Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Investment

More than half of U.S. households have some investment in the stock market – Pew Research Center

Uncertainty driven by the current coronavirus outbreak has caused the U.S. stock market to wipe away three years of gains in a matter of weeks. The S&P 500 index fell from 3,386 on Feb. 19 this year to 2,305 on March 20, a loss of 32%. This rate of descent is much sharper than during the initial stages of the Great Recession, when it took from October 2007 to October 2008 to see a similar decrease in the index.

The economic stimulus package agreed to by Senate leaders and the White House appears to have restored some optimism in the market, at least for now. Even so, the losses will impact a wide swath of American families.

The steep fall in stock prices comes at a time when roughly four-in-ten U.S. workers (41%) have access to employer- or union-sponsored retirement plans, with the values of many of these plans linked to the stock market.

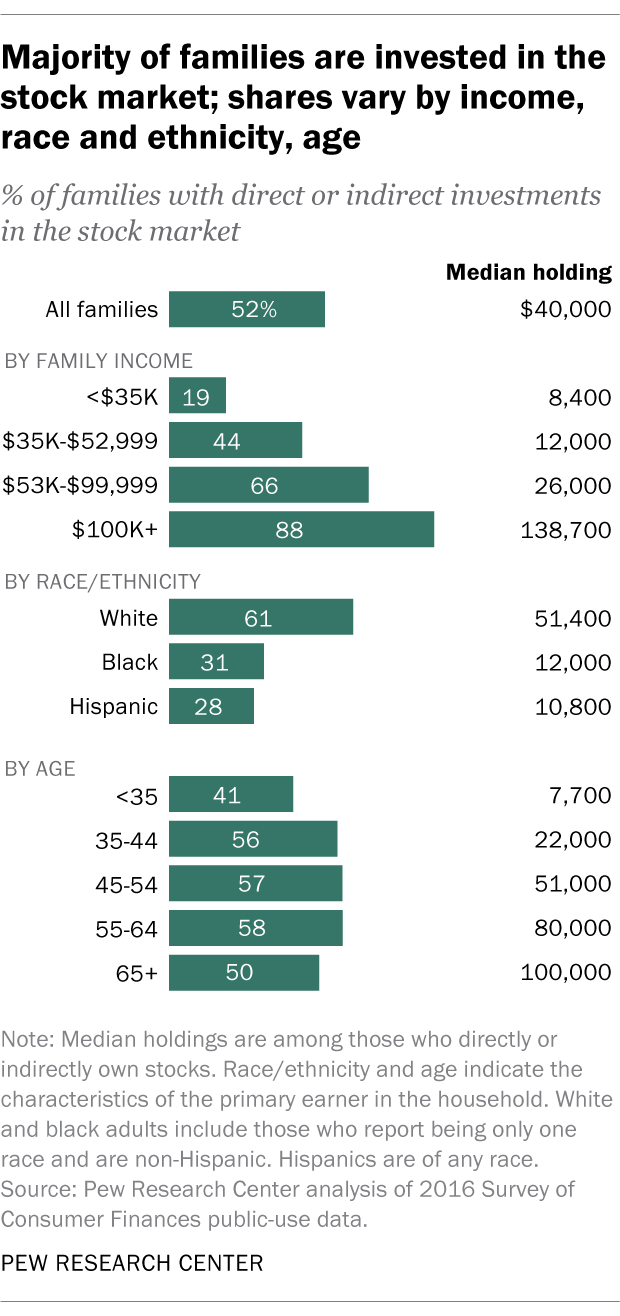

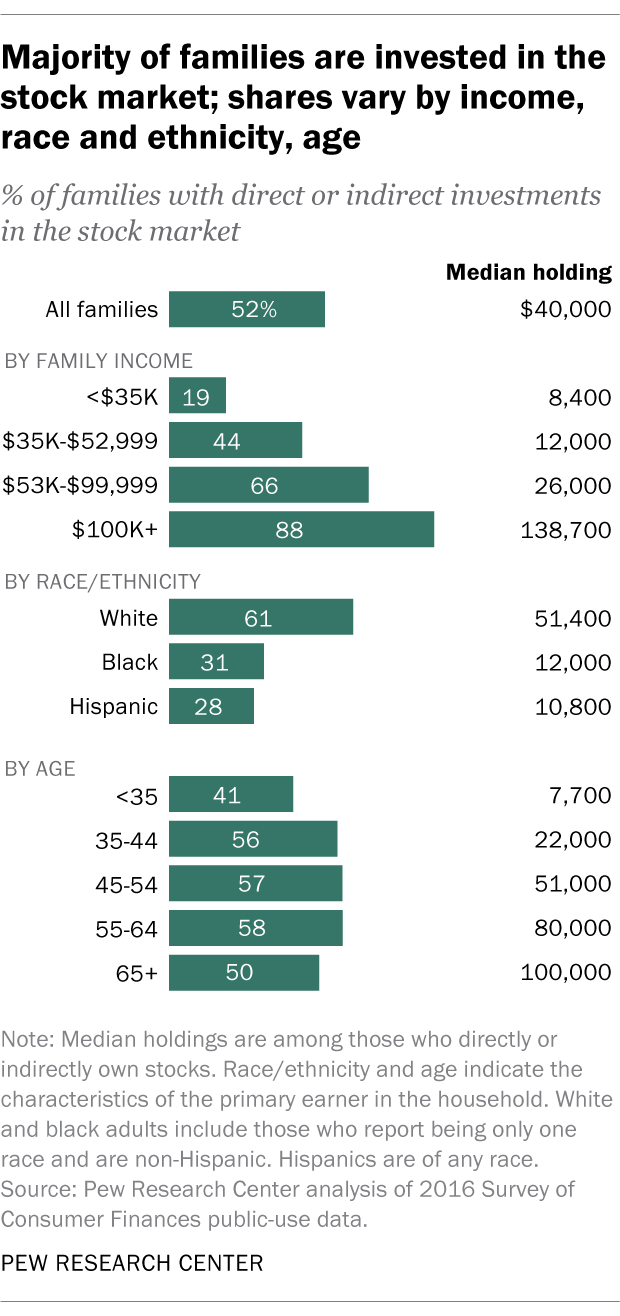

Data from 2016, the latest available, provides key insights into the broad reach of stock market investment in the United States. While a relatively small share of American families (14%) are directly invested in individual stocks, a majority (52%) have some level of investment in the market. Most of this comes in the form of retirement accounts such as 401(k)s.

How we did this

Participation in the stock market varies considerably across demographic groups. But even among those with annual family incomes of less than $35,000, about one-in-five have assets in the stock market. The shares increase as income rises, and among those with incomes above $100,000, 88% own stocks – either directly or indirectly. The amount of assets families hold in stocks also varies considerably by income. Among those with incomes less than $35,000, the median amount held is less than $10,000. For those at the higher end of the income scale, the median amount is more than $130,000.

Families headed by white adults are more likely than those headed by black or Hispanic adults to be invested in the stock market. A majority (61%) of non-Hispanic white households own some stock, compared with 31% of non-Hispanic black and 28% of Hispanic households. Median investments vary here as well: Among whites the median is about $51,000. By comparison, the median for black families is $12,000, and for Hispanic families it is just under $11,000.

There are differences by age as well, but even among families headed by a young adult (those under 35), 41% own some stock, either directly or indirectly. This is true of a majority of households headed by those ages 35 to 64 and half of those ages 65 and older. Assets accumulated over time also vary by age. The median amount invested by young adult households is relatively small – $7,700 among those younger than 35. And it rises steadily with age: $22,000 for households headed by 35- to 44-year-olds, $51,000 for those ages 45 to 54 and $80,000 or higher for those 55 and older.

