Article content

(Bloomberg) — The world’s third largest economy recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses.

The world’s third largest economy recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses.

(Bloomberg) — The world’s third largest economy recovered to its pre-pandemic size in the second quarter, as consumer spending picked up following the end of coronavirus curbs on businesses.

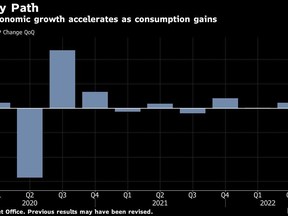

Gross domestic product grew at an annualized pace of 2.2% in the second quarter of this year, coming in below the median estimate of 2.6%, Cabinet Office data showed Monday. That lifted the size of the economy to 542.1 trillion yen ($4.1 trillion), above what it was at the end of 2019. First quarter GDP was revised to an expansion from a prior contraction.

“The economy managed to return to its pre-pandemic size, but its recovery pace has been slower than other nations,” said economist Takeshi Minami at Norinchukin Research Institute. “I expect growth to continue in the third quarter too, but it will likely be losing momentum down the road.”

The end of pandemic restrictions on businesses in late March helped spur the economy. Consumer spending, which accounts for more than half of Japan’s economic output, led the growth, as did capital expenditure. The relaxing of Covid rules resulted in increased spending at restaurants and hotels, as well as on clothes, according to the Cabinet Office.

Still, the gains were more limited than expected a few months ago, showing that pent-up demand among consumers has been moderate.

What Bloomberg Economics Says…

“Going forward, we expect growth to slow in 3Q. Persistent cost-push inflation and a surge in new Covid-19 cases point to downside risks to the recovery. These will probably outweigh any boost from inventory rebuilding.”

— Yuki Masujima, economist

For the full report, click here.

While the economy regained its pre-pandemic size, economists expect the central bank to stick to its current easing policy, and the government to continue providing support for households hit by both the pandemic and rising prices. Other developed economies are doing the opposite by raising interest rates to cool demand and rampant inflation.

Japan’s milestone also comes behind the US’s, which recovered its pre-pandemic economy size a year ago, while much of Europe regained it at the end of 2021.

The report came out as downside risks mount at home and abroad. Japan has been reporting record Covid infection cases with daily numbers continuing to top 200,000 this month. The government has so far kept economic activity as normal as possible without bringing back restrictions. But high-frequency data suggest people’s mobility is falling.

In Japan’s key trading partners, growth is slowing as the US and Europe fight inflation and China sticks to its zero-Covid policy. The war in Ukraine continues to disrupt food and energy supplies while the crisis in Taiwan is adding to geopolitical risks.

Inflation remains relatively moderate in Japan, but consumption may cool with prices rising faster than wages. After factoring in inflation, paychecks in Japan have been falling for three months in a row through June.

Prime Minister Fumio Kishida reshuffled his cabinet last week but signaled that the core parts of his policies will remain the same. Kishida also suggested he’ll remain flexible on fiscal support, although he’ll focus on spending existing reserve funds first before reaching for additional debt issuance.

Japan Kishida Orders Continued Wheat Prices Cap, More Grants (1)

Kishida ordered Monday another set of measures to contain inflation by early September, with a boost in funding for regional governments and a continued cap on imported wheat prices. He emphasized that wage gains need to be sustained, while saying that the additional support measures will concentrate on food, regional grants and energy.

For now, the measures will be supported by existing reserve funds, though Kishida said he’ll remain flexible in his approach.

“Inflation can cool consumption, although oil prices may stabilize with the global economy slowing down,” said Norinchukin’s Minami. “As downside risks mount in the world economy, there’s a risk that Japan’s economy could contract at some stage toward the end of the year.”

Bank of Japan Governor Haruhiko Kuroda has repeatedly said that the central bank must retain its easing program to support the economy until inflation becomes sustainable. He’s still seeking healthy wage gains, and price rises that go beyond a boom in commodities.

So far, economists expect growth in Japan to remain moderate for the rest of the year, slowing as the months progress. For the third quarter, analysts expect annualized gains of 3.2%.

