Bank of Nova Scotia stock (TSX:BNS)(NYSE:BNS) is now the cheapest big Canadian bank stock based on the price-to-earnings (P/E) multiple.

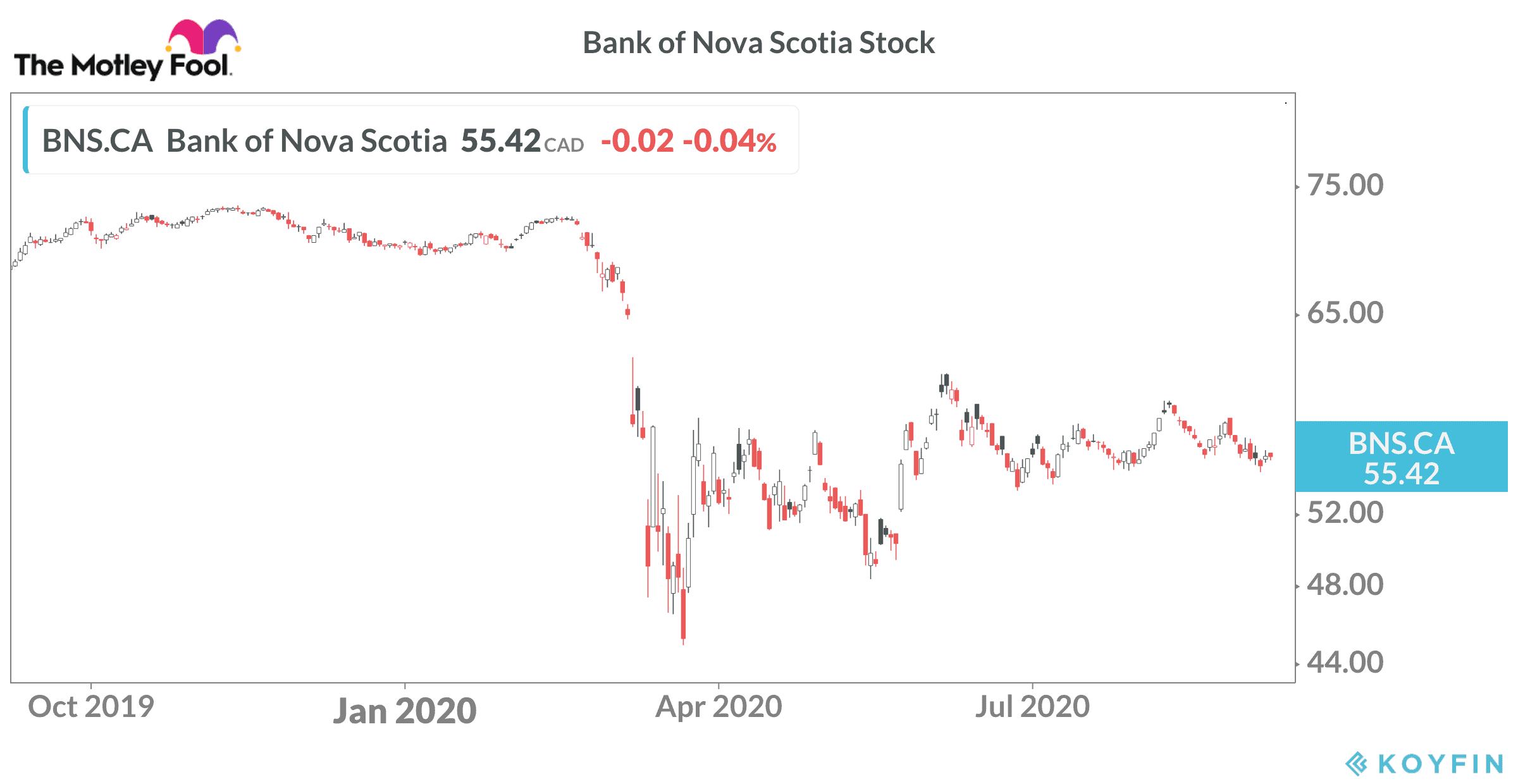

The stock price is down considerably this year, and investors searching for a top bank stock want to know if this is the right time to add Bank of Nova Scotia to their RRSP or TFSA portfolios.

Earnings

Bank of Nova Scotia reported adjusted net income of $1.3 billion for the three months that ended July 31. This was down 47% from the same period last year.

That looks bad, but the hit might not be quite as ugly as it appears.

Bank of Nova Scotia booked $752 million in provisions for credit losses (PCL) in the Canadian banking operations and another $1.3 billion in PCL for the international business in the quarter. This is money the bank sets aside to cover potential loan defaults.

The PCL number is up considerably due to the impact of the pandemic. The final losses might not be as high if the economy rebounds better than expected.

When the PCL is backed out, adjusted profit slipped 3% at the bank for the quarter compared to fiscal Q3 2019. Canadian banking profit fell 10% before PCL and international banking profit fell 21%.

Risks for Bank of Nova Scotia stock

The PCL can’t be ignored. In fact, the size of the charge in the international operations increased by 27% compared to Q2 2020. This indicates the uncertainty around the economic recovery time frame in the international group.

Bank of Nova Scotia invested billions of dollars in recent years to acquire banks and credit card portfolios in Mexico, Peru, Chile, and Colombia. These are the four core members of the Pacific Alliance trade bloc that enables the free movement of goods, capital, and labour.

Latin America continues to struggle with rising COVID-19 cases. Until vaccines are widely available, new lockdowns could be required. This would delay the recovery in the region.

In Canada, the economy appears to be bouncing back as anticipated. Unemployment rates fell in the past few months, and government aid measures helped millions of homeowners get through the worst part of the crisis.

That said, deferrals on mortgages will start to expire, and this could lead to a wave of personal and corporate bankruptcies. In the event the economic recovery falters, loan defaults could soar, and the housing market might take a significant hit. In that scenario, Bank of Nova Scotia and its peers would be in for some pain.

Opportunity

Beyond the pandemic, the Pacific Alliance countries offer attractive growth potential for Bank of Nova Scotia and its investors. The economic zone is home to more than 225 million people. Banking penetration is less than 50%, and an expanding middle class should lead to demand growth for loans, credit cards, and investment products.

At home, the Canadian housing market remains strong, despite the steep rise in unemployment. Cheap rates and a steady stream of buyers seems to be helping. It’s possible the overall market might not endure the 9-18% price crash predicted by CMHC over the next 12-18 months.

COVID vaccines are anticipated in the first half of 2021. Their arrival and distribution could give the economy a sharp boost. That would result in better jobs gains and reduce the threat of loan defaults.

Should you buy Bank of Nova Scotia stock today?

Near-term volatility should be expected, but Bank of Nova Scotia’s stock price likely reflects ongoing the challenges. The shares trade near $55.50 at the time of writing. That’s less than 10 times expected earnings. The other big Canadian banks currently sport multiples in the 11.5-12.5 range.

Bank of Nova Scotia stock was above $74 before the pandemic, so there is big upside potential.

If you have some cash available in a TFSA or RRSP it might be a good time to add some BNS stock to the portfolio. You get a solid 6.5% dividend yield and should see the share price trade meaningfully higher in the next five years.