Investment

Mitigating Investment Risk In Times Of Change – Forbes

Now that Joe Biden has been sworn in as President and the new Congress has been seated, many alternative asset investors are wondering what the new administration and shift in the balance of power in Congress might mean for their portfolios.

Following is a look at five alternative asset trends and developments to potentially watch out for this year under the new Biden administration. But first, let’s take a brief look back at how alternative assets performed in 2020.

While traditional asset classes like stocks rode a wild roller coaster last year — plunging to bear market lows in the spring when the COVID-19 pandemic was first declared and economic lockdowns began, only to soar to new records by the end of the year — many alternative assets experienced relatively minor volatility while generating positive ROI. In this regard, alternative assets helped bring some stability to investors’ portfolios during times of tremendous uncertainty.

1. Consumer Sentiment is Optimistic

Navigating major health, financial and social disruptions that were encountered in 2020, consumer sentiment is holding as consumer expectations are optimistic for the not-too-distant future. The University of Michigan Survey of Consumers Index fell slightly in January to 79 (from 80.7 in December) in what the report called a “trivial decline.” This modest drop was attributed to optimism about COVID-19 vaccinations, the quick substitution of remote work, and the prompt distribution of federal benefits for consumers.

In particular, there are high hopes for additional fiscal stimulus, consumer delinquencies and defaults were lower than many economists forecasted last year, and the savings rate skyrocketed as many consumers scaled back spending and socked away emergency funds. Surveys of Consumers chief economist Richard Curtin reported they anticipate consumers will reach into their savings and spark a significant gain in spending in late 2021. All these factors could signal good news for alternative assets in 2021.

2. Is Commercial Real Estate Due for a Rebound?

Commercial real estate (CRE) was hit hard last year as stay-at-home orders nationwide forced many businesses to shift to a work-from-home model. While it’s hard to predict what the future of the traditional office will look like in the post-COVID world, there are signs that business travel, at least, could be headed for a strong bounce-back this year.

Despite the pandemic-related pullback, the central tenets to business travel remain intact, which could bode well for the hard-hit hotel industry. The same holds for vacation travel once the pandemic is under control. Hotels of sub-standard quality in less-desirable locations could be challenged, however, as demand is no longer anticipated to exceed supply as it did before the pandemic.

The outlook is a little cloudier for retail CRE, however. In just six months, the pandemic accelerated the adoption of online shopping by five years, according to one estimate. The adoption acceleration has been most pronounced among older Americans. The question: Will these consumers be eager to return to brick-and-mortar retail stores when it’s safe to do so, or will they become so comfortable with e-tailing that they never return to their old shopping habits?

3. What About Single-Family Rentals?

Institutional investors have been slow to adapt their successful multi-family rental strategies to the single-family rental market. As a result, the single-family rental market has been largely institutionalized over the past decade, which has resulted in a low-single-digit net penetration for institutional investors.

This could change over the next few years as private property owners start selling rental properties to professionally managed investment companies. If the work-from-home trend continues, single-family rentals could become even more attractive.

4. Is the Future in ESG Investing?

2020 saw environmental, social, and corporate governance (ESG) investing become a major trend. Sustainable investing assets grew from $12 trillion in early 2018 to $17.1 trillion in early 2020, according to The Forum for Sustainable and Responsible Investments. This represents a 42% increase and a compound annual growth rate of 14%. ESG criteria and shareholder engagement address hot topics involved with climate change/carbon emissions, sustainable natural resources/agriculture, labor, diversity, and political spending. In the US SIF Foundation’s 2020 biennial Report on US Sustainable and Impact Investing Trends, the largest percent of 384 money managers and 1,204 community investment institutions conveyed their motivation for ESG investments are a focus because it helps them manage portfolio risk.

5. DOL Ruling Could Boost Private Equity

After plummeting during the second quarter of last year, global private equity (PE) buyout deals increased by nearly 20% during the third quarter to $58 billion. The ongoing scarcity of companies looking for private equity investors or buyouts could help drive the PE market even higher this year. Premiums will vary across sectors with higher multiples paid for companies that are more recession-resilient (like technology and healthcare) and lower multiples paid for a business that is more susceptible to downturns (such as retailers and oil and gas companies).

An important development last year could have a major impact on the PE market going forward. Last June, the Department of Labor ruled that private equity can be included in 401(k) plans. Access to PE funds may now be appropriate if they’re part of a diversified vehicle like a target-date fund. This helps level the field for retail investors who have historically been excluded from investing in PE funds. As a result, there could be a growing prevalence of PE investing in the $6 trillion U.S. 401(k) retail market.

