News

It's easy to point the finger at parties — but younger Canadians spread COVID-19 in all kinds of settings – CBC.ca

The virus behind COVID-19 has a knack for slithering through society undetected.

Not everyone gets a fever, and not everyone gets a cough. Instead, the range of symptoms can pop up in various parts of someone’s body, like a nagging headache or upset stomach, mimicking a whole host of other ailments. Many people don’t feel sick enough to worry, if they ever get symptoms at all.

So when someone young and healthy does test positive for SARS-CoV-2 — as hundreds of Canadians now do every day — the question often is: Where’d they catch it?

In Ontario, Premier Doug Ford often points the finger at crowded parties. “We can’t have these big parties,” he said earlier this month. “We can’t have the big weddings.”

There are multiple recent reports of cases tied to bustling indoor spaces — from strip clubs to wedding events — that build on months of research showing the combination of crowds, close contact and closed settings for virus transmission is like kindling for a fire.

But younger Canadians may also be fuelling the spread of COVID-19 in far more mundane ways, with potentially dire consequences.

Emerging details from public health officials suggest a variety of social gatherings are helping SARS-CoV-2 find new hosts — and in Ontario, a majority of those virus carriers are under 40.

They’re getting infected at cottages, family gatherings, dinner parties — all kinds of indoor settings, and not always the ones with large, headline-making crowds.

“The vast majority of transmission is with close contact with someone who’s infected, typically for a prolonged period of time in an indoor environment,” said Dr. Isaac Bogoch, a Toronto-based infectious disease specialist.

Risks in indoor settings

The notion that indoor settings are riskier is nothing new. For months, case studies from around the world have highlighted danger zones: cruise ships, a call centre, a choir practice.

But the specifics of where real people are getting real infections in Ontario has been hazier, beyond now-obvious hot spots like long-term care homes and other institutional settings.

In recent weeks, a clearer picture began emerging.

On one end of the spectrum, there are the big, risky gatherings called out by Ford: A series of wedding events in Markham led to more than 20 cases, for example, while infected staff at two Toronto strip clubs sparked multiple confirmed cases and hundreds of possible exposures.

In London, Ont., at least nine university students have tested positive for the virus so far, and public health officials suggested they socialized in the city’s jam-packed downtown bar scene.

WATCH | How to navigate daily challenges amid the COVID-19 pandemic:

Then there’s the other end of the spectrum: smaller groups of friends and family meeting up indoors.

In Windsor, public health officials recently carried out contact tracing and tracked more than 30 recent cases back to one family’s social life — including parties and dinners with friends at home and a card game in a storage unit, the region’s local newspaper reported.

Toronto’s medical officer of health, Dr. Eileen de Villa, on Monday outlined several similar settings that led to recent infections, including one family gathering and another family’s trip where time was spent with someone who wound up having COVID-19.

“Personal gatherings are the main driver of cases,” Dr. Mustafa Hirji, acting medical officer of health for Niagara Region, noted in a tweet the same day.

LISTEN | Helping Canadians under 40 stay safe from COVID-19:

One striking case study from Ottawa involved a 10-person cottage trip. It’s a gathering size allowed by the province, as long as there’s physical distancing in place, but according to the city’s medical officer of health, Dr. Vera Etches, the trip wound up being a cautionary tale.

“There was one person who developed cold-like symptoms while at the cottage party and then tested positive on their return home. Subsequently, seven of those friends tested positive for COVID-19,” Etches recently told Ottawa’s city council.

“Within nine days, one person with symptoms became 40 confirmed people who tested positive.”

After leaving the cottage, some members of the group had visited work and retail locations, including two child-care centres that wound up shuttered to prevent further spread — and several people ended up hospitalized.

‘It leaves lasting damage’

That’s the ripple effect of young adults getting infected: They can pass it on to more vulnerable people, including the elderly and those in long-term care, who are more likely to wind up seriously ill or worse.

