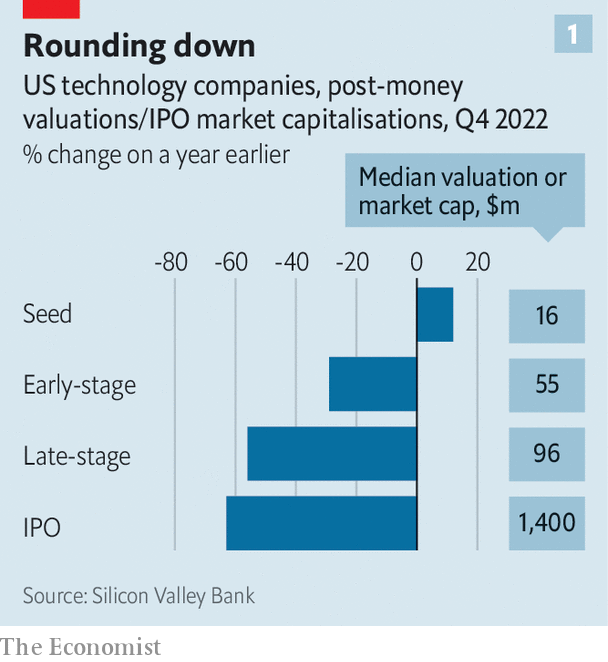

The VC giants’ newfound contrition comes on the back of a gigantic tech crash. The tech-heavy NASDAQ index fell by a third in 2022, making it one of the worst years on record and drawing comparisons with the dotcom bust of 2000-01. According to the Silicon Valley Bank, a tech-focused lender, between the fourth quarters of 2021 and 2022, the average value of recently listed tech stocks in America dropped by 63%. And the plunging public valuations dragged down private ones (see chart 1). The value of older, larger private firms (“late-stage” in the lingo) fell by 56% after funds marked down their assets or the firms raised new capital at lower valuations.

Investment

How the titans of tech investing are staying warm over the VC winter – The Economist

Venture capitalists are not known for their humility. But the world’s biggest investors in innovation have been striking a more humble tone of late. In a recent letter to investors Tiger Global, a hedge fund turned venture-capital (VC) investor, reportedly admitted that it had “underestimated” inflation and “overestimated” the boost the pandemic would give to the tech startups in its portfolio. In November Sequoia, a Silicon Valley VC blue blood, apologised to investors in its funds after the spectacular blow-up of FTX, a now defunct crypto-trading platform that it had backed. Speaking in January, Jeffrey Pichet Jaensubhakij, the chief investment officer of GIC, one of Singapore’s sovereign-wealth funds, said that he was “thinking much more soberly” about startup investing.

This has, predictably, had a chilling effect on the business of investing in startups. Soaring inflation and rising interest rates made companies whose promised profits lie primarily in the distant future look less attractive today. Scandals like FTX did not help. After a decade-long bull run, the amount of money flowing into startups globally declined by a third in 2022, calculates CB Insights, a data provider (see chart 2). In the final three months of 2022 it fell to $66bn, two-thirds lower than a year earlier; the number of mega-rounds, in which startups raise more than $100m, fell by 71%. Unicorns, the supposedly uncommon private firms valued at more than $1bn, became rarer again: the number of new ones contracted by 86%.

This turmoil is forcing the biggest venture investors—call them the VC whales—to shift their strategies. For Silicon Valley, it signals a reversion to a forgotten style of venture capitalism, with fewer deep-pocketed tourists splashing the cash and more bets on young companies by Silicon Valley stalwarts.

Misadventure capital

To understand the scale of VC’s reversal of fortune, consider its earlier bonanza. Between 2012 and 2021 annual global investments grew roughly ten-fold, to $638bn. Conventional VC firms faced competition from a new breed of investor from beyond Silicon Valley. These included hedge funds, the venture arms of multinational companies, from Shell to Samsung, and the world’s sovereign-wealth funds, some of which began investing in startups directly. Dealmaking turned frenetic. In 2021 Tiger Global inked almost one new deal a day. Across VC-dom activity “was a bit unhinged”, says Roelof Botha, boss of Sequoia Capital, “but rational”, given that low interest rates meant that money was virtually free. And “if you weren’t doing it, your competitor was.”

