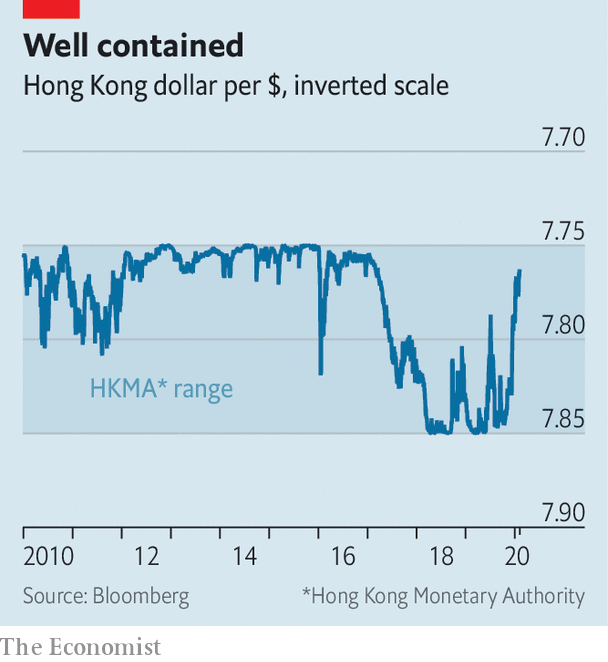

In other economies rocked by the virus, such as mainland China, Thailand and Singapore, the central bank has let the currency depreciate, easing financial conditions. But Hong Kong is different. Its currency has been tied to the American dollar since 1983 and confined to a narrow trading band of HK$7.75–7.85 to the dollar since 2005. If it falls to the weak side, the Hong Kong Monetary Authority (HKMA) is obliged to sell as many American dollars as people want to buy for HK$7.85. That has stopped the currency falling further (see chart).

Economy

Just how stable is Hong Kong’s economy? – The Economist

“I WANTED TRAVELLERS to arrive and know exactly which city they were in,” wrote Andrew Bromberg, an architect, to explain his design for West Kowloon station, where high-speed trains arrive in Hong Kong from mainland China. The platforms are deep underground, but passengers can enjoy the city’s skyline through 4,000 glass panes suspended from the station’s tilted roof. The more adventurous can go up to the rooftop for a better view.

But not anymore. The station and its rooftop are cordoned off. Four of the 21 people in Hong Kong that have been infected with the Wuhan coronavirus arrived in the city by high-speed rail. The station has now been closed, alongside ten of the other 13 entry points from the mainland.

These closures may or may not slow the spread of the disease. But they will certainly hamper an economy already debilitated by months of fierce anti-government protests. Figures released on February 3rd showed that GDP shrank by 2.9% year-on-year in the last quarter of 2019, when the protests reached a peak. Worse may be to come. Analysts at UBS, a bank, expect a fall of over 6% in the first quarter of this year compared with the same period last year.

But will it always do so? Even before the protests erupted or the virus mutated, some observers began to wonder if the peg would endure. According to Hong Kong’s mini-constitution, its autonomy and even the existence of its own currency is guaranteed only until 2047, which is within the duration of a 30-year mortgage. Hong Kong, many fear, is destined to become just another Chinese city—and they do not have their own currencies. Even if it remains semi-detached politically, its economy is increasingly attached to China’s. Why should its financial conditions remain tethered to America’s?

In the forward-looking world of financial markets, that question leads naturally to another: if Hong Kong’s currency regime is destined to change some day, how hard would Hong Kong fight for it today, if the markets tested its will? Such a test is not too hard to envisage. In December, property prices fell by 1.7%, compared with the previous month, and are now almost 5% below their peak. If those falls gained momentum, speculative capital might quit the market and the city. A collapse in property prices would also test the banking system. Its assets are worth 845% of Hong Kong’s GDP (although only 30% of its total loans are spent on Hong Kong property development or home purchases). And many of the deposits on the other side of its balance-sheet are held by non-residents, who might prove flighty in a crisis.

According to its defenders, Hong Kong’s currency peg is “virtually impregnable”. The HKMA’s foreign-exchange reserves amount to $440bn, twice as much as the money supply, narrowly defined to include banknotes and the banks’ claims on the monetary authority. The banks would run out of Hong Kong dollars before it ran out of American ones.

