Economy

It's hip to be bear: Business leaders join chorus of economic doomsayers – The Globe and Mail

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NDMVTKEOWZDZ5JUKW2UBTJVUZU.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NDMVTKEOWZDZ5JUKW2UBTJVUZU.jpg)

Photo illustration by The Globe and Mail/Source: Getty Images

Anyone taking the pulse of the economy right now has plenty of reasons to feel optimistic. The COVID-19 pandemic appears to be under control, the Canadian and U.S. economies are still expanding (albeit haltingly), household balance sheets are relatively sound, and unemployment has never been lower.

Yet, those choosing to see the economic bright side these days are a rapidly vanishing breed. Suddenly, the word “recession” is being tossed around by economists, business leaders, politicians and workers alike. Over the past two weeks, an unrelenting stream of high-profile names have joined the grim chorus, including top banking execs such as JPMorgan Chase’s Jamie Dimon, billionaire chief executives including Elon Musk and global institution heads like World Bank President David Malpass.

Even Grammy-winning rapper Cardi B chimed in earlier this week, tweeting: “When y’all think they going to announce that we going into a recession?”

Now bearish market watchers who were warning of a downturn as other forecasters ratcheted up their outlooks are finding the mood of the market is starting to match their voices – stock markets are flirting with bear-market territory, and American consumer confidence is plumbing depths not seen in half a century.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NZWHIS7APBECZOXWDA4CES4BMY.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/NZWHIS7APBECZOXWDA4CES4BMY.jpg)

Elon Musk is the latest high-profile name to join a grim chorus.RYAN LASH/AFP via Getty Images

And many bears think everyone else is still far too optimistic. “I hear everybody saying the recession is now a next-year story, but I’m saying the next-year story is going to be about the rebirth of the recovery,” says David Rosenberg, chief economist at Toronto-based Rosenberg Research and a self-proclaimed “maverick” contrarian. “I think the recession is already staring us in the face.”

Super-bad feeling

— Elon Musk on the economy

With the distorted sense of time brought on by COVID-19, it’s easy to forget that less than a year ago, some were waxing hopeful about a postpandemic economic boom to rival the Roaring Twenties, a decade popularly remembered for its prosperity and hedonism on the heels of the First World War and Spanish Flu pandemic. As vaccines rolled out last year and lockdowns lifted, headlines blared the coming “new Roaring Twenties,” with comedian Bill Maher joking, “Let’s do it this time without a depression at the end.”

Such hopefulness for the immediate future has largely evaporated. Social unrest, punishing price spirals for food and gasoline, and the spectre of a new cold war sparked by Russia’s Ukraine invasion have instead rekindled memories of the 1970s, a decade that gave birth to the toxic mix of low growth and fast-rising prices known as stagflation.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BQUPIANZNROVDD2D4TO2RLPPBY.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BQUPIANZNROVDD2D4TO2RLPPBY.JPG)

Cars line up in two directions at a gas station in New York City, on Dec. 23, 1973. Canada is leaning towards a new era of 1970’s-style stagflation as the pace of economic growth slows yet prices remain stubbornly high, economists say.Marty Lederhandler/The Associated Press

More immediate than that, though, economists and investors have been spooked by the resolve with which central bankers have sworn to tackle high inflation, ratcheting up interest rates and shrinking their bloated balance sheets.

The U.S. Federal Reserve has announced the most aggressive cycle of monetary tightening since former Fed chairman Paul Volcker nearly doubled interest rates in the 1980s, to 20 per cent, to crush runaway inflation.

Meanwhile, as recently as last month, the Bank of Canada was emphasizing that future rate hikes might be conditional on how the housing market responds. In a mid-May speech, deputy governor Toni Gravelle said “a larger-than-expected slowdown” in the housing market, amplified by the staggering debt loads being carried by Canadian households, “might lead us to pause” rate hikes once they enter the bank’s neutral range of 2 per cent to 3 per cent.

If homebuyers and homeowners took that as a wink-wink signal of an implied floor under house prices, a speech by Mr. Gravelle’s fellow deputy Paul Beaudry earlier this month put that to rest. Without mentioning the housing market once, Mr. Beaudry noted an annual inflation rate of just 5 per cent (it’s currently 6.8 per cent) robs Canadians of $2,000 a year and said inflation expectations are at risk of becoming unanchored. If workers, consumers and business leaders start to think prices will keep going up, he warned, high inflation can become entrenched. “We must – and we will – be resolute in bringing inflation back down.”