What passed for rationality in the boom times now looks somewhat insane. The downturn has spooked the VC funds’ main sources of capital—their limited partners (LPs). This group, which includes everyone from family offices and university endowments to industrial firms and pension funds, is growing more nervous. And stingier: lower returns from their current investments leave LPs with less capital to redeploy, and collapsing stockmarkets have left many of them overallocated to private firms, whose valuations take longer to adjust and whose share of some LPs’ portfolios thus suddenly exceeds their quotas. Preqin, a data firm, finds that in the last quarter of 2022 new money flowing into VC funds fell to $21bn, its lowest level since 2015.

What new VC funding there is increasingly flows into mega-funds. Data from PitchBook, a research firm, show that in America in 2022 funds worth more than $1bn accounted for 57% of all capital, up from 20% in 2018. How the VC whales behind these outsize pools of capital adapt to the VC winter will determine the shape of the industry in the years to come.

The venture cetaceans can be divided into three big subspecies, each typified by big-name investors. The startups they finance range from the newly founded, in need of “seed” funding, to the somewhat older, later stage firms that are looking to rapidly grow. First there is the conventional Silicon Valley royalty, such as Sequoia and Andreessen Horowitz. The second group comprises the private tourists, such as Tiger and its New York hedge-fund rival, Coatue, as well as SoftBank, a gung-ho Japanese investment house. Then there are the sovereign-wealth funds, such as Singapore’s GIC and Temasek, Saudi Arabia’s Public Investment Fund (PIF) and Mubadala of the United Arab Emirates. As well as investing directly, these entities are LPs in other VC funds; PIF, for example, is a large backer of SoftBank’s Vision Fund.

Together these nine institutions ploughed more than $200bn into startups in 2021 alone, or roughly a third of the global total (not counting the state funds’ indirect investments as LPs). All nine have been badly damaged by last year’s crash. Sequoia’s crossover fund, which invested in both public and private firms, reportedly lost two-fifths of its value in 2022. Temasek’s listed holdings on American exchanges shrank by about the same. SoftBank’s mammoth Vision Funds, which together raised around $150bn, lost more than $60bn, wiping out their previous gains. In a sign that things were terrible, its typically garrulous boss, Son Masayoshi, sat out its latest earnings call on February 7th. Tiger reportedly lost over half of the value of its flagship hedge fund and marked down its private investments by about a quarter, torching $42bn in value and leading one VC grandee to speculate that the hedge fund might turn itself into a family office.

All three groups have reined in their investments. But each has responded to the downturn in distinct ways. That is in part because it has affected them to different degrees.

The private outsiders have been hardest hit. The combined number of startup investments by the three firms in our sample fell by 76% between the second half of 2021 and the same period in 2022. Tiger has lowered the target for its latest fund from $6bn to $5bn; its previous one raised $13bn. In October Phillipe Laffont, Coatue’s boss, said that the hedge fund was holding 70-80% of its assets in cash. The firm has also raised $2bn for its “tactical solutions fund”, designed to give mature startups access to debt and other resources, as an alternative to raising equity at diminished valuations during a market downturn. SoftBank has all but stopped investing in new startups. Instead, in the second half of 2022 most of its capital went to well-performing portfolio firms, says Lydia Jett, a partner at the Vision Fund.

The other two groups are also retrenching, but not as drastically. According to data from PitchBook, in the second half of 2022 the number of deals struck by Sequoia and Andreessen Horowitz fell by a combined 47%. Direct investments by the four sovereign funds in our sample slowed by a more modest 31% in the same period, no doubt thanks to their governments’ deep pockets and longer time horizons.

Taken together, venture capitalists’ slowing pace of investment has left them with a record amount of capital that LPs had already pledged to stump up but that has yet to be put to use. Last year the amount of this “dry powder” was just shy of $300bn in America alone (see chart 3). According to data from PitchBook, our five private whales are sitting on a combined $50bn or so; the sovereign investors hold their numbers close to their chest but are likely to be of a similar order of magnitude, all told. Some of it may wait a long while to be deployed, if it ever is. But some will find grateful recipients. Who those recipients are also depends on which group of whales you look at.

