Economy

Hunt May Delay Cuts to Shield UK Economy and Tory Election Hopes

|

|

(Bloomberg) — UK Chancellor Jeremy Hunt is expected to delay much of the £55 billion ($65 billion) of savings to fill the hole in the public finances until after the next election in an attempt to protect the economy and shore up Tory support as the country heads into recession.

Hunt will unveil measures to bring the national debt under control in his Autumn Statement on Nov. 17, with around 40% of the savings coming from tax rises and 60% from spending cuts. The bulk will be delivered in the final years of the five-year forecast to protect growth now, two people familiar with the plans said.

Official figures on Friday revealed that GDP shrank for the first time since the start of 2021 in the three months to September. The Bank of England says the UK is in a recession that will, in the best case, last about a year.

“I want to make sure that this recession, if we are in one, is as short and shallow as possible,” Hunt said in an interview on Sky News on Sunday. There will be measures “grow the economy,” he added, but they are likely to be aspirations with no upfront cash.

Speaking to Channel 4, Anne Boden, chief executive of Starling Bank, warned Hunt not to tighten so hard he chokes off growth. “The thing we need to do is to make sure we don’t over-correct. That is really, really dangerous.”

Market Expectations

En-route to the G-20 meetings in Bali, Prime Minister Rishi Sunak told reporters that putting the public finances on a sustainable trajectory was essential to “deliver on the expectations of international markets” and keep interest rates low. But he added that growth was key to being “able to cut people’s taxes over time and support public services. And you’ll hear that side of the equation from the chancellor as well.”

To fill the hole in the public finances, Hunt said everyone will have to pay more tax but, writing in the Sun on Sunday newspaper, he insisted “those with the broadest shoulders” will carry more of the load.

Freezing thresholds while wages rise would see millions of people dragged into higher tax brackets and would generate around £6 billion if extended for two more years until 2028.

“The government probably doesn’t want to fill the black hole today by taking money out of people’s pockets, so they will delay some of the savings,” said Chris Sanger, UK tax policy leader at EY and chairman of the Treasury’s Tax Professionals’ Forum.

Labour Leads

Hunt and Sunak need to balance a number of objectives, as well as ensuring policy works in tandem with the BOE’s thinking to avoid stoking inflation. And they need to demonstrate immediate fiscal credibility to reassure markets that Britain will pay its way after the recklessness of Liz Truss’s mini-budget.

At the same time, their party needs to close the opposition Labour Party’s 20-point lead before an election, which has to be held by 2025.

“The most important thing we can do right now is to restore stability, sort out our public finances, and get debt falling,” Hunt wrote in the Sun on Sunday. “That is the only way to grip inflation and keep those interest rate rises as low as possible.”

Jamie Rush and Dan Hanson, of Bloomberg Economics, estimate that a fiscal consolidation of £30 billion would require the BOE to raise rates from 3% to 4.25% next year, where they would stay until late 2024.

A £45 billion consolidation would keep rate rises to 4% and they would fall quickly in 2024, they said.

Hunt is planning a budget consolidation of about 2% of GDP, less than a quarter of what was required after the financial crisis.

The retrenchment will be spread across the five years to soften the blow and will also be strikingly different to the 2010-2018 episode, when four fifths of the savings were made in cuts to departmental budgets.

After 12 years of Tory budget tightening, it is far harder to cut spending without damaging public services. “In 2010, it was easier to identify low-value programs you might cut,” Carl Emmerson, deputy director of the Institute for Fiscal Studies, said. “Now, after a period of hard cuts, it’s hard to see any easy savings.”

As well as the departmental savings from tighter post-election spending plans, Hunt is expected to find about £5 billion of annual savings from the aid budget and as much as £10 billion by cutting planned investment spending back to historic averages.

That would take annual spending cuts to about £35 billion.

Other Tax Measures

Around £20 billion is expected to be raised from taxes. On top of action on income tax thresholds and the energy windfall tax extension, the tax-free allowance for dividend income is expected to be cut and the rate increased.

Shareholders and business owners, while bringing the tax closer to the rate that workers pay on their salaries.

Pension reliefs and capital gains tax changes are also under consideration, and planned changes to social care reform that limit lifetime costs to £86,000 may be delayed, saving up to £3 billion a year.

