Investment

Institutional Investment in Crypto: Top 10 Takeaways of 2019 – Coindesk

This

post is part of CoinDesk’s 2019 Year in Review, a collection of 100+ op-eds,

interviews and takes on the state of blockchain and the world. Scott Army is

the founder and CEO of digital asset manager Vision Hill Group. The following

is a summary of the report: “An Institutional Take on the 2019/2020 Digital Asset Market”.

No. 1: There’s bitcoin, and then there’s everything else.

The

industry is currently segmented into two main categories: Bitcoin and

everything else. “Everything else” includes: Web3 innovation, Decentralized

Finance (“DeFi”), Decentralized Autonomous Organizations, smart contract

platforms, security tokens, digital identity, data privacy, gaming, enterprise

blockchain or distributed ledger technology, and much more.

Non-crypto natives are seldom aware that there are multiple blockchains. Bitcoin, by virtue of it being the first blockchain network brought into the mainstream and by being the largest digital asset by market capitalization, is often the first stop for many newcomers and likely will continue to be for the foreseeable future.

No. 2: Bitcoin is perhaps market beta, for now.

In traditional equity markets, beta is defined as a measure of volatility, or unsystematic risk an individual stock possesses relative to the systematic risk of the market as a whole. The difficulty in defining “market beta” in a space like digital assets is that there is no consensus for a market proxy like the S&P 500 or Dow Jones. Since the space is still very early in its development, and bitcoin has dominant market share (~68 percent at the time of writing), bitcoin is often viewed as the obvious choice for beta, despite the drawbacks of defining “market beta” as a single asset with idiosyncratic tendencies.

Bitcoin’s

size and its institutionalization (futures, options, custody, and clear

regulatory status as a commodity), have enabled it to be an attractive first

step for allocators looking to get exposure (both long and short) to the

digital asset market, suggesting that bitcoin is perhaps positioned to be digital

asset market beta, for now.

No. 3: Despite slow conversion, substantial progress was made on growing institutional investor interest in 2019.

Education,

education, education. Blockchain

technology and digital assets represent an extraordinarily complex asset class

– one that requires a non-trivial time commitment to undergo a proper learning

curve. While handfuls of institutions have already started to invest in the

space, a very small amount of institutional capital has actually made it in

(relative to the broader institutional landscape), gauged by the size of the

asset class and the public market trading volumes. This has led many to

repeatedly ask: “when will the herd actually come?”

The reality is that

institutional investors are still learning – slowly getting comfortable – and

this process will continue to take time. Despite educational progress through 2019, some

institutions are wondering if it’s too early to be investing in this space, and

whether they can potentially get involved in investing in digital assets in the

future and still generate positive returns, but in ways that are de-risked

relative to today.

Despite a few other

challenges imposed on larger institutional allocators with respect to investing

in digital assets, true believers inside these large organizations are

emerging, and the processes for forming a digital asset strategy are either

getting started or already underway.

No. 4: Long simplicity, short complexity

Another trend we

observed emerge this year was a shift away from complexity and toward

simplicity. We saw significant growth in simple,

passive, low-cost structures to capture beta. With the lowest-friction investor

adoption focused on the largest liquid asset in the space – bitcoin – the

proliferation of single asset vehicles has increased. These private vehicles are a result of

delayed approval of an official bitcoin ETF by the SEC.

In addition to the Grayscale

Bitcoin Trust, other bitcoin-focused

products this year include the launch of Bakkt, the launch of Galaxy Digital’s two new

bitcoin funds, Fidelity’s

bitcoin product rollout, TD Ameritrade’s bitcoin trading service on Nasdaq via its brokerage platform, 3iQ’s

recent favorable ruling for a bitcoin fund and Stone Ridge Asset Management’s recent SEC approval for its NYDIG Bitcoin Strategy Fund, based on cash-settled bitcoin

futures.