Conventional VCs and the hedge funds are focusing on younger “early-stage” firms. in part because volatility in the public markets makes it harder to value more mature companies that hope to list in the near future. Mr Botha says that Sequoia has doubled the number of “seed” deals with the youngest companies in 2022, compared with 2021. In January the firm launched its fifth seed fund, worth $195m. Last April Andreessen Horowitz launched an “accelerator” programme to nurture startups. About half the startups Tiger backed in 2022 were worth $50m or less, compared with just a fifth in 2021, according to PitchBook.

Early-stage firms are unlikely to be the only recipient of VC cash. David DiPietro, head of private equity at T. Rowe Price, a fund-management group, thinks that startups selling “must-have” products, such as cyber-security services, or cost-cutting tools, such as budgeting software, should fare well. Money will also keep flowing to well-managed businesses with strong balance-sheets., expects Kelly Rodriques, chief executive of Forge, a marketplace for private securities. Firms with buzzy new technologies, such as artificial-intelligence chatbots and other forms of whizzy “generative AI”, are also likely to attract investments—especially if those technologies already work in practice and underpin a viable business model.

Another category of startups likely to gain favour comprises those involved in industries that governments deem strategic. In America, that means climate-friendly technology and advanced manufacturing, on which Uncle Sam is showering subsidies and government contracts. Some 8% of the deals all our whales made in the second half of 2022 involved firms working on technologies to combat climate change, for example, up from 2% in the same period of 2021. Last year Andreessen Horowitz launched an “American Dynamism” fund, which partly invests in firms that rely on government procurement, such as Anduril, a defence-tech startup.

Sovereign-wealth funds are likely to be looking elsewhere. Seed deals are simply too small for them: whereas the typical early-stage American company is worth about $50m, in 2021 the median value of startups backed by the sovereign funds was a whopping $650m. And to them, what counts as “must-have” startups is somewhat different, determined less by the market or other states’ strategic imperatives, and more by their own governments’ nation-building plans.

On February 16th PIF said it would take a stake in VSPO, a Chinese platform for video-game tournaments. This is part of a plan dreamed up by Muhammad bin Salman, the Saudi crown prince, to invest $38bn in “e-sports” by 2030 and make Saudi Arabia a gamer’s mecca. Temasek invests heavily in firms that develop technology to boost food production. In the past year it backed Upside Foods, a startup selling lab-grown meat, and InnovaFeed, a maker of insect-based protein. This is motivated by Singapore’s goal of locally producing 30% of the city-state’s nutritional needs by 2030, up from about 10% in 2020. Rohit Sipahimalani, chief investment officer of Temasek, thinks that over the next few years his focus will shift towards “breakthrough innovation rather than incremental innovation”, on the back of government support of strategic tech.

One group of firms is likely to see less investment from our whales, however: those in China. The Communist Party’s harsh two-year crackdown on consumer technology may be easing but the VC titans remain wary of what was until recently one of the world’s hottest startup scenes. An executive at a big venture fund says that in the past, foreign investors in China knew that the government would be respectful of their capital. Now, he sighs, it feels like the government “has pulled the rug out from underneath us”.

Tiger has said that there is a “high bar” for new investments in China. GIC has reportedly scaled back its investments in China-focused private funds. Mr Sipahimalani of Temasek says diplomatically that he is trying to avoid investing in “areas caught in the cross-hairs of US-China tension”. Sequoia is reportedly asking external experts to screen new investments made by its Chinese arm into quantum computing and semiconductors, two such contentious areas. All told, the number of our whales’ deals with Chinese startups fell from 22% of the total in 2021 to 16% in 2022.

After the dotcom crunch VC investments needed nearly two decades to return to their previous peak. Today’s tech industry is more mature, startups’ balance-sheets are stronger and, according to the Silicon Valley Bank, their peak valuations relative to sales are lower than in 2000-01. This time the whales of VC are unlikely to need 20 years to nurse their wounds. But the experience will have lasting effects on the sort of businesses they back. ■

Investment

TFSAs, RRSPs and more could see changes in allowed investments – Investment Executive

“It’s a useful and probably much needed exercise,” said Carl Hinzmann, partner with Gowling WLG in Toronto. “If they can get the [qualified investments definitions] down to a singular definition, I think it would be significantly easier for the investment community that’s trying to provide advice and develop products.”

