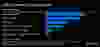

Mackenzie Investments, one of Canada’s largest fund managers, is turning less optimistic about stocks and sees better value in bonds after the 13 per cent rally for global equities in the first half.

Investment

Mackenzie Investments says it’s time to buy bonds after tech-fuelled rally

Central bankers’ campaigns to raise borrowing costs are starting to have an impact on the economy and will eventually force investors into a more defensive mode, Lesley Marks, Mackenzie’s chief investment officer of equities, said in an interview. There’s a 60 per cent chance of a U.S. recession in the next 12 months, according to economists in a recent Bloomberg survey.

“We think that as the data continues to unfold throughout the rest of the year, people will see that the economy is in fact slowing,” crimping corporate earnings, she said. “The relative value exists right now in fixed income.”

The firm’s strategists recommend adding investment grade debt and going underweight stocks.

Mackenzie’s view echoes growing wariness among global managers that the rally in equity benchmarks is out of sync with the economic reality. While a boom in artificial intelligence has powered gains in global tech stocks, masking weakness in other sectors, hawkish central-bank rhetoric is denting optimism about an economic soft landing.

Marks said any recession is likely to be mild, but “the slowdown in the economy is going to play a stronger role in the outlook for equities” in the second half of 2023.

Investment

Tesla shares soar more than 14% as Trump win is seen boosting Elon Musk’s electric vehicle company

NEW YORK (AP) — Shares of Tesla soared Wednesday as investors bet that the electric vehicle maker and its CEO Elon Musk will benefit from Donald Trump’s return to the White House.

Tesla stands to make significant gains under a Trump administration with the threat of diminished subsidies for alternative energy and electric vehicles doing the most harm to smaller competitors. Trump’s plans for extensive tariffs on Chinese imports make it less likely that Chinese EVs will be sold in bulk in the U.S. anytime soon.

“Tesla has the scale and scope that is unmatched,” said Wedbush analyst Dan Ives, in a note to investors. “This dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players.”

Tesla shares jumped 14.8% Wednesday while shares of rival electric vehicle makers tumbled. Nio, based in Shanghai, fell 5.3%. Shares of electric truck maker Rivian dropped 8.3% and Lucid Group fell 5.3%.

Tesla dominates sales of electric vehicles in the U.S, with 48.9% in market share through the middle of 2024, according to the U.S. Energy Information Administration.

Subsidies for clean energy are part of the Inflation Reduction Act, signed into law by President Joe Biden in 2022. It included tax credits for manufacturing, along with tax credits for consumers of electric vehicles.

Musk was one of Trump’s biggest donors, spending at least $119 million mobilizing Trump’s supporters to back the Republican nominee. He also pledged to give away $1 million a day to voters signing a petition for his political action committee.

In some ways, it has been a rocky year for Tesla, with sales and profit declining through the first half of the year. Profit did rise 17.3% in the third quarter.

The U.S. opened an investigation into the company’s “Full Self-Driving” system after reports of crashes in low-visibility conditions, including one that killed a pedestrian. The investigation covers roughly 2.4 million Teslas from the 2016 through 2024 model years.

And investors sent company shares tumbling last month after Tesla unveiled its long-awaited robotaxi at a Hollywood studio Thursday night, seeing not much progress at Tesla on autonomous vehicles while other companies have been making notable progress.

Tesla began selling the software, which is called “Full Self-Driving,” nine years ago. But there are doubts about its reliability.

The stock is now showing a 16.1% gain for the year after rising the past two days.

The Canadian Press. All rights reserved.

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

News23 hours ago

Freeland says she’s ready to deal with Trump |

-

News23 hours ago

NASA astronauts won’t say which one of them got sick after almost eight months in space

-

News23 hours ago

43 monkeys remain on the run from South Carolina lab. CEO thinks they’re having an adventure

-

News24 hours ago

Freeland rallies a united front ahead of Trump’s return to White House

-

News24 hours ago

Deputy minister appointed interim CEO of AIMCo after Alberta government fires board

-

News24 hours ago

Montreal says Quebec-Canada dispute stalling much-needed funding to help homeless

-

News24 hours ago

S&P/TSX composite index down Friday, Wall St. extends post-election gains

-

News24 hours ago

Mitch Marner powers Matthews-less Maple Leafs over Red Wings