There’s a goldilocks-style view of how the coming months will unfold. It holds that central banks can nudge their levers just enough to find the sweet spot where the economy is neither overheating nor contracting – where wages, job growth and consumer prices ease without crippling corporate profits or spooking the so-called animal spirits – thus bringing about a “softish landing” for the economy, as U.S. Federal Reserve chair Jerome Powell put it.

The problem is, fewer and fewer people seem to believe that’s possible.

In a note this week, Stephen Brown, senior Canadian economist for Capital Economics, wrote that the Bank of Canada now appears “unfazed” by a recent tumble in home sales and “leaves us concerned that it will take a more aggressive approach to policy tightening than is ultimately required, driving house prices sharply lower and risking a major recession.”

Against this backdrop, the question becomes whether the world’s bad mood will feed on itself. After all, economic activity is often a lagging indicator to sentiment. And while feelings of gloom are more acute in the U.S., that still has a spillover effect in Canada, both directly, through our close trade ties, and psychologically, as consumers here absorb America’s more intense feelings of misery.

I said there’s storm clouds but I’m going to change it. It’s a hurricane. You’d better brace yourself.

— Jamie Dimon, CEO of JPMorgan Chase

The longest bull market in history – which kicked off in 2009 after the Great Recession and which was only interrupted for a few brief months when the entire global economy was put on life support in early 2020 – has not been kind to bears. Investors with a pessimistic outlook and a belief that gravity would eventually pull valuations down from the cosmos were repeatedly left nursing bruised portfolios and battered reputations.

In fact, the past year has seen several famously dour investors call it quits. In November, British hedge fund manager Russell Clark wound down his RC Global Fund after a 10-year wrong-way bet against the bull market. Gabe Plotkin shut down Melvin Capital in May after his bearish wagers against so-called meme stocks – money-losers such as video-game retailer GameStop Corp. and theatre chain AMC Entertainment Holdings Inc. that became speculative darlings during the pandemic – went off the rails.

Others bears held on and are now being rewarded as the gloom spreads.

Crispin Odey, another Britain-based investor who oversees the Odey European Inc. hedge fund, has generated a return of 110 per cent this year thanks to his bets that stock prices would fall, erasing six years of losses. “I have the ability to remain in an uncomfortable place for an uncomfortable amount of time,” he told Bloomberg this week. “It is difficult to be a contrarian. You are wrong when you are early, and you make your money very quickly when you are right. It is a bad business structure, and that is why we are rare beasts.”

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HOEZDLCHG5HDHHSVZE4U6EIESY.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/HOEZDLCHG5HDHHSVZE4U6EIESY.jpg)

David Rosenberg is chief economist at Toronto-based Rosenberg Research and a self-proclaimed ‘maverick’ contrarian.Christopher Katsarov/The Globe and Mail

Being a bear can indeed be lonely, says Mr. Rosenberg. “The typical economist always feels the necessity to provide a view that’s filled with roses, tulips and violets,” he says, while noting his firm’s own clients don’t always appreciate his downbeat analysis. “It’s amazing that if you talk to clients and discuss the R word, it’s almost as if you’re saying their kid is ugly.”

While bears all share a dismal view of markets and the economy right now, their belief in how everything will come undone tends to differ, particularly when it comes to inflation.

One camp sees the economy on the brink of outright deflation, brought on by a recession caused by central bankers’ tightening policies.

Mr. Rosenberg is one of that camp’s most high-profile proponents. Having foreseen the collapse of the U.S. housing market in the mid-2000s while working as Merrill Lynch’s chief North American economist, he has consistently argued from the moment inflation anxiety took hold last year that prices for goods and services were going to tumble.

Even without central bank intervention, he sees inflation turning to deflation, arguing that with governments pulling back on fiscal stimulus the remaining driver of inflation will be supply disruptions, and the barrage of shocks – Omicron, Russia’s invasion of Ukraine and widespread lockdowns of Chinese cities and ports – are unlikely to be repeated.

