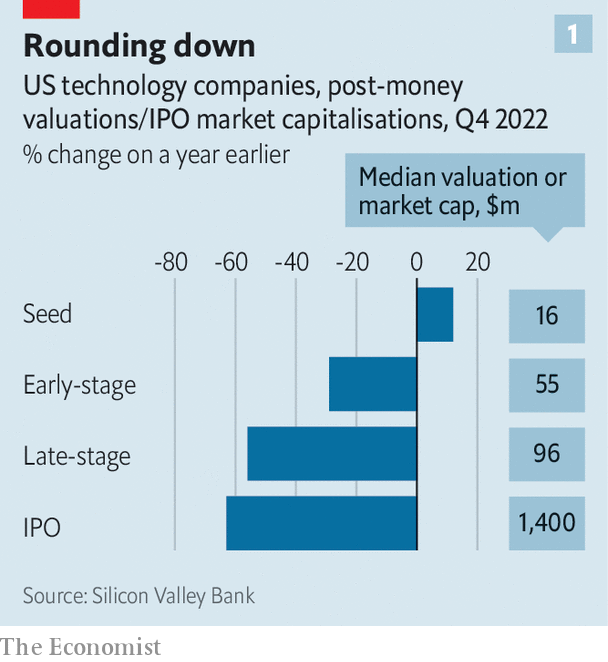

The VC giants’ newfound contrition comes on the back of a gigantic tech crash. The tech-heavy NASDAQ index fell by a third in 2022, making it one of the worst years on record and drawing comparisons with the dotcom bust of 2000-01. According to the Silicon Valley Bank, a tech-focused lender, between the fourth quarters of 2021 and 2022, the average value of recently listed tech stocks in America dropped by 63%. And the plunging public valuations dragged down private ones (see chart 1). The value of older, larger private firms (“late-stage” in the lingo) fell by 56% after funds marked down their assets or the firms raised new capital at lower valuations.

Investment

How the titans of tech investing are staying warm over the VC winter – The Economist

Venture capitalists are not known for their humility. But the world’s biggest investors in innovation have been striking a more humble tone of late. In a recent letter to investors Tiger Global, a hedge fund turned venture-capital (VC) investor, reportedly admitted that it had “underestimated” inflation and “overestimated” the boost the pandemic would give to the tech startups in its portfolio. In November Sequoia, a Silicon Valley VC blue blood, apologised to investors in its funds after the spectacular blow-up of FTX, a now defunct crypto-trading platform that it had backed. Speaking in January, Jeffrey Pichet Jaensubhakij, the chief investment officer of GIC, one of Singapore’s sovereign-wealth funds, said that he was “thinking much more soberly” about startup investing.

This has, predictably, had a chilling effect on the business of investing in startups. Soaring inflation and rising interest rates made companies whose promised profits lie primarily in the distant future look less attractive today. Scandals like FTX did not help. After a decade-long bull run, the amount of money flowing into startups globally declined by a third in 2022, calculates CB Insights, a data provider (see chart 2). In the final three months of 2022 it fell to $66bn, two-thirds lower than a year earlier; the number of mega-rounds, in which startups raise more than $100m, fell by 71%. Unicorns, the supposedly uncommon private firms valued at more than $1bn, became rarer again: the number of new ones contracted by 86%.

This turmoil is forcing the biggest venture investors—call them the VC whales—to shift their strategies. For Silicon Valley, it signals a reversion to a forgotten style of venture capitalism, with fewer deep-pocketed tourists splashing the cash and more bets on young companies by Silicon Valley stalwarts.

Misadventure capital

To understand the scale of VC’s reversal of fortune, consider its earlier bonanza. Between 2012 and 2021 annual global investments grew roughly ten-fold, to $638bn. Conventional VC firms faced competition from a new breed of investor from beyond Silicon Valley. These included hedge funds, the venture arms of multinational companies, from Shell to Samsung, and the world’s sovereign-wealth funds, some of which began investing in startups directly. Dealmaking turned frenetic. In 2021 Tiger Global inked almost one new deal a day. Across VC-dom activity “was a bit unhinged”, says Roelof Botha, boss of Sequoia Capital, “but rational”, given that low interest rates meant that money was virtually free. And “if you weren’t doing it, your competitor was.”

What passed for rationality in the boom times now looks somewhat insane. The downturn has spooked the VC funds’ main sources of capital—their limited partners (LPs). This group, which includes everyone from family offices and university endowments to industrial firms and pension funds, is growing more nervous. And stingier: lower returns from their current investments leave LPs with less capital to redeploy, and collapsing stockmarkets have left many of them overallocated to private firms, whose valuations take longer to adjust and whose share of some LPs’ portfolios thus suddenly exceeds their quotas. Preqin, a data firm, finds that in the last quarter of 2022 new money flowing into VC funds fell to $21bn, its lowest level since 2015.

