Investment

Ireland touts strong investment pipeline amid tech job cuts

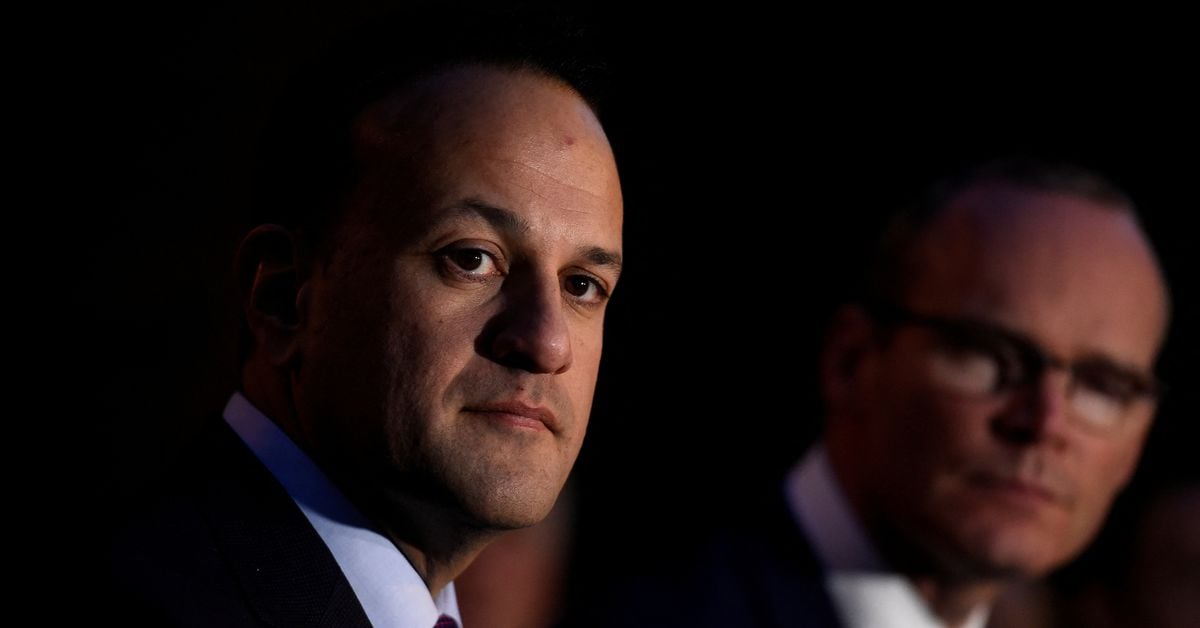

DUBLIN, Nov 7 (Reuters) – Ireland has a strong pipeline of investments from foreign-owned multinationals and expects many positive announcements in the coming months, Deputy Prime Minister Leo Varadkar said on Monday, looking to ease fears around tech-sector jobs cuts.

Ireland is hugely reliant on multinationals that employ over 275,000 people, or one in nine workers, and pay a large chunk of the country’s income and corporate taxes. Jobs growth in the sector soared to record levels in the first half of 2022.

However, digital payments firm Stripe and Twitter, both of whom employ around 500 in Ireland, announced layoffs last week and the Wall Street Journal reported on Sunday that Facebook parent Meta Platforms Inc (META.O) plans to begin large-scale layoffs this week.

Meta’s international headquarters are in Ireland, where it is one of the largest multinationals, directly employing around 3,000 staff with another 6,000 supporting its operations across the country.

It is also set to move into a large new campus in Dublin shortly.

Varadkar was briefed on Monday by the state’s inwards investment agency, IDA Ireland, on the current situation in the global tech sector. Tech multinationals employ over 37,000 people in Ireland, according to the IDA.

“There is a strong pipeline of new investments from overseas and within Ireland in a range of sectors including tech and in other sectors and we expect many positive announcements in the coming months,” Varadkar, who is also the country’s enterprise minister, said in a statement.

“As a country we are close to full employment, with high demand for tech, marketing and other skills across all sectors.”

Multinational job announcements have continued in the second half of the year with cloud data service provider NetApp Inc (NTAP.O) saying on Friday that it would create 500 jobs by 2025 at its new international headquarters in the city of Cork.

Multinational firms have been responsible for an enormous boom in corporate tax receipts in recent years, and also now account for around 33% of all income tax paid in the country due to their highly paid roles.

Editing by Matthew Lewis

Investment

Tesla shares soar more than 14% as Trump win is seen boosting Elon Musk’s electric vehicle company

NEW YORK (AP) — Shares of Tesla soared Wednesday as investors bet that the electric vehicle maker and its CEO Elon Musk will benefit from Donald Trump’s return to the White House.

Tesla stands to make significant gains under a Trump administration with the threat of diminished subsidies for alternative energy and electric vehicles doing the most harm to smaller competitors. Trump’s plans for extensive tariffs on Chinese imports make it less likely that Chinese EVs will be sold in bulk in the U.S. anytime soon.

“Tesla has the scale and scope that is unmatched,” said Wedbush analyst Dan Ives, in a note to investors. “This dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players.”

Tesla shares jumped 14.8% Wednesday while shares of rival electric vehicle makers tumbled. Nio, based in Shanghai, fell 5.3%. Shares of electric truck maker Rivian dropped 8.3% and Lucid Group fell 5.3%.

Tesla dominates sales of electric vehicles in the U.S, with 48.9% in market share through the middle of 2024, according to the U.S. Energy Information Administration.

Subsidies for clean energy are part of the Inflation Reduction Act, signed into law by President Joe Biden in 2022. It included tax credits for manufacturing, along with tax credits for consumers of electric vehicles.

Musk was one of Trump’s biggest donors, spending at least $119 million mobilizing Trump’s supporters to back the Republican nominee. He also pledged to give away $1 million a day to voters signing a petition for his political action committee.

In some ways, it has been a rocky year for Tesla, with sales and profit declining through the first half of the year. Profit did rise 17.3% in the third quarter.

The U.S. opened an investigation into the company’s “Full Self-Driving” system after reports of crashes in low-visibility conditions, including one that killed a pedestrian. The investigation covers roughly 2.4 million Teslas from the 2016 through 2024 model years.

And investors sent company shares tumbling last month after Tesla unveiled its long-awaited robotaxi at a Hollywood studio Thursday night, seeing not much progress at Tesla on autonomous vehicles while other companies have been making notable progress.

Tesla began selling the software, which is called “Full Self-Driving,” nine years ago. But there are doubts about its reliability.

The stock is now showing a 16.1% gain for the year after rising the past two days.

The Canadian Press. All rights reserved.

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

News24 hours ago

Freeland says she’s ready to deal with Trump |

-

News24 hours ago

NASA astronauts won’t say which one of them got sick after almost eight months in space

-

News24 hours ago

43 monkeys remain on the run from South Carolina lab. CEO thinks they’re having an adventure

-

News24 hours ago

Mitch Marner powers Matthews-less Maple Leafs over Red Wings

-

News8 hours ago

Affordability or bust: Nova Scotia election campaign all about cost of living

-

News8 hours ago

Canada’s Denis Shapovalov wins Belgrade Open for his second ATP Tour title

-

News24 hours ago

Trudeau pitches partnership with U.S. ahead of Trump government

-

News24 hours ago

Montreal says Quebec-Canada dispute stalling badly needed funding to help homeless |