Those younger Canadians themselves could also fare poorly, even if death is a rare outcome.

According to a random sample of hospital outpatients from the U.S. Centers for Disease Control and Prevention, 20 per cent of previously healthy adults between 18 and 34 weren’t back to their usual health 14 to 21 days after testing positive, while thousands of others around the world say their symptoms are lasting far longer.

Nada Forbes, a 37-year-old mother of two living in Oakville, Ont., has been suffering with lingering symptoms for six months after testing positive for the virus following a trip to Egypt in March.

The illness started with chest pain, but Forbes never had a fever or cough, which are the usual symptoms. Instead, she wound up having various gastrointestinal issues and shortness of breath.

“You can get a moderate case, or a mild case, that goes on and on and on, and leaves lasting damage and leaves you with these lingering problems — when you started as a healthy person without any pre-existing conditions,” she warned.

Don’t ‘shame and blame’

Months into the pandemic, health experts now say it’s crucial the younger demographic is better informed about how to avoid spreading the virus, without any finger-pointing.

“Harm reduction is not about shame and blame,” said Samantha Yammine, a Toronto-based neuroscientist and science communicator.

Yammine said for many young adults, avoiding risk can be difficult. She recently surveyed her roughly 70,000 Instagram followers about their COVID-19 experiences, and hundreds of respondents cited various challenges — from living with roommates or in a multi-generational home, to working in sectors where safety measures aren’t always followed.

“Why did we ever open up indoor dining and have a setting where people would be talking loudly, with people in large groups, without wearing masks?” Yammine said.

The province is holding off on the next phase of reopenings, but there’s no word yet if officials will start scaling back limits on the size of gatherings or implementing any lockdowns to curb rising case counts.

In the meantime, Bogoch said that for young adults trying to safely navigate daily choices, it’s all about layering in protection to lower the risk as much as possible, such as increasing ventilation and wearing masks as much as possible.

“You want to get together for this wedding, for your friend’s birthday, for some other ceremony, but let’s make smart choices,” he said. “So can you do it outside? Can you spread apart? Can you have fewer numbers?”

Yammine said the aim can’t be zero risk, since that’s an impossible goal.

“If we focus on what we can do versus what we can’t do, we can empower people to make decisions that are more safe but allow them to live their lives,” she said. “Because this isn’t going away any time soon.”

News

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

More money will land in the pockets of Canadian families on Friday for the latest Canada Child Benefit (CCB) installment.

The federal government program helps low and middle-income families struggling with the soaring cost of raising a child.

Canadian citizens, permanent residents, or refugees who are the primary caregivers for children under 18 years old are eligible for the program, introduced in 2016.

The non-taxable monthly payments are based on a family’s net income and how many children they have. Families that have an adjusted net income under $34,863 will receive the maximum amount per child.

For a child under six years old, an applicant can annually receive up to $7,437 per child, and up to $6,275 per child for kids between the ages of six through 17.

That translates to up to $619.75 per month for the younger cohort and $522.91 per month for the older group.

The benefit is recalculated every July and most recently increased 6.3 per cent in order to adjust to the rate of inflation, and cost of living.

To apply, an applicant can submit through a child’s birth registration, complete an online form or mail in an application to a tax centre.

The next payment date will take place on May 17.

News

Capital gains tax change draws ire from some Canadian entrepreneurs worried it will worsen brain drain – CBC.ca

A chorus of Canadian entrepreneurs and investors is blasting the federal government’s budget for expanding a tax on the rich. They say it will lead to brain drain and further degrade Canada’s already poor productivity.

In the 2024 budget unveiled Tuesday, Finance Minister Chrystia Freeland said the government would increase the inclusion rate of the capital gains tax from 50 per cent to 67 per cent for businesses and trusts, generating an estimated $19 billion in new revenue.

Capital gains are the profits that individuals or businesses make from selling an asset — like a stock or a second home. Individuals are subject to the new changes on any profits over $250,000.

