Economy

A slowing economy threatens the future of a generation of Canadian youths

|

|

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/W4D4A23565J67EPYG4Y3MY52OI.jpg)

A woman checks out a jobs advertisement sign during the COVID-19 pandemic in Toronto on April 29, 2020.Nathan Denette/The Canadian Press

Lisa Lalande is chief executive of Century Initiative. Pedro Barata is executive director of the Future Skills Centre.

With COVID-19 receding, the possibility of an economic downturn is becoming a stronger reality. The majority of Canadian financial institutions are predicting a slowdown in the next year.

Whenever it comes, we can expect governments to implement policies and programs to try to lessen the immediate impacts of job losses. But if this response follows the same pattern as in previous recessions and periods of tight labour markets, even a strong approach will leave half the job undone.

While the short-term slowdown effects of layoffs and cutbacks make headlines, the long-term impacts typically go unnoticed and unaddressed. The lasting scars of economic shocks, particularly for young people, lead to lower lifetime earnings and increased social exclusion, undermining Canadians’ economic, physical and mental health.

On Monday, Century Initiative launched our third National Scorecard on Canada’s Growth and Prosperity. The scorecard highlights where Canada’s long-term prosperity is on track and where there are risks. And for young people, labour markets are already lagging – something that could be amplified with a likely slowing of the economy, including a potential recession.

In light of these warning signs, Century Initiative is focusing on the long-term labour market scarring on youth after economic shocks. Together with the Future Skills Centre, we’re looking beyond the immediate aftermath of economic changes to help shape long-term responses to the dislocation and underemployment faced by young people in Canada.

The effects of negative labour market trends on youth are significant. When young people graduate and/or enter a weak labour market, they compete with more job seekers for fewer jobs. Some employers see this as an opportunity to raise the skill requirements for open positions, meaning any job a new graduate does get will often come with lower pay, and fewer training and promotion opportunities.

This labour market scarring can have lasting impacts on a person’s earnings and career opportunities. According to an American Economic Journal: Applied Economics study, simply having the unfortunate timing of graduating into a recession can account for continuing losses in earnings well after the economy picks up again. It’s also been shown that long periods of unemployment can harm a person’s ability to land future work, weakening their ties to the labour market.

High youth unemployment during economic hard times also risks a person’s well-being and social inclusion. Research shows there is a clear and significant mental-health decline immediately after a period of unemployment as a young person, and that the decline can linger well into a person’s mid-life.

Some youth can be more severely affected than others. For example, young people with lower levels of education suffer even larger losses of earnings. And while COVID-19 shutdowns disproportionately impacted all young people, women and racialized youth experienced the highest rates of unemployment.

Such groups are therefore at greater risk of experiencing the lasting effects on their mental and physical health. Another potential recession following closely after recent COVID-19 job losses could compound these inequalities, and cause setbacks in gender and racial equality in Canada.

The individual consequences of unemployment also harm Canada’s economy and our collective well-being as a society. When fewer people are in the work force or working at their full potential, our economy is less productive. Research shows that long-term unemployment is associated with, and can increase, the risk of homelessness, interactions with the justice system and mental-health challenges.

Typical government responses to economic slowdowns involve short-term initiatives that wrap up as economic conditions improve. Even the unprecedented responses to prevent job losses during COVID-19 such as the Canada Emergency Wage Subsidy did not take into account these lasting effects.

A very tight labour market is unlikely to cancel out these challenges, especially for younger people with a less stable footing in the job market. In fact, even the short-term responses are less likely to be available to young people just entering the labour market or working in gig-type roles.

If we want any chance of a swift and effective response to the next economic downturn, the time to act is now – not after it arrives. Thinking critically about a long-term policy response can help to prepare Canada for what may come and create worthwhile individual and societal benefits.