Local authorities may be given headroom to raise council taxes to offset some of the squeeze on their budgets.

Speaking to the BBC, Hunt signaled the government would likely extend measures to protect households from soaring gas and electricity bills, but that “there has to be some constraints” on the level of future aid once the current support plan ends in April.

In August, the government introduced an energy price cap intended to ensure that the average household will pay no more than £2,500 annually.

The cap was initially planned to last two years but later shortened. Hunt is expected to extend the scheme for another six months beyond April at a cost of £20 billion, about a third of the amount allocated for a six-month period in the current package, the Times of London reported.

Economy

Climate Change Will Cost Global Economy $38 Trillion Every Year Within 25 Years, Scientists Warn – Forbes

Topline

Climate change is on track to cost the global economy $38 trillion a year in damages within the next 25 years, researchers warned on Wednesday, a baseline that underscores the mounting economic costs of climate change and continued inaction as nations bicker over who will pick up the tab.

Key Facts

Damages from climate change will set the global economy back an estimated $38 trillion a year by 2049, with a likely range of between $19 trillion and $59 trillion, warned a trio of researchers from Potsdam and Berlin in Germany in a peer reviewed study published in the journal Nature.

To obtain the figure, researchers analyzed data on how climate change impacted the economy in more than 1,600 regions around the world over the past 40 years, using this to build a model to project future damages compared to a baseline world economy where there are no damages from human-driven climate change.

The model primarily considers the climate damages stemming from changes in temperature and rainfall, the researchers said, with first author Maximilian Kotz, a researcher at the Potsdam Institute for Climate Impact Research, noting these can impact numerous areas relevant to economic growth like “agricultural yields, labor productivity or infrastructure.”

Importantly, as the model only factored in data from previous emissions, these costs can be considered something of a floor and the researchers noted the world economy is already “committed to an income reduction of 19% within the next 26 years,” regardless of what society now does to address the climate crisis.

Global costs are likely to rise even further once other costly extremes like weather disasters, storms and wildfires that are exacerbated by climate change are considered, Kotz said.

The researchers said their findings underscore the need for swift and drastic action to mitigate climate change and avoid even higher costs in the future, stressing that a failure to adapt could lead to average global economic losses as high as 60% by 2100.

!function(n) if(!window.cnxps) window.cnxps=,window.cnxps.cmd=[]; var t=n.createElement(‘iframe’); t.display=’none’,t.onload=function() var n=t.contentWindow.document,c=n.createElement(‘script’); c.src=’//cd.connatix.com/connatix.playspace.js’,c.setAttribute(‘defer’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c) ,n.head.appendChild(t) (document);

(function()

function createUniqueId()

return ‘xxxxxxxx-xxxx-4xxx-yxxx-xxxxxxxxxxxx’.replace(/[xy]/g, function(c) 0,

v = c == ‘x’ ? r : (r & 0x3 );

const randId = createUniqueId();

document.getElementsByClassName(‘fbs-cnx’)[0].setAttribute(‘id’, randId);

document.getElementById(randId).removeAttribute(‘class’);

(new Image()).src = ‘https://capi.connatix.com/tr/si?token=546f0bce-b219-41ac-b691-07d0ec3e3fe1’;

cnxps.cmd.push(function ()

cnxps(

playerId: ‘546f0bce-b219-41ac-b691-07d0ec3e3fe1’,

storyId: ”

).render(randId);

);

)();

How Do The Costs Of Inaction Compare To Taking Action?

Cost is a major sticking point when it comes to concrete action on climate change and money has become a key lever in making climate a “culture war” issue. The costs and logistics involved in transitioning towards a greener, more sustainable economy and moving to net zero are immense and there are significant vested interests such as the fossil fuel industry, which is keen to retain as much of the profitable status quo for as long as possible. The researchers acknowledged the sizable costs of adapting to climate change but said inaction comes with a cost as well. The damages estimated already dwarf the costs associated with the money needed to keep climate change in line with the limits set out in the 2015 Paris Climate Agreement, the researchers said, referencing the globally agreed upon goalpost set to minimize damage and slash emissions. The $38 trillion estimate for damages is already six times the $6 trillion thought needed to meet that threshold, the researchers said.