We also observed a growing

institutional appetite for simpler hedge fund and venture fund structures. For

the last several years, many fundamental-focused crypto-native hedge funds

operated hybrid structures with the use of side-pockets that enabled a barbell

strategy approach to investing in both the public and private digital asset

markets. These hedge funds tend to have

longer lock-up periods – typically two or three years – and low liquidity.

While this may be attractive from an opportunistic perspective, the reality is it’s

quite complicated from an institutional perspective for reporting purposes.

No. 5: Active management’s been challenged, but differentiated sources of alpha are emerging.

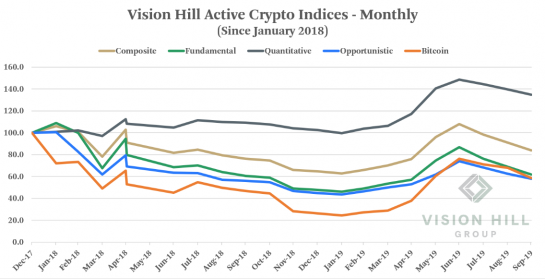

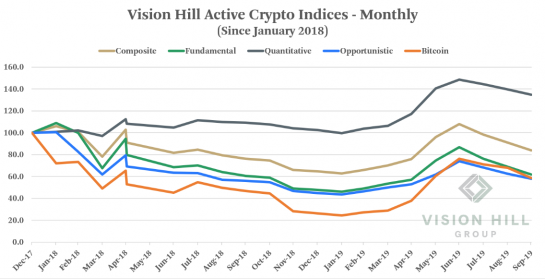

For the year-to-date period ended Q3 2019, active managers were collectively up 30 percent on an absolute return basis according to our tracking of approximately 50 institutional-quality funds, compared to bitcoin being up 122 percent over the same time period.

Bitcoin’s performance this year, particularly in Q2 2019, has made it clear that its parabolic ascents challenge the ability of active managers to outperform bitcoin during the windows they occur. Active managers generally need to justify the fees they charge investors by outperforming their benchmark(s), which are often beta proxies, yet at the same time they need to avoid imprudent risk behavior that can potentially have swift and sizable negative effects on their portfolios.

Interestingly, active management performance from the beginning of 2018 consistently outperformed passively holding bitcoin (with the exception of “opportunistic” managers who also take advantage of yield and staking opportunities, as of May 2019). This is largely due to various risk management techniques used to mitigate the negative performance drawdowns experienced throughout the extended market sell-off in 2018.

Although 2019 has challenged the large-scale

success of these alpha strategies, they are nonetheless in the process of

proving themselves out through various market cycles, and we expect this to be

a growing theme in 2020.

No. 6: Token value accrual: Transitioning from subjective to objective

At the end of Q3 2019, according to dapp.com, there were 1,721 decentralized applications built on top of ethereum, with 604 of them actively used – more than any other blockchain. Ethereum also had 1.8 million total unique users, with just under 400,000 of them active – also more than any other blockchain. Yet, despite all this growing network activity, the value of ETH has remained largely flat throughout most of 2019 and is on track to end the year down approximately 10 percent at the time of writing (by comparison, BTC has nearly doubled in value over the same period). This begs the question: is ETH adequately capturing the economic value of the ethereum network’s activity, and DeFi in particular?

A new fundamental metric was introduced

earlier this year by Chris Burniske – the Network Value to Token

Value (“NVTV”) ratio – to ascertain whether the value of all assets anchored

into a platform can be greater than the value of the base platform’s asset.

The ETH NVTV ratio has steadily declined throughout the last few years. There are likely to be several reasons for this, but I think one theory summarizes it best: most applications and tokens built and issued atop ethereum may be parasitic. ETH token holders are paying for the security of all these applications and tokens, via the inflation rate that is currently given to the miners – dilution for ETH holders, but not for holders of ethereum-based tokens.

This is not a bullish or bearish

statement on ETH; rather it is an observation of early signs of network stack

value capture in the space.