What new VC funding there is increasingly flows into mega-funds. Data from PitchBook, a research firm, show that in America in 2022 funds worth more than $1bn accounted for 57% of all capital, up from 20% in 2018. How the VC whales behind these outsize pools of capital adapt to the VC winter will determine the shape of the industry in the years to come.

The venture cetaceans can be divided into three big subspecies, each typified by big-name investors. The startups they finance range from the newly founded, in need of “seed” funding, to the somewhat older, later stage firms that are looking to rapidly grow. First there is the conventional Silicon Valley royalty, such as Sequoia and Andreessen Horowitz. The second group comprises the private tourists, such as Tiger and its New York hedge-fund rival, Coatue, as well as SoftBank, a gung-ho Japanese investment house. Then there are the sovereign-wealth funds, such as Singapore’s GIC and Temasek, Saudi Arabia’s Public Investment Fund (PIF) and Mubadala of the United Arab Emirates. As well as investing directly, these entities are LPs in other VC funds; PIF, for example, is a large backer of SoftBank’s Vision Fund.

Together these nine institutions ploughed more than $200bn into startups in 2021 alone, or roughly a third of the global total (not counting the state funds’ indirect investments as LPs). All nine have been badly damaged by last year’s crash. Sequoia’s crossover fund, which invested in both public and private firms, reportedly lost two-fifths of its value in 2022. Temasek’s listed holdings on American exchanges shrank by about the same. SoftBank’s mammoth Vision Funds, which together raised around $150bn, lost more than $60bn, wiping out their previous gains. In a sign that things were terrible, its typically garrulous boss, Son Masayoshi, sat out its latest earnings call on February 7th. Tiger reportedly lost over half of the value of its flagship hedge fund and marked down its private investments by about a quarter, torching $42bn in value and leading one VC grandee to speculate that the hedge fund might turn itself into a family office.

All three groups have reined in their investments. But each has responded to the downturn in distinct ways. That is in part because it has affected them to different degrees.

The private outsiders have been hardest hit. The combined number of startup investments by the three firms in our sample fell by 76% between the second half of 2021 and the same period in 2022. Tiger has lowered the target for its latest fund from $6bn to $5bn; its previous one raised $13bn. In October Phillipe Laffont, Coatue’s boss, said that the hedge fund was holding 70-80% of its assets in cash. The firm has also raised $2bn for its “tactical solutions fund”, designed to give mature startups access to debt and other resources, as an alternative to raising equity at diminished valuations during a market downturn. SoftBank has all but stopped investing in new startups. Instead, in the second half of 2022 most of its capital went to well-performing portfolio firms, says Lydia Jett, a partner at the Vision Fund.

The other two groups are also retrenching, but not as drastically. According to data from PitchBook, in the second half of 2022 the number of deals struck by Sequoia and Andreessen Horowitz fell by a combined 47%. Direct investments by the four sovereign funds in our sample slowed by a more modest 31% in the same period, no doubt thanks to their governments’ deep pockets and longer time horizons.

Taken together, venture capitalists’ slowing pace of investment has left them with a record amount of capital that LPs had already pledged to stump up but that has yet to be put to use. Last year the amount of this “dry powder” was just shy of $300bn in America alone (see chart 3). According to data from PitchBook, our five private whales are sitting on a combined $50bn or so; the sovereign investors hold their numbers close to their chest but are likely to be of a similar order of magnitude, all told. Some of it may wait a long while to be deployed, if it ever is. But some will find grateful recipients. Who those recipients are also depends on which group of whales you look at.

Conventional VCs and the hedge funds are focusing on younger “early-stage” firms. in part because volatility in the public markets makes it harder to value more mature companies that hope to list in the near future. Mr Botha says that Sequoia has doubled the number of “seed” deals with the youngest companies in 2022, compared with 2021. In January the firm launched its fifth seed fund, worth $195m. Last April Andreessen Horowitz launched an “accelerator” programme to nurture startups. About half the startups Tiger backed in 2022 were worth $50m or less, compared with just a fifth in 2021, according to PitchBook.

Early-stage firms are unlikely to be the only recipient of VC cash. David DiPietro, head of private equity at T. Rowe Price, a fund-management group, thinks that startups selling “must-have” products, such as cyber-security services, or cost-cutting tools, such as budgeting software, should fare well. Money will also keep flowing to well-managed businesses with strong balance-sheets., expects Kelly Rodriques, chief executive of Forge, a marketplace for private securities. Firms with buzzy new technologies, such as artificial-intelligence chatbots and other forms of whizzy “generative AI”, are also likely to attract investments—especially if those technologies already work in practice and underpin a viable business model.