Crucial Quote

“We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer,” said study author Anders Levermann. The researcher, also of the Potsdam Institute, explained there is a “considerable inequity of climate impacts” around the world and that “further temperature increases will therefore be most harmful” in tropical countries. “The countries least responsible for climate change” are expected to suffer greater losses, Levermann added, and they are “also the ones with the least resources to adapt to its impacts.”

What To Watch For

The fundamental inequality over who is impacted most by climate change and who has benefited most from the polluting practices responsible for the climate crisis—who also have more resources to mitigate future damages—has become one of the most difficult political sticking points when it comes to negotiating global action to reduce emissions. Less affluent countries bearing the brunt of climate change argue wealthy nations like the U.S. and Western Europe have already reaped the benefits from fossil fuels and should pay more to cover the losses and damages poorer countries face, as well as to help them with the costs of adapting to greener sources of energy. Other countries, notably big polluters India and China, stymie negotiations by arguing they should have longer to wean themselves off of fossil fuels as their emissions actually pale in comparison to those of more developed countries when considered in historical context and on a per capita basis. Climate financing is expected to be key to upcoming negotiations at the United Nations’s next climate summit in November. The COP29 summit will be held in Baku, the capital city of oil-rich Azerbaijan.

Further Reading

Economy

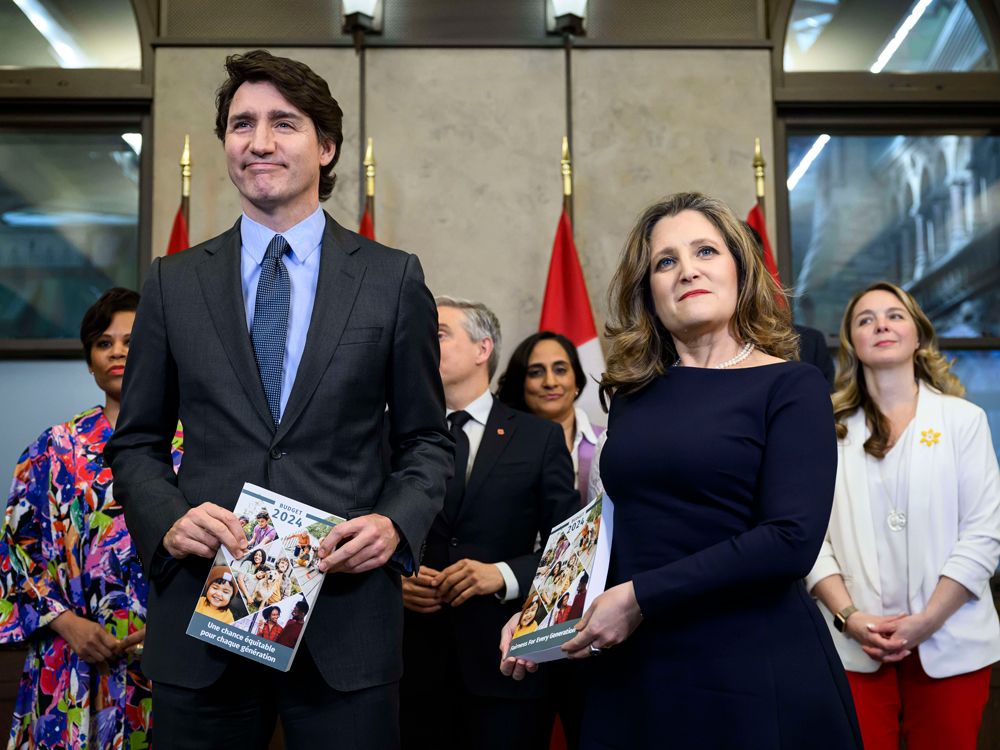

Canada's budget 2024 and what it means for the economy – Financial Post

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Economy

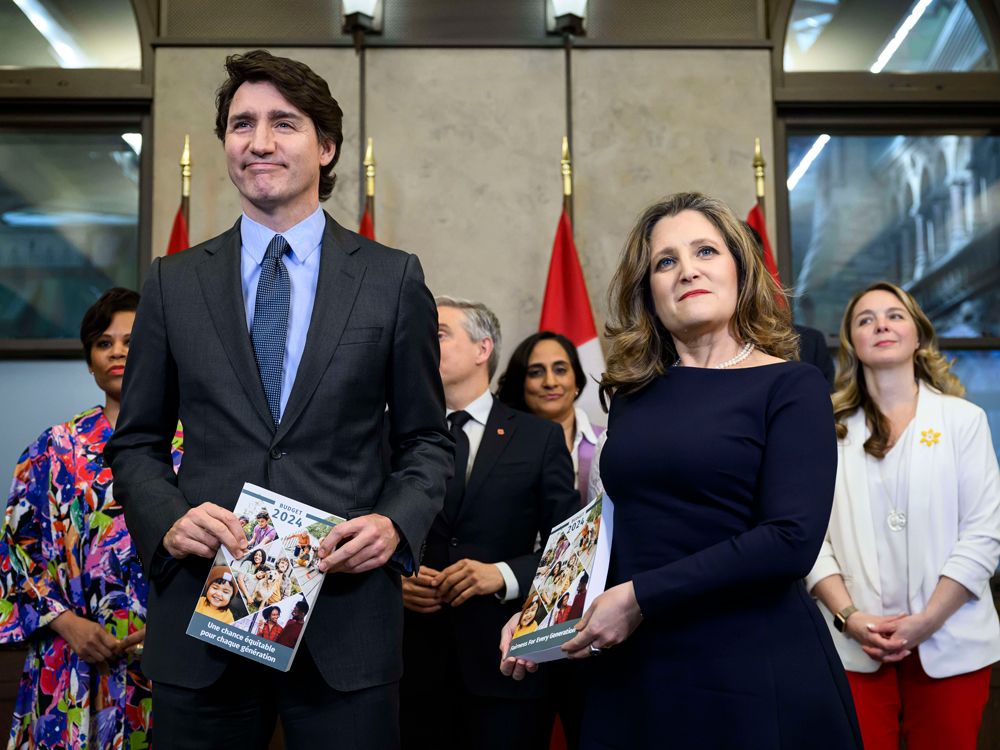

Opinion: Canada's economy has stagnated despite Trudeau government spin – Financial Post

Article content

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of economic performance. To assess Canadian living standards and the current health of the economy, journalists, politicians and analysts often compare Canada’s GDP growth to growth in other countries or in Canada’s past. But GDP is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Article content

Federal Finance Minister Chrystia Freeland recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. In this she echoes then-prime minister Stephen Harper, who said in 2015 that Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Article content