While Mr. Rosenberg has yet to be proven right with his deflation call, his warning that the Federal Reserve could break the back of the U.S. economy with its rate hikes has become more mainstream. “The Fed has had its thumbprints on 11 recessions since 1950 and only achieved soft landings 20 per cent of the time,” Mr. Rosenberg says. “All I know is what history teaches me, which is that inflation melts in a recession.”

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BYCAORPU5JHUXJ5Y7VNEZAZO3E.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/BYCAORPU5JHUXJ5Y7VNEZAZO3E.jpg)

Bill Dudley, former President of the Federal Reserve Bank of New York.Pool/Reuters

”A hard landing is virtually inevitable.”

— Bill Dudley, former president of the Federal Reserve Bank of New York

There’s another camp of bears who believe high inflation will become a lingering problem, even as they foresee a sharper market crash and recession on the horizon. Jeremy Grantham, a prominent value investor and co-founder of Boston money manager GMO LLC, is among them.

In January, Mr. Grantham warned the U.S. was in its “fourth super-bubble” of the modern era, with the previous three being equity bubbles in 1929 and 2000, and the housing bubble in 2006. “At the peak of a bubble, no one wants to hear the bear case,” he says. “People always believe the economy is in fabulous shape and is basically indestructible, and of course in none of the cases has that ever turned out to be true.”

While Mr. Grantham points out the S&P 500 index in the first four months of this year suffered its biggest decline “since I was one year old in 1939,″ he says he wouldn’t feel vindicated in his call if markets stabilized at current levels. (The S&P 500 index is up 5.5 per cent from its 52-week low in May, while the Nasdaq has recovered 6.5 per cent – though both indexes have fallen sharply in recent days.)

That’s because Mr. Grantham sees a much steeper drop ahead, in line with what occurred after the dot-com bubble burst in 2000. In that crash, the S&P 500 was cut in half, while the tech-heavy Nasdaq plunged 75 per cent. “This period is eerily like 2000,” he says.

Mr. Grantham also predicts a recession will hit the U.S. economy in the next 12 months. “If you break the psychological bubble, you get a recession,” he says. Even so, after a temporary slowdown in inflation, he sees price pressures picking up again because of structural factors such as limitations in the supply of labour and resource scarcity. “You have fewer workers, which is inflationary, and shortages of energy, metals and food, which is inflationary, and so the recession will phase into longer-term stagflationary forces that we lived through for quite a long time in the 1970s and 1980s.”

Even the World Bank’s Mr. Malpass, in the organization’s latest Global Economic Prospects report released this week, warned that whether a recession occurs or not, “the pain of stagflation could persist for several years.” (All told, the word “stagflation” appears 75 times in the World Bank report.)

For each of these grim viewpoints, there are, of course, many who take the opposing position. Analysts at U.S. investment bank Goldman Sachs this week pointed to signs that economic output continues to expand, even if the “near-term recession risk has increased in a mechanical sense.”

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/IZ4W5SJ3PBGA5EKY2LIL62D6WU.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/IZ4W5SJ3PBGA5EKY2LIL62D6WU.jpg)

World Bank President David Malpass warned that the pain of stagflation could persist for several years.Yves Herman/Reuters

Meanwhile, Canada’s Big Bank CEOs were cautiously optimistic when they reported second-quarter results last month. “Markets are struggling to predict how we land the economy,” Royal Bank of Canada chief executive Dave McKay said in a call with investors. “Do we land it with a slight recession? Our message today is it could go either way. It’s 50-50. However … we believe the key ingredients are in place to help mitigate any sustained slowdown.” Mr. McKay highlighted low unemployment, rising wages and elevated liquidity as keys to avoiding a recession.

Yet as any bear will tell you, wages and the job market are lagging indicators. And with the mood of investors and consumers souring by the day, the worry now is that feelings of gloom about the economy are becoming a self-fulfilling prophecy.

The world economy is again in danger. … Even if a global recession is averted, the pain of stagflation could persist for several years.

— David Malpass, World Bank President

The world has every right to feel dour. Those early predictions of another Roaring Twenties were rooted in an assumption shared by many during the height of the pandemic that an awful moment in time was about to come to an end, that the world would return to normal.

Last May, that sentiment was captured, of all places, in a viral gum commercial. In the spot (which Adweek saw as tapping into the world’s desire for a “euphoric release”) comically dishevelled workers cast off their Zoom-dominated lives, pour into the streets, break down doors to return to their offices and make out with strangers in a park.