The government estimates that the changes would impact 40,000 individuals (or 0.13 per cent of Canadians in any given year) and 307,000 companies in Canada.

However, some members of the business community say that expanding the taxable amount will devastate productivity, investment and entrepreneurship in Canada, and might even compel some of the country’s talent and startups to take their business elsewhere.

Finance Minister Chrystia Freeland unveiled the government’s 2024 federal budget, with spending targeted at young voters and a plan to raise capital gains taxes for some of the wealthiest Canadians.

Benjamin Bergen, president of the Council of Canadian Innovators (CCI), said the capital gains tax has overshadowed parts of the federal budget that the business community would otherwise be excited about.

“There were definitely some other stars in the budget that were interesting,” he said. “However, the … capital gains piece really is the sun, and it’s daylight. So this is really the only thing that innovators can see.”

The CCI has written and is circulating an open letter signed by more than 1,000 people in the Canadian business community to Trudeau’s government asking it to scrap the tax change.

Shopify CEO Tobi Lütke and president Harley Finkelstein also weighed in on the proposed hike on X, formerly known as Twitter.

We need to be doing everything we can to turn Canada into the best place for entrepreneurs to build 🇨🇦<br><br>What’s proposed in the federal budget will do the complete opposite. Innovators and entrepreneurs will suffer and their success will be penalized — this is not a wealth tax,…

—@harleyf

Former finance minister Bill Morneau said his successor’s budget disincentivizes businesses from investing in the country’s innovation sector: “It’s probably very troubling for many investors.”

Canada’s productivity — a measure that compares economic output to hours worked — has been relatively poor for decades. It underperforms against the OECD average and against several other G7 countries, including the U.S., Germany, U.K. and Japan, on the measure.

Bank of Canada senior deputy governor Carolyn Rogers sounded the alarm on Canada’s lagging productivity in a speech last month, saying the country’s need to increase the rate had reached emergency levels, following one of the weakest years for the economy in recent memory.

The government said it was proposing the tax change to make life more affordable for younger generations and fund efforts to boost housing supply — and that it would support productivity growth.

A challenge for investors, founders and workers

The change could have a chilling effect for several reasons, with companies already struggling to access funding in a high interest rate environment, said Bergen.

He questioned whether investors will want to fund Canadian companies if the government’s taxation policies make it difficult for those firms to grow — and whether founders might just pack up.

The expanded inclusion rate “is just one of the other potential concerns that firms are going to have as they’re looking to grow their companies.”

He said the rejigged tax is also an affront to high-skilled workers from low-innovation sectors who might have taken the risk of joining a startup for the opportunity, even taking a lower wage on the chance that a firm’s stock options grow in value.

But Lindsay Tedds, an associate economics professor at the University of Calgary, said the tax change is one of the most misunderstood parts of the federal budget — and that its impact on the country’s talent has been overstated.

“This is not a major innovation-biting tax change treatment,” Tedds said. “In fact, when you talk to real grassroots entrepreneurs that are setting up businesses, tax rates do not come into their decision.”

As for productivity, Tedds said Canadians might see improvements in the long run “to the degree that some of our productivity problems are driven by stresses like housing affordability, access to child care, things like that.”

‘One foot on the gas, one foot on the brake’

Some say the government is sending mixed messages to entrepreneurs by touting tailored tax breaks — like the Canada Entrepreneurs’ Incentive, which reduces the capital gains inclusion rate to 33 per cent on a lifetime maximum of $2 million — while introducing measures they say would dampen investment and innovation.

“They seem to have one foot on the gas, one foot on the brake on the very same file,” said Dan Kelly, president of the Canadian Federation of Independent Business.

Some business groups are worried that new capital gains tax changes could hurt economic growth. But according to Small Business Minister Rechie Valdez, most Canadians won’t be impacted by that change — and it’s a move to create fairness.