(Updates with more details on additional price relief measures)

OTTAWA – Finance Minister Chrystia Freeland says the government is making some changes to mortgage rules to help more Canadians to purchase their first home.

She says the changes will come into force in December and better reflect the housing market.

The price cap for insured mortgages will be boosted for the first time since 2012, moving to $1.5 million from $1 million, to allow more people to qualify for a mortgage with less than a 20 per cent down payment.

The government will also expand its 30-year mortgage amortization to include first-time homebuyers buying any type of home, as well as anybody buying a newly built home.

On Aug. 1 eligibility for the 30-year amortization was changed to include first-time buyers purchasing a newly-built home.

Justice Minister Arif Virani is also releasing drafts for a bill of rights for renters as well as one for homebuyers, both of which the government promised five months ago.

Virani says the government intends to work with provinces to prevent practices like renovictions, where landowners evict tenants and make minimal renovations and then seek higher rents.

The government touts today’s announced measures as the “boldest mortgage reforms in decades,” and it comes after a year of criticism over high housing costs.

The Liberals have been slumping in the polls for months, including among younger adults who say not being able to afford a house is one of their key concerns.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

OTTAWA – Statistics Canada says manufacturing sales rose 1.4 per cent to $71 billion in July, helped by higher sales in the petroleum and coal and chemical product subsectors.

The increase followed a 1.7 per cent decrease in June.

The agency says sales in the petroleum and coal product subsector gained 6.7 per cent to total $8.6 billion in July as most refineries sold more, helped by higher prices and demand.

Chemical product sales rose 5.3 per cent to $5.6 billion in July, boosted by increased sales of pharmaceutical and medicine products.

Sales of wood products fell 4.8 per cent for the month to $2.9 billion, the lowest level since May 2023.

In constant dollar terms, overall manufacturing sales rose 0.9 per cent in July.

This report by The Canadian Press was first published Sept. 16, 2024.

The Canadian Press. All rights reserved.

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets climbed to their best week of the year.

“It’s been almost a complete opposite or retracement of what we saw last week,” said Philip Petursson, chief investment strategist at IG Wealth Management.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

While last week saw a “healthy” pullback on weaker economic data, this week investors appeared to be buying the dip and hoping the central bank “comes to the rescue,” said Petursson.

Next week, the U.S. Federal Reserve is widely expected to cut its key interest rate for the first time in several years after it significantly hiked it to fight inflation.

But the magnitude of that first cut has been the subject of debate, and the market appears split on whether the cut will be a quarter of a percentage point or a larger half-point reduction.

Petursson thinks it’s clear the smaller cut is coming. Economic data recently hasn’t been great, but it hasn’t been that bad either, he said — and inflation may have come down significantly, but it’s not defeated just yet.

“I think they’re going to be very steady,” he said, with one small cut at each of their three decisions scheduled for the rest of 2024, and more into 2025.

“I don’t think there’s a sense of urgency on the part of the Fed that they have to do something immediately.

A larger cut could also send the wrong message to the markets, added Petursson: that the Fed made a mistake in waiting this long to cut, or that it’s seeing concerning signs in the economy.

It would also be “counter to what they’ve signaled,” he said.

More important than the cut — other than the new tone it sets — will be what Fed chair Jerome Powell has to say, according to Petursson.

“That’s going to be more important than the size of the cut itself,” he said.

In Canada, where the central bank has already cut three times, Petursson expects two more before the year is through.

“Here, the labour situation is worse than what we see in the United States,” he said.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

— With files from The Associated Press

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Penguins re-sign Crosby to two-year extension that runs through 2026-27 season

Next phase of federal foreign interference inquiry to begin today in Ottawa

Feds wary of back-to-work legislation despite employer demands: labour experts

Liberals announce expansion to mortgage eligibility, draft rights for renters, buyers

Voters head to the polls for byelections in Montreal and Winnipeg

Ontario considers further expanding pharmacists’ scope to include more minor ailments

National housing market in ‘holding pattern’ as buyers patient for lower rates: CREA

Statistics Canada says manufacturing sales up 1.4% in July at $71B