Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Business

Posthaste: Home price drop within 'striking distance' of the last big downturn — and it's not over yet – Financial Post

Article content

Good Morning!

Advertisement 2

Article content

Article content

Seven months and 300 basis points into the Bank of Canada’s hiking cycle and homebuyers remain on the defensive.

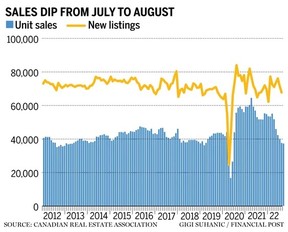

Housing data last week revealed that the national composite MLS Home Price Index fell another 1.6 per cent in August from the month before.

“It’s now down 7.4 per cent since February’s peak, within striking distance of the 8% peak-to-trough decline recorded during 2017-2019 downturn,” wrote RBC assistant chief economist Robert Hogue in a note.

And most agree it’s not over yet.

RBC sees the housing market decline continuing with the Bank expected to keep hiking interest rates until the end of the year. After the Bank’s last increase on Sept. 7, RBC economists now forecast the policy rate will rise to 4 per cent, up from the 3.5 per cent they had previously expected.

Advertisement 3

Article content

“Higher interest rates will disqualify more buyers from obtaining a mortgage and shrink the size of a mortgage others can qualify for,” said Hogue.

Ontario and British Columbia, and increasingly Quebec and parts of Atlantic Canada, are suffering the biggest declines, Hogue said, with home sales falling below pre-pandemic levels last month.

Corrections are steepest in the most overheated markets. Over the past six months, the composite MLS Home Price Index has plunged 19 per cent in Cambridge, Ontario, 16 per cent in Kitchener-Waterloo and London, 15 per cent in Brantford and 13 per cent in Guelph. Chilliwack, B.C., is down 14 per cent and the Fraser Valley, nine per cent.

Eastern Canada has fared better, but “downward pressure is intensifying,” said Hogue. Montreal prices are down 3.3 per cent over the past three months, about half the drop in Toronto. But Halifax has fallen 6.3 per cent in the same time period, with a 3.9 per cent drop in August alone. Prices in Saint John, New Brunswick, fell 4.2 per cent last month.

Advertisement 4

Article content

Still August’s national data leaves some room for optimism. Home sales fell one per cent from the month before, and while it’s the sixth monthly drop in a row, it was also the smallest. Compared to a year ago, sales were down 24.7 per cent in August, a smaller decline than the 29 per cent seen in July.

“August saw national sales hold steady month-to-month for the first time since February which, along with a stabilization of demand/supply conditions in many markets, could be an early sign that this year’s sharp adjustment in housing markets across Canada may have mostly run its course,” Canadian Real Estate Association chair Jill Oudil, said in the release of August’s data.

The average national home price, different than the composite home price index, was also up 1.9 per cent in August from July to $663,000 on a seasonally adjusted basis, the first increase after five months of decline.

Advertisement 5

Article content

However, Randall Bartlett, senior director of Canadian economics at Desjardins, says a closer look at the details should curb any budding enthusiasm.

Gains in the average price month over month were concentrated in the Greater Toronto Area, and the composite benchmark prices, which he says better reflects market conditions, are still falling.

“We believe this is more likely to be a dead cat bounce than a bounce back in the Canadian housing market,” he wrote in a note Thursday.

RBC, which predicts home sales will fall 23 per cent this year and another 15 per cent next, doesn’t expect the market to hit bottom until the spring, by which time prices will have fallen 14 per cent from their peak nationwide.

Ontario and B.C. will experience bigger declines of 16 per cent, while markets in Alberta and Saskatchewan prices are expected to lose just four per cent.

Advertisement 6

Article content

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

THE QUEEN’S QUILT As the world marks the funeral of Queen Elizabeth II today, here is a story of a woman in Nunavut who over the decades has accumulated what she believes is the largest private collection of Queen Elizabeth-themed souvenirs in the Canadian Arctic. Teacups, saucers, cookie tins, pots, spoons, old newspapers, magazines, books about the royal family, Joy Suluk has it all, totalling some 200 objects. But there is a twist in this tale. One day in 1994, the Queen herself showed up on an official visit to Rankin Inlet, and while touring an artisanal fair, bought a handmade blue-and-white quilt with polar bears and whales on it from a speechless Suluk. That’s the quilt above. Get the whole story from the Financial Post’s Joe O’Connor. Photo from Joy Suluk