A founder may be able to sell their successful company with a lower capital gains treatment than otherwise possible, he said.

“At the same time, though, big chunks of it may be subject to a higher rate of capital gains inclusion.”

Selling a company can fund an individual’s retirement, he said, which is why it’s one of the first things founders consider when they think about capital gains.

Mainstreet NS7:03Ottawa is proposing a hike to capital gains tax. What does that mean?

Tuesday’s federal budget includes nearly $53 billion in new spending over the next five years with a clear focus on affordability and housing. To help pay for some of that new spending, Ottawa is proposing a hike to the capital gains tax. Moshe Lander, an economics lecturer at Concordia University, joins host Jeff Douglas to explain.

Dennis Darby, president and CEO of Canadian Manufacturers & Exporters, says he was disappointed by the change — and that it sends the wrong message to Canadian industries like his own.

He wants to see the government commit to more tax credit proposals like the Canada Carbon Rebate for Small Businesses, which he said would incentivize business owners to stay and help make Canada competitive with the U.S.

“We’ve had a lot of difficulties attracting investment over the years. I don’t think this will make it any better.”

Tech titan says change will only impact richest of the rich

Toronto tech entrepreneur Ali Asaria will be one of those subject to the expanded capital gains inclusion rate — but he says it’s only fair.

“It’s going to really affect the richest of the rich people,” Asaria, CEO of open source platform Transformer Lab and founder of well.ca, told CBC News.

“The capital gains exemption is probably the largest tax break that I’ve ever received in my life,” he said. “So I know a lot about what that benefit can look like, but I’ve also always felt like it was probably one of the most unfair parts of the tax code today.”

While Asaria said Canada needs to continue encouraging talent to take risks and build companies in the country, taxation policies aren’t the most major problem.

“I think that the biggest central issue to the reason why people will leave Canada is bigger issues, like housing,” he said.

“How do we make it easier to live in Canada so that we can all invest in ourselves and invest in our companies? That’s a more important question than, ‘How do we help the top 0.13 per cent of Canadians make more money?'”

News

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

More money will land in the pockets of Canadian families on Friday for the latest Canada Child Benefit (CCB) installment.

The federal government program helps low and middle-income families struggling with the soaring cost of raising a child.

Canadian citizens, permanent residents, or refugees who are the primary caregivers for children under 18 years old are eligible for the program, introduced in 2016.

The non-taxable monthly payments are based on a family’s net income and how many children they have. Families that have an adjusted net income under $34,863 will receive the maximum amount per child.

For a child under six years old, an applicant can annually receive up to $7,437 per child, and up to $6,275 per child for kids between the ages of six through 17.

That translates to up to $619.75 per month for the younger cohort and $522.91 per month for the older group.

The benefit is recalculated every July and most recently increased 6.3 per cent in order to adjust to the rate of inflation, and cost of living.

To apply, an applicant can submit through a child’s birth registration, complete an online form or mail in an application to a tax centre.

The next payment date will take place on May 17.

-

Media19 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media21 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment19 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Real eState11 hours ago

Botched home sale costs Winnipeg man his right to sell real estate in Manitoba – CBC.ca

-

News18 hours ago

Canada Child Benefit payment on Friday | CTV News – CTV News Toronto

-

Sports24 hours ago

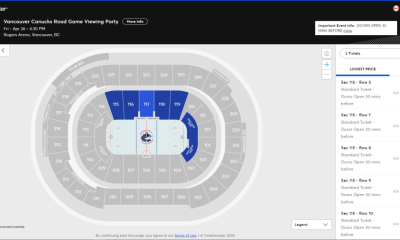

Sports24 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com

-

Business20 hours ago

Gas prices see 'largest single-day jump since early 2022': En-Pro International – Yahoo Canada Finance

-

Art23 hours ago

Enter the uncanny valley: New exhibition mixes AI and art photography – Euronews