A Final Thought

Finally, it’s worth pointing out that with the 10-year U.S. Treasury at or near historic lows, its use as a counterbalance to equity risk in a well-diversified portfolio has probably diminished. When considered alongside soaring equity prices, this could make the traditional 60/40 equity/fixed-income portfolio weighting worth reconsidering.

With new leaders come new priorities and as the Biden administration enacts new policies it is likely the stock market will react. In this environment, alternative assets could play a greater role in creating a well-diversified portfolio. Alternatives typically offer returns that are uncorrelated to equities and fixed income, thus helping mitigate portfolio risk. Investing through a self-directed IRA gives individuals a vehicle to make these types of non-traditional, alternative asset investments a reality.

Investment

Ukraine prime minister calls for more investment in war-torn country during Chicago stop of US visit – Toronto Star

/* OOVVUU Targeting */

const path = ‘/news/world/united-states’;

const siteName = ‘thestar.com’;

let domain = ‘thestar.com’;

if (siteName === ‘thestar.com’)

domain = ‘thestar.com’;

else if (siteName === ‘niagarafallsreview.ca’)

domain = ‘niagara_falls_review’;

else if (siteName === ‘stcatharinesstandard.ca’)

domain = ‘st_catharines_standard’;

else if (siteName === ‘thepeterboroughexaminer.com’)

domain = ‘the_peterborough_examiner’;

else if (siteName === ‘therecord.com’)

domain = ‘the_record’;

else if (siteName === ‘thespec.com’)

domain = ‘the_spec’;

else if (siteName === ‘wellandtribune.ca’)

domain = ‘welland_tribune’;

else if (siteName === ‘bramptonguardian.com’)

domain = ‘brampton_guardian’;

else if (siteName === ‘caledonenterprise.com’)

domain = ‘caledon_enterprise’;

else if (siteName === ‘cambridgetimes.ca’)

domain = ‘cambridge_times’;

else if (siteName === ‘durhamregion.com’)

domain = ‘durham_region’;

else if (siteName === ‘guelphmercury.com’)

domain = ‘guelph_mercury’;

else if (siteName === ‘insidehalton.com’)

domain = ‘inside_halton’;

else if (siteName === ‘insideottawavalley.com’)

domain = ‘inside_ottawa_valley’;

else if (siteName === ‘mississauga.com’)

domain = ‘mississauga’;

else if (siteName === ‘muskokaregion.com’)

domain = ‘muskoka_region’;

else if (siteName === ‘newhamburgindependent.ca’)

domain = ‘new_hamburg_independent’;

else if (siteName === ‘niagarathisweek.com’)

domain = ‘niagara_this_week’;

else if (siteName === ‘northbaynipissing.com’)

domain = ‘north_bay_nipissing’;

else if (siteName === ‘northumberlandnews.com’)

domain = ‘northumberland_news’;

else if (siteName === ‘orangeville.com’)

domain = ‘orangeville’;

else if (siteName === ‘ourwindsor.ca’)

domain = ‘our_windsor’;

else if (siteName === ‘parrysound.com’)

domain = ‘parrysound’;

else if (siteName === ‘simcoe.com’)

domain = ‘simcoe’;

else if (siteName === ‘theifp.ca’)

domain = ‘the_ifp’;

else if (siteName === ‘waterloochronicle.ca’)

domain = ‘waterloo_chronicle’;

else if (siteName === ‘yorkregion.com’)

domain = ‘york_region’;

let sectionTag = ”;

try

if (domain === ‘thestar.com’ && path.indexOf(‘wires/’) = 0)

sectionTag = ‘/business’;

else if (path.indexOf(‘/autos’) >= 0)

sectionTag = ‘/autos’;

else if (path.indexOf(‘/entertainment’) >= 0)

sectionTag = ‘/entertainment’;

else if (path.indexOf(‘/life’) >= 0)

sectionTag = ‘/life’;

else if (path.indexOf(‘/news’) >= 0)

sectionTag = ‘/news’;

else if (path.indexOf(‘/politics’) >= 0)

sectionTag = ‘/politics’;

else if (path.indexOf(‘/sports’) >= 0)

sectionTag = ‘/sports’;

else if (path.indexOf(‘/opinion’) >= 0)

sectionTag = ‘/opinion’;

} catch (ex)

const descriptionUrl = ‘window.location.href’;

const vid = ‘mediainfo.reference_id’;

const cmsId = ‘2665777’;

let url = `https://pubads.g.doubleclick.net/gampad/ads?iu=/58580620/$domain/video/oovvuu$sectionTag&description_url=$descriptionUrl&vid=$vid&cmsid=$cmsId&tfcd=0&npa=0&sz=640×480&ad_rule=0&gdfp_req=1&output=vast&unviewed_position_start=1&env=vp&impl=s&correlator=`;

url = url.split(‘ ‘).join(”);

window.oovvuuReplacementAdServerURL = url;

CHICAGO (AP) — Ukraine Prime Minister Denys Shmyhal kicked off a United States visit Tuesday with multiple stops in Chicago aimed at drumming up investment and business in the war-torn country.