Holding a non-qualified or prohibited investment can lead to severe tax consequences: the plan would incur a 50% tax on the fair market value of the non-qualified or prohibited investment at the time it was acquired or changed status, and the investment’s income also would be taxable.

The consultation asked stakeholders to consider whether updated rules should favour Canada-based investments. Hinzmann likened this to the debate about whether pension funds should invest more domestically.

“I don’t think tax legislation is the appropriate way to tell pension funds to invest their money, so why [do that to] ordinary Canadians?” he said.

To achieve the goal of favouring Canadian investments, Hinzmann said the government could either require a certain percentage of domestic investments or treat domestic investments more favourably within a plan. Canada had a foreign content limit for RRSPs and RRIFs from 1971 to 2005, which ranged from 10% to 30%.

The budget acknowledged that the qualified investment rules “can be inconsistent or difficult to understand” due to their many updates since their introduction in 1966.

For example, different plans have slightly different rules for making investments in small businesses; certain types of annuities are qualified investments only for RRSPs, RRIFs and RDSPs; and certain pooled investment products are qualified investments only if they are registered with the Canada Revenue Agency.

“There’s no good policy reason” for the inconsistencies, Hinzmann said, adding that the purpose of the rules is to ensure registered plans hold stable, liquid products and that the planholder does not gain a personal tax advantage.

By having unwieldy, inconsistent rules, “all you’re really doing is increasing costs for the people offering these investment services to Canadians,” he said.

The budget asked for suggestions on how to improve the regime. In addition to questioning whether the rules should favour Canadian investments, the budget asked stakeholders to consider the pros and cons of harmonizing the small-business and annuities rules; whether crypto-backed assets should be considered qualified investments; and whether a registration process is indeed required for certain pooled investment products.

Hinzmann said the consultation’s highlighting of crypto-backed assets suggests the government may be questioning whether investment funds that hold cryptocurrency should be included in registered plans, though he acknowledged the government also could wish to expand the types of crypto products allowed.

Cryptocurrency itself is a non-qualifying investment in registered plans.

The qualified investments consultation ends July 15.

Qualified, non-qualifying and prohibited investments

Registered plans are allowed to hold a wide range of investments, including cash, GICs, bonds, mutual funds, ETFs, shares of a company listed on a designated exchange, and private shares under certain conditions. These are called qualified investments.

However, investments such as land, general partnership units and cryptocurrency are generally non-qualifying investments. (A cryptocurrency ETF is qualified if it’s listed on a designated exchange.)

A prohibited investment is property to which the planholder is “closely connected.” This includes a debt of the planholder or a debt or share of, or an interest in, a corporation, trust or partnership in which the planholder has an interest of 10% or more. A debt or a share of, or an interest in, a corporation, trust or partnership in which the planholder does not deal at arm’s length also is prohibited.

A registered plan that acquires or holds a non-qualified or prohibited investment is subject to a 50% tax on the fair market value of the investment at the time it was acquired or became non-qualified or prohibited. However, a refund of the tax is available if the property is disposed of, unless the planholder acquired the investment knowing it could become non-qualified or prohibited.

Income from a non-qualified investment is considered taxable to the plan at the highest marginal rate. Income earned by a prohibited investment is subject to an advantage tax of 100%, payable by the planholder.

A non-qualified investment that is also a prohibited investment is treated as prohibited.

Investment

Bill Morneau slams Freeland’s budget as a threat to investment, economic growth

|

|

Finance Minister Chrystia Freeland’s predecessor Bill Morneau says there was talk of increasing the capital gains tax when he was on the job — but he resisted such a change because he feared it would discourage investment by companies and job creators.

He said Canada can expect that investment drought now, in response to a federal budget that targets high-end capital gains for a tax hike.

“This was very clearly something that, while I was there, we resisted. We resisted it for a very specific reason — we were concerned about the growth of the country,” he said at a post-budget Q&A session with KPMG, one of the country’s large accounting firms.