Unfortunately, normal has yet to return. Instead, we got Omicron, supply chain bottlenecks that have made it impossible to buy a car or stove, rising prices for food and gas, a war in Europe accompanied by nuclear sabre-rattling, even higher food and gas prices, severe lockdowns in China, and still higher food and gas prices.

As it turns out, last spring – as that gum commercial was making the rounds – marked the high point of the postpandemic mood. Within a month, the University of Michigan’s consumer sentiment index, the longest-running gauge of consumer confidence in the U.S., topped out before going into free fall. It was also roughly the moment when inflation rates blasted past the 2-per-cent target central banks strive to maintain.

It’s worth remembering that the economic stories in Canada and the U.S. share a lot of similarities, but key differences, too. For one thing, inflation sticker shock isn’t quite as severe here – at least not yet. The Canadian consumer price index rose by 6.8 per cent in April from the year before, compared with 8.6 per cent in the U.S. in May.

At the same time, Canada’s benchmark stock index, the resource-heavy S&P/TSX Composite, has held up relatively well at a time of rising commodity prices. The index is down just 6.5 per cent from its 52-week high, compared with a drop of 16 per cent for the S&P 500. At one point, the U.S. benchmark was down by 25 per cent, briefly putting it in bear-market territory.

As a result, the Canadian decline in consumer confidence has been less acute than south of the border. But aside from the old adage “when the U.S. sneezes, Canada catches a cold,” bears like Mr. Rosenberg also point to what they consider one of the world’s largest housing bubbles as a sign Canada is dangerously exposed to rising interest rates. A drop in house prices would have a profound impact on the psychology of Canadian consumers, he argues, with the “wealth effect” that has driven rising levels of consumption over the past two decades sliding into reverse.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/B4ZDLIIIUBFCDBAKR5CPVZDRYY.jpg)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/B4ZDLIIIUBFCDBAKR5CPVZDRYY.jpg)

Michael Harnett, Bank of America’s chief investment strategistHandout

”’Inflation shock’ worsening, ‘rates shock’ just beginning, ‘recession shock’ coming.”

— BofA chief investment strategist Michael Hartnett

Amid the gloom, those who study the interplay between sentiment and the economy see the risk of a feedback loop forming. “How people feel today will drive the decisions they make economically,” says Peter Atwater, an adjunct professor of economics at the College of William & Mary, who sees falling consumer confidence as a rising sense of vulnerability. “Inflation is not economic, it’s psychological, and it creates feelings of scarcity that weigh heavily on people’s feelings of certainty and control.” That, in turn, can translate into a pullback in spending, which stokes yet more fears.

This is also a moment for investors to remind themselves not to panic, says Lisa Kramer, a professor at the University of Toronto’s Rotman School of Management who studies the interplay between human emotion and markets. “Fear doesn’t drive good decision making,” she says. “If you look at your portfolio every day or multiple times a day, it will just look more volatile.” With that in mind, Prof. Kramer has started to minimize her consumption of market and economic news. (In other words, read this story, but then step away from the screen.)

Could all the recession talk actually be a sign we’re reaching a bottom? After all, when even Cardi B is weighing in on the business cycle, surely that means pessimism is reaching a saturation point. Perhaps, says Mr. Atwater, but the mood in markets still feels more like “impatience rather than capitulation.” For his part, Mr. Grantham argues a bottom won’t come until investors are “terrified” to own stocks.

The bears, meanwhile, continue to accumulate data points they say prove their case: inventory pileups at retailers, weakening corporate profit outlooks, plunging auto sales. And as of Friday, the mood in America reached a devastating new low: The University of Michigan’s consumer sentiment index fell to 50.8, a level not seen since the gauge was created in the 1950s.

For 46 of those years, until last month, Richard Curtin served as the consumer survey’s director. He took on the job amid one era of rising inflation and geopolitical uncertainty, and now he’s leaving in another.

The good news, he argues, is that consumers are in much better shape financially than they were in the 1980s, having rebuilt their savings during the pandemic. “This is only a pale reflection of the kind of horrendous pain households went through in the early 1980s,” he says. Back then, inflation hit nearly 15 per cent, and massive rate hikes brought on a recession that pushed unemployment to nearly 11 per cent.