Stocks represent a larger share of the total value of assets for some groups than others. For higher-income families (those with incomes over $100,000), whites and those ages 55 and older, investments in the stock market make up about a quarter of their total assets. For those with incomes less than $53,000, black- and Hispanic-led households and those headed by someone younger than 35, stocks represent only about 10% of their total assets.

The future direction of stock market prices is unknown. During the financial crisis that triggered the Great Recession, the S&P 500 index lost 53% of its value from October 2007 to February 2009. The recovery took longer, and it was not until March 2013 that the index returned to its pre-recession peak. From March 2013 to February 2020 the index value increased by 88%. But the losses so far in the stock market prompted by COVID-19 have turned the clock back to early 2017.

Investment

Want $1 Million in Retirement? Invest $15000 in These 3 Stocks

|

|

Compound interest is a thing of magic. It’s also one of your best bets if you’re looking to retire rich.

It might take time and patience but there’s not a whole lot of heavy lifting when it comes to a buy-and-hold investment strategy. What matters most is having decades of time in front of you, which will allow you to maximize the benefits of compounded returns. And, of course, choosing the right investments is equally important.

The magic of compound interest

With a decent return, building a million-dollar portfolio might not be as hard as you think. An initial investment of $15,000, returning 15% annually, would be worth just shy of $1 million in 30 years.

First off, 30 years is a long time, which means you’ll need to be planning your retirement far in advance. However, all it takes is one initial investment of $15,000 and the right stocks to build a $1 million portfolio.

Additionally, it’s important to remain realistic and acknowledge that a stock returning 15% annually is not exactly common. That being said, the TSX certainly has its share of dependable companies with track records of returning far more than just 15% per year.

I’ve put together a list of three Canadian stocks that are perfect for hands-off investors who are looking to retire rich.

Constellation Software

It will require a steep initial investment, but Constellation Software (TSX:CSU) is well worth its nearly $4,000-a-share price tag. When it comes to market-crushing returns, the tech stock has been in a league of its own over the past two decades.

Even as the company is now valued at a massive market cap of close to $80 billion, the impressive returns have continued. Shares are up more than 200% over the past five years. That’s good enough for a compound annual growth rate (CAGR) of 25%.

At a 25% annual return, a $15,000 investment would be worth a whopping $12 million in 30 years.

Descartes Systems

Descartes Systems (TSX:DSG) is another tech stock that’s no stranger to delivering market-beating returns. The company is also only valued at a market cap of $10 billion, leaving plenty of room for growth in the coming decades.

There’s a reason why Descartes Systems is one of the few tech stocks trading near all-time highs today. This stock is a proven winner, with lots of growth left in the tank.

Over the past five years, the stock has had a CAGR just shy of 20%.

goeasy

The last pick on my list is a beaten-down growth stock that’s trading at a serious discount.

The consumer-facing financial services provider has been hit by short-term headwinds from sky-high interest rates. With potential rate cuts around the corner though, now could be an excellent time to be loading up on goeasy (TSX:GSY).

Even with shares down 25% from all-time highs, the stock is still nearing a return of 300% over the past five years.

goeasy was crushing the market’s returns before the recent spike in interest rates, and there’s no reason to believe why the company won’t continue to do so for years to come.

Investment

FLAGSHIP COMMUNITIES REAL ESTATE INVESTMENT TRUST ANNOUNCES CLOSING OF APPROXIMATELY US

|

|

TORONTO, April 24, 2024 /CNW/ – Flagship Communities Real Estate Investment Trust (the “REIT” or “Flagship“) (TSX: MHC.U) (TSX: MHC.UN) announced today that it has completed its previously announced public offering (the “Offering“) of 3,910,000 trust units (the “Units“) on a bought deal basis at a price of US$15.35 per Unit for total gross proceeds to the REIT of approximately US$60 million.

The Offering was completed through a syndicate of underwriters co-led by BMO Capital Markets and Canaccord Genuity Corp.