Morneau, who served as Prime Minister Justin Trudeau’s finance minister from 2015 to 2020 before leaving after reports of a rift, said Wednesday that Freeland’s move to hike the inclusion rate from one-half to two-thirds on capital gains over $250,000 for individuals, and on all gains for corporations and trusts, is “clearly a negative to our long-term goal, which is growth in the economy, productive growth and investments.”

Morneau said the wealthy, business owners and corporations — the people most likely to face a higher tax burden as a result of Freeland’s change — will think twice about investing in Canada because they stand to make less money on their investments.

“We’ve created a disincentive and that’s very difficult. I think we always have to recognize any measure that creates a disincentive for investment not only impacts us within the country but also impacts foreign investors that are looking at our country,” he said.

“I don’t think there’s any way to sugarcoat it. It’s a challenge. It’s probably very troubling for many investors.”

KPMG accountants on hand for Morneau’s remarks said they’ve already received calls from some clients worried about how the capital gains change will affect their investments.

Praise from progressives

While Freeland’s move to tax the well-off to pay for new spending is catching heat from wealthy businesspeople like Morneau, and from the Canadian Chamber of Commerce, progressive groups said they were pleased by the change.

“We appreciate moves to increase taxes on the wealthiest Canadians and profitable corporations,” said the Canadian Labour Congress.

“We have been calling on the government to fix the unfair tax break on capital gains for a decade,” said Katrina Miller, the executive director of Canadians for Tax Fairness. “Today we are pleased to see them take action and decrease the tax gap between wage earners and wealthy investors.”

“This is how housing, pharmacare and a Canada disability benefit are afforded. If this is the government’s response to spending concerns, let’s bring it on. It’s about time we look at Canada’s revenue problem,” said the Canadian Centre for Policy Alternatives.

The capital gains tax change was pitched by Freeland as a way to make the tax system fairer — especially for millennials and Generation Z Canadians who face falling behind the economic status of their parents and grandparents.

“We are making Canada’s tax system more fair by ensuring that the very wealthiest pay their fair share,” Freeland said Tuesday after tabling her budget in Parliament.

WATCH: New investment to lead ‘housing revolution in Canada,’ Freeland says

Finance Minister and Deputy Prime Minister Chrystia Freeland said this year’s federal budget will pave the way for Canada to build more homes at a pace not seen since the Second World War. The new investment and changes to funding models will also cut through red tape and break down zoning barriers for people who want to build homes faster, she said

The capital gains tax, which the government says will raise about $19 billion over five years, is also being pitched as a way to help pay for the government’s ambitious housing plan.

The plan is geared toward young voters who have struggled to buy a home. Average housing prices in Canada are among the highest in the world and interest rates are at 20-year highs.

Tuesday’s budget document says some wealthy people who make money off asset sales and dividends — instead of income from a job — can face a lower tax burden than working and middle-class people.

Morneau, who comes from a wealthy family and married into another one, is on the board of directors of CIBC and Clairvest, a private equity management firm that manages about $4 billion in assets.

According to government data, only 0.13 per cent of Canadians — people with an average income of about $1.4 million a year — are expected to pay more on their capital gains as a result of this change.

But there’s also a chance less wealthy people will pay more as a result of the change.

Put simply, capital gains occur when you sell certain property for more than you paid for it.

While capital gains from the sale of a primary residence will remain untaxed, the tax change could affect the sales of cottages and other seasonal and investment properties, along with stocks and mutual funds sold at a profit.

A cottage bought years ago and sold for a gain of more than $250,000 would see part of the proceeds taxed at the new higher rate.

But there’s some protection for people who sell a small business or a farming or fishing property — the lifetime capital gains exemption is going up by about 25 per cent to $1.25 million for those taxpayers.

Freeland said Tuesday she anticipates some blowback.

“I know there will be many voices raised in protest. No one likes paying more tax, even — or perhaps particularly — those who can afford it the most,” she said.

“Tax policy is not only, or chiefly, the province of accountants or economists. It belongs to all of us because it is how we decide what kind of country we want to live in and what kind of country we want to build.”

Morneau had little praise for what his successor included in her fourth budget.

Morneau said Canada’s GDP per capita is declining, growth is limited and productivity is lagging other countries — making the country as a whole less wealthy than it was.