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. Lately, our aggregate GDP growth has been driven primarily by population and labour force growth, not productivity improvements. It is not mainly the result of Canadians becoming better at producing goods and services and thus generating more real income for their families. Instead, it is a result of there simply being more people working. That increases the total amount of goods and services produced but doesn’t translate into increased living standards.

Let’s look at the numbers. From 2000 to 2023 Canada’s annual average growth in real (i.e., inflation-adjusted) GDP growth was the second highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good — until you adjust for population. Then a completely different story emerges.

Article content

Over the same period, the growth rate of Canada’s real per person GDP (0.7 per cent) was meaningfully worse than the G7 average (1.0 per cent). The gap with the U.S. (1.2 per cent) was even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, an average of 1.1 per cent per year — more than twice the 0.5 per cent experienced in the G7 as a whole. In aggregate, Canada’s population increased by 29.8 per cent during this period, compared to just 11.5 per cent in the entire G7.

Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in Canada’s population growth. This increase has obscured historically weak economic growth per person over the same period. From 2015 to 2023, under the Trudeau government, real per person economic growth averaged just 0.3 per cent. That compares with 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Recommended from Editorial

Canada is neither leading the G7 nor doing well in historical terms when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Ben Eisen, Milagros Palacios and Lawrence Schembri are analysts at the Fraser Institute.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network

-

Sports21 hours ago

Sports21 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

News22 hours ago

Richard Chevolleau Short Film “Marvelous Marvin” Set to go to Camera

-

Business20 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca

-

Investment23 hours ago

Investment23 hours agoStephen Poloz will lead push to boost domestic investment by Canadian pension funds

-

Tech13 hours ago

Tech13 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

News23 hours ago

Federal budget 2024: Some of the winners and losers

-

Sports13 hours ago

Sports13 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post

-

Investment21 hours ago

Investment21 hours agoWall Street bosses cheer investment banking gains but stay cautious