ADVERTISEMENT

The REIT intends to use the net proceeds from the Offering to fund a portion of the approximately US$93 million aggregate purchase price for the REIT’s previously announced acquisition of seven manufactured housing communities comprising 1,253 lots (the “Acquisitions“) and for general business purposes. In the event the REIT is unable to consummate one or both of the Acquisitions, the REIT intends to use the net proceeds of the Offering to fund future acquisitions and for general business purposes.

The REIT has also granted the underwriters an over-allotment option to purchase up to an additional 586,500 Units on the same terms and conditions, exercisable at any time, in whole or in part, up to 30 days after the date hereof.

About Flagship Communities Real Estate Investment Trust

Flagship Communities Real Estate Investment Trust is a leading operator of affordable residential Manufactured Housing Communities primarily serving working families seeking affordable home ownership. The REIT owns and operates exceptional residential living experiences and investment opportunities in family-oriented communities in Kentucky, Indiana, Ohio, Tennessee, Arkansas, Missouri, and Illinois. To learn more about Flagship, visit www.flagshipcommunities.com.

Forward-Looking Statements

This press release contains statements that include forward-looking information (within the meaning of applicable Canadian securities laws). Forward-looking statements are identified by words such as “believe”, “anticipate”, “project”, “expect”, “intend”, “plan”, “will”, “may”, “can”, “could”, “would”, “must”, “estimate”, “target”, “objective”, and other similar expressions, or negative versions thereof, and include statements herein concerning the use of the net proceeds of the Offering.

These forward-looking statements are based on the REIT’s expectations, estimates, forecasts and projections, as well as assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies that could cause actual results to differ materially from those that are disclosed in such forward-looking statements. While considered reasonable by management of the REIT as at the date of this news release, any of these expectations, estimates, forecasts, projections, or assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those expectations, estimates, forecasts, projections, or assumptions could be incorrect. Material factors and assumptions used by management of the REIT to develop the forward-looking information in this news release include, but are not limited to, that the conditions to closing of the Acquisitions will be met or waived in a timely manner and that both of the Acquisitions will be completed on the current agreed upon terms.

When relying on forward-looking statements to make decisions, the REIT cautions readers not to place undue reliance on these statements, as they are not guarantees of future performance and involve risks and uncertainties that are difficult to control or predict. A number of factors, many of which are beyond the REIT’s control, could cause actual results to differ materially from the results discussed in the forward-looking statements, such as the risks identified in the REIT’s management’s discussion and analysis for the year ended December 31, 2023 available on the REIT’s profile on SEDAR+ at www.sedarplus.com, including, but not limited to, the factors discussed under the heading “Risks and Uncertainties” therein and the risk of the REIT’s plans with respect to debt bridge financing for the Acquisitions not being achieved as anticipated. There can be no assurance that forward-looking statements will prove to be accurate as actual outcomes and results may differ materially from those expressed in these forward-looking statements. Readers, therefore, should not place undue reliance on any such forward-looking statements. Forward-looking statements are made as of the date of this press release and, except as expressly required by applicable Canadian securities laws, the REIT assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Investment

Taxes should not wag the tail of the investment dog, but that’s what Trudeau wants

|

|

Kim Moody: Ottawa is encouraging people to crystallize their gains and pay tax. That’s a hell of a fiscal plan

The Canadian federal budget has been out for a week, which is plenty of time to absorb just how terrible it is.

The problems start with weak fiscal policy, excessive spending and growing public-debt charges estimated to be $54.1 billion for the upcoming year. That is more than $1 billion per week that Canadians are paying for things that have no societal benefit.

Why? Well, for the CEI, virtually every entrepreneurial industry (except technology) is not eligible. If you happen to be in an industry that qualifies, the $2-million exemption comes with a long, stringent list of criteria (which will be very difficult for most entrepreneurs to qualify for) and it is phased in over a 10-year period of $200,000 per year.