No. 7: Money or not, software-powered collateral economies are here

Another trend we observed this year is a larger migration away from “cryptocurrencies” in an ideological currency (e.g., money/payment and a means of exchange) sense, and toward digital assets for financial applications and economic utility. A form of economic utility that took the stage this year is the notion of software-powered collateral economies. People generally want to hold assets with disinflationary or deflationary supply curves, because part of their promise is that they should store value well. Smart contracts enable us to program the characteristics of any asset, thus it is not irrational to assume that it’s only a matter of time until traditional collateral assets get digitized and put to economic use on blockchain networks.

The

benefit of digital collateral is that it can be liquid and economically

productive in its nature while at the same time serving its primary purpose (to

collateralize another asset), yet without possessing the risks of traditional

rehypothecation. If assets can be allocated for multiple purposes

simultaneously, with the risks appropriately managed, we should see more

liquidity, lower cost of borrowing, and more effective allocation of capital in

ways the traditional world may not be able to compete with.

No. 8: Network lifecycles: An established supply side meets a quiet but emerging demand side.

Supply side services in digital asset

networks are services provided by a third party to a decentralized network in

exchange for compensation allocated by that network. Examples include mining,

staking, validation, bonding, curation, node operation and more, done to help bootstrap

and grow these networks. Incentivizing the supply side is important in digital

assets to facilitate their growth early in their lifecycles, from initial fundraising

and distribution through the bootstrapping phase to eventual mainnet launches.

While there has been significant growth of this supply side of the equation in

2019 from funds, companies, and developers, the open question is how and when

demand for these services will pick up. Our view is that as developer

infrastructure continues to mature and activity begins to move “up the stack”

toward the application layer, more obvious manifestations of product-market fit

are likely to emerge with cleaner and simpler interfaces that will attract high

volumes of users in the process. In essence, it is important to build the

necessary infrastructure first (the supply side) to enable buy-in from the end

users of those services (the demand side).

No. 9: We are in the late innings of the smart contract wars.

While ethereum leads the space on adoption and moves closer to executing on its scalability initiatives, dozens of smart contract competitors fundraised in the market throughout 2018 and 2019 in an attempt to dethrone ethereum. A handful have formally launched their chains and operate in mainnet as of the end of 2019, while many others remain in testnet or have stalled in development.

What’s

been particularly interesting to observe is the accelerative pace of innovation

– not just technologically, but economically (incentive mechanisms) and

socially (community building) as well.

We expect many more smart contract competitors operating privately as of

Q4 2019 to launch their mainnets in 2020. Thus, given the incoming magnitude of

publicly observable experimentations throughout 2020, if a smart contract

platform does not launch in 2020, it is likely to become disadvantageously

positioned relative to the rest of the landscape as it relates to capturing

substantial developer mindshare and future users and creating defensible

network effects.

No. 10: Product-market fit is coming, if not already here

We don’t think human and financial capital would have

continued pouring into the digital asset space in such great magnitude over the

last several years if there wasn’t a focus on solving at least one very clear

problem. The questionable sustainability of modern monetary theory is one of

them, and Ray Dalio of Bridgerwater Associates has been quite vocal about it. Big Tech centralization is another. There are also growing

global concerns related to data privacy and identity. And let’s not forget

cybersecurity. The list goes on. We are at the tip of the iceberg as it

relates to the products and applications blockchain technology enables, and mainstream users will come with growing

manifestations of product-market fit. As more time and attention gets spent on

diagnosing problems and working on solutions, the industry will begin to

achieve its full potential. Facebook’s Libra and

Twitter’s Bluesky initiative confirm that as an industry we are heading in the

right direction.

A 2020 look ahead

We see 2020 shaping up to be one of the brightest years on record for the digital asset industry. To be clear, this is not a price forecast; if we exclusively measured the health of the industry from a fundamental progress perspective, by various accounts and measures we should have been in a raging bull market for the last two years, and that has not been the case. Rather, we expect 2020 to be a year of accelerated industry maturation.