Failing to deal with the long-term scarring of slowdowns, including being prepared for the hard impacts of recessions on youth, isn’t just bad for young people; it’s bad for all Canadians, today and in the future. Building a bigger, bolder Canada tomorrow starts with bold policy moves today.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Economy

IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost – BNN Bloomberg

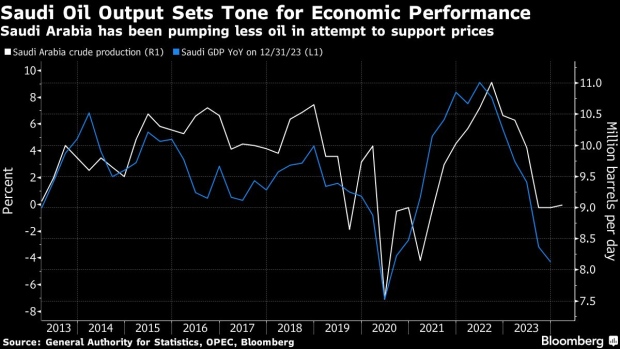

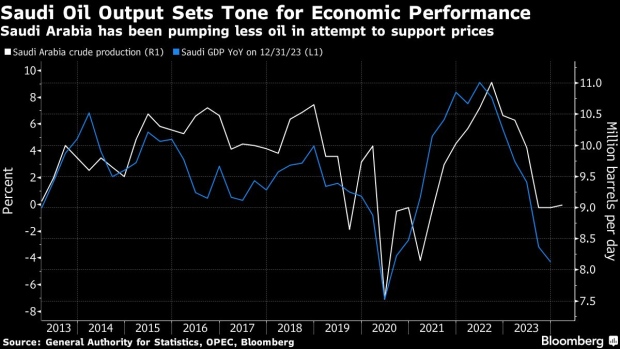

(Bloomberg) — The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

©2024 Bloomberg L.P.

Economy

IMF Boss Says ‘All Eyes’ on US Amid Risks to Global Economy – BNN Bloomberg

(Bloomberg) — The head of the International Monetary Fund warned the US that the global economy is closely watching interest rates and industrial policies given the potential spillovers from the world’s biggest economy and reserve currency.

“All eyes are on the US,” Kristalina Georgieva said in an interview on Bloomberg’s Surveillance on Thursday.

The two biggest issues, she said, are “what is going to happen with inflation and interest rates” and “how is the US going to navigate this world of more intrusive government policies.”

The sustained strength of the US dollar is “concerning” for other currencies, particularly the lack of clarity on how long that may last.

“That’s what I hear from countries,” said the leader of the fund, which has about 190 members. “How long will the Fed be stuck with higher interest rates?”

Georgieva was speaking on the sidelines of the IMF and World Bank’s spring meetings in Washington, where policymakers have been debating the impacts of Washington and Beijing’s policies and their geopolitical rivalry.

Read More: A Resilient Global Economy Masks Growing Debt and Inequality

Georgieva said the IMF is optimistic that the conditions will be right for the Federal Reserve to start cutting rates this year.

“The Fed is not yet prepared, and rightly so, to cut,” she said. “How fast? I don’t think we should gear up for a rapid decline in interest rates.”

The IMF chief also repeated her concerns about China devoting too much capital and labor toward export-oriented manufacturing, causing other countries, including the US, to retaliate with protectionist policies.

China Overcapacity

“If China builds overcapacity and pushes exports that create reciprocity of action, then we are in a world of more fragmentation not less, and that ultimately is not good for China,” Georgieva said.

“What I want to see China doing is get serious about reforms, get serious about demand and consumption,” she added.

A number of countries have recently criticized China for what they see as excessive state subsidies for manufacturers, particularly in clean energy sectors, that might flood global markets with cheap goods and threaten competing firms.

US Treasury Secretary Janet Yellen hammered at the theme during a recent trip to China, repeatedly calling on Beijing to shift its economic policy toward stimulating domestic demand.

Chinese officials have acknowledged the risk of overcapacity in some areas, but have largely portrayed the criticism as overblown and hypocritical, coming from countries that are also ramping up clean energy subsidies.

(Updates with additional Georgieva comments from eighth paragraph.)

©2024 Bloomberg L.P.

-

Investment21 hours ago

Investment21 hours agoUK Mulls New Curbs on Outbound Investment Over Security Risks – BNN Bloomberg

-

Sports19 hours ago

Sports19 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Business18 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media2 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art17 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment18 hours ago

Investment18 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech20 hours ago

Tech20 hours agoSave $700 Off This 4K Projector at Amazon While You Still Can – CNET

-

Tech19 hours ago

Tech19 hours ago'Kingdom Come: Deliverance II' Revealed In Epic New Trailer And It Looks Incredible – Forbes