But as the U.S. Federal Reserve tries to lower demand, Mr. Curtin believes the outside forces pushing up food and gasoline prices will remain, resulting in a stew of wilting economic activity and rising prices. “If I had to pick the most likely result of all this, it would be stagflation, with a falling job market and uncomfortably high inflation.”

A bear might say he told you so.

Your time is valuable. Have the Top Business Headlines newsletter conveniently delivered to your inbox in the morning or evening. Sign up today.

Economy

Climate Change Will Cost Global Economy $38 Trillion Every Year Within 25 Years, Scientists Warn – Forbes

Topline

Climate change is on track to cost the global economy $38 trillion a year in damages within the next 25 years, researchers warned on Wednesday, a baseline that underscores the mounting economic costs of climate change and continued inaction as nations bicker over who will pick up the tab.

Key Facts

Damages from climate change will set the global economy back an estimated $38 trillion a year by 2049, with a likely range of between $19 trillion and $59 trillion, warned a trio of researchers from Potsdam and Berlin in Germany in a peer reviewed study published in the journal Nature.

To obtain the figure, researchers analyzed data on how climate change impacted the economy in more than 1,600 regions around the world over the past 40 years, using this to build a model to project future damages compared to a baseline world economy where there are no damages from human-driven climate change.

The model primarily considers the climate damages stemming from changes in temperature and rainfall, the researchers said, with first author Maximilian Kotz, a researcher at the Potsdam Institute for Climate Impact Research, noting these can impact numerous areas relevant to economic growth like “agricultural yields, labor productivity or infrastructure.”

Importantly, as the model only factored in data from previous emissions, these costs can be considered something of a floor and the researchers noted the world economy is already “committed to an income reduction of 19% within the next 26 years,” regardless of what society now does to address the climate crisis.

Global costs are likely to rise even further once other costly extremes like weather disasters, storms and wildfires that are exacerbated by climate change are considered, Kotz said.

The researchers said their findings underscore the need for swift and drastic action to mitigate climate change and avoid even higher costs in the future, stressing that a failure to adapt could lead to average global economic losses as high as 60% by 2100.

!function(n) if(!window.cnxps) window.cnxps=,window.cnxps.cmd=[]; var t=n.createElement(‘iframe’); t.display=’none’,t.onload=function() var n=t.contentWindow.document,c=n.createElement(‘script’); c.src=’//cd.connatix.com/connatix.playspace.js’,c.setAttribute(‘defer’,’1′),c.setAttribute(‘type’,’text/javascript’),n.body.appendChild(c) ,n.head.appendChild(t) (document);

(function()

function createUniqueId()

return ‘xxxxxxxx-xxxx-4xxx-yxxx-xxxxxxxxxxxx’.replace(/[xy]/g, function(c) 0,

v = c == ‘x’ ? r : (r & 0x3 );

const randId = createUniqueId();

document.getElementsByClassName(‘fbs-cnx’)[0].setAttribute(‘id’, randId);

document.getElementById(randId).removeAttribute(‘class’);

(new Image()).src = ‘https://capi.connatix.com/tr/si?token=546f0bce-b219-41ac-b691-07d0ec3e3fe1’;

cnxps.cmd.push(function ()

cnxps(

playerId: ‘546f0bce-b219-41ac-b691-07d0ec3e3fe1’,

storyId: ”

).render(randId);

);

)();

How Do The Costs Of Inaction Compare To Taking Action?

Cost is a major sticking point when it comes to concrete action on climate change and money has become a key lever in making climate a “culture war” issue. The costs and logistics involved in transitioning towards a greener, more sustainable economy and moving to net zero are immense and there are significant vested interests such as the fossil fuel industry, which is keen to retain as much of the profitable status quo for as long as possible. The researchers acknowledged the sizable costs of adapting to climate change but said inaction comes with a cost as well. The damages estimated already dwarf the costs associated with the money needed to keep climate change in line with the limits set out in the 2015 Paris Climate Agreement, the researchers said, referencing the globally agreed upon goalpost set to minimize damage and slash emissions. The $38 trillion estimate for damages is already six times the $6 trillion thought needed to meet that threshold, the researchers said.

Crucial Quote

“We find damages almost everywhere, but countries in the tropics will suffer the most because they are already warmer,” said study author Anders Levermann. The researcher, also of the Potsdam Institute, explained there is a “considerable inequity of climate impacts” around the world and that “further temperature increases will therefore be most harmful” in tropical countries. “The countries least responsible for climate change” are expected to suffer greater losses, Levermann added, and they are “also the ones with the least resources to adapt to its impacts.”