Canada has a growth problem, Morneau warns

The government is more interested in rolling out new costly social programs than introducing measures that will reverse some of those troubling national wealth trends, he said.

“Canada is not growing at the pace we need it to grow and if you can’t grow the size of the pie, it’s not easy to figure out how to share the proceeds,” he said.

“You think about that first before you add new programs and the government’s done exactly the opposite.”

The U.S. has a “dynamic investment culture,” something that has turbo-charged economic growth and kept unemployment at decades-low levels, Morneau said. Canada doesn’t have that luxury, he said.

He said Freeland hasn’t done enough to rein in the size of the federal government, which has grown on Trudeau’s watch.

The deficit is now roughly double what it was when he left office, Morneau noted.

“There wasn’t enough done to reduce spending,” he said, while offering muted praise for the government’s decision to focus so much of its spending on the housing conundrum. “The priority was appropriate.”

Investment

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

|

|

Article content

RIYADH, Saudi Arabia — The Saudi Ministry of Tourism is currently taking a prominent stage at the International Hospitality Investment Forum (IHIF), presenting a unique opportunity for global investors to dive into the thriving tourism landscape of the Kingdom. With the spotlight on the Tourism Investment Enablers Program (TIEP), that was recently announced, Saudi Arabia is aggressively pushing towards its Vision 2030 goal of being a top global tourism destination for investors and tourists alike.

Article content

This strategic presentation comes at a time when Saudi Arabia’s tourism sector celebrates an incredible milestone of 100 million visitors in 2023, seven years ahead of schedule, marking a significant stride towards economic diversification and emphasizing the sector’s growing contribution to the national GDP. The flagship Hospitality Investment Enablers (HIE), one of TIEP’s initiatives, aims to leverage this momentum, planning an investment infusion into the hospitality sector of up to SAR 42 billion in key destinations, which alone is anticipated to create 120,000 new jobs by 2030.

Article content

The IHIF audience is getting a close look at Saudi Arabia’s plans to expand its accommodation capacity dramatically. The Kingdom is targeting an increase in hotel rooms to over 500,000 and aiming to welcome 150 million visitors annually by 2030. The HIE stands at the core of these ambitions, designed to energize the hospitality sector by introducing a new wave of supply in targeted tourism hotspots, significantly enriching the Kingdom’s diverse tourism offerings.

The initiative is supported by a suite of strategic enablers, including access to government-owned land under favorable terms, streamlined project development processes, and regulatory adjustments aimed at reducing barriers to market entry and operational costs. This comprehensive approach is expected to catalyze a significant socio-economic transformation within the Kingdom, with private sector investments projected to reach SAR 42.3 billion and a forecasted annual GDP increase of SAR 16.4 billion by 2030.

Saudi Arabia’s active participation in IHIF aims to showcase the Kingdom as an enticing investment frontier for international investors, emphasizing the lucrative opportunities within the tourism and hospitality sectors. This global stage provides the perfect platform for the Ministry of Tourism to forge lasting partnerships and highlight the Kingdom’s commitment to elevating its tourism industry standards, fostering sustainable growth, and offering robust support to investors.

Through this engagement, the Saudi Ministry of Tourism is not just showcasing investment opportunities; it is inviting the world to be a part of Saudi Arabia’s ambitious journey towards redefining global tourism norms. Investors are encouraged to seize this unparalleled chance to collaborate with the Kingdom, as it paves the way for a new era of tourism excellence aligned with Vision 2030’s transformative objectives.

-

Tech18 hours ago

Tech18 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Sports18 hours ago

Sports18 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

Politics24 hours ago

Politics24 hours agoTrump gave MAGA politicians permission to move left on abortion. Some are taking it. – Semafor

-

Science21 hours ago

Science21 hours agoAstronomers discover Milky Way's heaviest known black hole – Xinhua

-

Business23 hours ago

Traders Place Bets On $250 Oil – OilPrice.com

-

News16 hours ago

Toronto airport gold heist: Police announce nine arrests – CP24

-

Tech16 hours ago

Tech16 hours agoVenerable Video App Plex Emerges As FAST Favorite – Forbes

-

Business24 hours ago

After 5 years, Budget 2024 lays out promised small business carbon rebate – Global News