He spoke to Chicago-area business leaders before a joint news conference with Penny Pritzker, the U.S. special representative for Ukraine’s economic recovery, and her brother, Illinois Gov. J.B. Pritzker.

function buildUserSwitchAccountsForm()

var form = document.getElementById(‘user-local-logout-form-switch-accounts’);

if (form) return;

// build form with javascript since having a form element here breaks the payment modal.

var switchForm = document.createElement(‘form’);

switchForm.setAttribute(‘id’,’user-local-logout-form-switch-accounts’);

switchForm.setAttribute(‘method’,’post’);

switchForm.setAttribute(‘action’,’https://www.thestar.com/tncms/auth/logout/?return=https://www.thestar.com/users/login/?referer_url=https%3A%2F%2Fwww.thestar.com%2Fnews%2Fworld%2Funited-states%2Fukraine-prime-minister-calls-for-more-investment-in-war-torn-country-during-chicago-stop-of%2Farticle_15ada14e-b83e-5396-9b2d-0997cf4689bd.html’);

switchForm.setAttribute(‘style’,’display:none;’);

var refUrl = document.createElement(‘input’); //input element, text

refUrl.setAttribute(‘type’,’hidden’);

refUrl.setAttribute(‘name’,’referer_url’);

refUrl.setAttribute(‘value’,’https://www.thestar.com/news/world/united-states/ukraine-prime-minister-calls-for-more-investment-in-war-torn-country-during-chicago-stop-of/article_15ada14e-b83e-5396-9b2d-0997cf4689bd.html’);

var submit = document.createElement(‘input’);

submit.setAttribute(‘type’,’submit’);

submit.setAttribute(‘name’,’logout’);

submit.setAttribute(‘value’,’Logout’);

switchForm.appendChild(refUrl);

switchForm.appendChild(submit);

document.getElementsByTagName(‘body’)[0].appendChild(switchForm);

function handleUserSwitchAccounts()

window.sessionStorage.removeItem(‘bd-viafoura-oidc’); // clear viafoura JWT token

// logout user before sending them to login page via return url

document.getElementById(‘user-local-logout-form-switch-accounts’).submit();

return false;

buildUserSwitchAccountsForm();

console.log(‘=====> bRemoveLastParagraph: ‘,0);

Investment

Canada Pension Plan investment board to host public meeting in Calgary – CTV News Calgary

The Canada Pension Plan (CPP) investment board will be hosting a public meeting from 6 to 8 p.m. on April 16 at the BMO Centre.

Registration for the public is closed, but organizers say there is room for some walk-ins.

The board hosts public meetings across Canada every two years to update people on the fund’s performance, governance and investment approach.

The pension plan has been a hot topic in Alberta over the last year, after the provincial government released a commissioned report exploring the possibility of an Alberta Pension Plan (APP).

According to the report, if Alberta gave the required three-year notice to quit the CPP, it would be entitled to $334 billion, or about 53 per cent of the fund by 2027.

However, critics say that is an overestimation.

Premier Danielle Smith has said she will not call a referendum on the topic until the Office of the Chief Actuary releases an updated number.

More information on the public meetings can be found on the CPP Investments’ website.

Investment

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April – Yahoo Finance

The artificial intelligence (AI) space is red-hot right now. Companies across every industry are looking to capitalize on the technology, and are investing heavily to gain an edge over the competition. That’s true in the social media space, where advertisers are keen to get in front of the right audience for them.

While the social media landscape is jam-packed with competition, one company is separating itself from the pack. Meta Platforms (NASDAQ: META) is making strides across various aspects of the AI realm, and its performance over the competition shows.

Let’s dig in to why now is a lucrative opportunity to invest in Meta as the long-term AI narrative plays out.

The profit machine is up and running

One of the most appealing aspects of Meta is how efficiently management runs the business. In 2023, Meta grew revenue 16% year over year to $135 billion. However, the company increased income from operations by a whopping 62% year over year to $46.7 billion.