Why then is it only “virtually” impregnable? For one thing, there are broader definitions of money supply. A war chest of $440bn may be large compared with banks’ deposits at the HKMA. But it is small compared with customers’ deposits with banks (HK$6.9trn, equivalent to $880bn). If every depositor wanted to convert their holdings into American dollars, there would not be enough to go around.

Such conversions would also have broader economic implications. Every Hong Kong dollar sold to the monetary authority disappears. All else equal, it then becomes dearer for the banks to borrow the diminishing number of Hong Kong dollars that remain. These high interest rates make holding the currency more lucrative and short-selling it more costly. But insofar as households and firms still need to borrow in Hong Kong dollars, these high interest rates also hurt the economy. How much pain would Hong Kong be willing to take?

The peg’s downfall may be imaginable. But is it probable? One place to look is the options market, where investors can hedge against the risk of the currency moving outside the band. For about 40% of the period from June 2005 to July 2018, option prices implied that the odds of the peg breaking were above 10%, suggests a recent study by Samuel Drapeau, Tan Wang and Tao Wang of Shanghai Jiao Tong University. But for most of that time markets were betting on the currency strengthening past HK$7.75 to the dollar, not weakening past HK$7.85.

Bearish bets became more popular last year during the worst of the protests. But the speculation was not as fierce as it had been in 2016, after China clumsily devalued the yuan. Capital outflows picked up in the third quarter of last year, diminishing Hong Kong’s foreign-exchange reserves. But reserves have stabilised since, helped by a truce in the trade war between America and China. Hong-Kong dollar deposits are lower than they were six months ago, but still higher than they were a year ago.

Any signs of sustained capital outflows are, then, “embryonic”, says Alicia Garcia Herrero of Natixis, a bank. If capital is leaving, its speed of departure is reminiscent of one of Hong Kong’s quaint trams, not one of its bullet trains.■

This article appeared in the Finance and economics section of the print edition under the headline “Just how stable is Hong Kong’s economy?”

Economy

Canada’s unemployment rate holds steady at 6.5% in October, economy adds 15,000 jobs

OTTAWA – Canada’s unemployment rate held steady at 6.5 per cent last month as hiring remained weak across the economy.

Statistics Canada’s labour force survey on Friday said employment rose by a modest 15,000 jobs in October.

Business, building and support services saw the largest gain in employment.

Meanwhile, finance, insurance, real estate, rental and leasing experienced the largest decline.

Many economists see weakness in the job market continuing in the short term, before the Bank of Canada’s interest rate cuts spark a rebound in economic growth next year.

Despite ongoing softness in the labour market, however, strong wage growth has raged on in Canada. Average hourly wages in October grew 4.9 per cent from a year ago, reaching $35.76.

Friday’s report also shed some light on the financial health of households.

According to the agency, 28.8 per cent of Canadians aged 15 or older were living in a household that had difficulty meeting financial needs – like food and housing – in the previous four weeks.

That was down from 33.1 per cent in October 2023 and 35.5 per cent in October 2022, but still above the 20.4 per cent figure recorded in October 2020.

People living in a rented home were more likely to report difficulty meeting financial needs, with nearly four in 10 reporting that was the case.

That compares with just under a quarter of those living in an owned home by a household member.

Immigrants were also more likely to report facing financial strain last month, with about four out of 10 immigrants who landed in the last year doing so.

That compares with about three in 10 more established immigrants and one in four of people born in Canada.

This report by The Canadian Press was first published Nov. 8, 2024.

The Canadian Press. All rights reserved.

Economy

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

The Canadian Institute for Health Information says health-care spending in Canada is projected to reach a new high in 2024.

The annual report released Thursday says total health spending is expected to hit $372 billion, or $9,054 per Canadian.

CIHI’s national analysis predicts expenditures will rise by 5.7 per cent in 2024, compared to 4.5 per cent in 2023 and 1.7 per cent in 2022.

This year’s health spending is estimated to represent 12.4 per cent of Canada’s gross domestic product. Excluding two years of the pandemic, it would be the highest ratio in the country’s history.