Another category of startups likely to gain favour comprises those involved in industries that governments deem strategic. In America, that means climate-friendly technology and advanced manufacturing, on which Uncle Sam is showering subsidies and government contracts. Some 8% of the deals all our whales made in the second half of 2022 involved firms working on technologies to combat climate change, for example, up from 2% in the same period of 2021. Last year Andreessen Horowitz launched an “American Dynamism” fund, which partly invests in firms that rely on government procurement, such as Anduril, a defence-tech startup.

Sovereign-wealth funds are likely to be looking elsewhere. Seed deals are simply too small for them: whereas the typical early-stage American company is worth about $50m, in 2021 the median value of startups backed by the sovereign funds was a whopping $650m. And to them, what counts as “must-have” startups is somewhat different, determined less by the market or other states’ strategic imperatives, and more by their own governments’ nation-building plans.

On February 16th PIF said it would take a stake in VSPO, a Chinese platform for video-game tournaments. This is part of a plan dreamed up by Muhammad bin Salman, the Saudi crown prince, to invest $38bn in “e-sports” by 2030 and make Saudi Arabia a gamer’s mecca. Temasek invests heavily in firms that develop technology to boost food production. In the past year it backed Upside Foods, a startup selling lab-grown meat, and InnovaFeed, a maker of insect-based protein. This is motivated by Singapore’s goal of locally producing 30% of the city-state’s nutritional needs by 2030, up from about 10% in 2020. Rohit Sipahimalani, chief investment officer of Temasek, thinks that over the next few years his focus will shift towards “breakthrough innovation rather than incremental innovation”, on the back of government support of strategic tech.

One group of firms is likely to see less investment from our whales, however: those in China. The Communist Party’s harsh two-year crackdown on consumer technology may be easing but the VC titans remain wary of what was until recently one of the world’s hottest startup scenes. An executive at a big venture fund says that in the past, foreign investors in China knew that the government would be respectful of their capital. Now, he sighs, it feels like the government “has pulled the rug out from underneath us”.

Tiger has said that there is a “high bar” for new investments in China. GIC has reportedly scaled back its investments in China-focused private funds. Mr Sipahimalani of Temasek says diplomatically that he is trying to avoid investing in “areas caught in the cross-hairs of US-China tension”. Sequoia is reportedly asking external experts to screen new investments made by its Chinese arm into quantum computing and semiconductors, two such contentious areas. All told, the number of our whales’ deals with Chinese startups fell from 22% of the total in 2021 to 16% in 2022.

After the dotcom crunch VC investments needed nearly two decades to return to their previous peak. Today’s tech industry is more mature, startups’ balance-sheets are stronger and, according to the Silicon Valley Bank, their peak valuations relative to sales are lower than in 2000-01. This time the whales of VC are unlikely to need 20 years to nurse their wounds. But the experience will have lasting effects on the sort of businesses they back. ■

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite little changed in late-morning trading, U.S. stock markets down

TORONTO – Canada’s main stock index was little changed in late-morning trading as the financial sector fell, but energy and base metal stocks moved higher.

The S&P/TSX composite index was up 0.05 of a point at 24,224.95.

In New York, the Dow Jones industrial average was down 94.31 points at 42,417.69. The S&P 500 index was down 10.91 points at 5,781.13, while the Nasdaq composite was down 29.59 points at 18,262.03.

The Canadian dollar traded for 72.71 cents US compared with 73.05 cents US on Wednesday.

The November crude oil contract was up US$1.69 at US$74.93 per barrel and the November natural gas contract was up a penny at US$2.67 per mmBTU.

The December gold contract was up US$14.70 at US$2,640.70 an ounce and the December copper contract was up two cents at US$4.42 a pound.

This report by The Canadian Press was first published Oct. 10, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

News23 hours ago

A look at what people are saying about the Bank of Canada’s rate decision

-

News19 hours ago

Abdelrazik tells of despair when Ottawa denied him passport to return home from Sudan

-

News23 hours ago

BoC delivers half percentage point rate cut, says it now must keep inflation at 2%

-

News18 hours ago

Quick Quotes: What Liberal MPs have to say as the caucus debates Trudeau’s future

-

News22 hours ago

Nova Scotia premier announces one point cut to HST, to 14 per cent, starting April 1

-

News22 hours ago

University of Waterloo stabber should face lengthy sentence: Crown

-

Business1 hour ago

Hiring Is a Process of Elimination

-

News12 hours ago

Search of Manitoba landfill for remains of slain First Nations women on track: Kinew