Digital assets are still an emerging asset class with many quickly evolving narratives, trends, and investment strategies. It is important to note, that not all strategies are suitable for all investors. The size of allocations to each category will and should vary depending on the specific allocator’s type, risk tolerance, return expectations, liquidity needs, time horizon and other factors. What is encouraging is that as the asset class continues to grow and mature, the opacity slowly dissipates and clearly defined frameworks for evaluation will continue to emerge. This will hopefully lead to more informed investment decisions across the space. The future is bright for 2020 and beyond.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.

Investment

Canada Pension Plan investment board to host public meeting in Calgary – CTV News Calgary

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Investment

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April – Yahoo Finance

The artificial intelligence (AI) space is red-hot right now. Companies across every industry are looking to capitalize on the technology, and are investing heavily to gain an edge over the competition. That’s true in the social media space, where advertisers are keen to get in front of the right audience for them.

While the social media landscape is jam-packed with competition, one company is separating itself from the pack. Meta Platforms (NASDAQ: META) is making strides across various aspects of the AI realm, and its performance over the competition shows.

Let’s dig in to why now is a lucrative opportunity to invest in Meta as the long-term AI narrative plays out.

The profit machine is up and running

One of the most appealing aspects of Meta is how efficiently management runs the business. In 2023, Meta grew revenue 16% year over year to $135 billion. However, the company increased income from operations by a whopping 62% year over year to $46.7 billion.

By expanding its operating margin, Meta recognized significant growth on the bottom line as well. Last year, the company generated $43 billion in free cash flow. With such a robust financial profile, Meta is well-positioned to invest profits back into the business as well as reward shareholders.

Investing for the future

During Meta’s fourth-quarter earnings call in February, investors learned how the company is deploying its cash heap. For starters, it has increased its share repurchase program by $50 billion. This is encouraging to see as it could imply that management views Meta stock as a good value.

But perhaps more exciting was the announcement of a quarterly dividend. Many high-growth tech companies are not in a financial position to pay a dividend — or instead choose to reinvest profits into research and development or marketing strategies. Meta’s new dividend certainly sets the company apart from many of its peers, and is a nice sweetener for long-term shareholders.

Another way Meta is using its cash flow is in the realm of artificial intelligence. Like many enterprises, Meta relies heavily on sophisticated graphics processing units (GPUs) from Nvidia. However, Meta has been hinting for a while that the company is investing in its own hardware. Earlier this month, Meta announced that an updated version of its training and inference chips, called MTIA, is now available.

This is important for a couple of reasons. Namely, in-house chips will allow Meta to “control the whole stack” and scale back its reliance on semiconductors from third parties. Additionally, given the company’s knowledge base of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips put Meta in a position to improve its targeted recommendation models and ad campaigns through the power of generative AI.

A compelling valuation

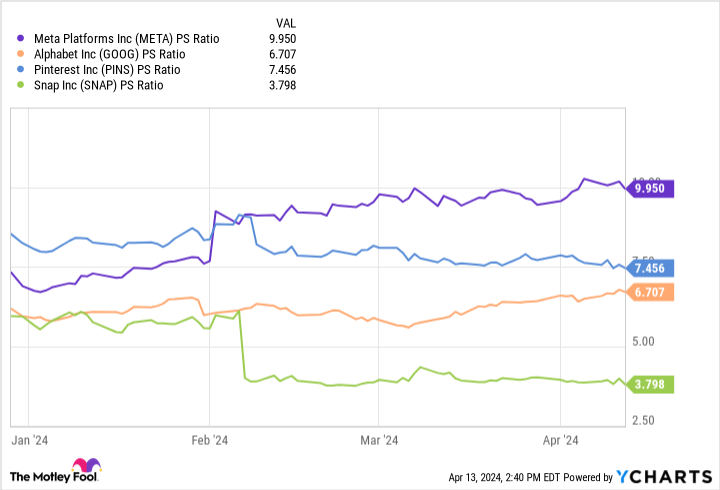

Meta competes with a number of players in the social media landscape. Alphabet is one of the company’s top competitors given that it operates the world’s top-two most visited websites: YouTube and Google. However, in 2023 Alphabet only grew its core advertising business by 6% year over year. By contrast, Meta’s advertising segment increased 16%.