Advertisement 7

Article content

___________________________________________________

- The government of Canada will hold a national ceremony in honour of the late Queen Elizabeth II, who passed away on Sept. 8

- Today’s Data: Canadian industrial product and raw materials price indices

_______________________________________________________

All but set in stone’: More economists join chorus predicting a Canadian recession

The Bank of Canada is losing money for the first time ever on rising rates

Quiet quitting is nonsense: Expecting all staff to work above and beyond is a mistake

Structured notes can offer investors some protection when markets are volatile

FP Answers: Pros and cons of fixed vs variable mortgages as borrowing rates rise

Advertisement 8

Article content

Send your small business questions to the Financial Post

_____________________________________________

__________

Everybody is watching housing starts these days for signs of whether construction will follow the housing market into a historic downturn.

Data from the Canada Mortgage and Housing Corporation Friday showed Canadian housing starts fell 2.8 per cent to 267,443 units on a seasonally adjusted annual basis in August. Despite the decline, housing starts are still near record levels and the six-month moving average inched higher to 267,309 units.

“Construction activity continues to hold up remarkably well in the face of an historic downturn in the Canadian home resale market. Still, starts are showing signs of weakening,” wrote Marc Desormeaux, Desjardins principal economist, in a note after the data was released.

Advertisement 9

Article content

Desjardins believes this is just the early innings of a downturn in home construction and it expects the effects of the cooling housing market to increasingly spill over into the building sector, gaining force as the Bank of Canada raises interest rates again in October.

“We are of the mind that this will eventually push the Canadian economy into recession in the first half of 2023,” Desormeaux wrote.

__________________________________________

Rents are soaring in Canadian cities, up 32 per cent in Metro Vancouver and 18 per cent in Toronto.

Our content parent MoneyWise has some tips on how to navigate today’s “unreal” rental market and find an affordable place to live as demand and prices increase.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven (@pamheaven), with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below:

Advertisement

Business

Oil Firms Doubtful Trans Mountain Pipeline Will Start Full Service by May 1st

|

|

Oil companies planning to ship crude on the expanded Trans Mountain pipeline in Canada are concerned that the project may not begin full service on May 1 but they would be nevertheless obligated to pay tolls from that date.

In a letter to the Canada Energy Regulator (CER), Suncor Energy and other shippers including BP and Marathon Petroleum have expressed doubts that Trans Mountain will start full service on May 1, as previously communicated, Reuters reports.

Trans Mountain Corporation, the government-owned entity that completed the pipeline construction, told Reuters in an email that line fill on the expanded pipeline would be completed in early May.

After a series of delays, cost overruns, and legal challenges, the expanded Trans Mountain oil pipeline will open for business on May 1, the company said early this month.

“The Commencement Date for commercial operation of the expanded system will be May 1, 2024. Trans Mountain anticipates providing service for all contracted volumes in the month of May,” Trans Mountain Corporation said in early April.

The expanded pipeline will triple the capacity of the original pipeline to 890,000 barrels per day (bpd) from 300,000 bpd to carry crude from Alberta’s oil sands to British Columbia on the Pacific Coast.

The Federal Government of Canada bought the Trans Mountain Pipeline Expansion (TMX) from Kinder Morgan back in 2018, together with related pipeline and terminal assets. That cost the federal government $3.3 billion (C$4.5 billion) at the time. Since then, the costs for the expansion of the pipeline have quadrupled to nearly $23 billion (C$30.9 billion).

The expansion project has faced continuous delays over the years. In one of the latest roadblocks in December, the Canadian regulator denied a variance request from the project developer to move a small section of the pipeline due to challenging drilling conditions.

The company asked the regulator to reconsider its decision, and received on January 12 a conditional approval, avoiding what could have been another two-year delay to start-up.

Business

Tesla profits cut in half as demand falls

|

|

Tesla profits slump by more than a half

Tesla has announced its profits fell sharply in the first three months of the year to $1.13bn (£910m), compared with $2.51bn in 2023.

It caps a difficult period for the electric vehicle (EV) maker, which – faced with falling sales – has announced thousands of job cuts.

Boss Elon Musk remains bullish about its prospects, telling investors the launch of new models would be brought forward.

Its share price has risen but analysts say it continues to face significant challenges, including from lower-cost rivals.

The company has suffered from falling demand and competition from cheaper Chinese imports which has led its stock price to collapse by 43% over 2024.

