Investment

Indonesia Passes Law to Simplify Labor, Investment Rules

|

|

(Bloomberg) — Indonesia has rushed the approval of a law aimed at creating jobs and attracting investments, a day before 2 million workers were set to stage a three-day strike to reject it.

The parliament agreed to pass the omnibus bill on jobs in a plenary meeting on Monday. It was previously set to hold the meeting on Oct. 8.

The law that seeks to simplify and revise more than 70 existing regulations will overhaul the country’s labor rules, make it easier for companies to secure permits and ease foreign ownership requirements. Its passage sets the income tax from capital gains to 20%, while some dividend taxes will be exempted.

The bill’s passage could help President Joko Widodo shore up an economy that’s set to slip into another contraction in the third quarter as the continued spread of the coronavirus damped household spending and investments. The government has sought to speed up state spending, while warning that growth can’t come from the public sector alone.

The rupiah gained 0.4% to 14,800 a dollar as lawmakers voiced their support for the bill, the steepest rise in two weeks. The benchmark Jakarta Composite Index of shares advanced 0.7%.

Unemployment Fund

As part of the law, the government will set up an unemployment fund to support workers who lost their jobs, with the premiums paid for by the state budget. The fund will give cash payments, provide access to the job market and pay for training. The law will also maintain workers’ rights to maternity and menstruation leave as set out in the existing labor rule.

The law has been met with opposition from labor unions and politicians who sought to reject the reduction in severance pay and the introduction of indefinite labor contracts. Activists have also spoken out against the bill, which lets investments judged to be low risk to continue without needing to submit a report on their expected environmental impact.

Other changes included in the jobs creation omnibus law:

Government to set up one-map policy to solve the issue of overlapping land claims and conflicts, which would ensure legal certainty for businessesThose who hire foreign workers are required to submit a plan for how the employee will work, while banning foreigners from holding roles that oversee personnelSimplified process for registering intellectual property and getting halal certificationLaw to speed up the construction of low-cost homes

(Updates with market movement in fifth paragraph.)

<p class=”canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm” type=”text” content=”For more articles like this, please visit us at bloomberg.com” data-reactid=”30″>For more articles like this, please visit us at bloomberg.com

<p class=”canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm” type=”text” content=”Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”31″>Subscribe now to stay ahead with the most trusted business news source.

Source: – Yahoo Canada Finance

Investment

UK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

(Bloomberg) — The UK is considering new curbs on outward investment in emerging technologies such as artificial intelligence and semiconductors, citing the potential security risks of aiding hostile states such as Russia and China.

Britain’s deputy prime minister Oliver Dowden, who oversees the UK’s investment regime, said he’s planning to work with other Group of Seven nations to assess the risks and consider whether to introduce extra restrictions.

The government’s concern is that some outbound investments may be used to “facilitate and support and aid strategic uplift of adversaries,” Dowden said in an interview, citing areas such as semi-conductor manufacturing, cryogenic equipment and facial recognition technology. Nevertheless, “there’s a high bar for the imposition of any form of restrictions,” he said.

The UK’s focus on the issue follows President Joe Biden’s order last year to limit US investment in some Chinese advanced technology companies, as Western nations try to strike a balance between protecting national security while encouraging free trade and innovation. Dowden said he will also review Britain’s approach to export controls and clarify the circumstances in which the government would review inward investment in sensitive sectors like critical minerals and semiconductors.

Read More: UK Weighs Measures to Crimp Investment in China After Biden

“The risk landscape is increasing all the time,” Dowden said, referring to Russia’s invasion of Ukraine, Chinese aggression in the South China Sea and the threat of ransomware attacks. “We are in a state of cyber and economic contestation with an increasing range of state and non-state actors.”

The move by Biden last year regulated US investments in some Chinese semiconductor, quantum computing and AI firms, and the British government said at the time that it would consider its own next steps.

Yet whether the Conservative Party will be in power to see through changes in this area is far from certain, given the opposition Labour Party’s commanding poll lead ahead of a general election that must be called by January 2025 at the latest.

©2024 Bloomberg L.P.

Investment

Sylvia Jones makes announcement in Muncey | CTV News – CTV News London

An investment has been announced to help connect over 23,000 people to primary care teams in the region.

Speaking in Muncey on Thursday, Ontario Health Minister Sylvia Jones said $6.4-million will help people in London, Lambton and Chathamk-Kent.

The money, part of a bigger $110-million investment will support seven new and expanded interprofessional primary care initiatives that will connect over 23,000 Ontarians to primary care teams and provide services.

Services include

- New mobile services for an Indigenous Primary Health Care Organization that will support First Nations, Inuit and Metis community members in Middlesex County.

- A new mobile bus to connect Indigenous people in rural and urban areas of Lambton-Kent-Middlesex with Indigenous led, culturally relevant primary care services in person and virtually.

- A new Family Health Team for London and the surrounding area, that will expand services through additional Community Hub locations throughout the area. By meeting people where they are, and reducing other barriers, this program will help connect people experiencing homelessness or at risk of homelessness with primary care providers that are trauma and violence informed.

- An expanded Family Health Team in Elgin County that will partner with another Family Health Team and Community Health Centre to increase the number of people who can connect to team-based primary care services.

- A new rural site along with expanded capacity at an urban clinic in Lambton County, focused on connecting isolated seniors, socioeconomically disadvantaged and vulnerable people, newcomers, and refugees to primary care.