While Meta’s price-to-sales (P/S) ratio of 10 is higher than many of its social media peers, the company’s growth in the highly competitive and cyclical advertising landscape may warrant the premium.

Additionally, considering Meta’s price-to-free-cash-flow ratio of about 31 is actually trading relatively in line with its 10-year average of 32, the stock might not be as expensive as it appears.

Overall, I am optimistic about Meta’s aggressive ambitions in artificial intelligence — an investment that is yet to play out. The AI narrative is going to be a long-term story. But I see Meta as extremely well-equipped to take advantage of secular themes fueling AI, and benefiting across its entire business.

The combination of a dividend, share buybacks, consistent cash flow, and a compelling AI play make Meta stick out in a highly contested AI landscape. I think now is a great opportunity to scoop up shares in Meta and prepare to hold for the long term.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April was originally published by The Motley Fool

Investment

Goldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg

(Bloomberg) — The growth equity unit of Goldman Sachs Group Inc. has invested $47.5 million in Kontakt.io, a startup that helps hospital managers make decisions about patients, beds and equipment.

It’s the 39th investment in health care from the bank’s growth equity division and the deal is “a good example of what is coming down the pipe” for its portfolio, according to Christian Resch, the UK-based the Goldman partner who led the financing and will sit on Kontakt.io’s board.

Kontakt.io, formed in Poland in 2014, makes small bluetooth-connected devices that stick on hospital equipment and software for managing the data collected by the sensors. The idea is to track practically everything inside a hospital — from patient beds to ultrasound machines — to help managers make decisions about capacity and replacement. The startup wants to build out an AI system that can offer suggestions to managers. It bills for the entire tracking system, rather than solo sensors.

Philipp von Gilsa, Kontakt.io’s chief executive officer, said his business helps health-care operators curb inefficiencies and manage pressures like crippling nursing shortages. “Hospitals are extremely, extremely wasteful in how they treat their resources,” he said. “We help them address that and, at the end of the day, save money.”

Health-care and life sciences IT spend is expected to continue rising, growing 8.3% in 2023 to $245.8 billion, according to Gartner estimates. But that money hasn’t always found its way to startups, which have struggled to compete with entrenched medical suppliers and navigate byzantine health-care networks. While many startups offer tools for managing health records or apps for patient use, Kontakt.io is focused on operations. The company pointed to a 2019 study that found roughly a quarter of US health spending was wasted due to issues like fraud and administrative hassles.

Kontakt.io has largely grown without major outside capital. It first marketed to a range of sectors interested in tracking indoor data, but has since homed in on health care, which now provides 80% of its sales, according to von Gilsa.

The startup has “roughly 500” enterprise customers, he said, including HCA Healthcare Inc. and the UK’s National Health Service. Von Gilsa declined to share revenue but said 2022 sales exceeded the $7.5 million his company raised before Goldman’s funding, and revenues tripled in the last twelve months. Kontakt.io, he said, has been profitable for the last four years.

With the financing, which came solely from Goldman, von Gilsa plans to hire more engineers to build an automated system for hospital staff using artificial intelligence. Machines will offer recommendations for daily decisions like how to stock certain machines or when to move patients into surgery.

Some 4 million devices in circulation give the startup an edge in building this AI, according to von Gilsa, who said the large quantities of data gathered by Kontakt.io sensors can help train its models.

Larger rivals, like GE HealthCare Technologies Inc., have also touted recent AI features designed to streamline hospital operations. Goldman’s Resch said Kontakt.io’s integration of sensors and software gave the bank confidence in its prospects.

©2024 Bloomberg L.P.

-

Media18 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Tech22 hours ago

Tech22 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState21 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports21 hours ago

Sports21 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Health24 hours ago

Health24 hours agoOpioid-related deaths between 2019 and 2021 across 9 Canadian provinces and territories

-

Science21 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment18 hours ago

Investment18 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

News23 hours ago

Montrealers conduct a sit-in to demand that Scotiabank divest from Elbit Systems