By expanding its operating margin, Meta recognized significant growth on the bottom line as well. Last year, the company generated $43 billion in free cash flow. With such a robust financial profile, Meta is well-positioned to invest profits back into the business as well as reward shareholders.

Investing for the future

During Meta’s fourth-quarter earnings call in February, investors learned how the company is deploying its cash heap. For starters, it has increased its share repurchase program by $50 billion. This is encouraging to see as it could imply that management views Meta stock as a good value.

But perhaps more exciting was the announcement of a quarterly dividend. Many high-growth tech companies are not in a financial position to pay a dividend — or instead choose to reinvest profits into research and development or marketing strategies. Meta’s new dividend certainly sets the company apart from many of its peers, and is a nice sweetener for long-term shareholders.

Another way Meta is using its cash flow is in the realm of artificial intelligence. Like many enterprises, Meta relies heavily on sophisticated graphics processing units (GPUs) from Nvidia. However, Meta has been hinting for a while that the company is investing in its own hardware. Earlier this month, Meta announced that an updated version of its training and inference chips, called MTIA, is now available.

This is important for a couple of reasons. Namely, in-house chips will allow Meta to “control the whole stack” and scale back its reliance on semiconductors from third parties. Additionally, given the company’s knowledge base of data that it collects from social media platforms Facebook, Instagram, and WhatsApp, these new chips put Meta in a position to improve its targeted recommendation models and ad campaigns through the power of generative AI.

A compelling valuation

Meta competes with a number of players in the social media landscape. Alphabet is one of the company’s top competitors given that it operates the world’s top-two most visited websites: YouTube and Google. However, in 2023 Alphabet only grew its core advertising business by 6% year over year. By contrast, Meta’s advertising segment increased 16%.

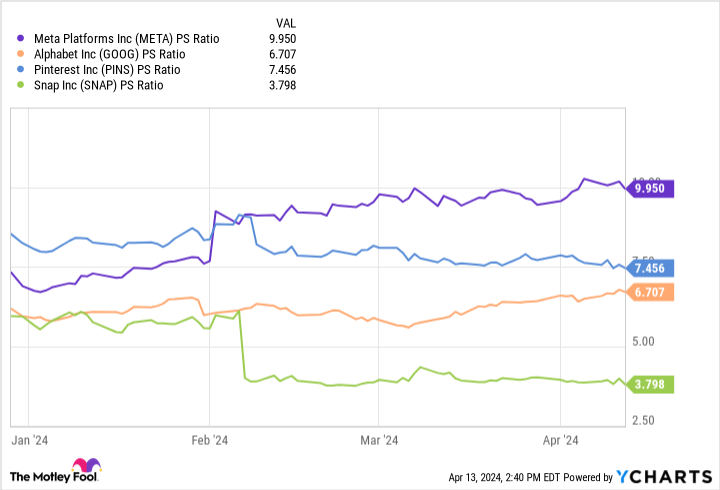

While Meta’s price-to-sales (P/S) ratio of 10 is higher than many of its social media peers, the company’s growth in the highly competitive and cyclical advertising landscape may warrant the premium.

Additionally, considering Meta’s price-to-free-cash-flow ratio of about 31 is actually trading relatively in line with its 10-year average of 32, the stock might not be as expensive as it appears.

Overall, I am optimistic about Meta’s aggressive ambitions in artificial intelligence — an investment that is yet to play out. The AI narrative is going to be a long-term story. But I see Meta as extremely well-equipped to take advantage of secular themes fueling AI, and benefiting across its entire business.

The combination of a dividend, share buybacks, consistent cash flow, and a compelling AI play make Meta stick out in a highly contested AI landscape. I think now is a great opportunity to scoop up shares in Meta and prepare to hold for the long term.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $540,321!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, Nvidia, and Pinterest. The Motley Fool has a disclosure policy.

A Once-in-a-Generation Investment Opportunity: 1 Sizzling Artificial Intelligence (AI) Stock to Buy Hand Over Fist in April was originally published by The Motley Fool

-

Media18 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Tech22 hours ago

Tech22 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Real eState22 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Sports21 hours ago

Sports21 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Science22 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment19 hours ago

Investment19 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

News24 hours ago

Montrealers conduct a sit-in to demand that Scotiabank divest from Elbit Systems

-

Politics21 hours ago

Politics21 hours agoQuebec employers group urges governments to base immigration on labour needs, not politics – CityNews Montreal