What To Watch For

The fundamental inequality over who is impacted most by climate change and who has benefited most from the polluting practices responsible for the climate crisis—who also have more resources to mitigate future damages—has become one of the most difficult political sticking points when it comes to negotiating global action to reduce emissions. Less affluent countries bearing the brunt of climate change argue wealthy nations like the U.S. and Western Europe have already reaped the benefits from fossil fuels and should pay more to cover the losses and damages poorer countries face, as well as to help them with the costs of adapting to greener sources of energy. Other countries, notably big polluters India and China, stymie negotiations by arguing they should have longer to wean themselves off of fossil fuels as their emissions actually pale in comparison to those of more developed countries when considered in historical context and on a per capita basis. Climate financing is expected to be key to upcoming negotiations at the United Nations’s next climate summit in November. The COP29 summit will be held in Baku, the capital city of oil-rich Azerbaijan.

Further Reading

Economy

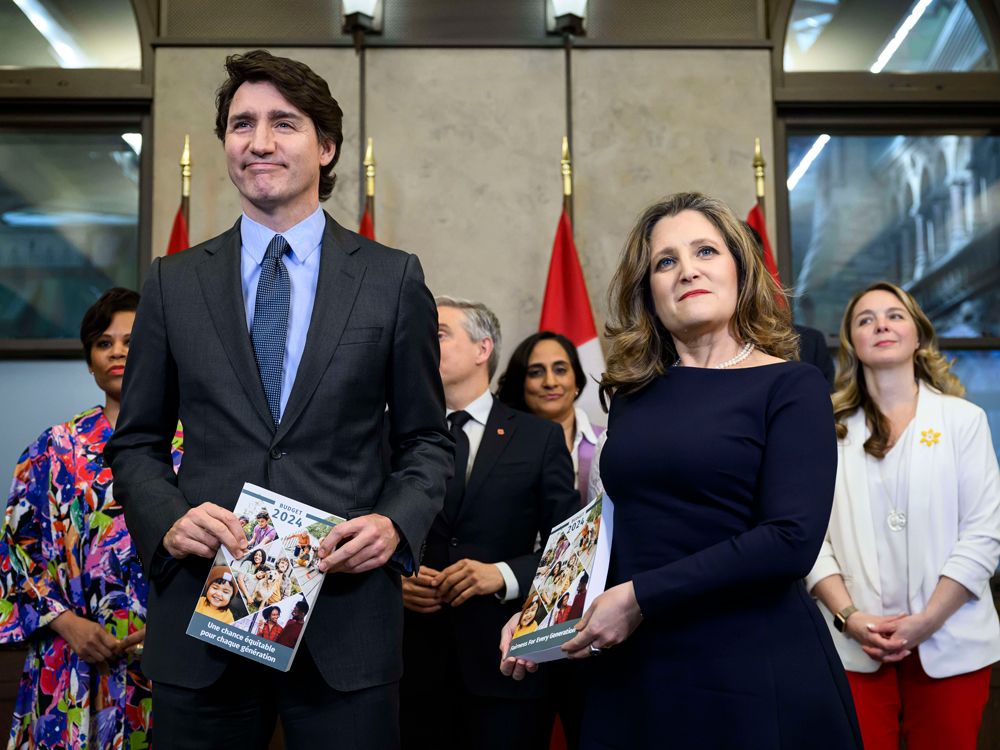

Canada's budget 2024 and what it means for the economy – Financial Post

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Economy

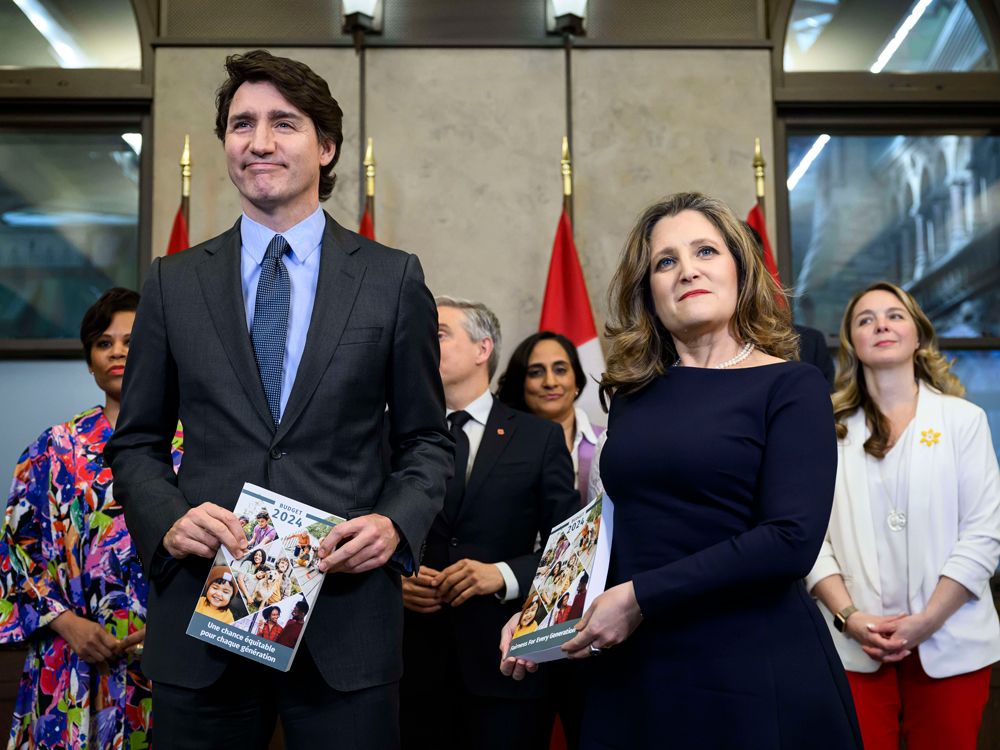

Opinion: Canada's economy has stagnated despite Trudeau government spin – Financial Post

Article content

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of economic performance. To assess Canadian living standards and the current health of the economy, journalists, politicians and analysts often compare Canada’s GDP growth to growth in other countries or in Canada’s past. But GDP is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Article content

Federal Finance Minister Chrystia Freeland recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. In this she echoes then-prime minister Stephen Harper, who said in 2015 that Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Article content

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. Lately, our aggregate GDP growth has been driven primarily by population and labour force growth, not productivity improvements. It is not mainly the result of Canadians becoming better at producing goods and services and thus generating more real income for their families. Instead, it is a result of there simply being more people working. That increases the total amount of goods and services produced but doesn’t translate into increased living standards.