- New mobile primary care services in Chatham-Kent, including clinics for respiratory and diabetes management, cancer screening and traditional healers to help provide culturally appropriate care.

- Primary care service expansion in Tillsonburg to connect vulnerable and medically complex community members to comprehensive, convenient and connected primary care closer to home.

Investment

Ottawa's new EV tax credit raises hope of big new Honda investment – The Globe and Mail

People work at Honda’s auto manufacturing plant in Alliston, Ont., on April 5, 2023.CARLOS OSORIO/Reuters

A new tax credit in Tuesday’s federal budget is fuelling industry speculation that Canada is close to landing a massive electric-vehicle investment by Honda.

The proposed measure would provide companies with a 10-per-cent rebate on the costs of constructing new buildings to be used in the electric-vehicle supply chain. It would be atop other such incentives to which Ottawa has previously committed, including a 30-per-cent manufacturing investment tax credit, as well as provincial supports.

But unlike those other credits, this one would only be available to companies making across-the-board investments in battery-making, the manufacturing of battery components known as cathode active materials, and vehicle assembly.

Honda Motor Co. Ltd. HMC-N is the only automaker known to be in advanced talks with the federal and provincial governments for a Canadian EV-sector commitment of that breadth. Earlier this year, the Japanese news group Nikkei reported that the company is considering an investment here of up to $18.5-billion – pointing toward more comprehensive Canadian supply chain plans than those of competitors such as Volkswagen Group and Stellantis NV STLA-N, whose high-profile investments squarely in battery manufacturing would not qualify.

Japanese automaker Honda considering multibillion-dollar EV plant in Canada, report says

Amid a flurry of trips to Japan by Canadian officials – most recently a visit this month by Ontario Economic Development Minister Vic Fedeli – the perception among industry insiders is that the new tax credit may be a final component of an incentive package offered by the federal and provincial governments, to get the negotiations over the finish line.

“There’s a very short list of very big companies who are looking at a very big investment and talking to Canada, Ontario and Quebec, to whom this would apply,” said Automotive Parts Manufacturers’ Association president Flavio Volpe, referring to the two provinces vying for major EV commitments. “The translation here is that there are big new EV investments coming.”

That assessment was echoed by Brendan Sweeney, the managing director of the Trillium Network for Advanced Manufacturing. “All the bread crumbs are leading to something,” he said.

More than just heralding the potential for the largest EV-related Canadian commitment by a global auto giant to date, the new measure is seemingly part of a shift in strategy for how Canada subsidizes supply chain growth – one in which Ottawa and the provinces stop competing for investment by simply matching multibillion-dollar subsidies offered in the United States, and instead offer more nuanced packages that could prove more efficient.

That subsidy-matching approach – in which Canada has guaranteed companies of annual subsidies equivalent to production tax credits offered in the U.S. – has to this point been considered a prerequisite to securing the battery factories meant to serve as EV supply chain anchors.

However, those have come with projected cumulative costs of up to $13-billion for the factory being constructed by Volkswagen in St. Thomas, Ont., and up to $15-billion for the one being constructed by Stellantis and LG Energy Solution in Windsor, Ont., during the early years of plant operations when the subsidies would be available. And Ottawa, which will cover about two-thirds of those costs while Ontario pays the rest, has previously signalled that it does not have the fiscal capacity to provide many more such deals.

But since the Honda negotiations came to light, government officials have expressed optimism about that company being open to a package of support that would revolve more around tax breaks on investment costs – as opposed to operational subsidies once factories have been commissioned – and likely carry a less staggering government cost relative to the total investment. (The Globe and Mail is not identifying the officials, because they were not authorized to speak publicly about the talks.)

One reason for that optimism may be the multifaceted nature of the investment that Honda is considering.

Mr. Volpe noted that for battery factories alone, Canada’s investment tax credits (ITCs) are not enough to compete with the U.S. production tax credits. But he said it’s a different story if the company is also looking at vehicle assembly, production of battery components and other parts of the supply chain, which the U.S. is not subsidizing the same way.

At the same time, those other aspects of the Honda package under consideration also seemingly make its potential investment more attractive to Ottawa than merely chasing another battery plant alone.

Other companies could also take advantage of the new incentive, along with the others being offered by the federal and provincial governments.

The governments have also been in less advanced talks with Toyota Motor Corp., which is the only one of the five global automakers with an established manufacturing presence in Canada not to have made major EV-related commitments here. (The others are General Motors Co. GM-N, Ford Motor Co. F-N, Stellantis and Honda.)

But for now, it’s the prospect of Honda as the first taker for a made-in-Canada approach to EV supports that is causing the most buzz around the sector.

“I think this could be a really useful departure,” Mr. Sweeney said. “We have to be competitive with the United States, but we’re a sovereign country. Can we do this in a way that works better for Canada?”

-

Tech19 hours ago

Tech19 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

News20 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Politics23 hours ago

Politics23 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health15 hours ago

Health15 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech21 hours ago

Tech21 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca

-

Science23 hours ago

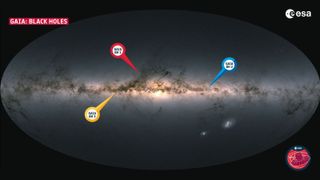

Science23 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Tech20 hours ago

Nintendo Indie World Showcase April 2024 – Every Announcement, Game Reveal & Trailer – Nintendo Life

-

Media24 hours ago

Georgia’s parliament votes to approve so-called ‘Russian law’ targeting media in first reading – CityNews Kitchener