For transfers to EOTs, an entrepreneur must give up complete legal and factual control to be eligible for the $10-million exemption, even though the EOT will likely pay the entrepreneur out of future profits. The commercial risk associated with such a transfer is likely too great for most entrepreneurs to accept.

Capital gains tax hike

But the budget’s highlight proposal was the capital gains inclusion rate increase to 66.7 per cent from 50 per cent for dispositions effective after June 24, 2024. The proposal includes a 50 per cent inclusion rate on the first $250,000 of annual capital gains for individuals, but not for corporations and trusts. Oh, those evil corporations and trusts.

Some economists have come out in strong favour of the proposal, mainly because of equity arguments (a buck is a buck), but such arguments ignore the real world of investing where investors look at overall risk, liquidity and the time value of money.

If capital gains are taxed at a rate approaching wage taxation rates, why would entrepreneurs and investors want to risk their capital when such investments might be illiquid for a long period of time and be highly risky?

They will seek greener pastures for their investment dollars and they already are. I’ve been fielding a tremendous number of questions from investors over the past week and I’d invite those academics and economists who support the increased inclusion rate to come live in my shoes for a day to see how the theoretical world of equity and behaviour collide. It’s not good and it certainly does nothing to help Canada’s obvious productivity challenges.

The government messaging around this tax proposal has many people upset, including me. Specifically, it is the following paragraph in the budget documents that many supporters are parroting that is upsetting:

“Next year, 28.5 million Canadians are not expected to have any capital gains income, and 3 million are expected to earn capital gains below the $250,000 annual threshold. Only 0.13 per cent of Canadians with an average income of $1.4 million are expected to pay more personal income tax on their capital gains in any given year. As a result of this, for 99.87 per cent of Canadians, personal income taxes on capital gains will not increase.” (This is supposedly about 40,000 taxpayers.)

Bluntly, this is garbage. It outright ignores several facts.

Furthermore, public corporations that have capital gains will pay tax at a higher inclusion rate and this results in higher corporate tax, which means decreased amounts are available to be paid out as dividends to individual shareholders (including those held by individuals’ pensions).

The budget documents simply measured the number of corporations that reported capital gains in recent years and said it is 12.6 per cent of all corporations. That measurement is shallow and not the whole story, as described above.

Tax hit for cottages

There are also millions of Canadians who hold a second real estate property, either a cottage-type and/or rental property. Those properties will eventually be sold, with the probability that the gain will exceed the $250,000 threshold.

And people who become non-residents of Canada — and that is increasing rapidly — have deemed dispositions of their assets (with some exceptions). They will face the distinct possibility that such gains will be more than $250,000.

The politics around the capital gains inclusion rate increase are pretty obvious. The government is planning for Canadian taxpayers to crystallize their inherent gains prior to the implementation date, especially corporations that will not have a $250,000 annual lower inclusion rate. For the current year, the government is projecting a $4.9-billion tax take. But next year, it dramatically drops to an estimated $1.3 billion.

This is a ridiculous way to shield the government’s tremendous spending and try to make them look like they are holding the line on their out-of-control deficits. The government is encouraging people to crystallize their gains and pay tax. That’s a hell of a fiscal plan.

I hope the government has some second sober thoughts about the capital gains proposal, but I’m not holding my breath.

-

Health14 hours ago

Health14 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art20 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Health18 hours ago

Health18 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

Investment18 hours ago

Investment18 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

Science22 hours ago

Science22 hours agoiN PHOTOS: Nature lovers celebrate flora, fauna for Earth Day in Kamloops, Okanagan | iNFOnews | Thompson-Okanagan's News Source – iNFOnews

-

News19 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News

-

Art19 hours ago

An exhibition with a cause: Montreal's 'Art by the Water' celebrates 15 years – CityNews Montreal

-

Media13 hours ago

Vaughn Palmer: B.C. premier gives social media giants another chance