Let’s look at the numbers. From 2000 to 2023 Canada’s annual average growth in real (i.e., inflation-adjusted) GDP growth was the second highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good — until you adjust for population. Then a completely different story emerges.

Article content

Over the same period, the growth rate of Canada’s real per person GDP (0.7 per cent) was meaningfully worse than the G7 average (1.0 per cent). The gap with the U.S. (1.2 per cent) was even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, an average of 1.1 per cent per year — more than twice the 0.5 per cent experienced in the G7 as a whole. In aggregate, Canada’s population increased by 29.8 per cent during this period, compared to just 11.5 per cent in the entire G7.

Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in Canada’s population growth. This increase has obscured historically weak economic growth per person over the same period. From 2015 to 2023, under the Trudeau government, real per person economic growth averaged just 0.3 per cent. That compares with 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Recommended from Editorial

Canada is neither leading the G7 nor doing well in historical terms when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Ben Eisen, Milagros Palacios and Lawrence Schembri are analysts at the Fraser Institute.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network

-

Sports21 hours ago

Sports21 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

News22 hours ago

Richard Chevolleau Short Film “Marvelous Marvin” Set to go to Camera

-

Business20 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca

-

Tech13 hours ago

Tech13 hours agoiPhone 15 Pro Desperado Mafia model launched at over ₹6.5 lakh- All details about this luxury iPhone from Caviar – HT Tech

-

Investment23 hours ago

Investment23 hours agoStephen Poloz will lead push to boost domestic investment by Canadian pension funds

-

Art24 hours ago

Richmond art exhibits travel back in time, explore legacies

-

News23 hours ago

Federal budget 2024: Some of the winners and losers

-

Sports13 hours ago

Sports13 hours agoLululemon unveils Canada's official Olympic kit for the Paris games – National Post