signs beneath the surface that the industry is integrating geopolitics into more of its investment decisions.

The most obvious cases have been the ways investors have responded to Russia’s full-scale invasion of Ukraine in 2022. For example, investors poured almost $3bn into aerospace and defence-focused funds between February and April 2022, according to Morningstar Direct data. Strong inflows have continued since, in contrast to 13 consecutive months of net withdrawals in the run-up to the invasion.

Firebird, the eastern European-focused hedge fund, had at least half of its assets in Russia at the time of the invasion, many of which were frozen and marked down to zero within days.

“It was a reminder that the politics is not to ever be taken for granted,” says Sawikin, who leads the firm’s eastern European and Russian investments. “You can love your portfolio from the bottom up, but if something major goes wrong at the macro level you’re going to have a big problem.”

Few western investors had such a large direct exposure to Russia, but the experience led many to consider how a shock like a Chinese invasion of Taiwan could have a similar effect at a much greater scale.

The number of funds offering investors a way to invest in emerging markets while excluding China has ballooned from eight at the start of 2022 to 20 today, according to Morningstar, and inflows have exploded as tensions between the US and China have worsened.

Almost $1bn a month has been invested into EM ex-China funds this year, up from an average of about $500mn a month in 2023 and $200mn a month in 2022.

Others are turning to even more explicitly political funds. This year Tikehau Capital, the Paris-listed group that manages $48bn in assets, launched a “European Sovereignty Fund” as a response to “escalating geopolitical tensions and the repercussions of excessive globalisation”. Germany’s DWS recently opened a US “National Critical Technologies” fund, which attempts to pick stocks based on quantitative measures of geopolitical risk.

Thomas Friedberger, Tikehau Capital’s deputy chief executive, says: “Our conviction is that deglobalisation is probably triggering a switch in the way financial value is created: instead of the creation of efficiency it is from the creation of resilience.”

Discussions of “geopolitics” and related terms during the earnings calls and conference appearances of S&P 500 companies surged after the invasion of Ukraine, and have remained elevated since, according to AlphaSense data. Almost half of companies in the US benchmark index have discussed politics in analyst calls or events over the past 12 months.

Friedberger says there is a greater sense of urgency among investors in continental Europe than in America, with Europeans having felt the impact of geopolitics more acutely since Russia’s invasion of Ukraine. He says he was also surprised by the amount of early interest in the European Sovereignty Fund that had come from institutional investors in China.

“I still meet a lot of peers who say it’s not a big deal,” he says. “[but] the closer those events are to you, the higher the impact on your way of thinking.”

For all the growing discussion of political risks among investors, some industry observers suggest it often amounts to little more than lip service.

Chip equipment maker Applied Materials, for example, told investors in a regulatory filing in October 2022 that it was being investigated by the US authorities over its exports to customers in China, but analysts took little notice until it was highlighted by a news report more than a year later.

The stock, which at the time had a market capitalisation of about $130bn, initially dropped 8 per cent on the news report. For Ted Mortonson, a technology strategist at RW Baird, the belated response highlights a broader problem.

“The subpoena was [reported] in October 2022, but Wall Street is lazy — they didn’t do any further work on it,” he says.

Mortonson, a former US Navy pilot who flew in the Middle East and South China Sea, has spent years trying to convince investors to pay more attention to politics, but with tech stocks almost constantly scaling new heights, most shrugged it off. Applied Materials recovered from that drop within a month and it has rallied strongly this year.

When news broke of a potential Chinese government crackdown on Apple last September, its stock shed $200bn in market capitalisation in the space of two days, but it was back at a record high within two months.

With these kinds of precedents, the fear of missing out means even investors who are personally worried about politics are unlikely to let it sway their investment decisions.

Some believe the incentive structure of the industry makes investors less likely to take decisions based on political risks. If the entire market tanks in response to a sudden event, an individual portfolio manager probably would not suffer reputational damage for missing a risk that few people noticed. But if their caution causes the fund to miss out on a marketwide rally, they will be blamed.

“Being a first mover isn’t likely to be rewarded,” says Tina Fordham, the founder of advisory firm Fordham Global Foresight. “That’s why we are in this state where . . . people give more credence to the idea that they need to be more aware of risks, but they’re not actually trading on them.”

“Institutional portfolios change very slowly because people are risk averse and [portfolio managers] don’t have any great geopolitical insight,” agrees Bernstein. “I think most people will wait and take the hit.”

So far, that has not been a bad tactic. Although BlackRock has repeatedly emphasised the growing importance of politics, its own study in 2019 found that “the average market response to unexpected geopolitical shocks has historically been relatively modest and shortlived”.

Even some of the experts being paid to advise on political risk think the recent hiring sprees may have gone overboard. One political specialist at a US investment bank argues that in most cases financial markets tend to have a bigger impact on politics than the other way around.

Liz Truss’s ill-fated “mini” Budget in September 2022 sparked a sell-off in government bond markets, but the sell-off had a bigger long-term impact on politics than the policy had on markets. The skyrocketing gilt yield helped force out the prime minister, then returned to its previous levels within a month.

Fordham says that the imprisonment of several prominent business leaders in China is the sort of shift that helped to permanently change investors’ willingness to invest in the Chinese market. But in general it takes “a big shock” to really change the widespread belief that markets will keep bouncing back.

“Normalcy bias is very common,” she says. “People assume things will be as they have been indefinitely and you will always get mean reversion . . . [but] I think there’s a massive failure of imagination going on.”