Figures for the first quarter of 2024 revealed revenues of $21.3bn, down on analysts’ predictions of just over $22bn.

But the decision by Tesla to bring forward the launch of new models from the second half of 2025 boosted its shares by nearly 12.5% in after-hours trading.

It did not reveal pricing details for the new vehicles.

However Mr Musk made clear he also grander ambitions, touting Tesla’s AI credentials and plans for self-driving vehicles – even going as far as to say considering it to be just a car company was the “wrong framework.”

“If somebody doesn’t believe Tesla is going to solve autonomy I think they should not be an investor,” he said.

Such sentiments have been questioned by analysts though, with Deutsche Bank saying driverless cars face “technological, regulatory and operational challenges.”

Some investors have called for the company to instead focus on releasing a lower price, mass-market EV.

However, Tesla has already been on a charm offensive, trying to win over new customers by dropping its prices in a series of markets in the face of falling sales.

It also said its situation was not unique.

“Global EV sales continue to be under pressure as many carmakers prioritize hybrids over EVs,” it said.

Despite plans to bring forward new models originally planned for next year the firm is cutting its workforce.

Tesla said it would lose 3,332 jobs in California and 2,688 positions in Texas, starting mid-June.

The cuts in Texas represent 12% of Tesla’s total workforce of almost 23,000 in the area where its gigafactory and headquarters are located.

However, Mr Musk sought to downplay the move.

“Tesla has now created over 30,000 manufacturing jobs in California!” he said in a post on his social media platform X, formerly Twitter, on Tuesday.

Another 285 jobs will be lost in New York.

Tesla’s total workforce stood at more than 140,000 late last year, up from around 100,000 at the end of 2021, according to the company’s filings with US regulators.

Musk’s salary

The car firm is also facing other issues, with a struggle over Mr Musk’s compensation still raging on.

On Wednesday, Tesla asked shareholders to vote for a proposal to accept Mr Musk’s compensation package – once valued at $56bn – which had been rejected by a Delaware judge.

The judge found Tesla’s directors had breached their fiduciary duty to the firm by awarding Mr Musk the pay-out.

Due to the fall in Tesla’s stock value, the compensation package is now estimated to be around $10bn less – but still greater than the GDP of many countries.

In addition, Tesla wants its shareholders to agree to the firm being moved from Delaware to Texas – which Mr Musk called for after the judge rejected his payday.

Business

Stock market today: Nasdaq futures pop, Tesla surges after earnings with more heavyweights on deck

|

|

Tech stocks rose on Wednesday, outstripping the broader market as investors welcomed Tesla’s (TSLA) cheaper car pledge and waited for the next rush of corporate earnings.

The Nasdaq Composite (^IXIC) rose roughly 0.6%, coming off a sharp closing gain. The S&P 500 (^GSPC) was up 0.2%, continuing a rebound from its longest losing streak of 2024, while the Dow Jones Industrial Average (^DJI) fell 0.1%.

Tesla shares jumped nearly 12% after the EV maker’s vow to speed up the launch of more affordable models eclipsed its quarterly earnings and revenue miss. That cheered up investors worried about growth amid a strategy shift to robotaxis and the planned cancellation of a cheaper model.

The results from the first “Magnificent Seven” to report have intensified the already high hopes for Big Tech earnings, that the megacaps can revive the rally in stocks they powered. The spotlight is now on Meta’s (META) report due after the market close, as the Facebook owner’s shares rose after the Senate voted for a potential ban on rival TikTok. Microsoft (MSFT) and Alphabet (GOOG) next up on Thursday.

Meanwhile, Boeing (BA) reported better than expected first quarter results before the opening bell with a loss per share of $1.13, narrower than the $1.72 estimated by Wall Street. Shares rose about 2% in morning trade.

Live6 updates

-

Health14 hours ago

Health14 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art20 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Health18 hours ago

Health18 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

Investment19 hours ago

Investment19 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

News19 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News

-

Science23 hours ago

Science23 hours agoiN PHOTOS: Nature lovers celebrate flora, fauna for Earth Day in Kamloops, Okanagan | iNFOnews | Thompson-Okanagan's News Source – iNFOnews

-

Art20 hours ago

An exhibition with a cause: Montreal's 'Art by the Water' celebrates 15 years – CityNews Montreal

-

Media14 hours ago

Vaughn Palmer: B.C. premier gives social media giants another chance