While it’s not unusual for health expenditures to outpace economic growth, the report says this could be the case for the next several years due to Canada’s growing population and its aging demographic.

Canada’s per capita spending on health care in 2022 was among the highest in the world, but still less than countries such as the United States and Sweden.

The report notes that the Canadian dental and pharmacare plans could push health-care spending even further as more people who previously couldn’t afford these services start using them.

This report by The Canadian Press was first published Nov. 7, 2024.

Canadian Press health coverage receives support through a partnership with the Canadian Medical Association. CP is solely responsible for this content.

The Canadian Press. All rights reserved.

Economy

Trump’s victory sparks concerns over ripple effect on Canadian economy

As Canadians wake up to news that Donald Trump will return to the White House, the president-elect’s protectionist stance is casting a spotlight on what effect his second term will have on Canada-U.S. economic ties.

Some Canadian business leaders have expressed worry over Trump’s promise to introduce a universal 10 per cent tariff on all American imports.

A Canadian Chamber of Commerce report released last month suggested those tariffs would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

More than 77 per cent of Canadian exports go to the U.S.

Canada’s manufacturing sector faces the biggest risk should Trump push forward on imposing broad tariffs, said Canadian Manufacturers and Exporters president and CEO Dennis Darby. He said the sector is the “most trade-exposed” within Canada.

“It’s in the U.S.’s best interest, it’s in our best interest, but most importantly for consumers across North America, that we’re able to trade goods, materials, ingredients, as we have under the trade agreements,” Darby said in an interview.

“It’s a more complex or complicated outcome than it would have been with the Democrats, but we’ve had to deal with this before and we’re going to do our best to deal with it again.”

American economists have also warned Trump’s plan could cause inflation and possibly a recession, which could have ripple effects in Canada.

It’s consumers who will ultimately feel the burden of any inflationary effect caused by broad tariffs, said Darby.

“A tariff tends to raise costs, and it ultimately raises prices, so that’s something that we have to be prepared for,” he said.

“It could tilt production mandates. A tariff makes goods more expensive, but on the same token, it also will make inputs for the U.S. more expensive.”

A report last month by TD economist Marc Ercolao said research shows a full-scale implementation of Trump’s tariff plan could lead to a near-five per cent reduction in Canadian export volumes to the U.S. by early-2027, relative to current baseline forecasts.

Retaliation by Canada would also increase costs for domestic producers, and push import volumes lower in the process.

“Slowing import activity mitigates some of the negative net trade impact on total GDP enough to avoid a technical recession, but still produces a period of extended stagnation through 2025 and 2026,” Ercolao said.

Since the Canada-United States-Mexico Agreement came into effect in 2020, trade between Canada and the U.S. has surged by 46 per cent, according to the Toronto Region Board of Trade.

With that deal is up for review in 2026, Canadian Chamber of Commerce president and CEO Candace Laing said the Canadian government “must collaborate effectively with the Trump administration to preserve and strengthen our bilateral economic partnership.”

“With an impressive $3.6 billion in daily trade, Canada and the United States are each other’s closest international partners. The secure and efficient flow of goods and people across our border … remains essential for the economies of both countries,” she said in a statement.

“By resisting tariffs and trade barriers that will only raise prices and hurt consumers in both countries, Canada and the United States can strengthen resilient cross-border supply chains that enhance our shared economic security.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

-

News19 hours ago

‘I get goosebumps’: Canadians across the country mark Remembrance Day

-

News19 hours ago

Surrey police transition deal still in works, less than three weeks before handover

-

News18 hours ago

From transmission to symptoms, what to know about avian flu after B.C. case

-

News18 hours ago

Bitcoin has topped $87,000 for a new record high. What to know about crypto’s post-election rally

-

News18 hours ago

Wisconsin Supreme Court grapples with whether state’s 175-year-old abortion ban is valid

-

News19 hours ago

Twin port shutdowns risk more damage to Canadian economy: business groups

-

News8 hours ago

Canadanewsmedia news November 12, 2024: Union serves strike notice to Canada Post

-

News8 hours ago

As Toronto enters its Taylor Swift era, experts say crowd safety depends on planning