October

9, 2020

4 min read

This article was translated from our

Spanish edition using AI technologies. Errors may exist due to this process.

This story originally appeared on Alto Nivel

By Jaume Molet

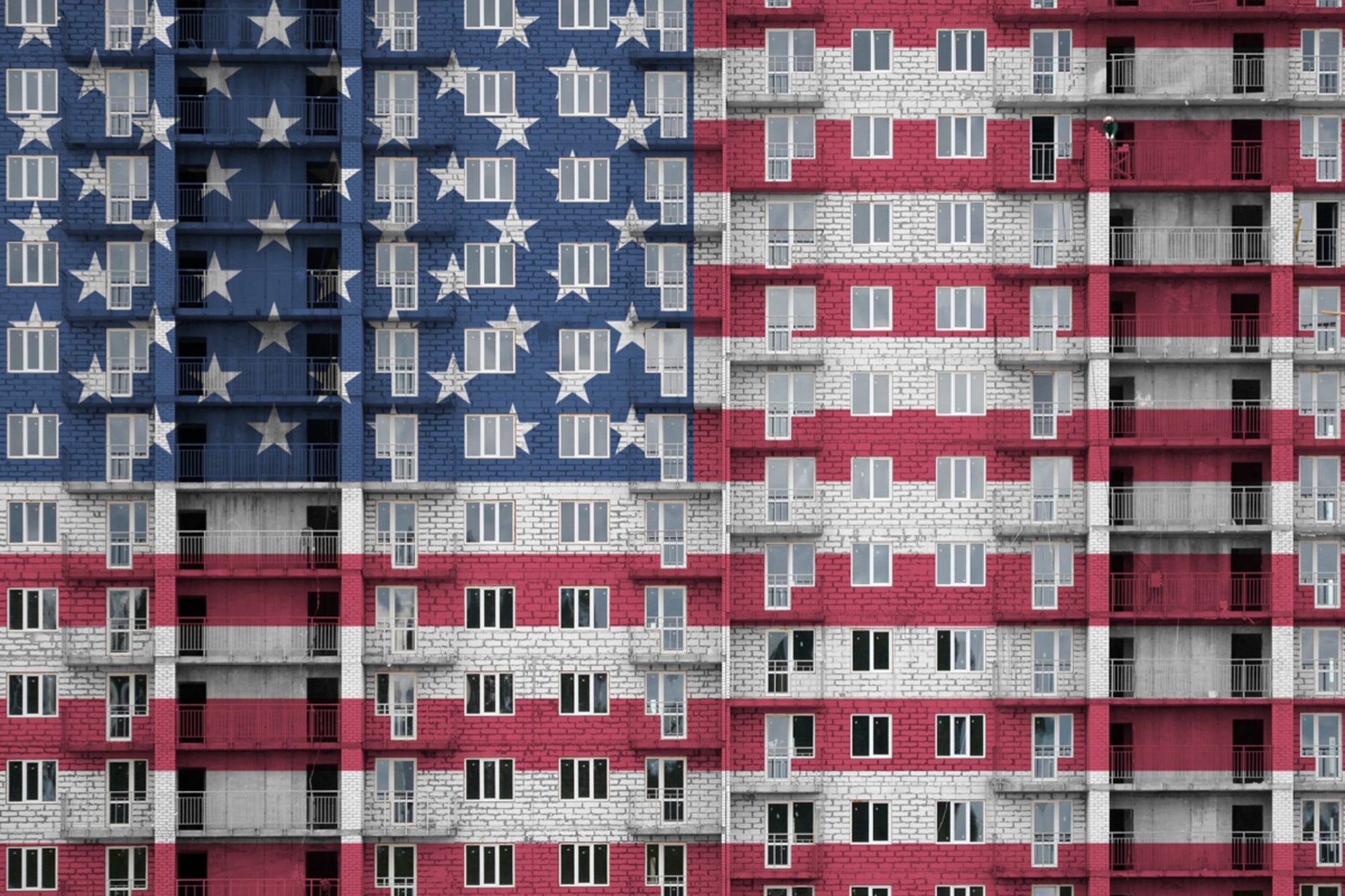

In times like the ones we are experiencing, of a national and global slowdown, investing in a property in the United States continues to be an option for many Mexicans.

At the 4D Real Estate Sharks Forum, presented by Lamudi and Real Estate Sharks, held 100% virtual, the conference “Binational Businesses MEX-USA” was presented by Tom Salomone, Former President of NAR ( National Association of REALTORS®) who spoke about the best way to do real estate business in the United States, strengthening relationships with other brokers and strengthening ties.

For example, Texas and especially the city of Houston is between 5% -20% below the current fair market value, the real estate of the home is affordable and offers continuous employment opportunities, the real estate market of the city It is very active, with trade volumes said to be high and the housing stock moving rapidly.

The purchase of houses is manifested in a very active way by the incentive of low interest rates, which allows people who kept their jobs during the crisis or who have savings , to venture into a large investment, but on the other hand for some people This situation is a reflection of the social inequality that prevails in almost the entire world where there are people who have not been able to pay their rents or their mortgages.

Industry experts consider that crises mean the opportunity to invest in a home that will be vital at the time of retirement or for vacation, and even to have an extra income if they rent it and for this it is essential to know where you can find good prices and In the same way, try to ensure that the investment does not depreciate in future years.

We must not forget the EB-5 visa program, which allows foreigners who invest and create jobs in that country to apply for permanent residence . This benefit extends to the investor’s spouse and their children under 21 years of age. The requirements for those who wish to apply to this program include an investment of at least $ 1.8 million and generating 10 full-time jobs. If the investment is made in a specific employment area (TEA) or rural, the minimum investment is $ 900,000.

However, the US market now faces two great challenges: after the pandemic, the real estate market in the neighboring country has seen a decrease in inventory, which has generated a price war, and let’s not forget that it is experiencing a moment of uncertainty about immigration policies that depend on the next elections.

But the key message that I would like to leave is to highlight the importance of always having a trusted real estate agent who takes us by the hand, not only in an international investment, but also in local investments, in this way we ensure that our money is well protected .

Editor’s Note: This text belongs to our Opinion section and reflects the author’s vision, not necessarily the High Level point of view.